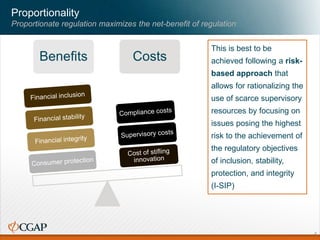

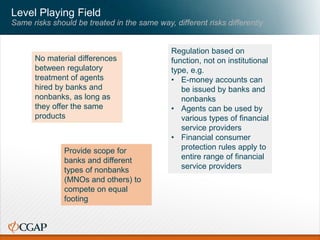

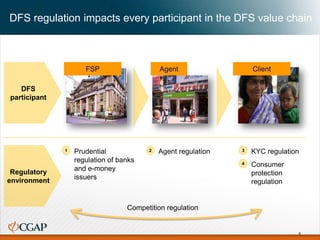

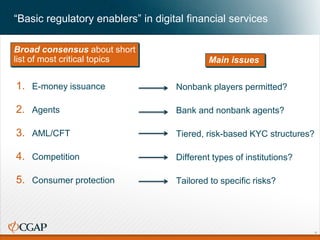

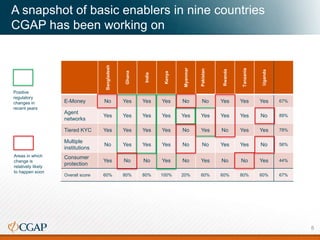

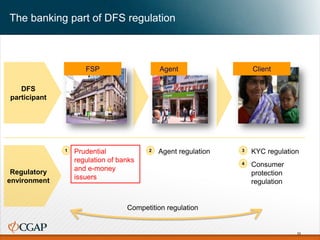

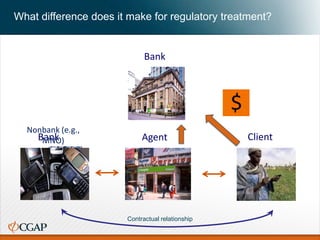

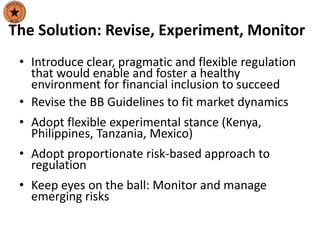

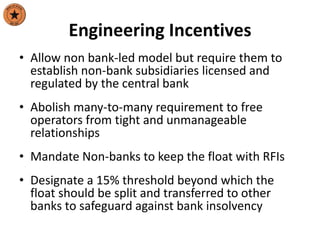

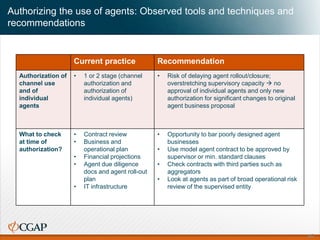

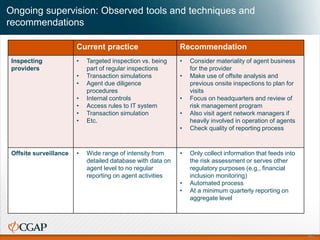

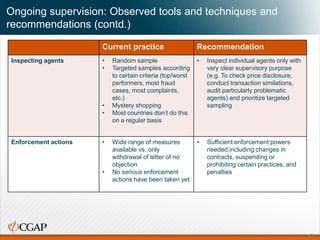

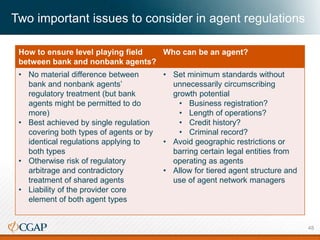

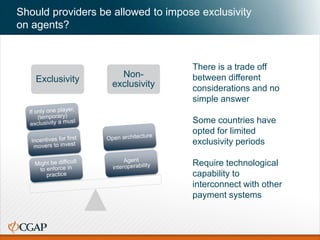

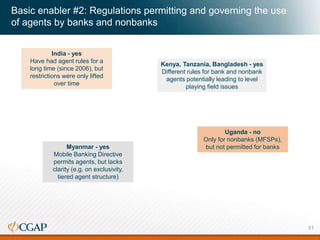

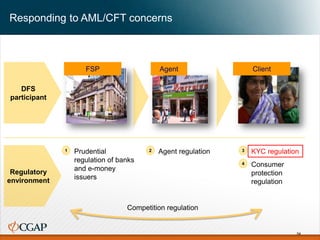

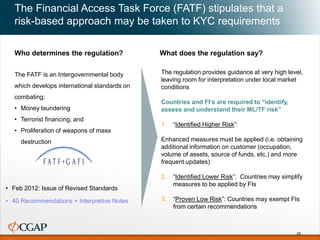

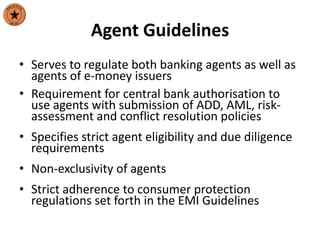

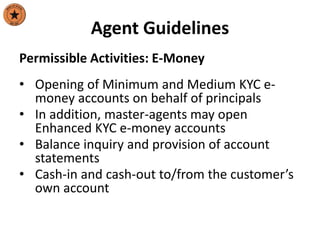

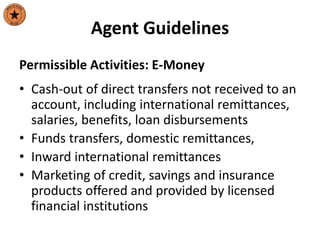

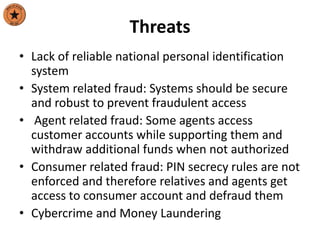

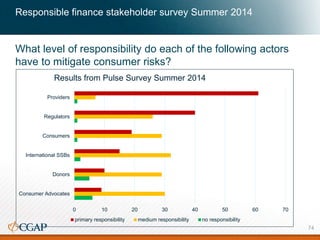

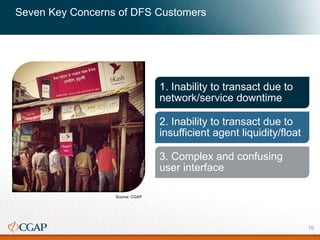

This document discusses key considerations for regulating agents in digital financial services. It recommends authorizing agent use through a risk-based approach focusing on operational risks, consumer risks, and anti-money laundering risks rather than approving individual agents. Ongoing supervision of agents should include targeted inspections of providers and agents according to materiality and risks. Reporting requirements should be proportionate. Ensuring a level playing field between bank and non-bank agents is important. Regulations should set minimum standards without restricting growth potential and allow for tiered agent structures.