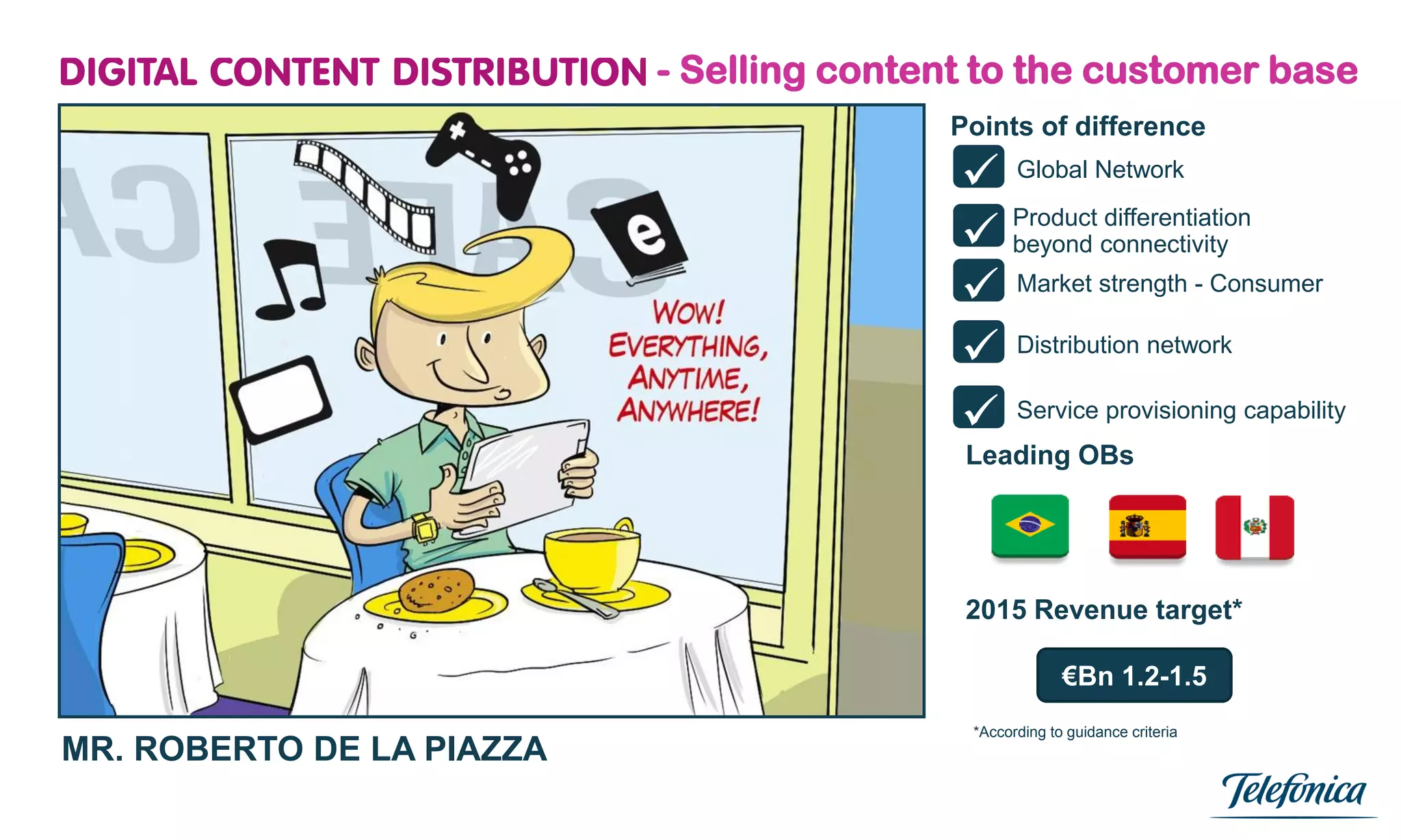

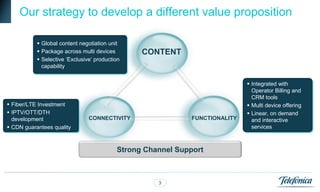

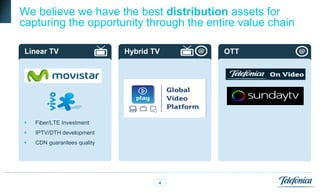

- The company has strengths in global content negotiation, connectivity through fiber/LTE networks, and a large distribution network that position it well to capture opportunities in video consumption.

- It aims to develop a differentiated value proposition through exclusive content, multi-device packages, and integrated operator billing and services.

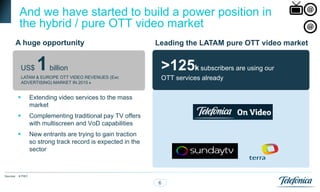

- The growth of internet video traffic and connected devices is reshaping the content landscape, providing an opportunity for telcos to become trusted providers of internet video.