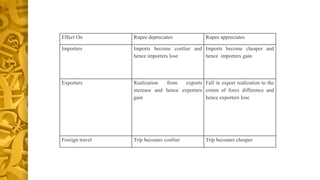

The document discusses the devaluation of the Indian rupee over time. It notes that the rupee was initially pegged to the US dollar at parity but has devalued significantly since India's independence. Major devaluations occurred in the 1960s-1970s due to wars and inflation, in the 1980s due to political instability, and in 1991 during economic liberalization when the rupee hit 24.58 rupees to the dollar. More recent fluctuations are due to factors like the US dollar strengthening, a rising current account deficit, and insufficient foreign investment inflows and outflows. Devaluation impacts trade, tourism, GDP, imports, exports, and foreign investment.