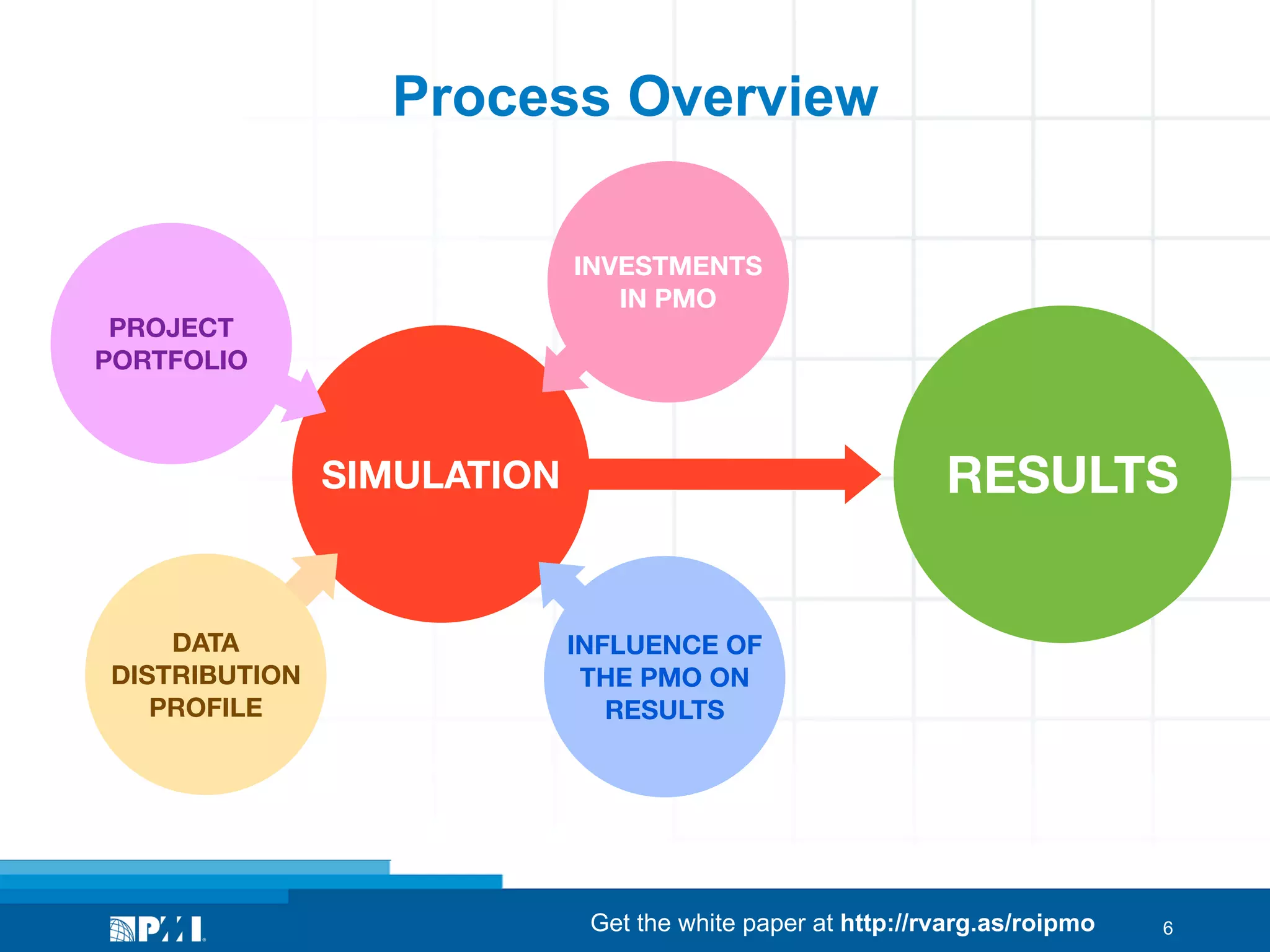

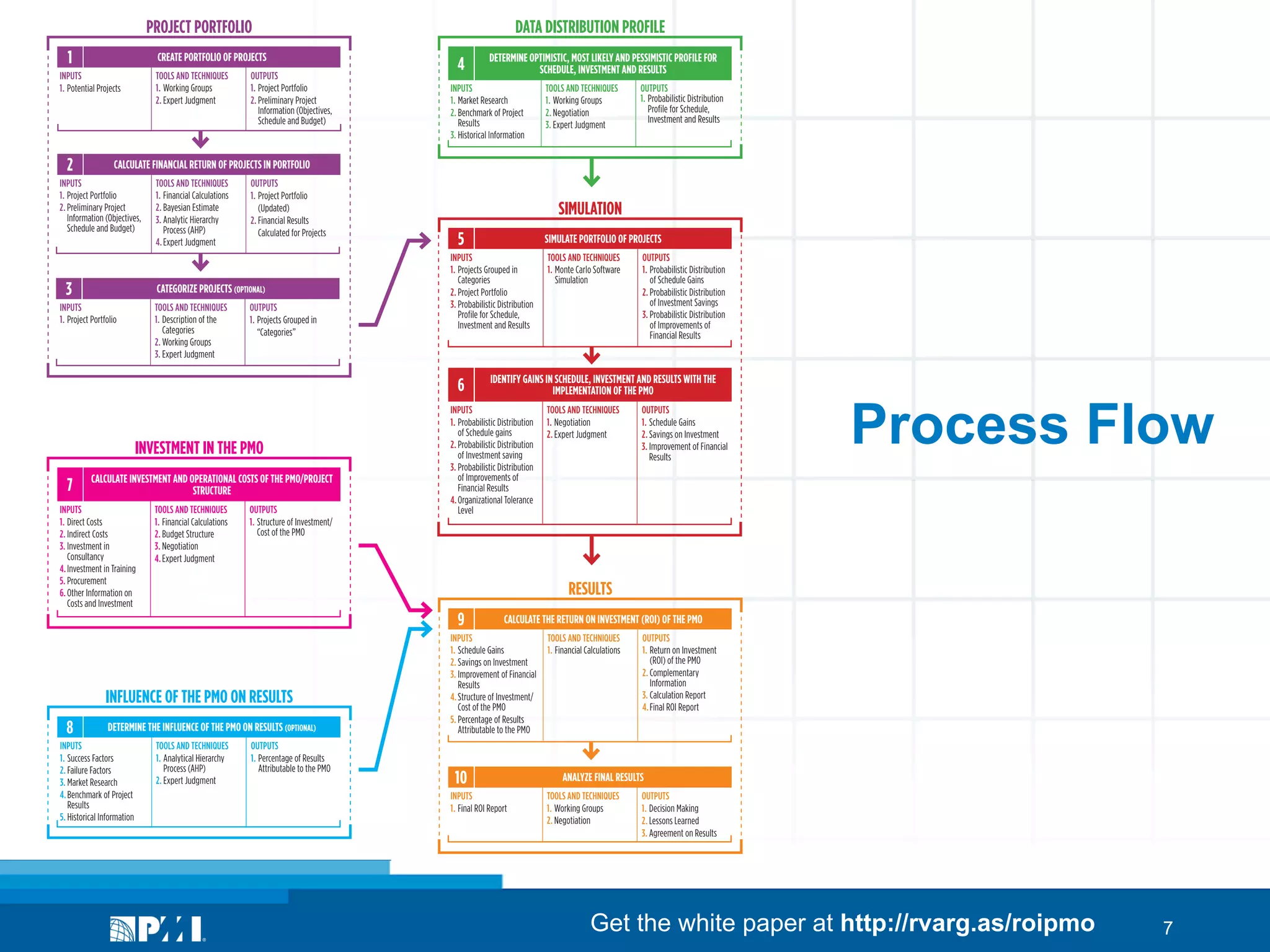

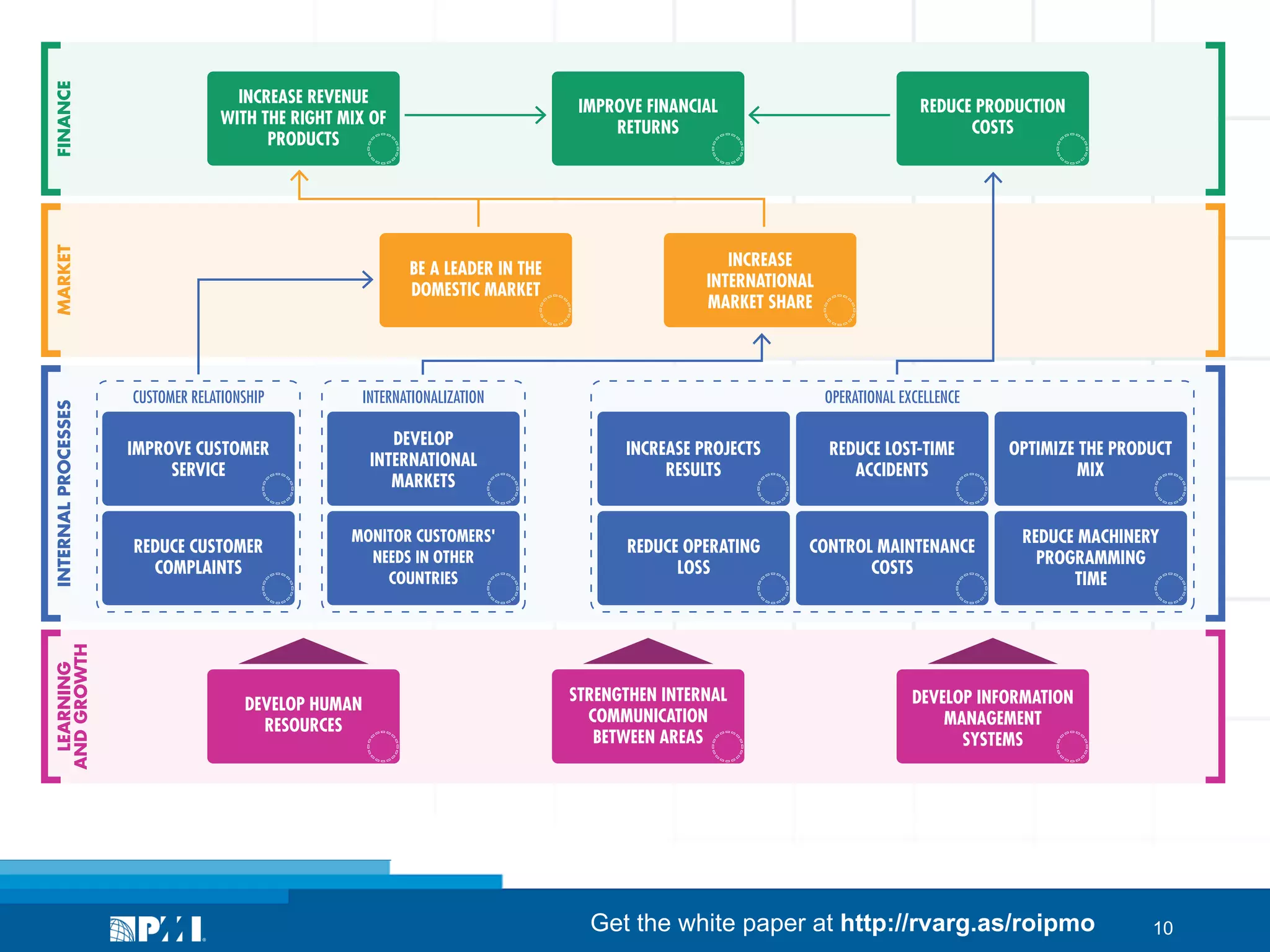

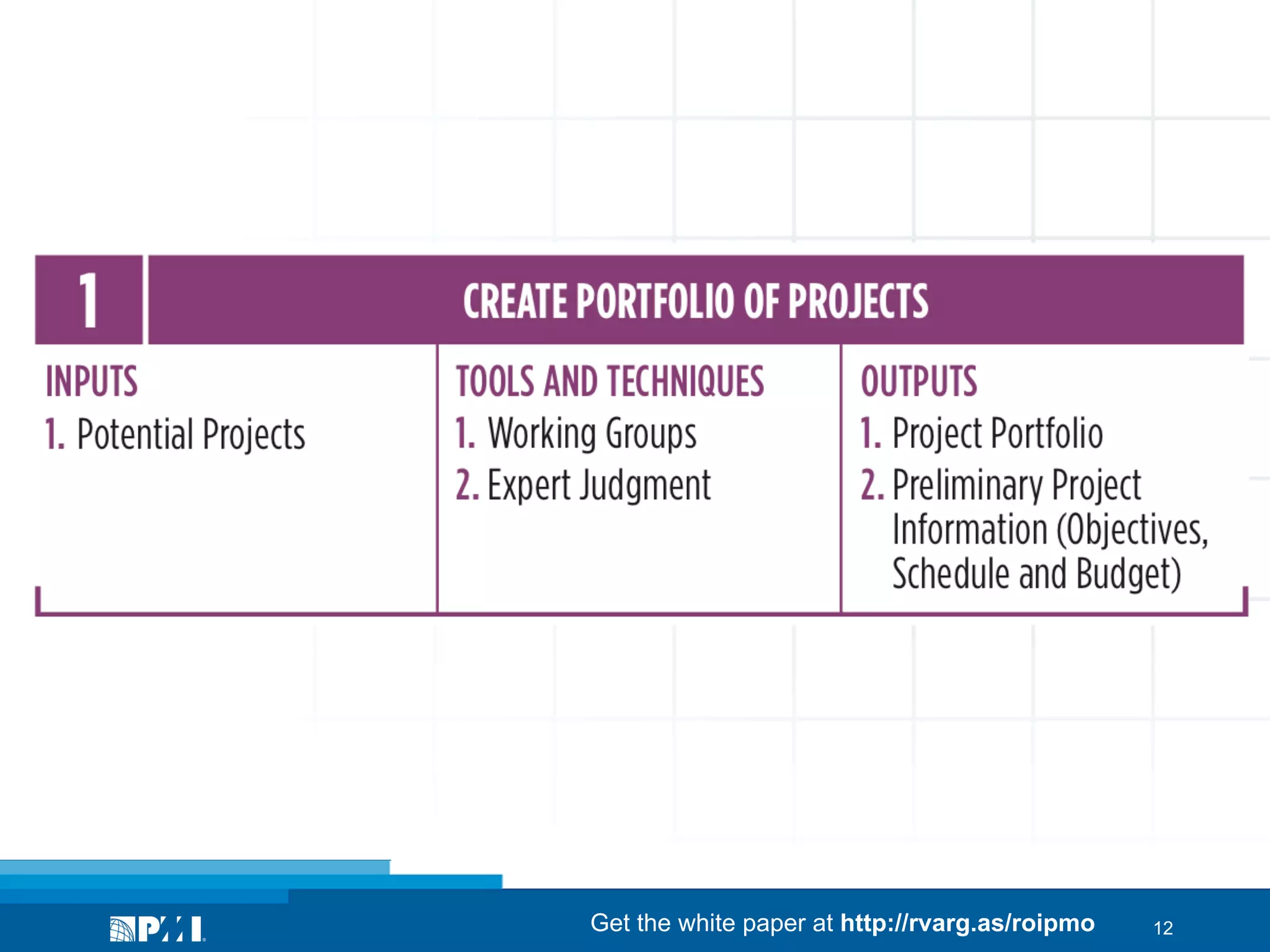

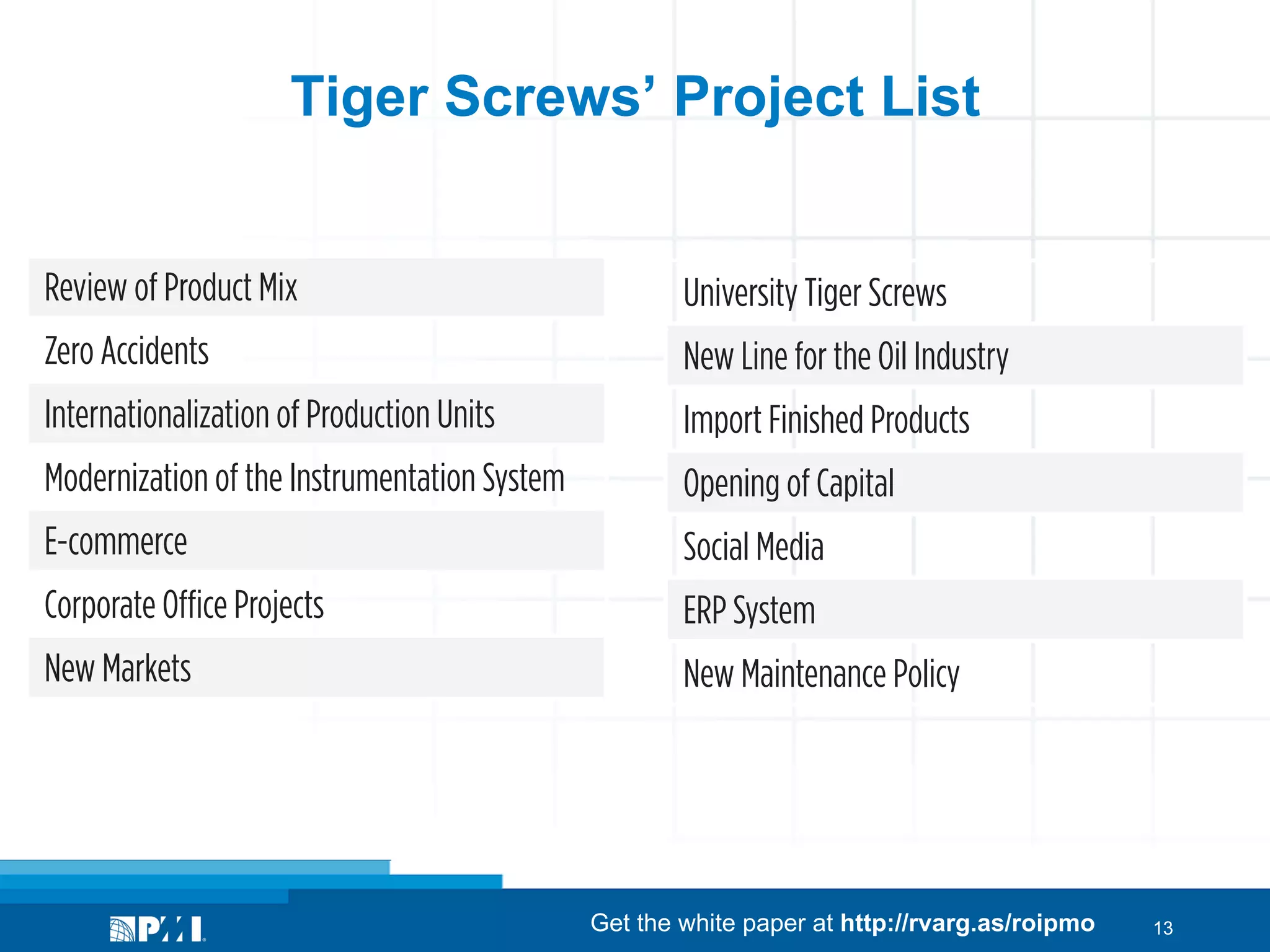

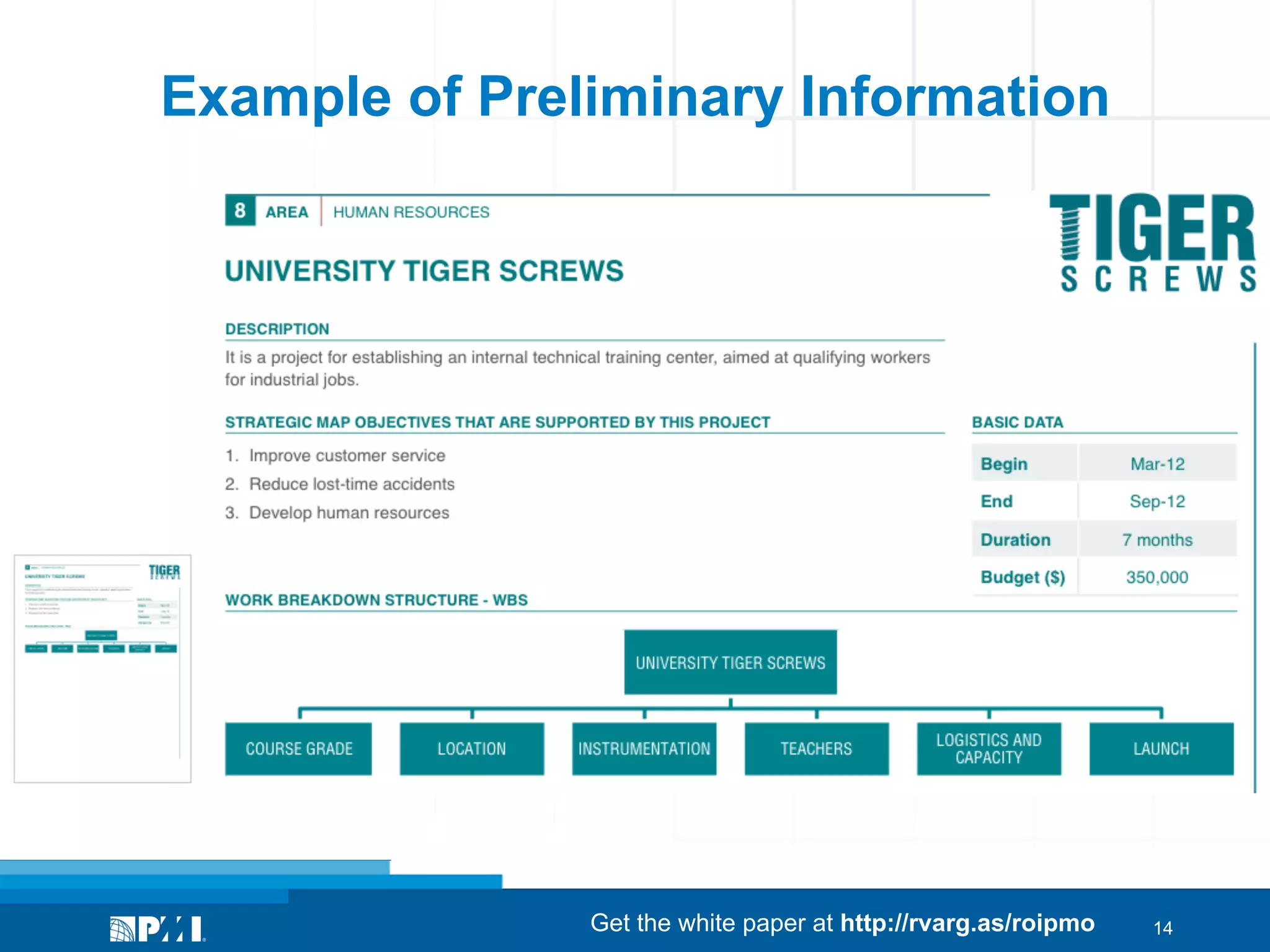

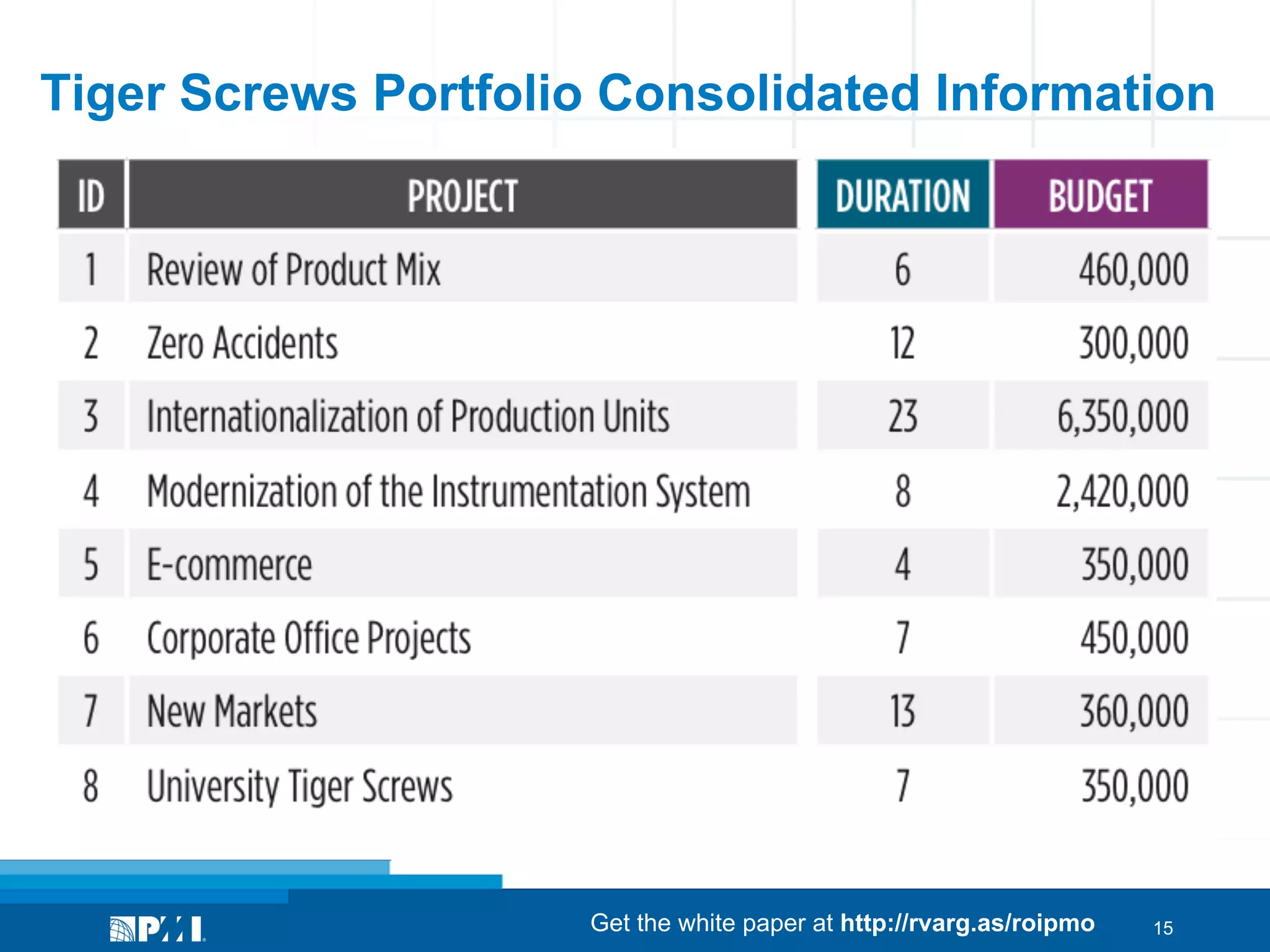

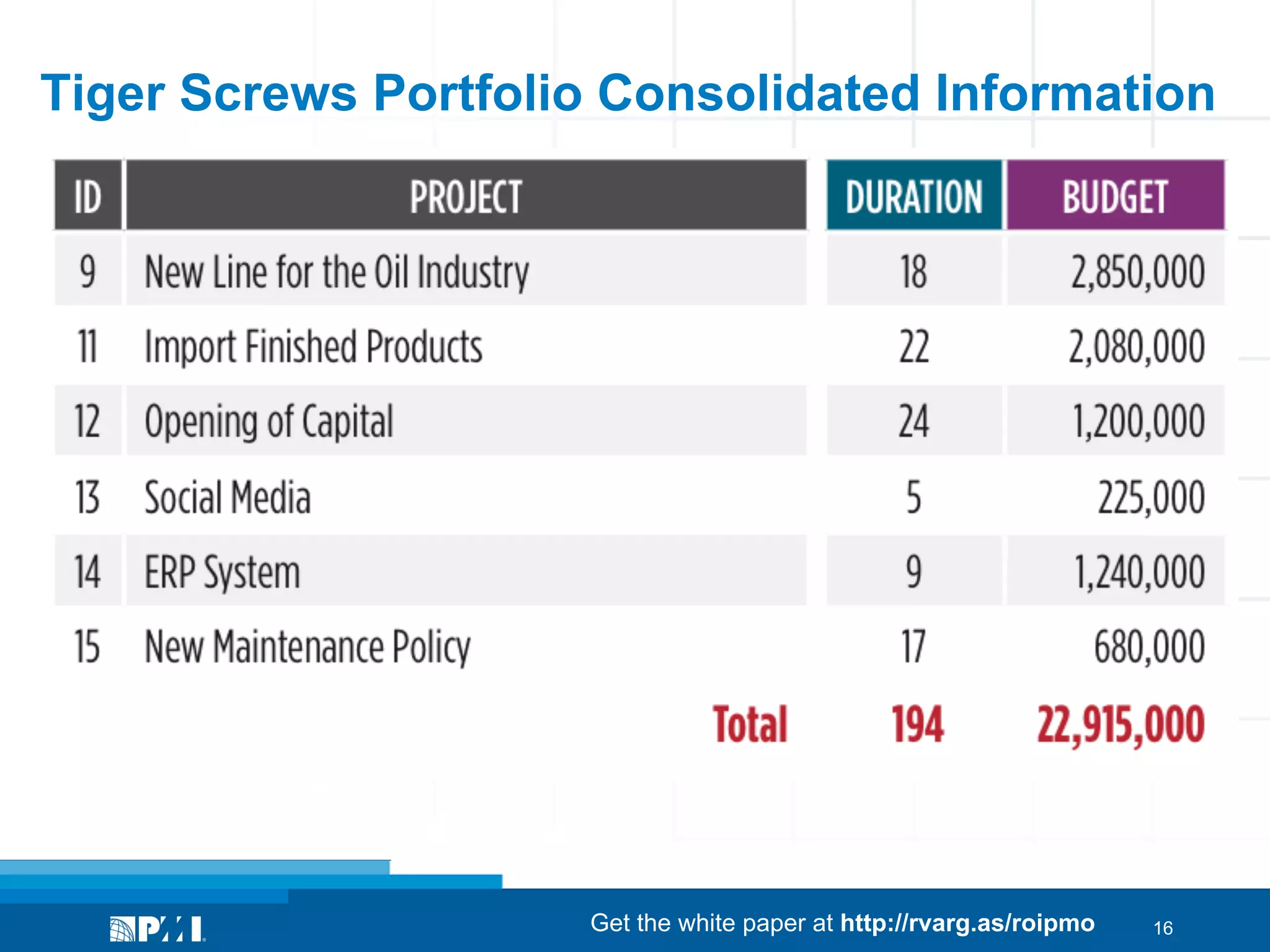

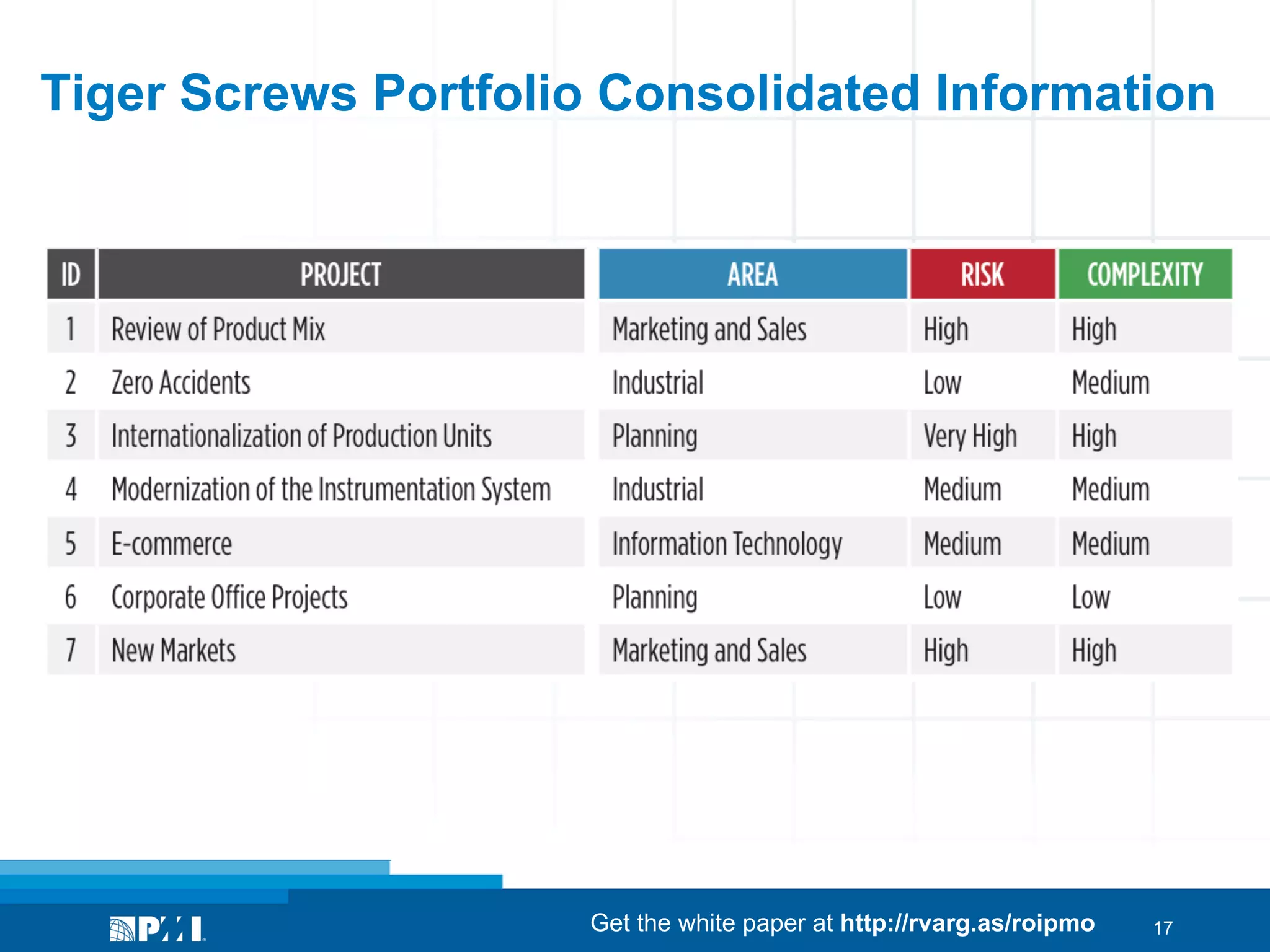

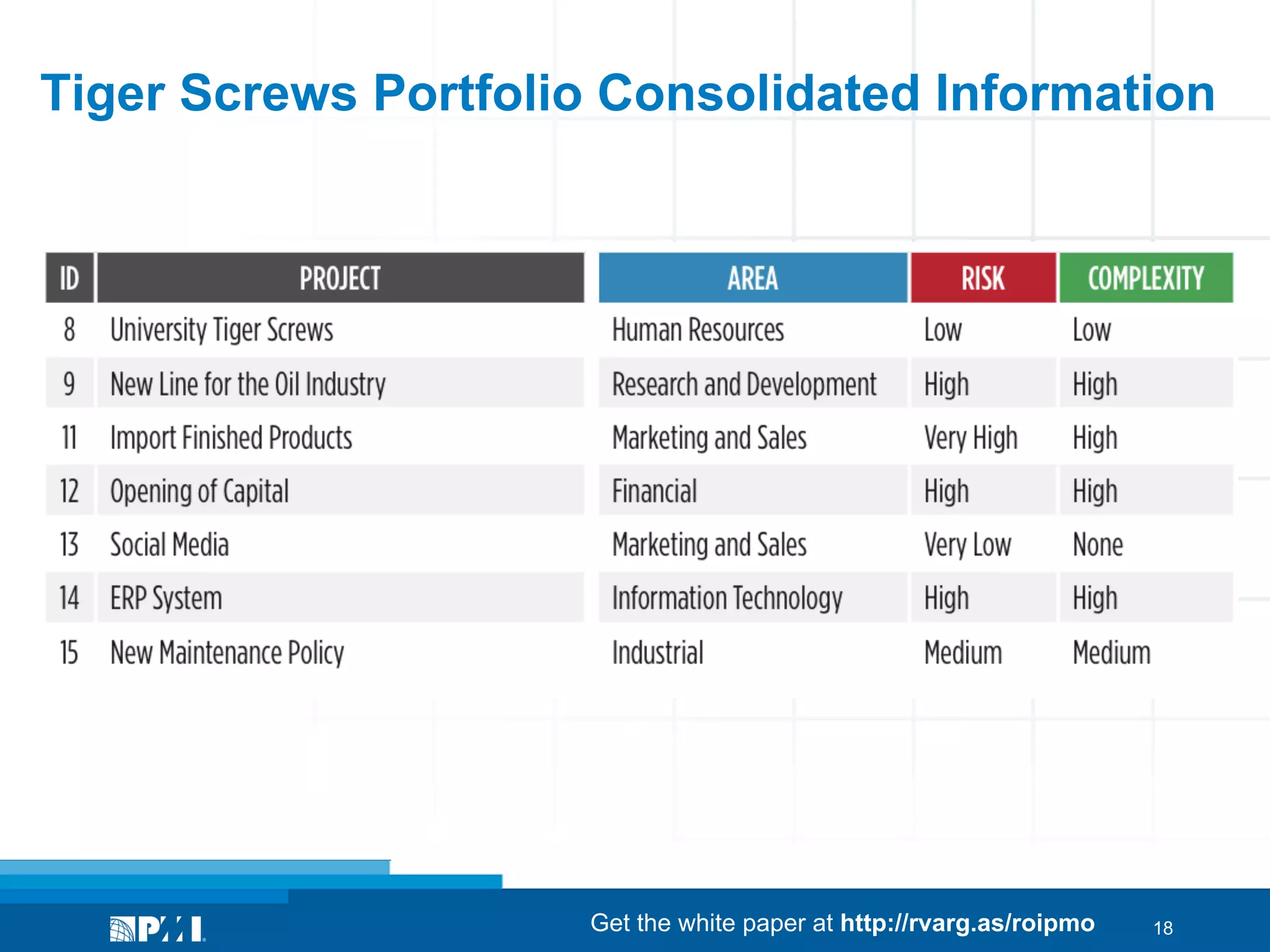

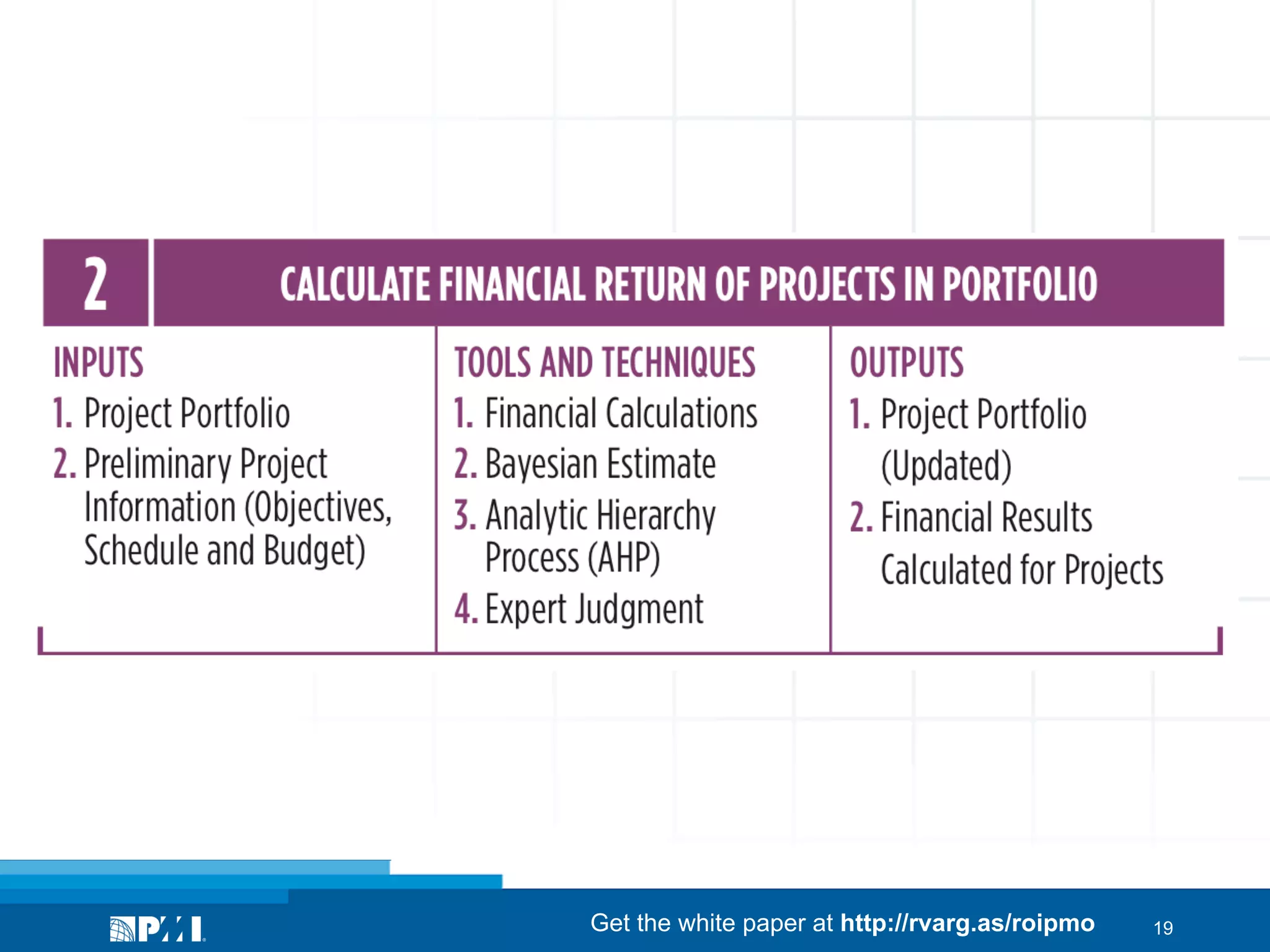

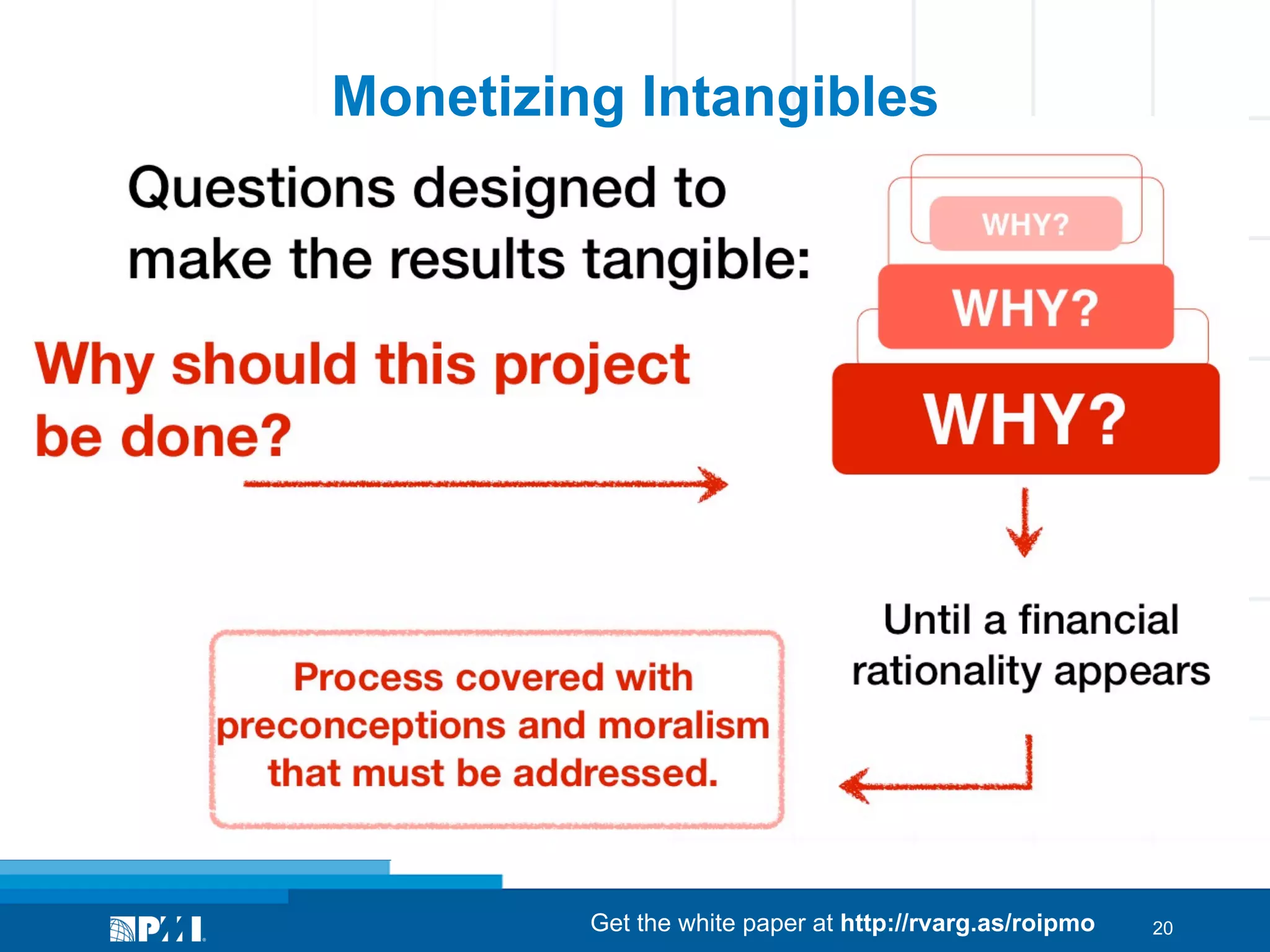

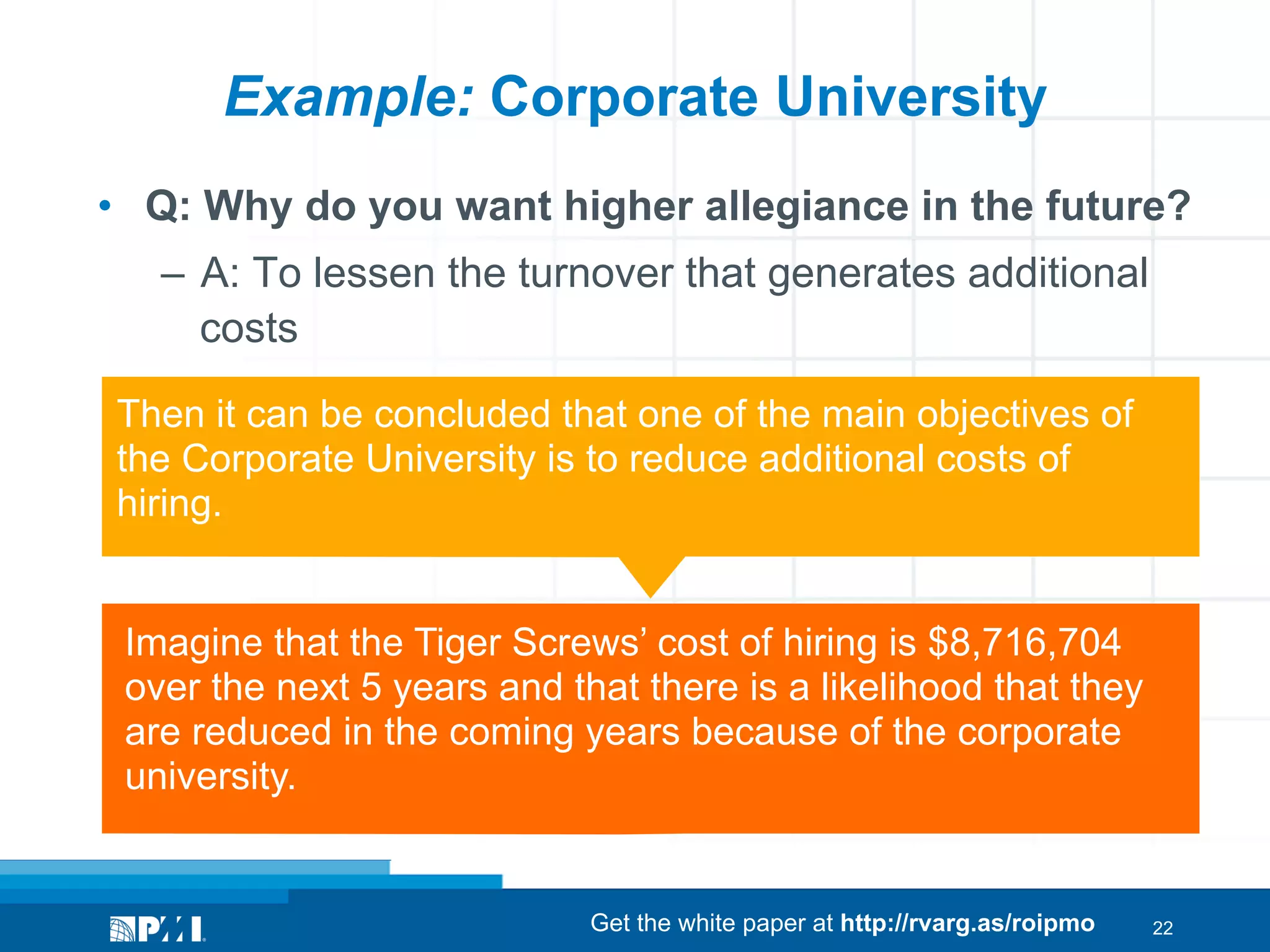

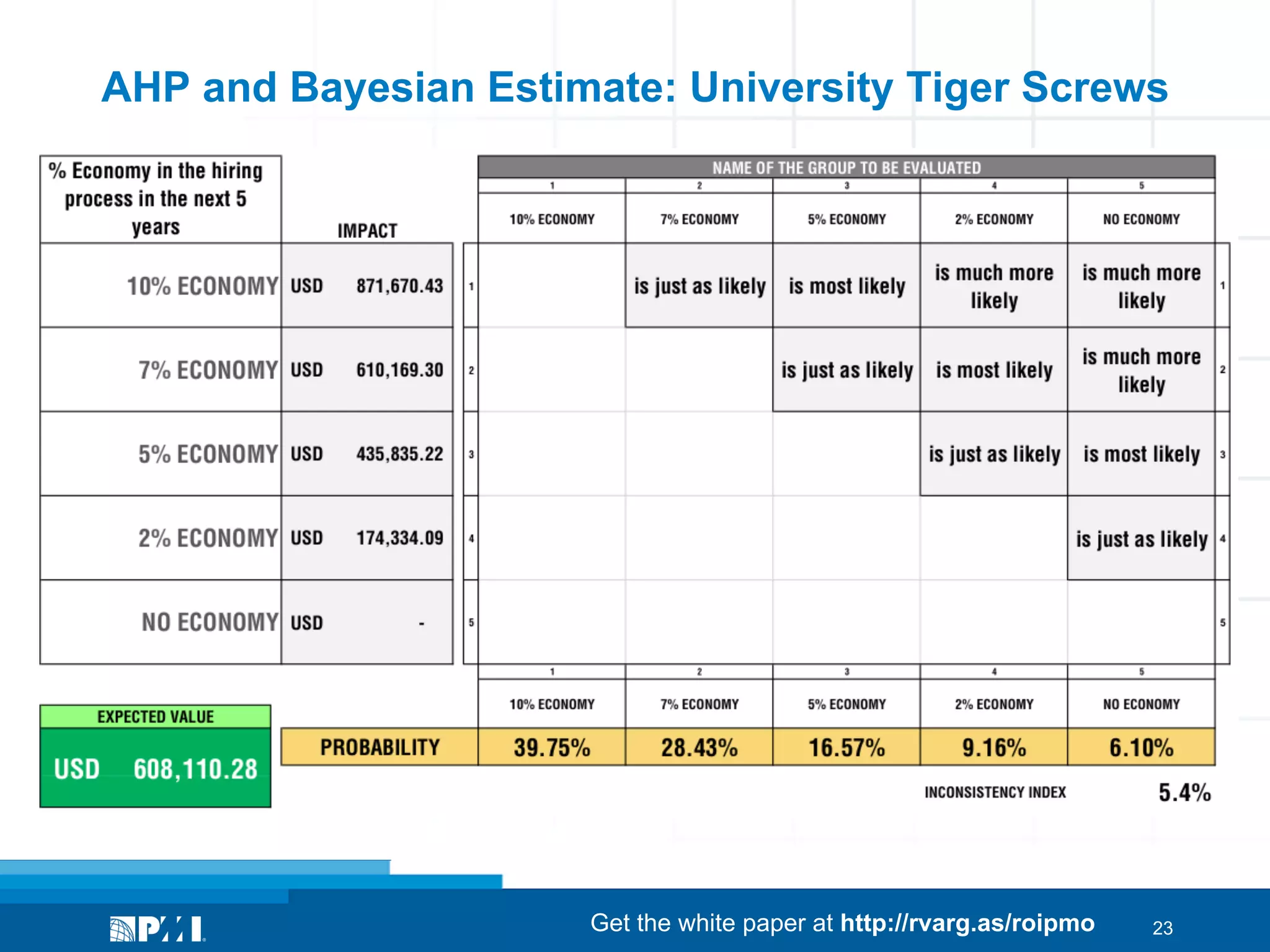

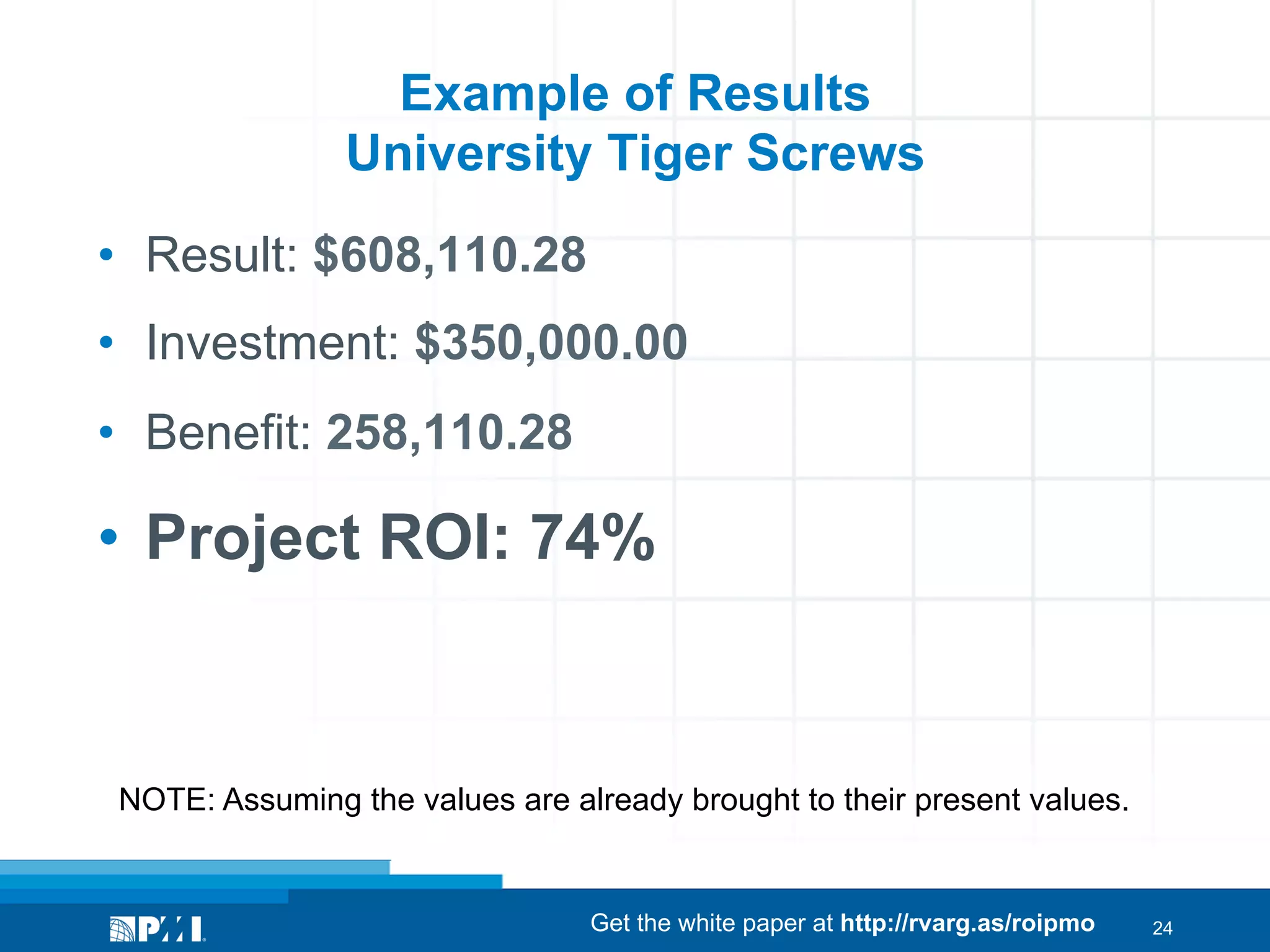

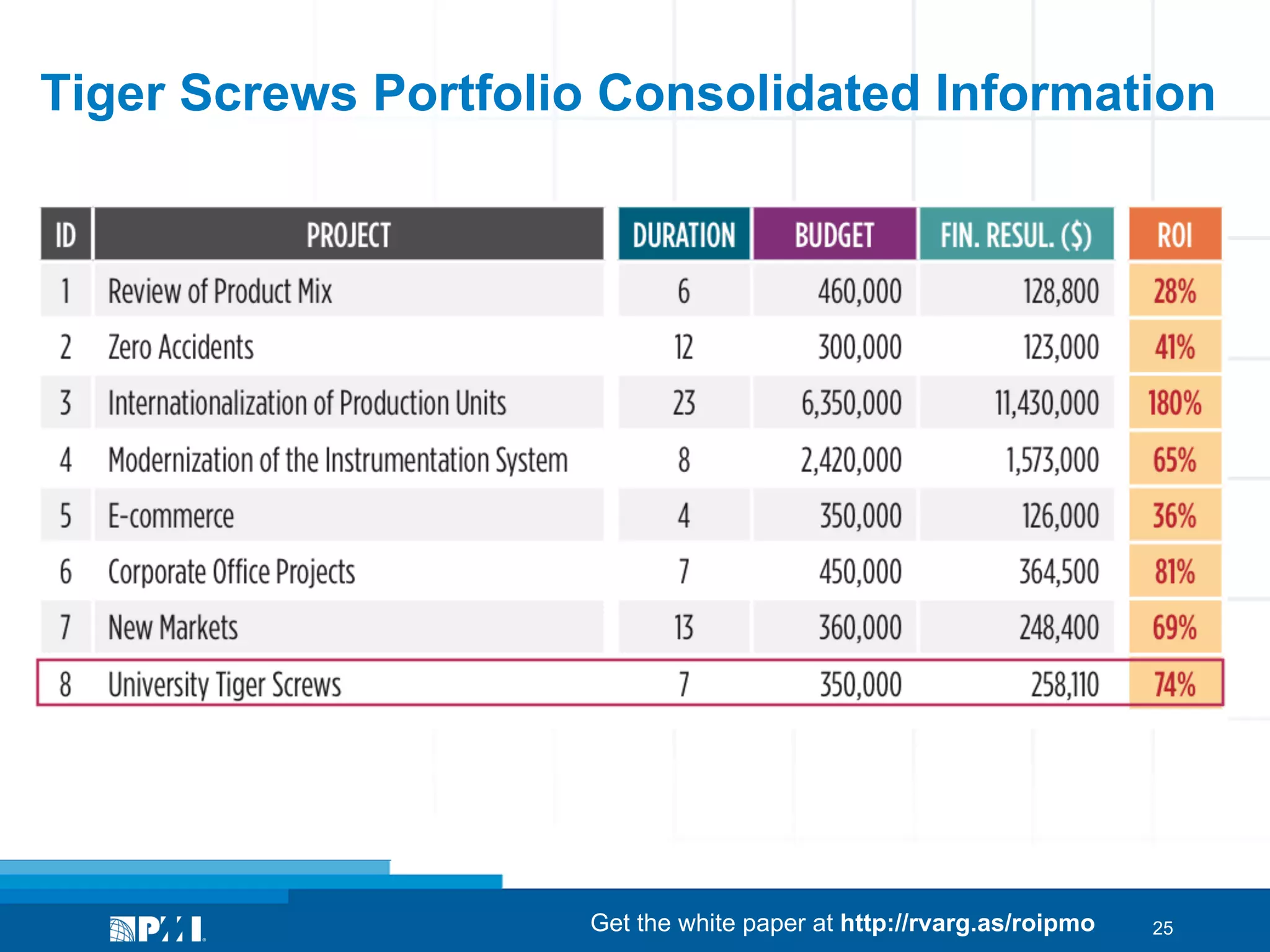

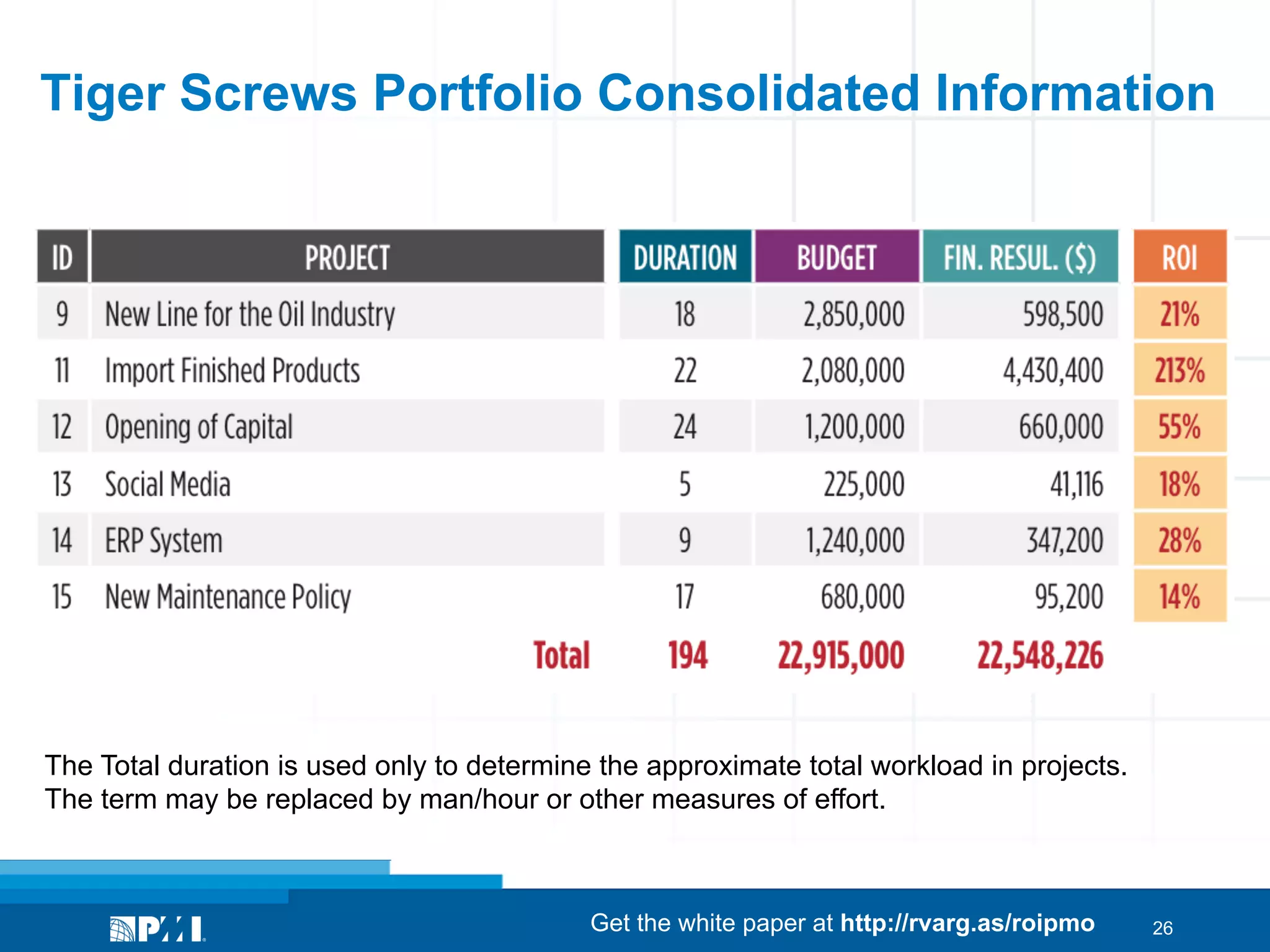

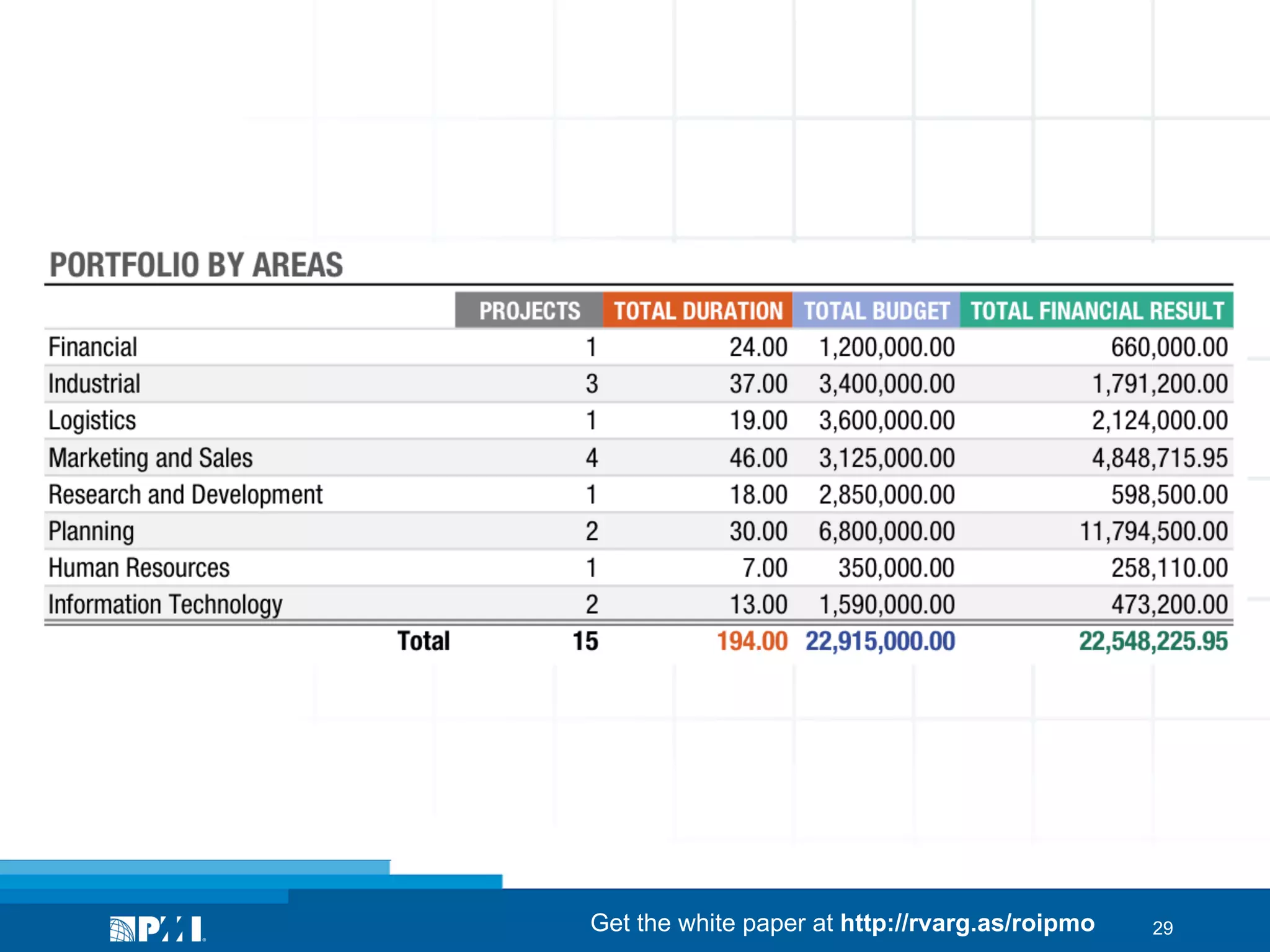

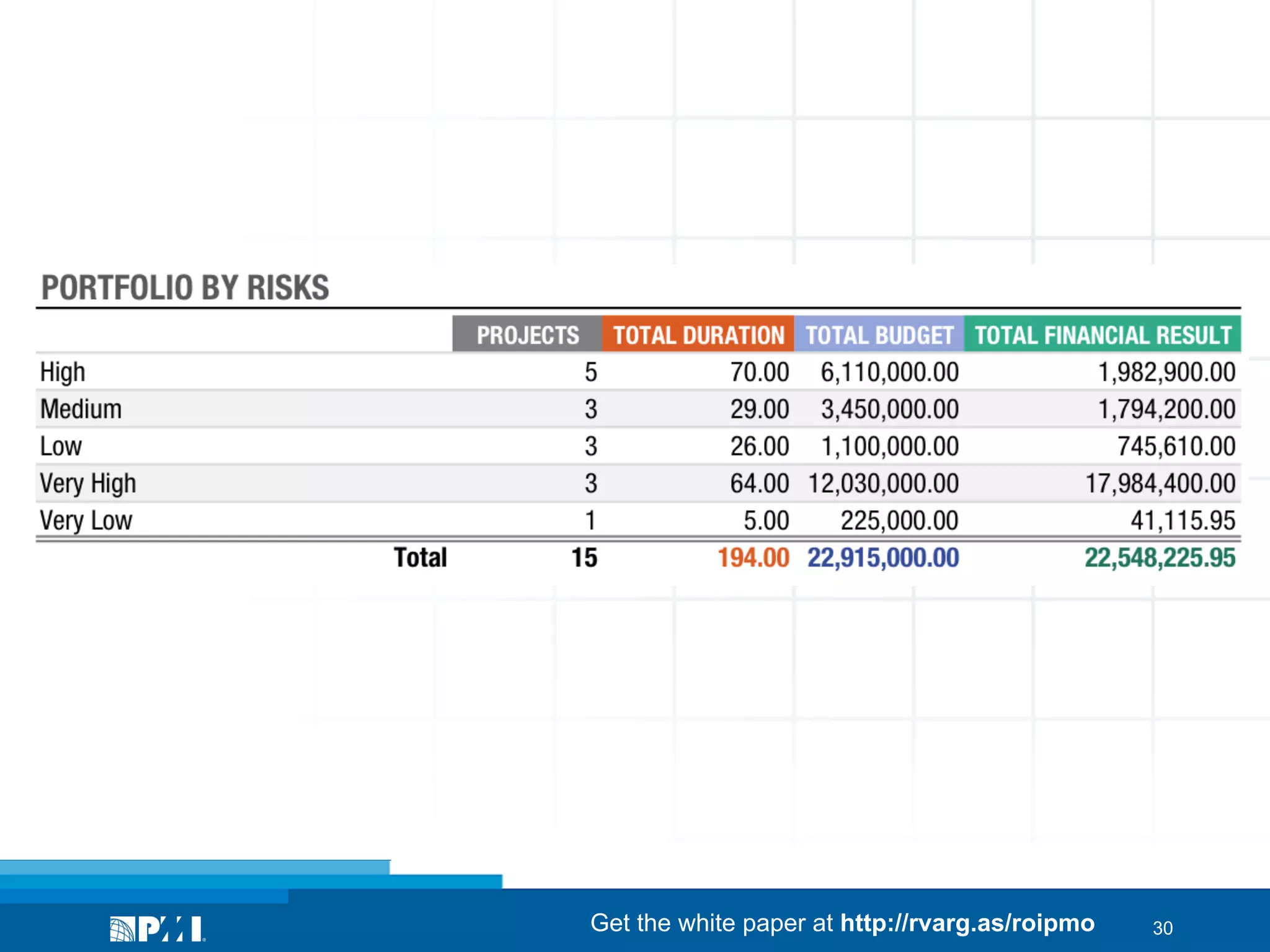

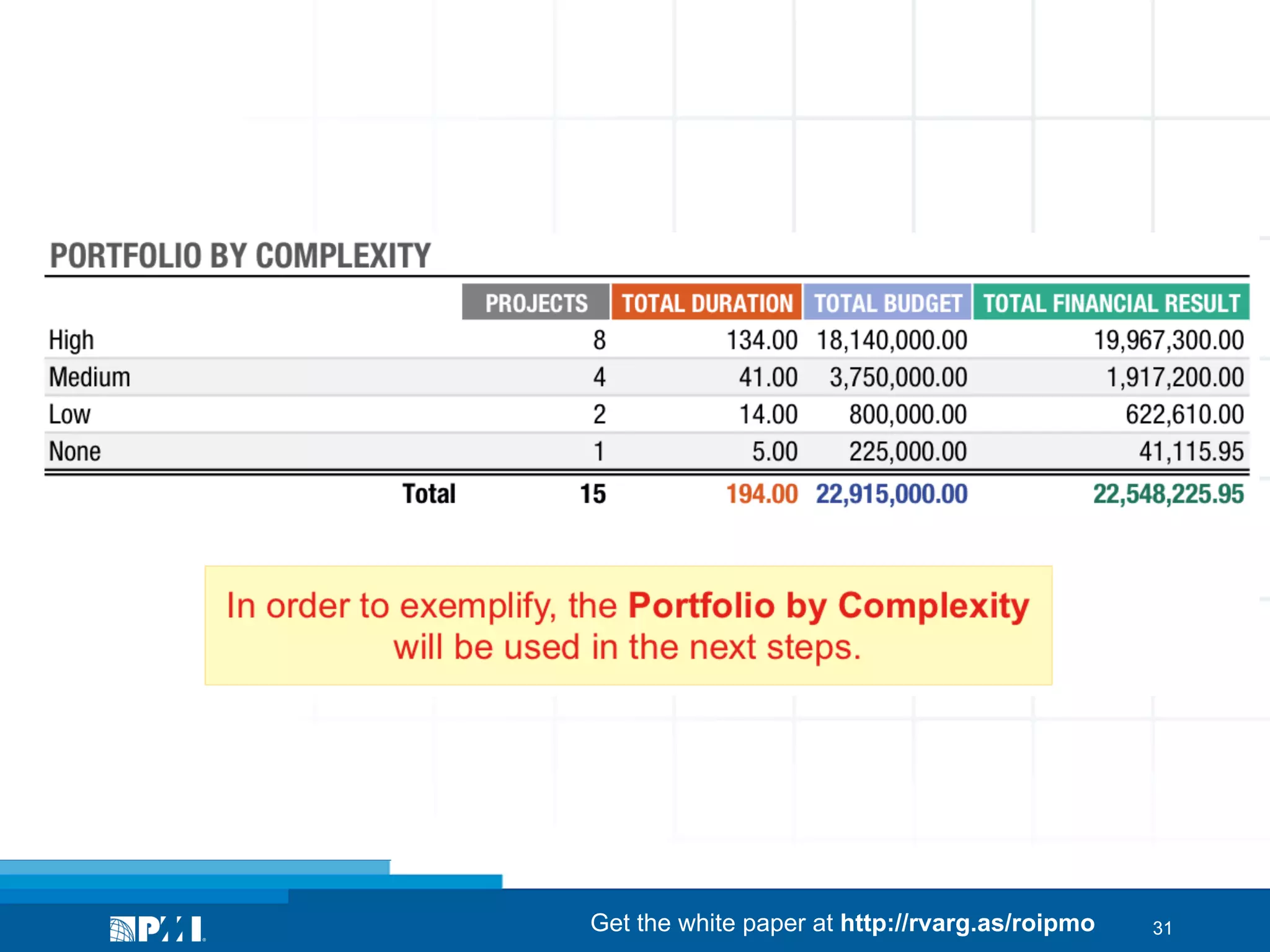

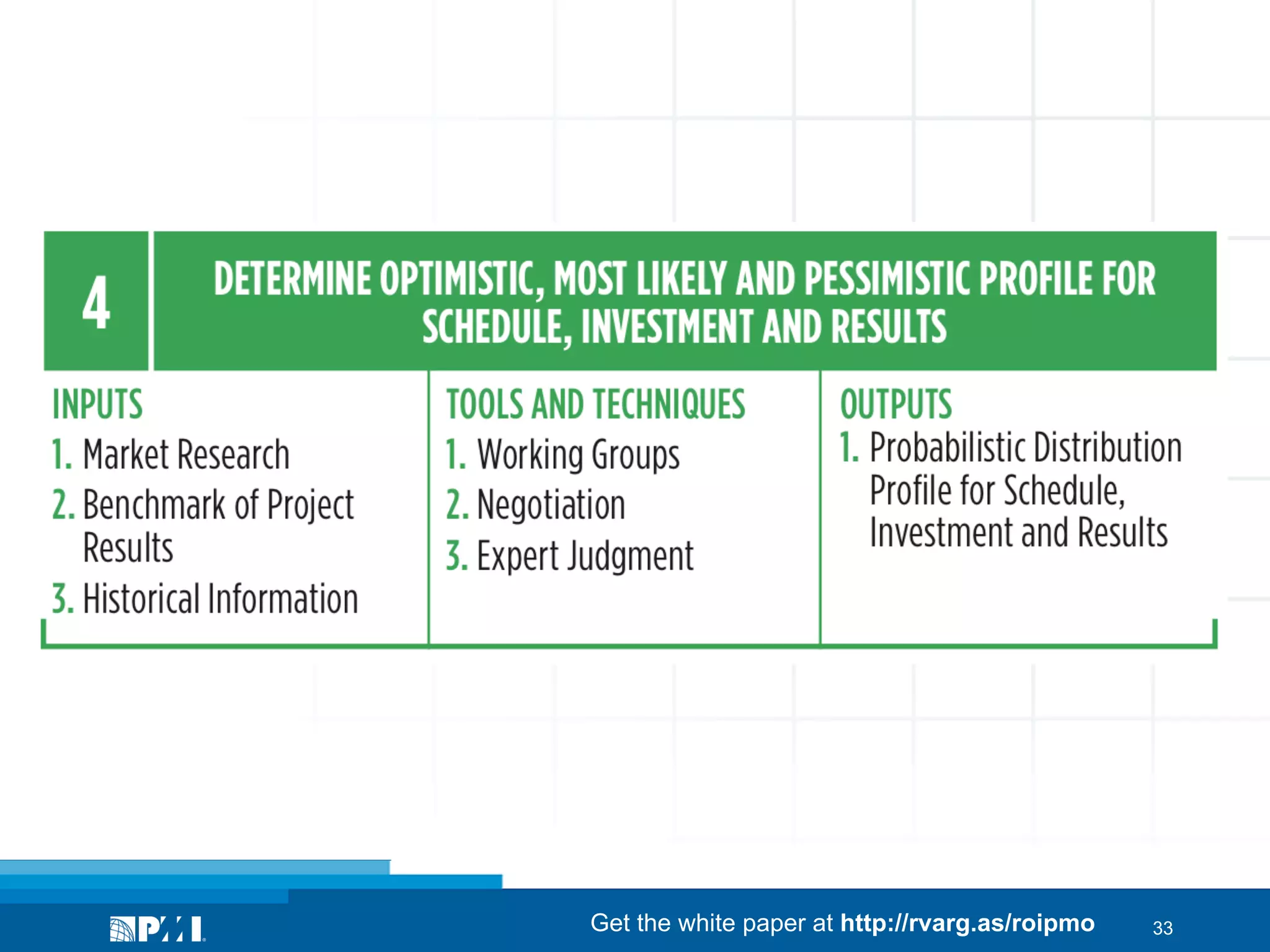

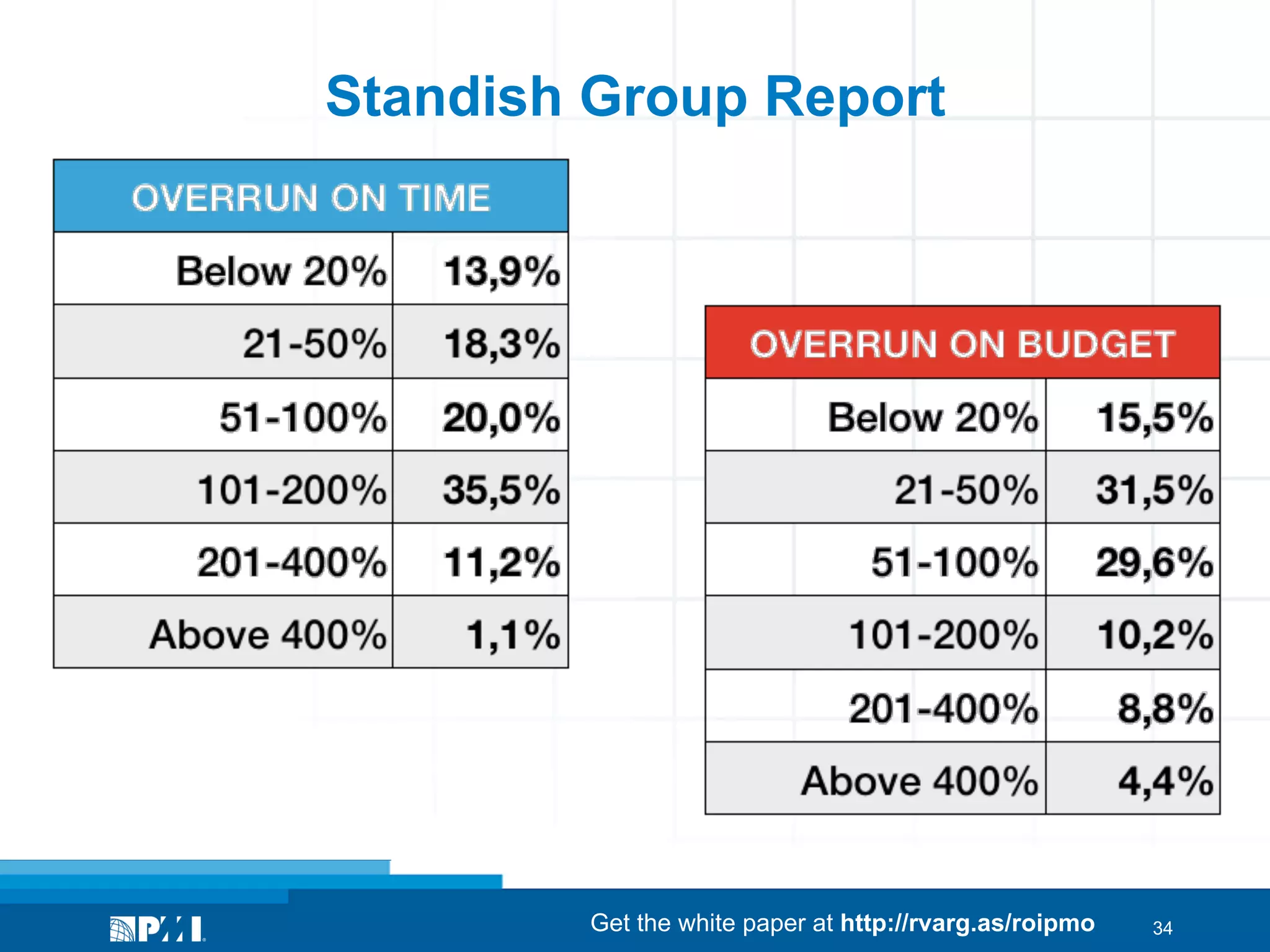

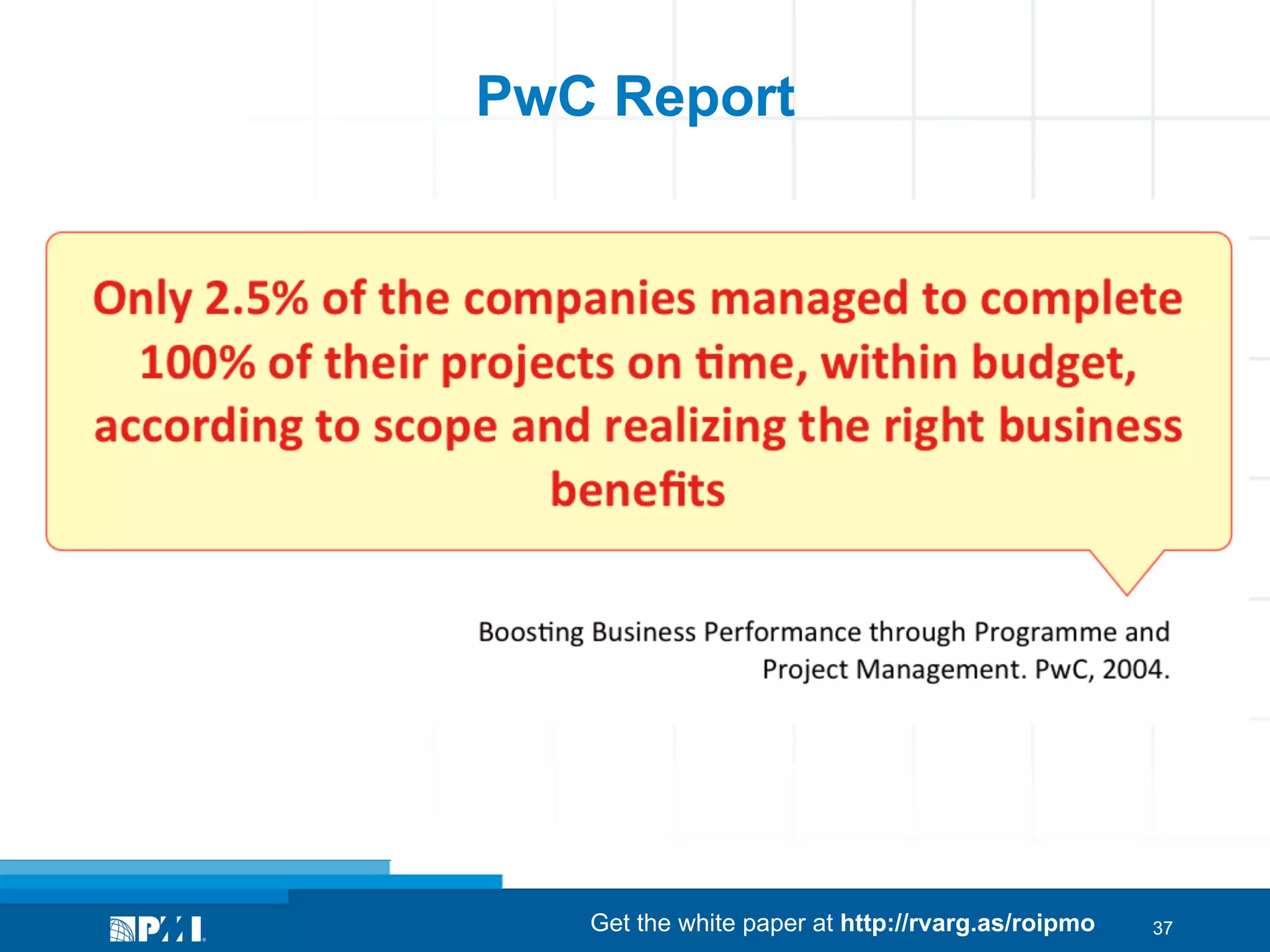

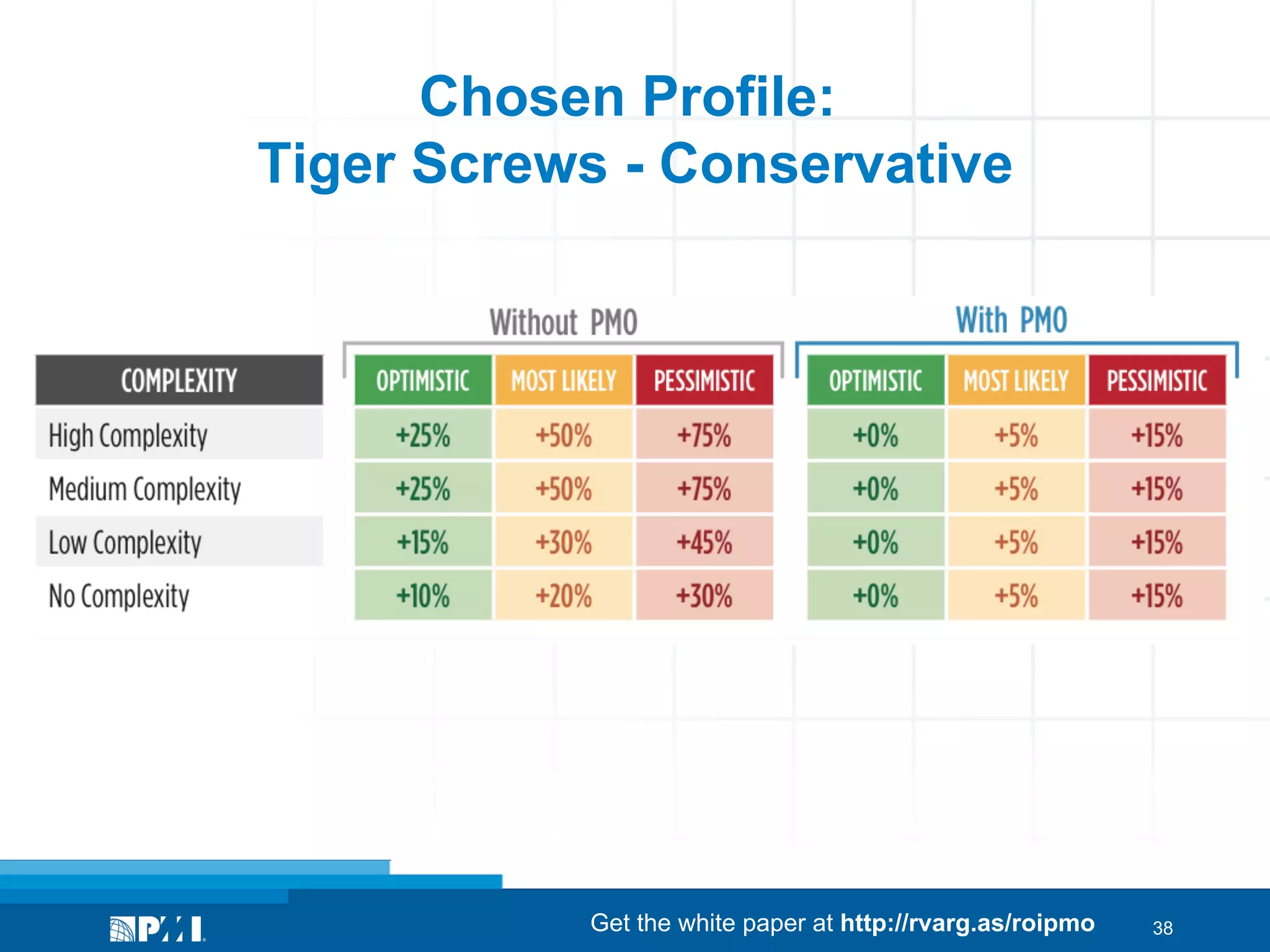

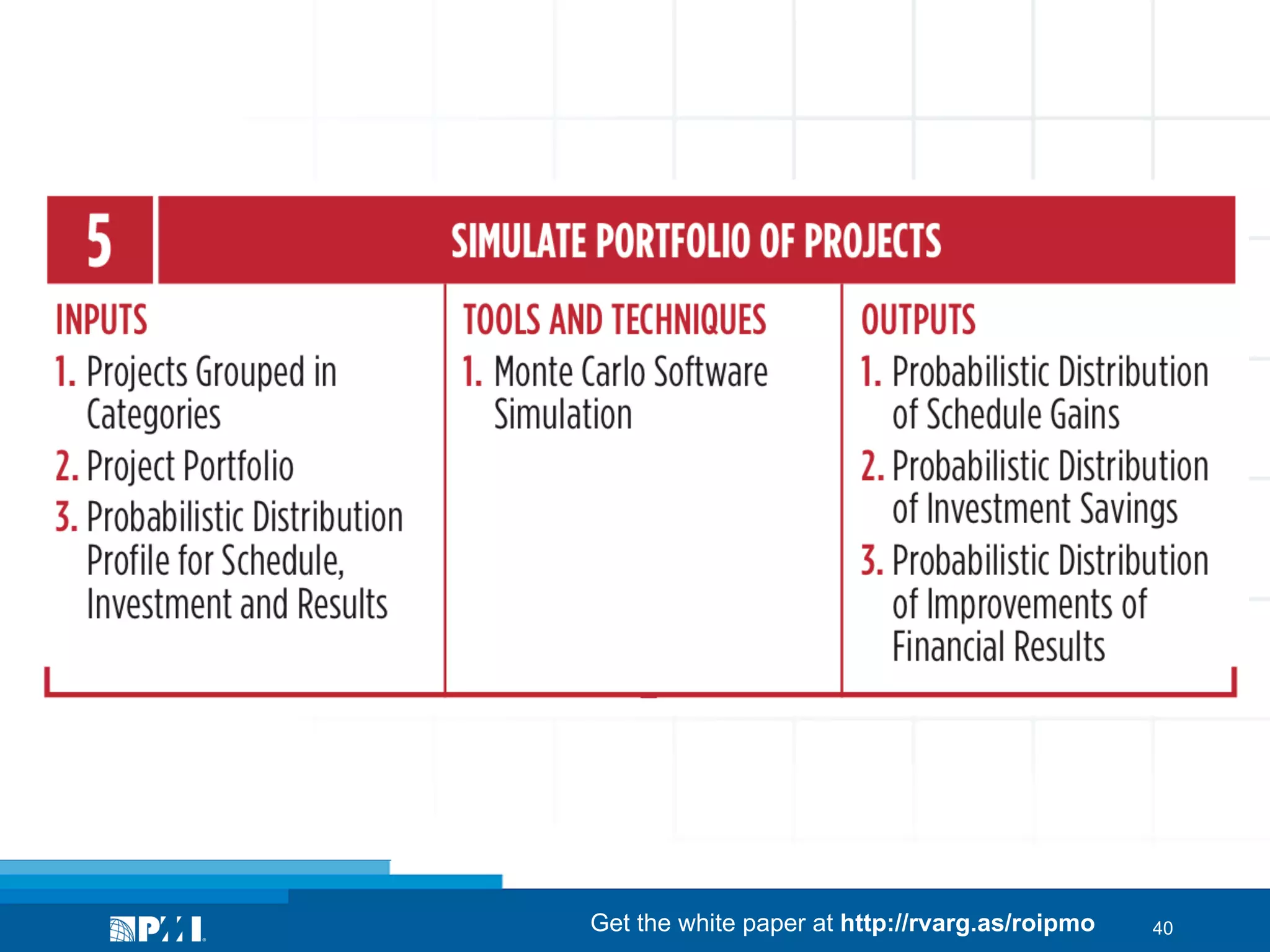

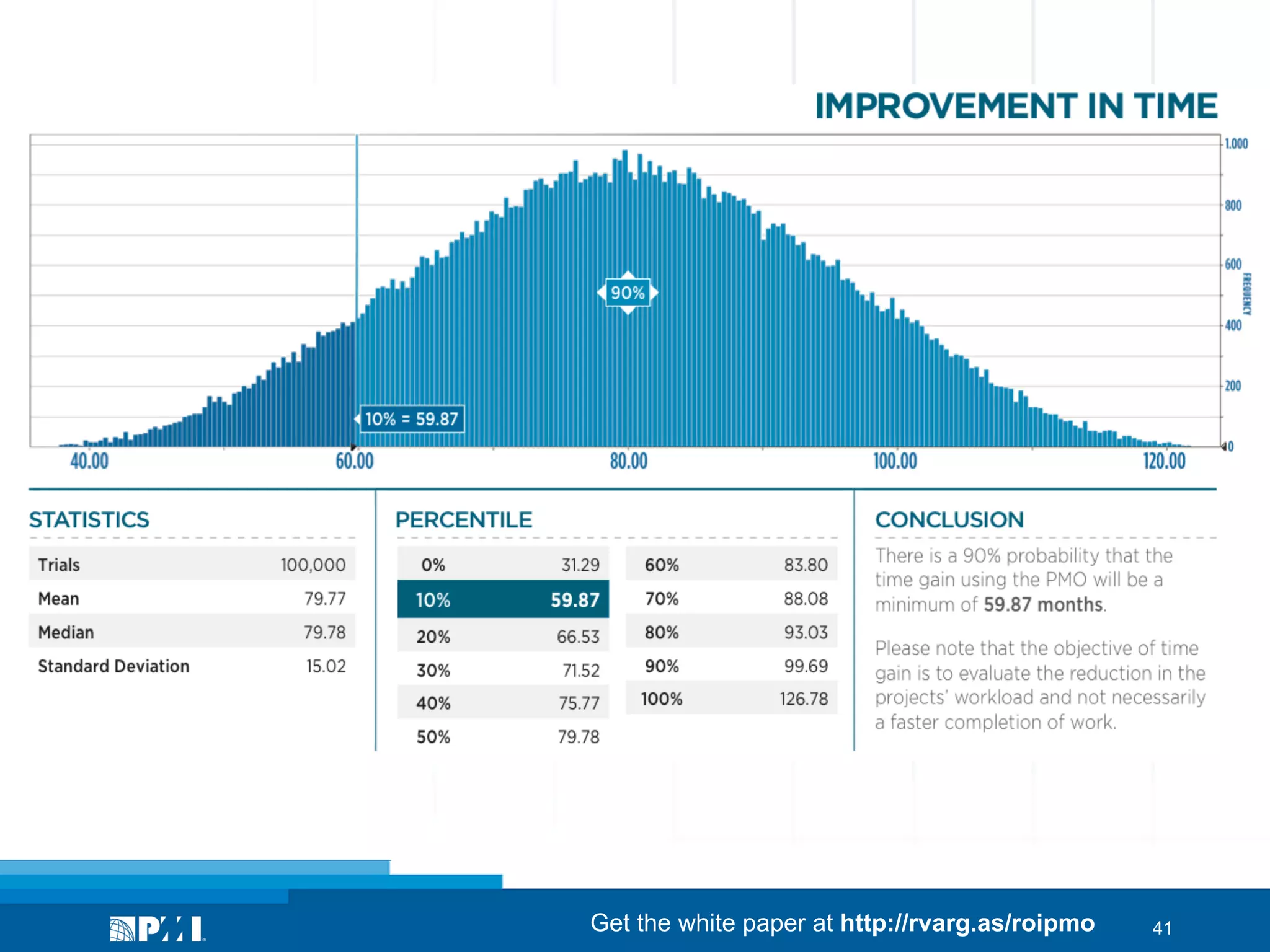

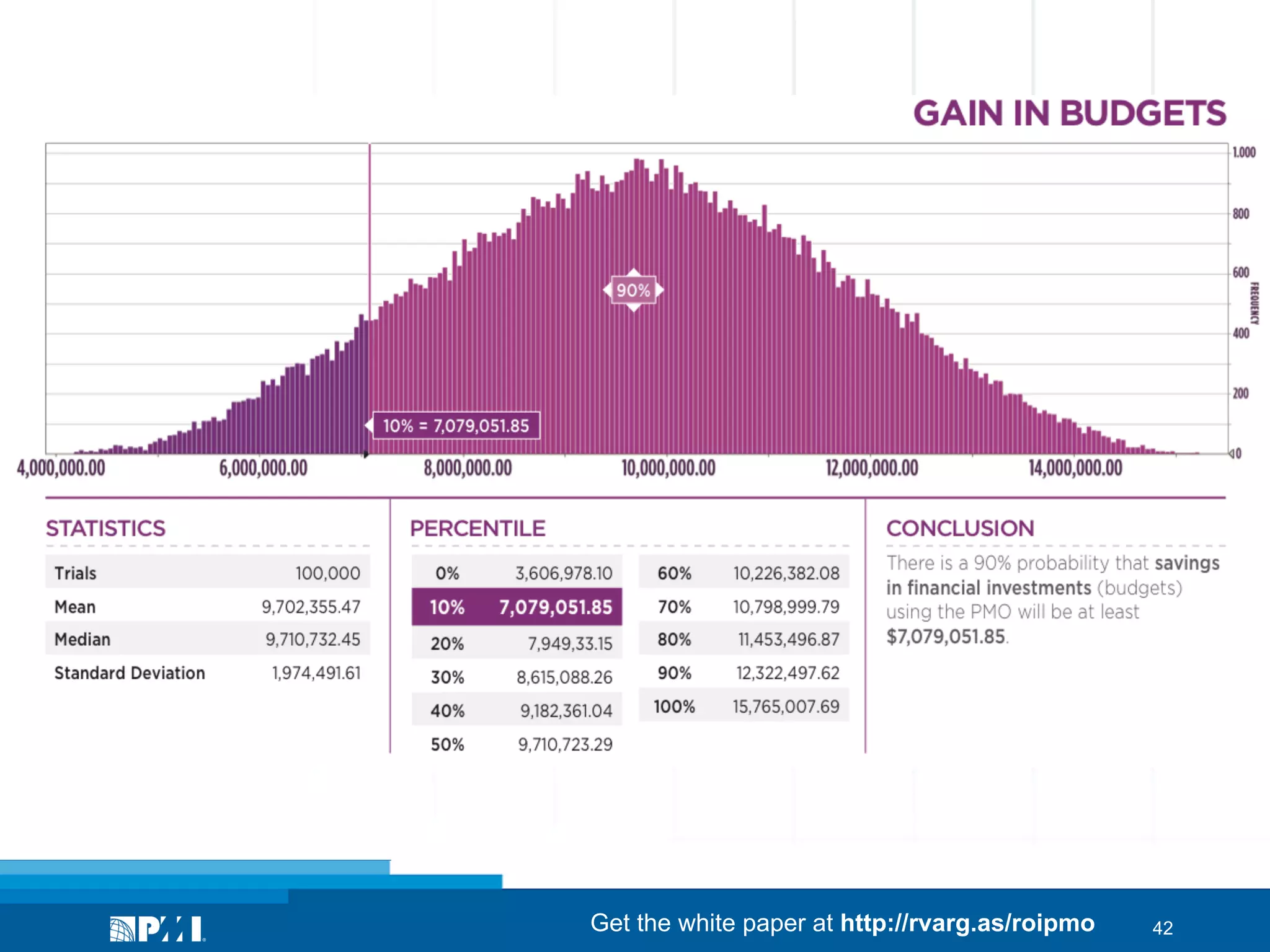

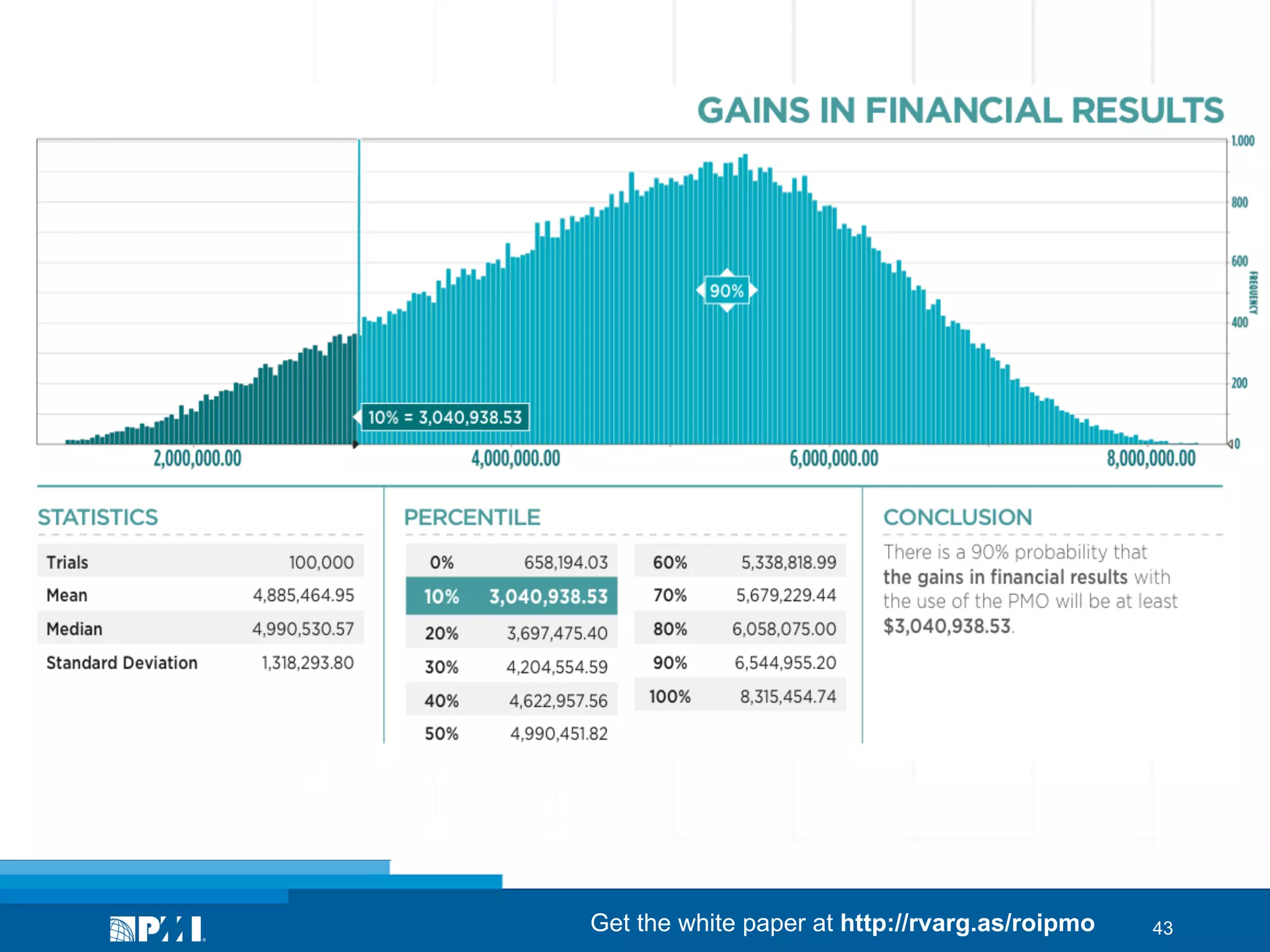

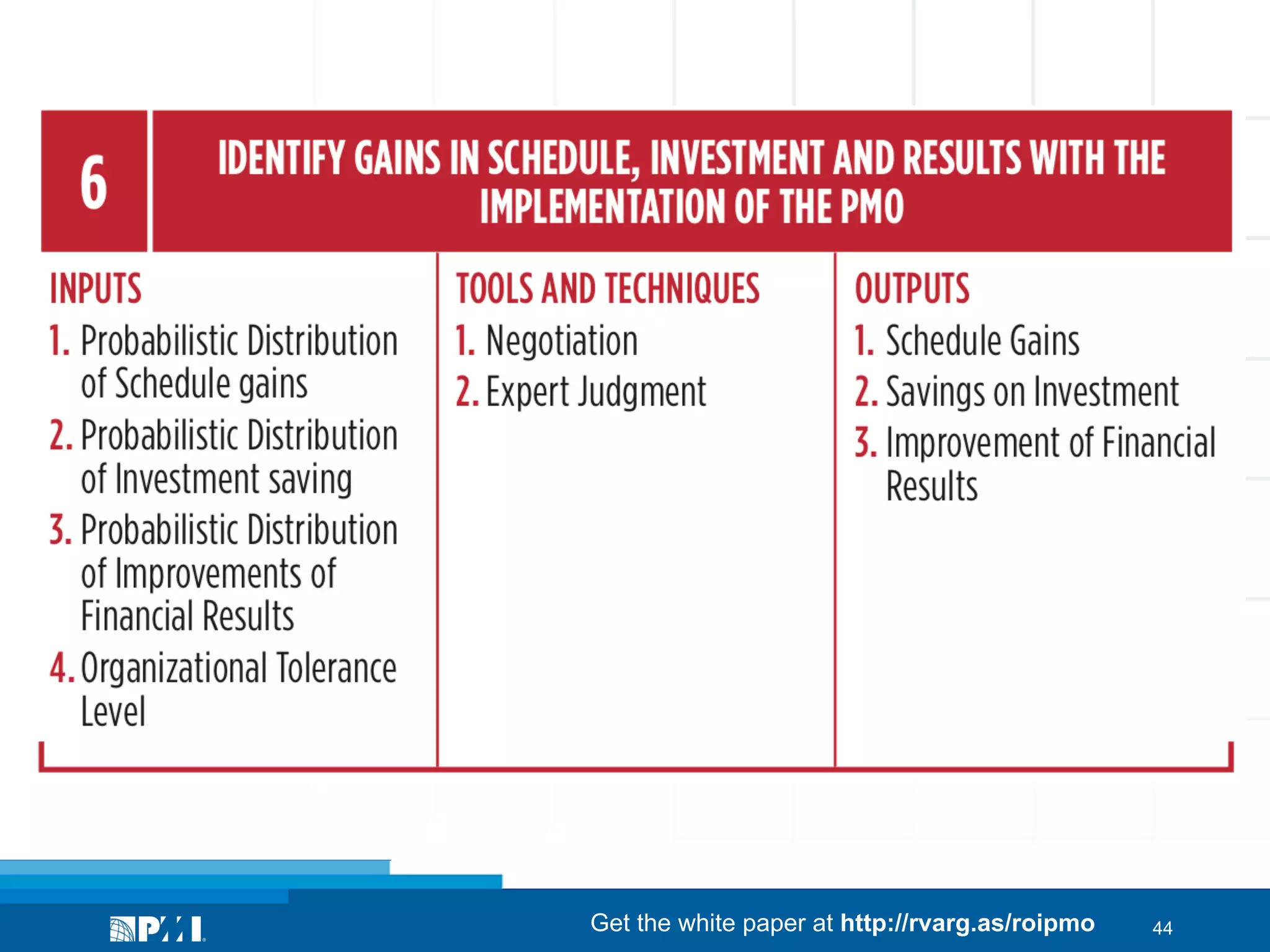

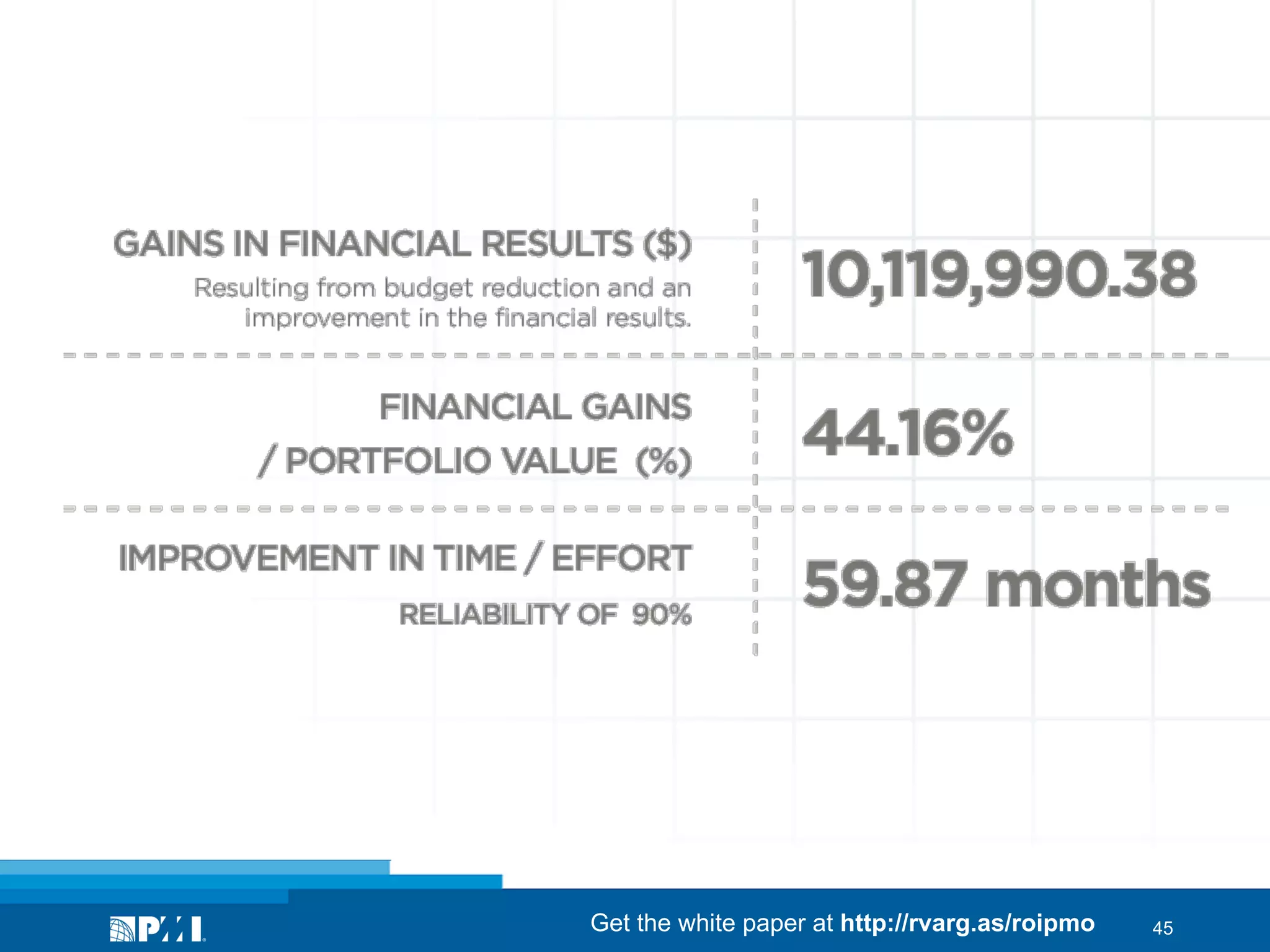

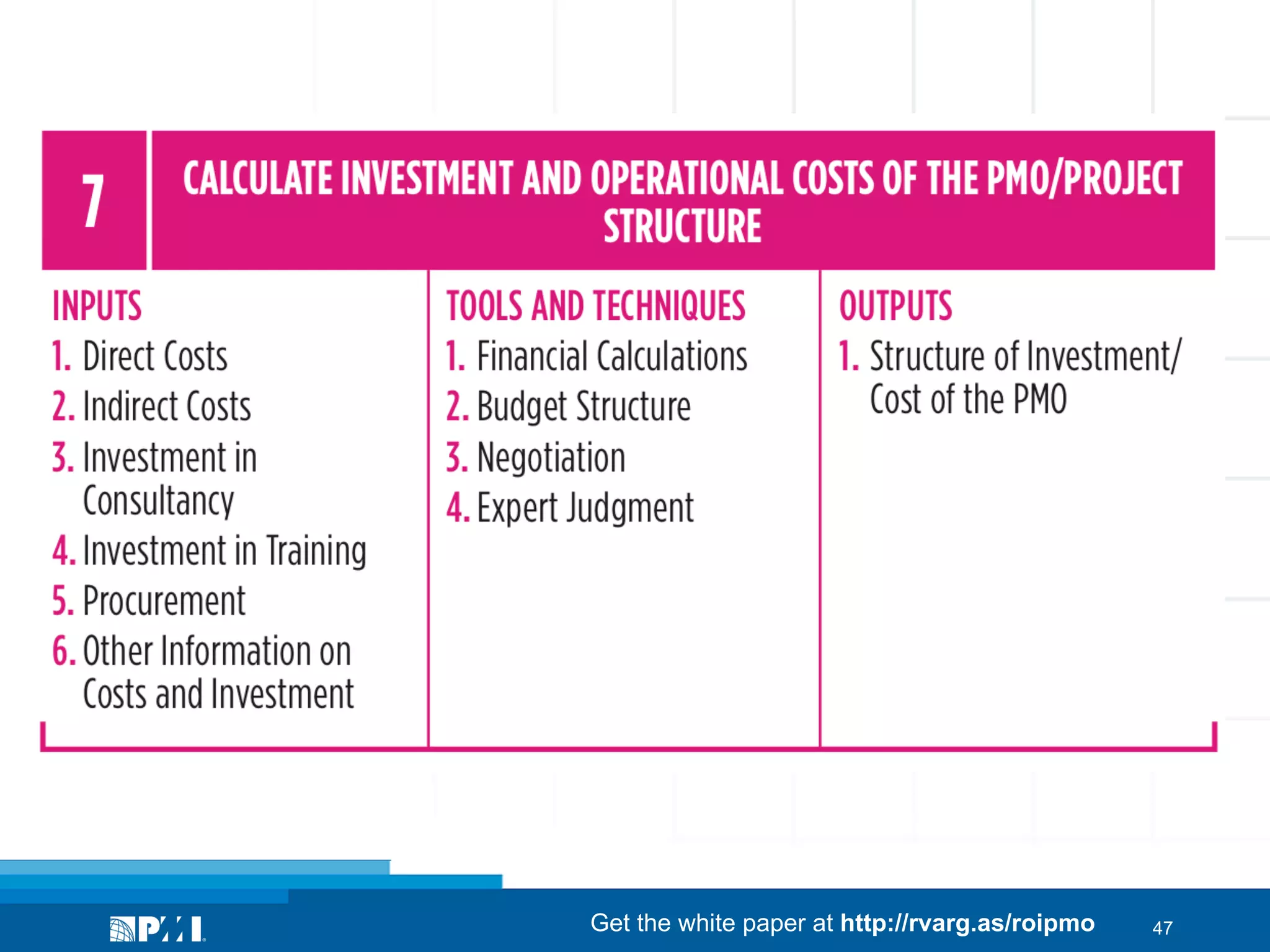

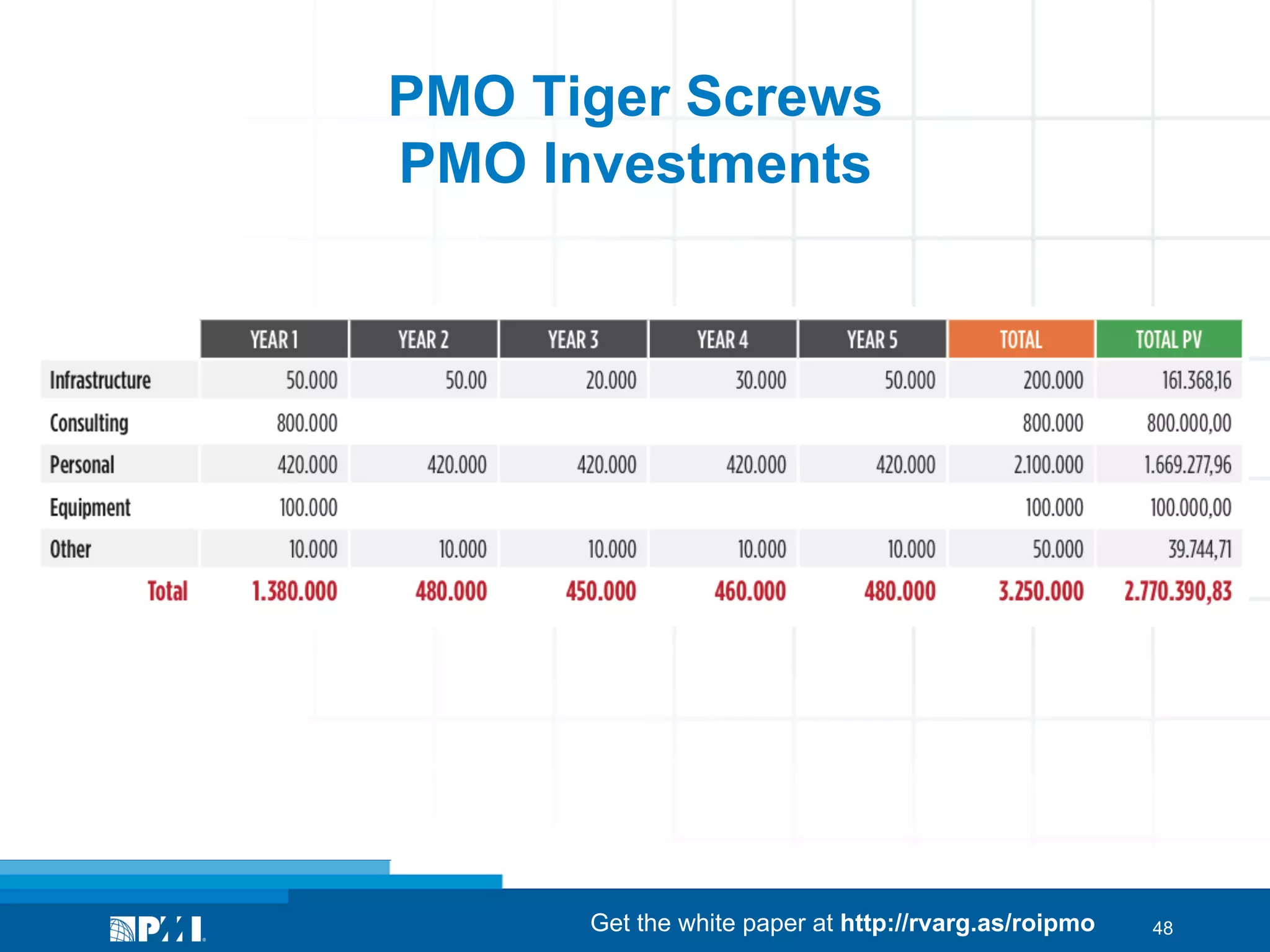

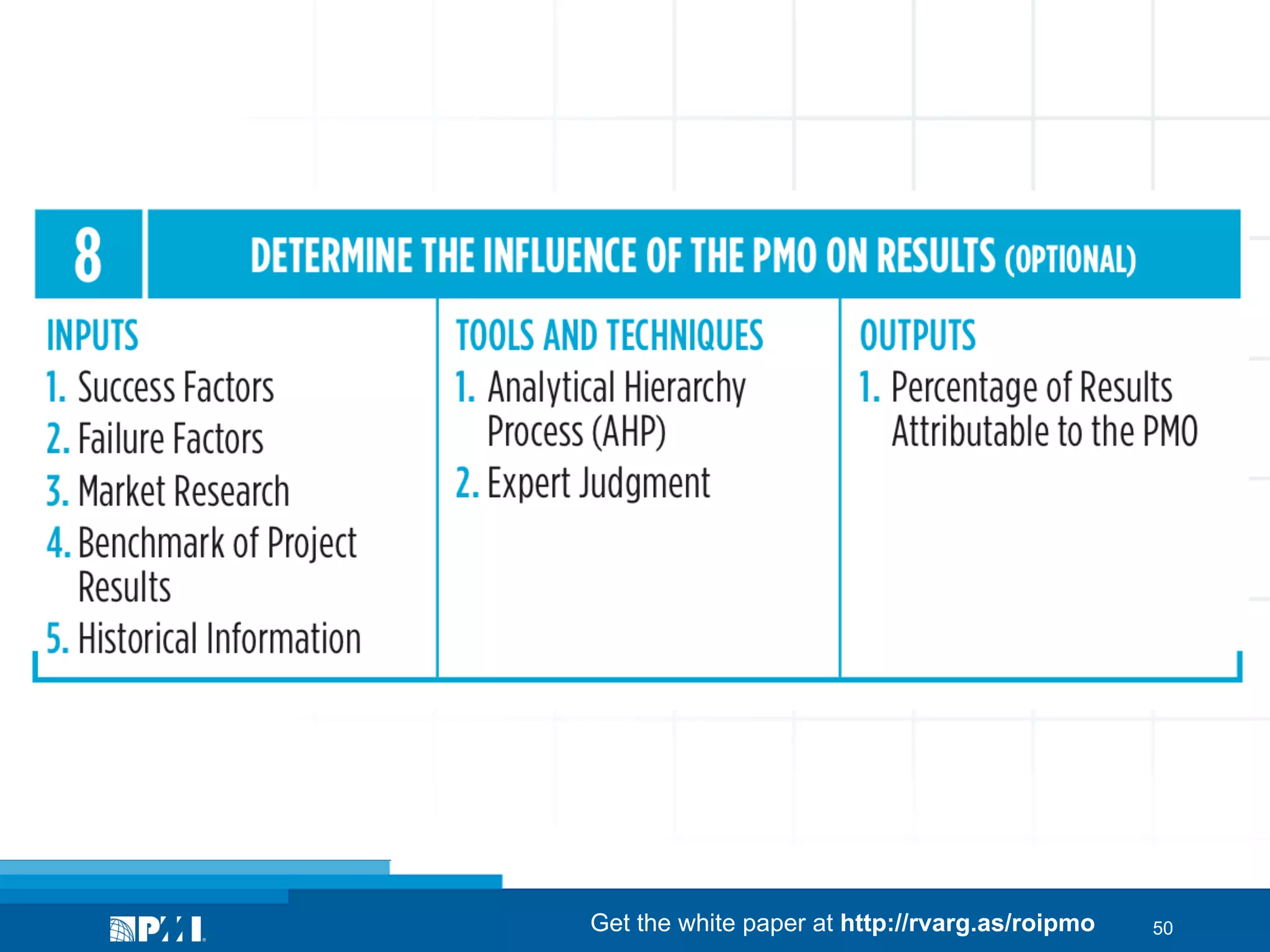

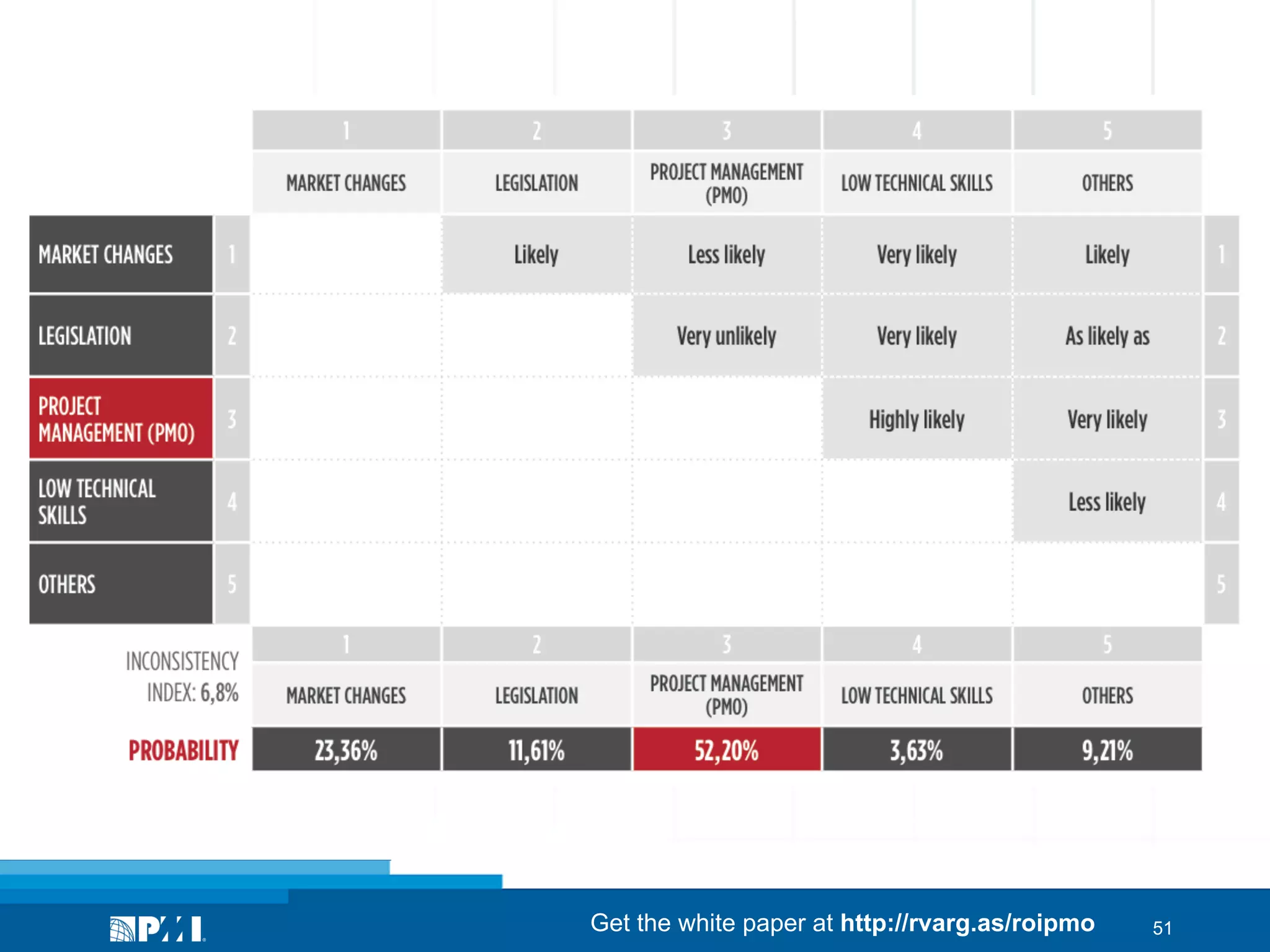

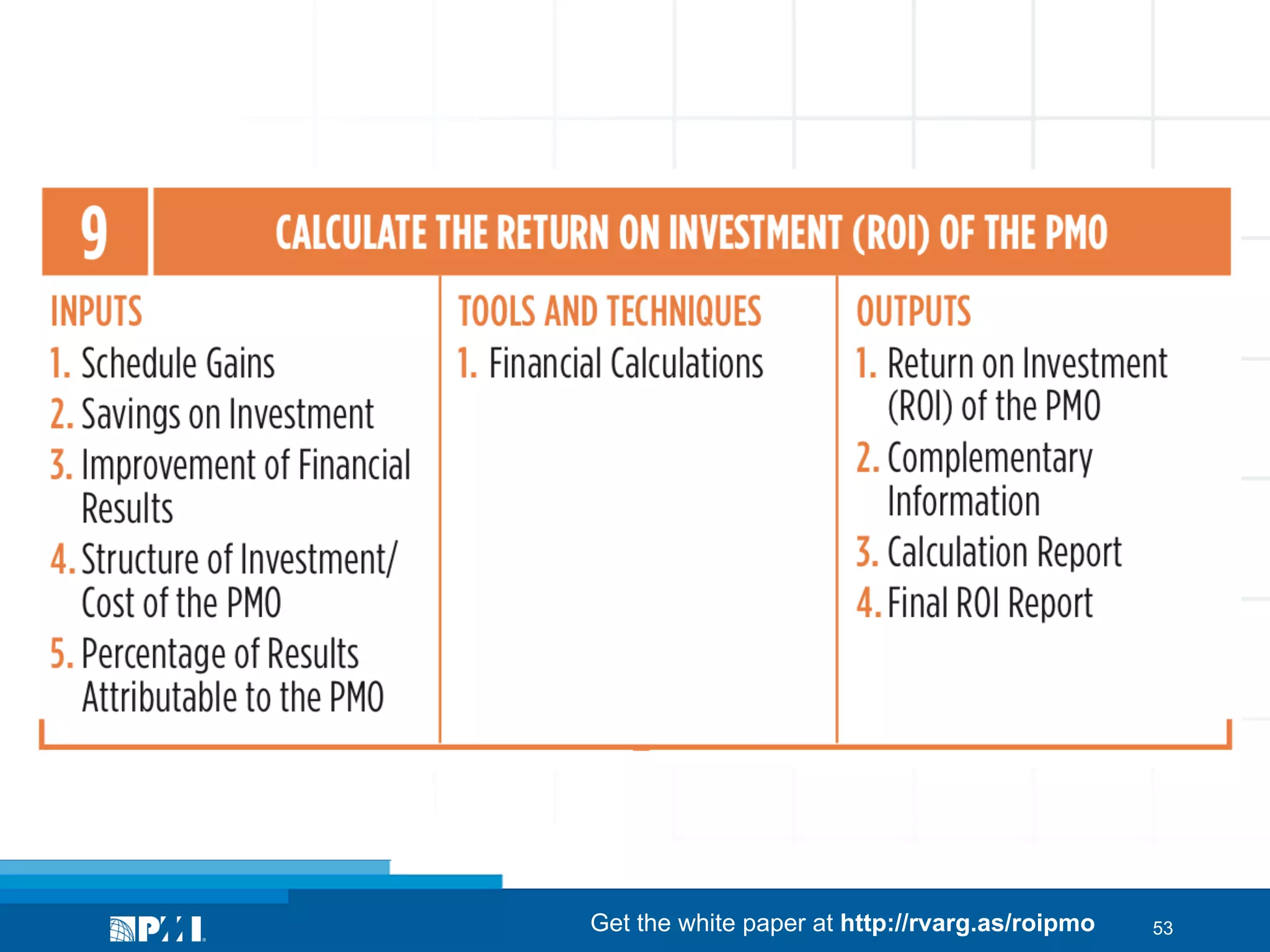

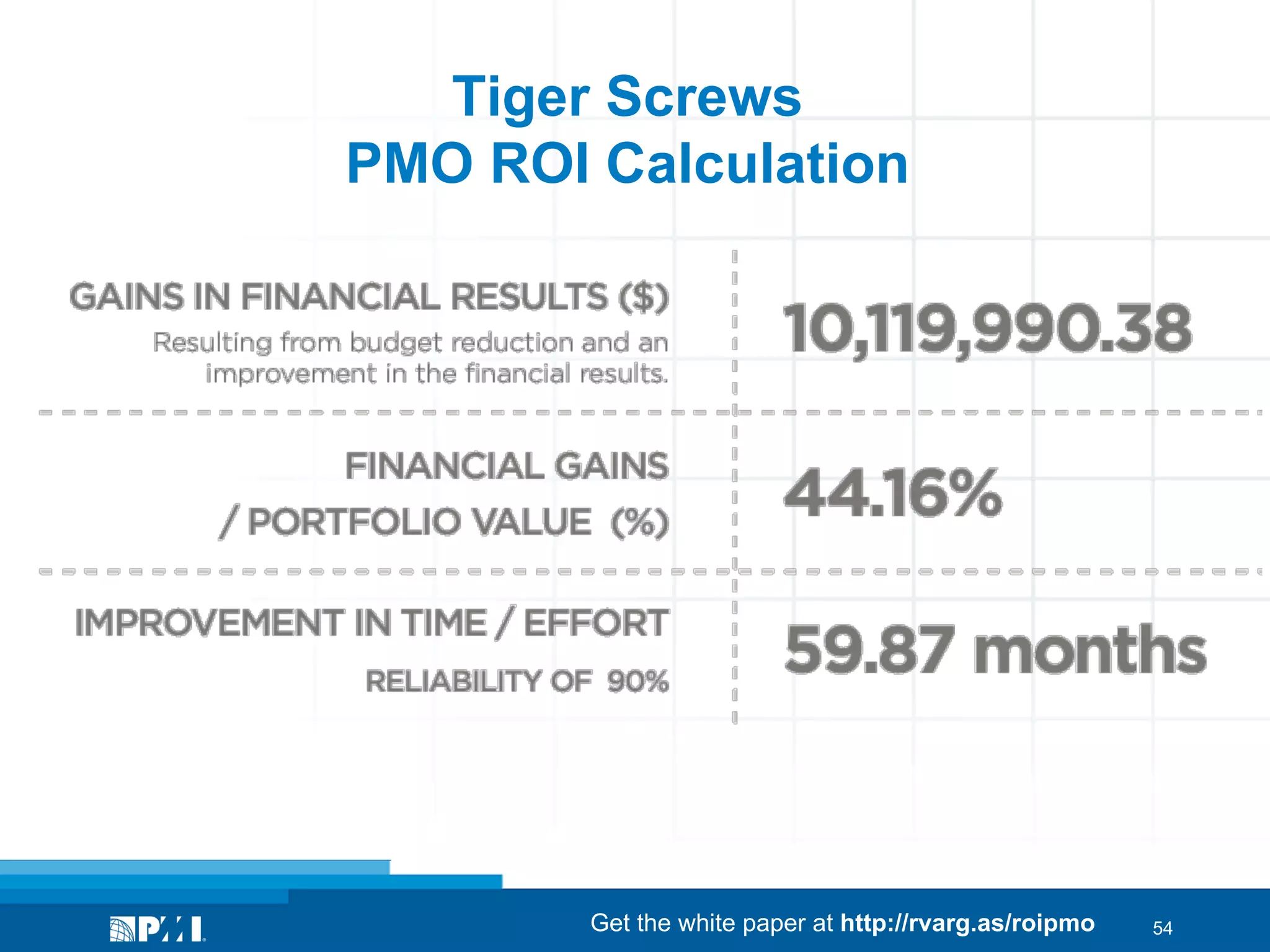

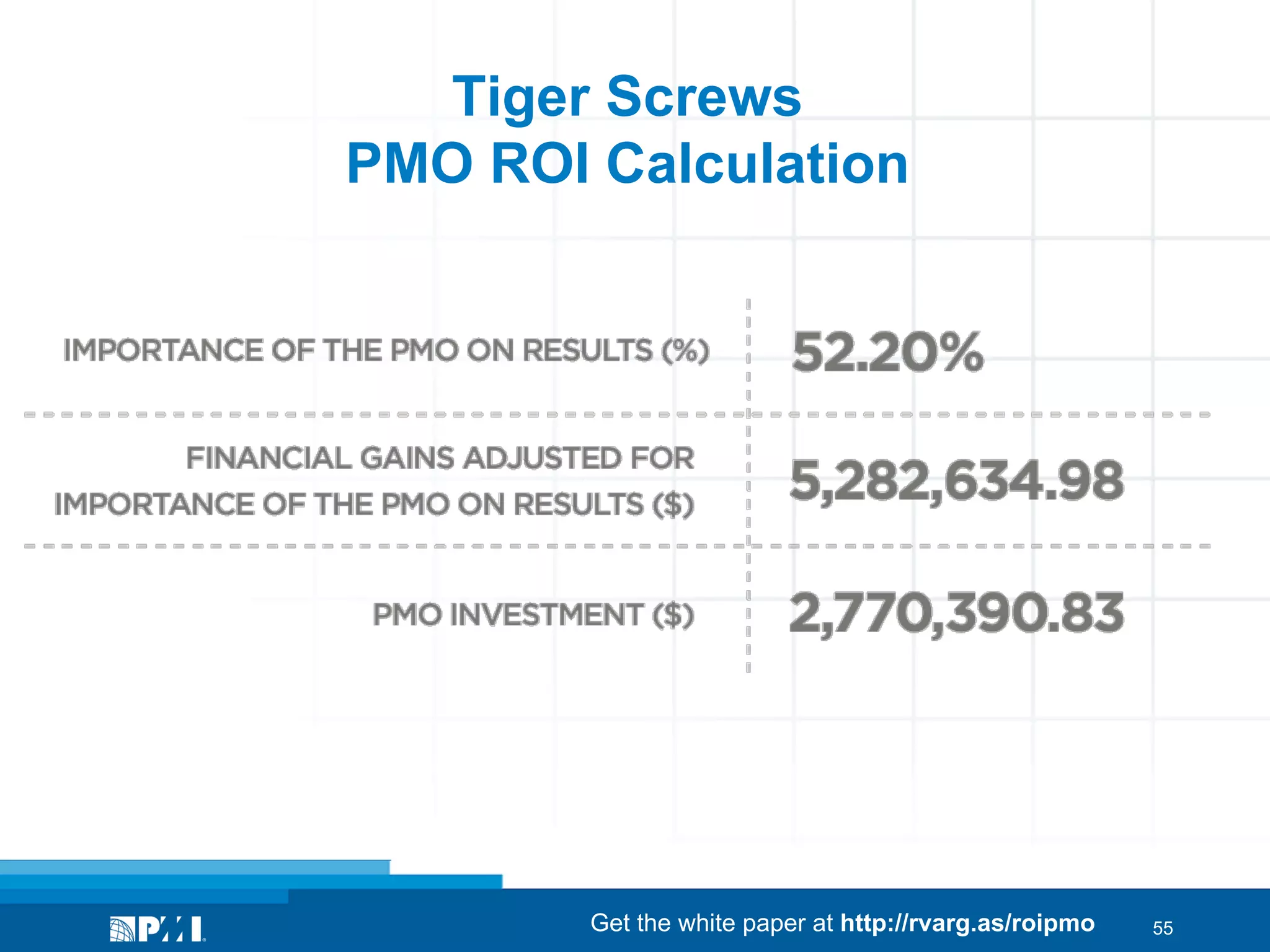

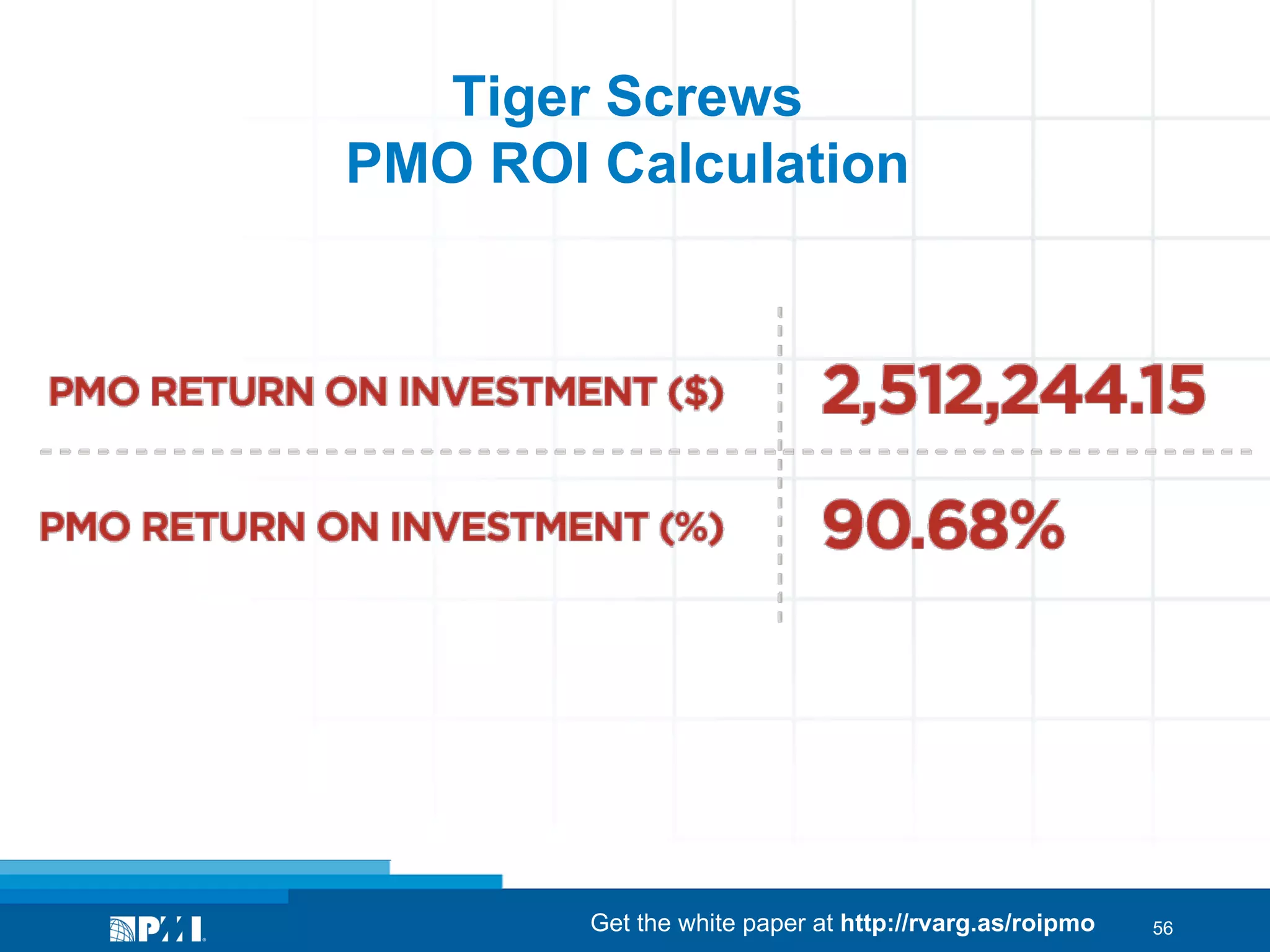

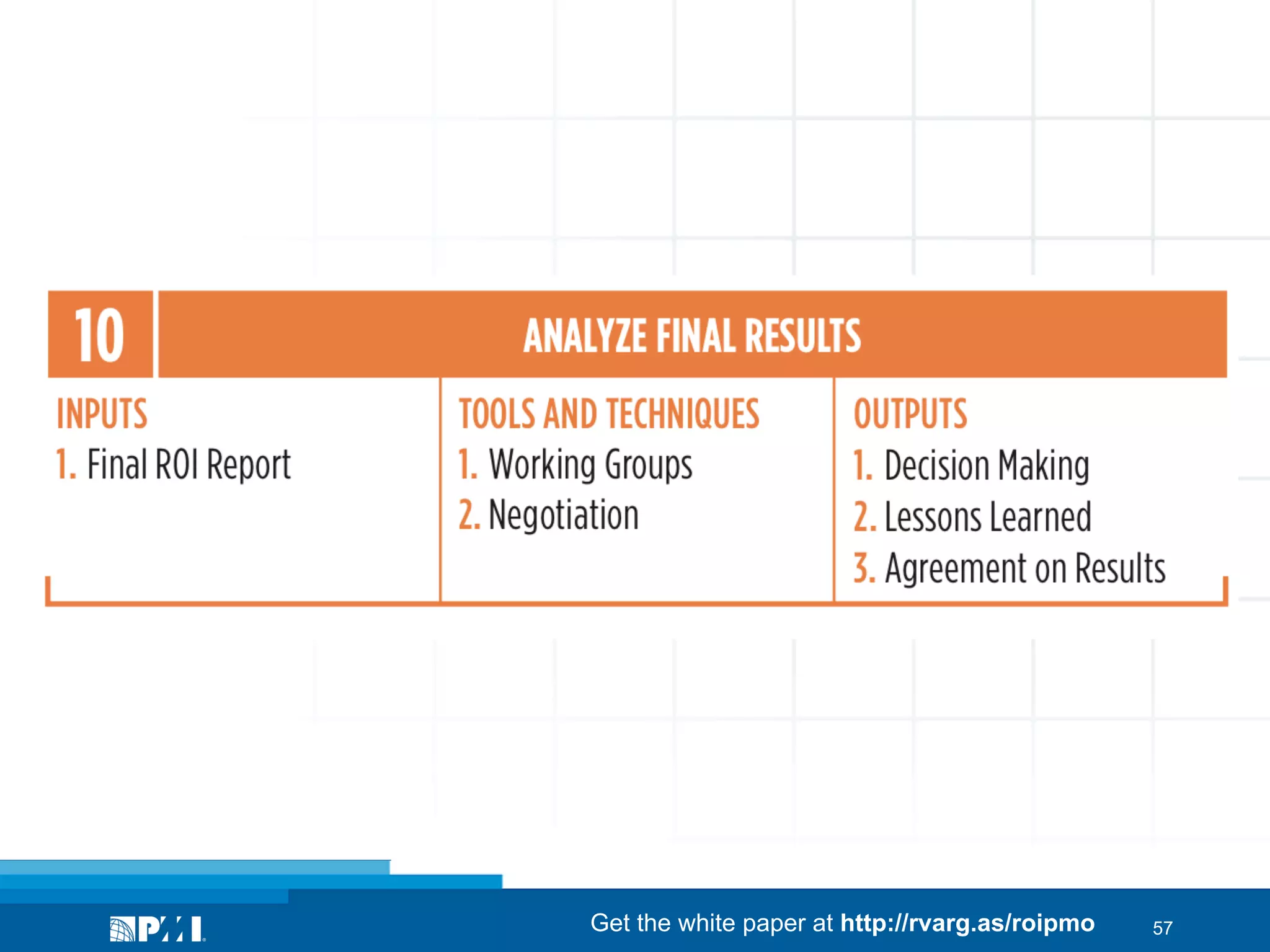

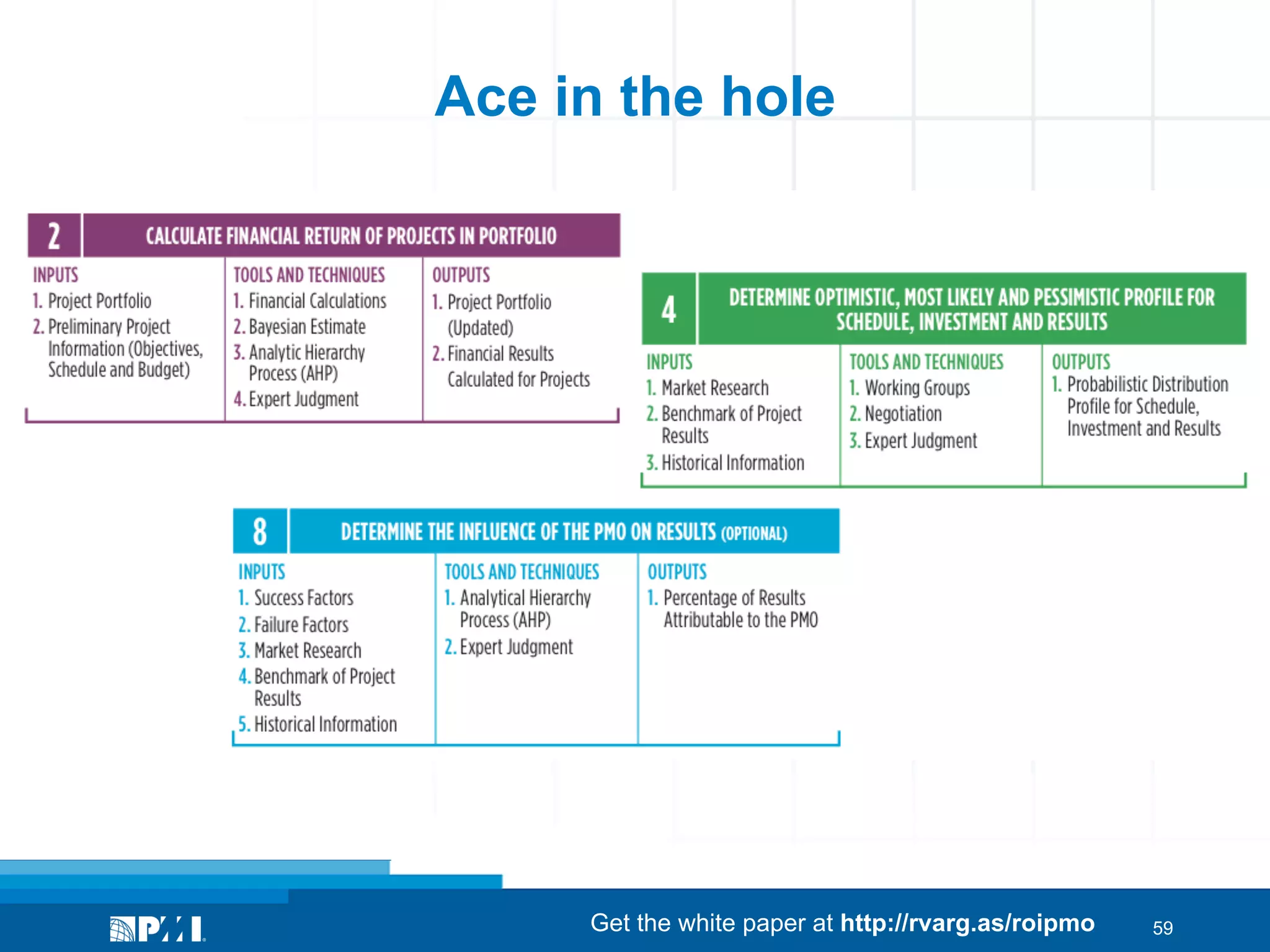

The document discusses the process of calculating the return on investment (ROI) for a Project Management Office (PMO) implementation, highlighting its benefits and challenges. It outlines a step-by-step method for assessing project portfolios, including financial calculations and simulations to identify investments, costs, and potential gains. Key insights emphasize that the process is complex and requires careful project selection and management to effectively demonstrate the PMO's value.