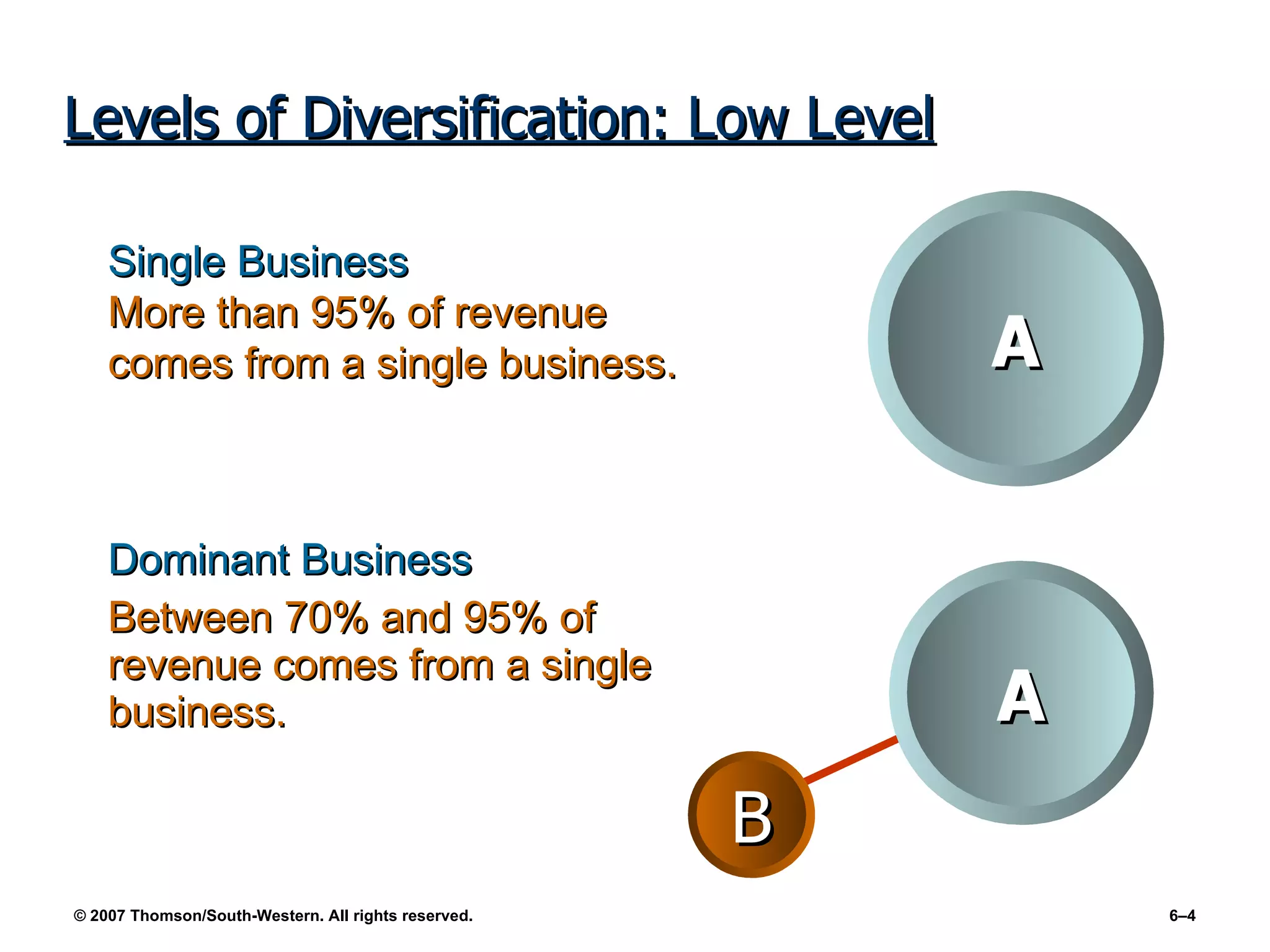

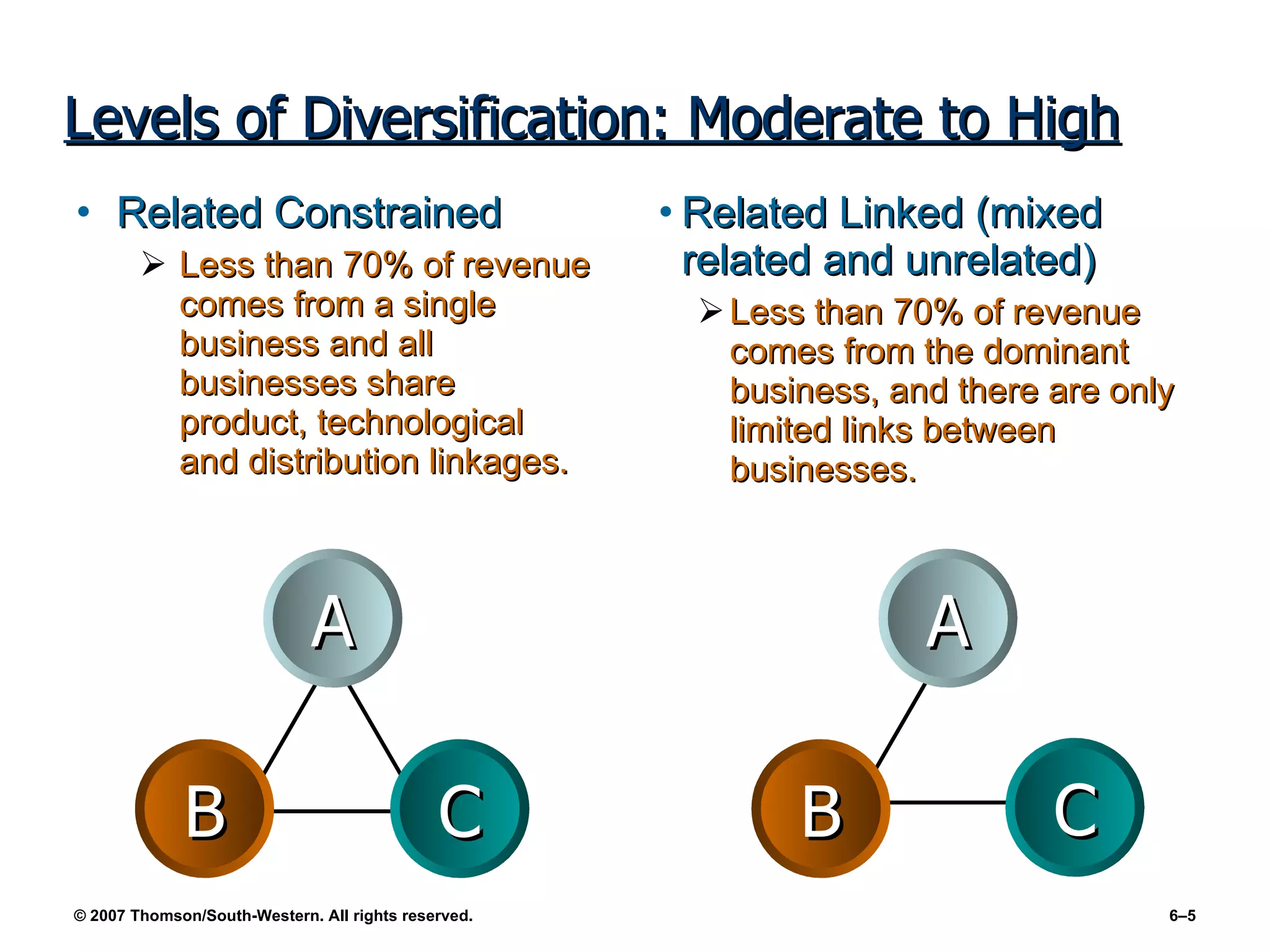

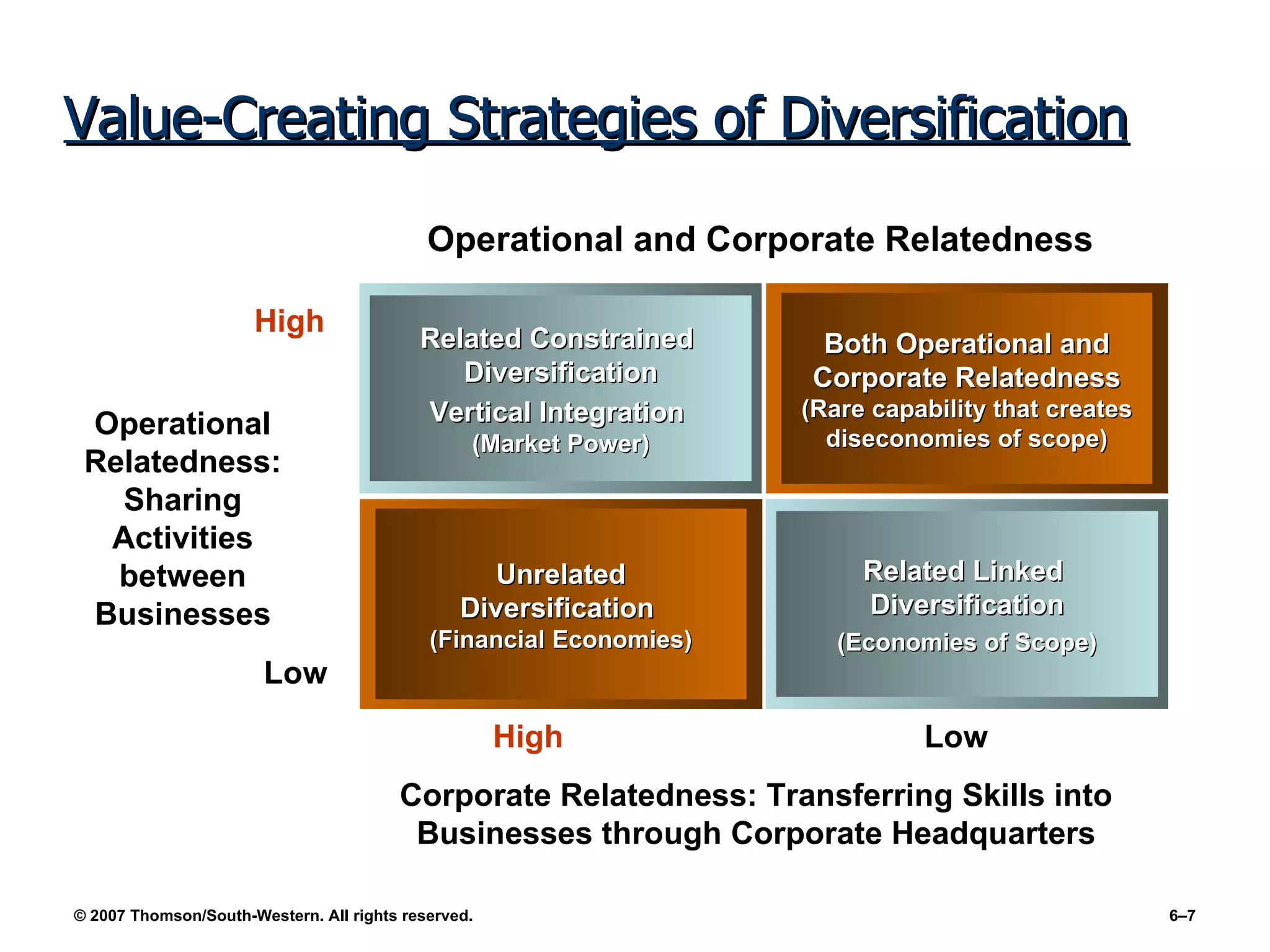

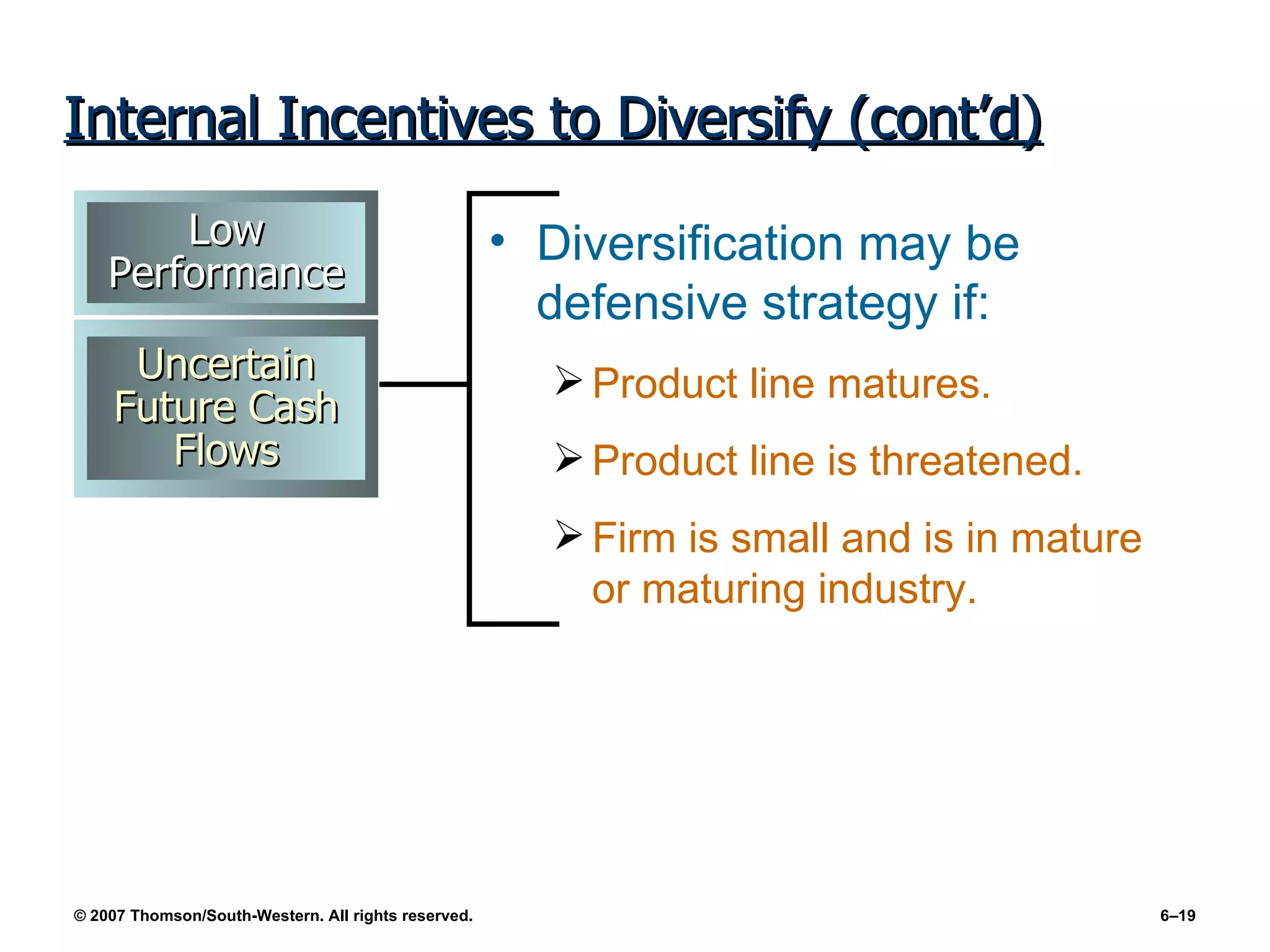

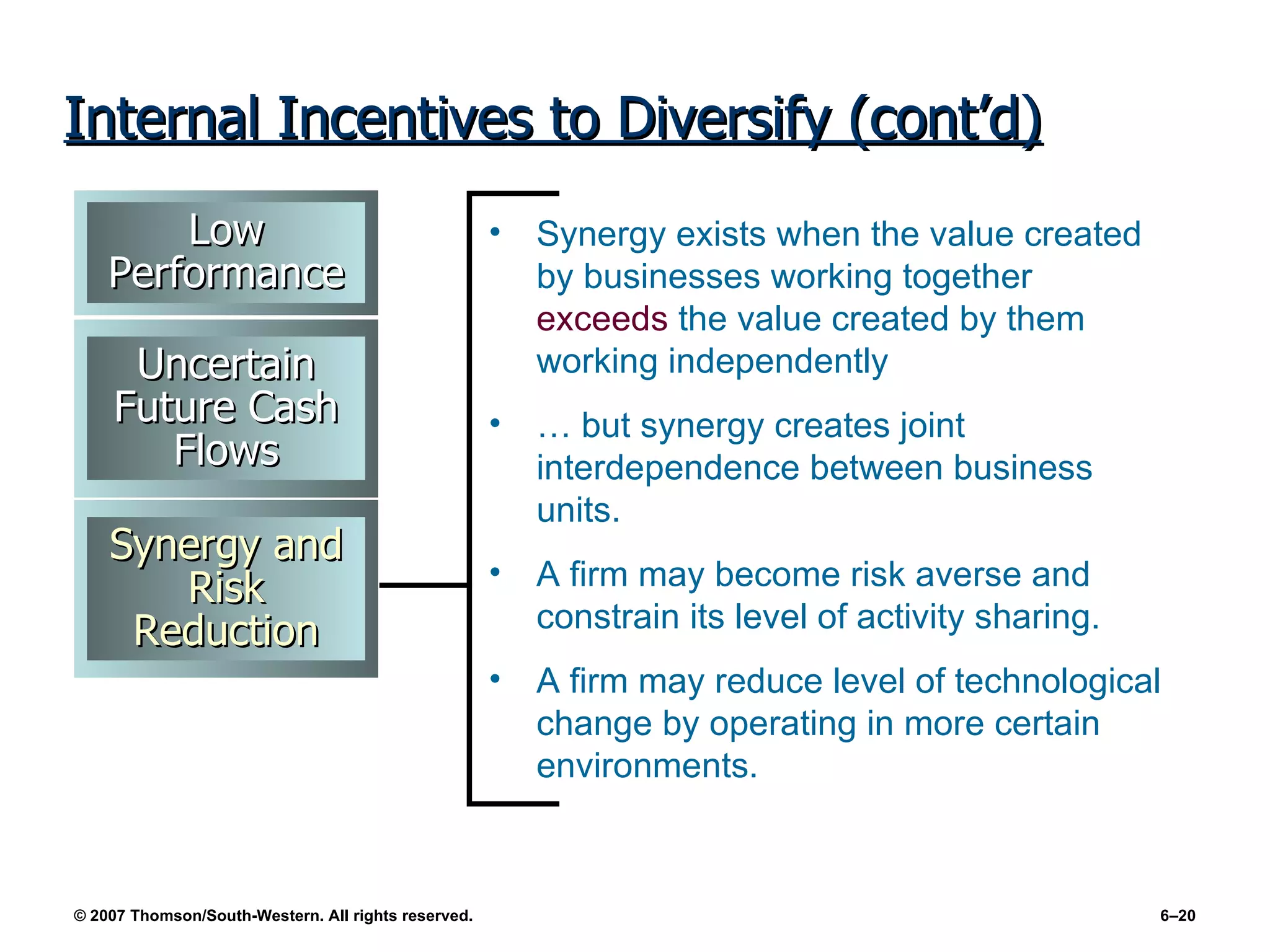

There are two levels of corporate strategy: business-level strategy which involves competitive strategies for individual business units, and corporate-level strategy which specifies how a firm will manage a portfolio of different businesses. Firms can diversify across low, moderate, and high levels depending on how concentrated revenue is in the dominant business. Related diversification creates value through economies of scope and market power by building on a firm's resources and capabilities. Unrelated diversification creates value through financial economies from efficient capital allocation and restructuring other firms' assets. External factors like antitrust laws and tax policies influence diversification decisions, as do internal factors such as a firm's performance and need to reduce risk or uncertainty.