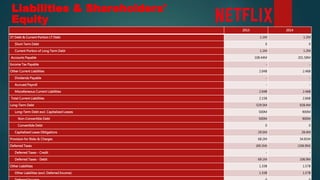

Netflix's total assets in 2014 were $7.06 billion, up from $5.41 billion in 2013. The majority of Netflix's assets are intangible assets like goodwill and intellectual property, which totaled $2.77 billion in 2014. Netflix also had significant cash and short-term investment assets of $1.61 billion in 2014. Netflix's total liabilities in 2014 were $5.2 billion, consisting mainly of long-term debt of $928.4 million and other current liabilities of $2.46 billion.