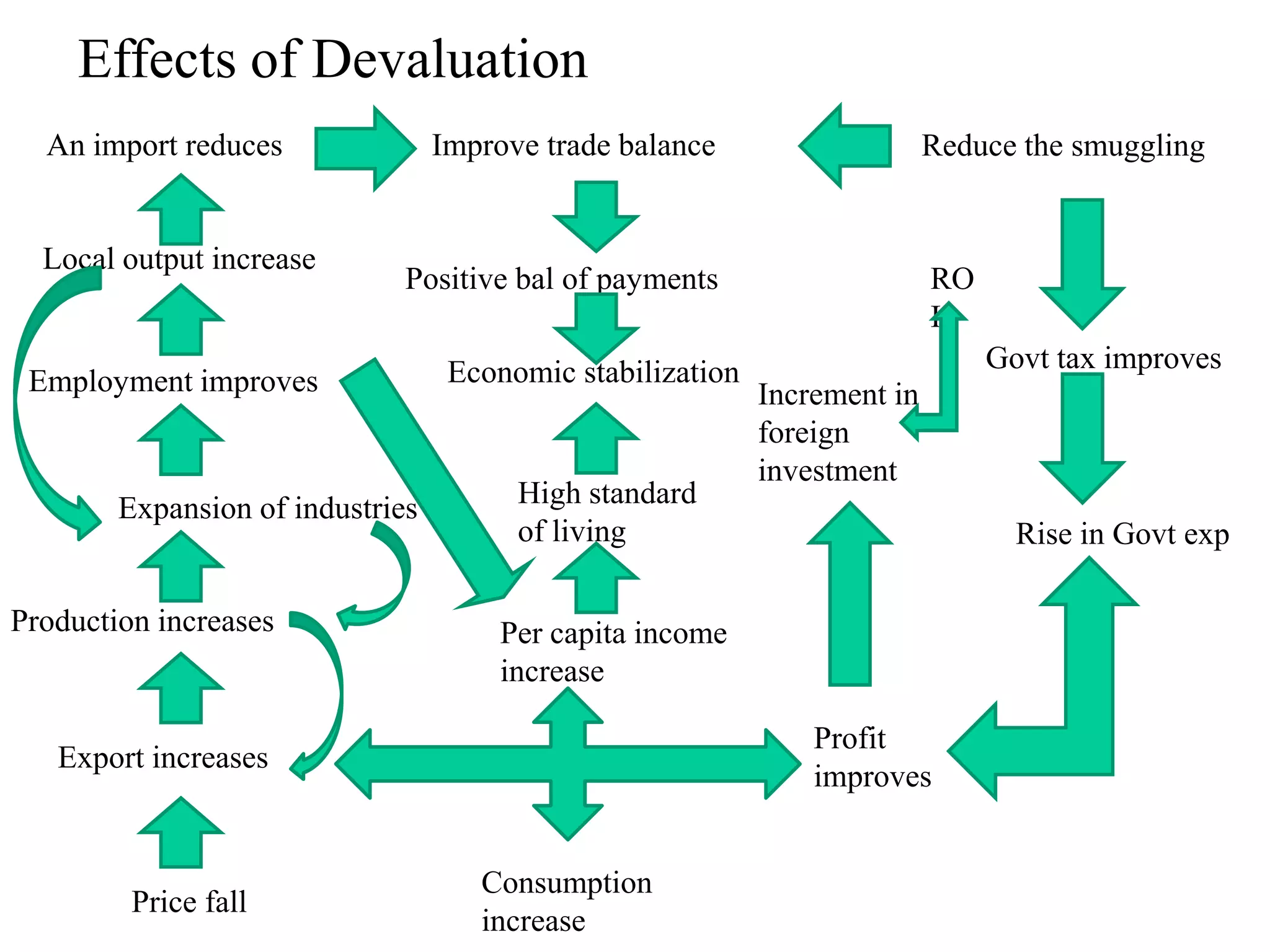

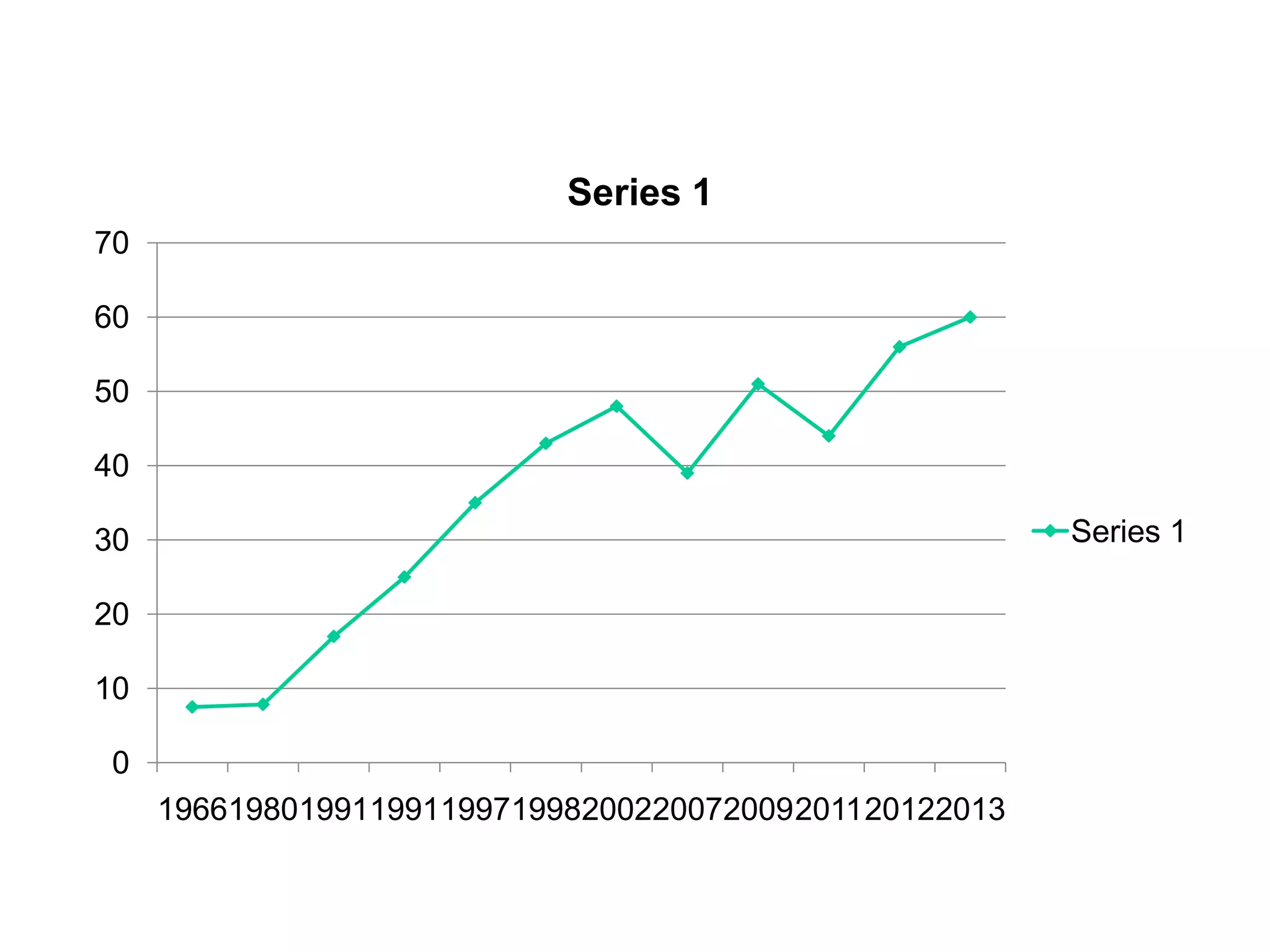

The document discusses the devaluation of the Indian rupee over time. It provides details on what causes devaluation, its effects, and specific instances of rupee devaluation in 1966 and 1991. In 1966, factors like the India-Pakistan war, withdrawal of foreign aid, and a large budget deficit led to devaluation. In 1991, a high trade deficit, current account deficit, inflation, and depleting foreign reserves necessitated another major devaluation. The rupee has fluctuated over the decades since 1966, driven by various economic and geopolitical events both domestic and international.