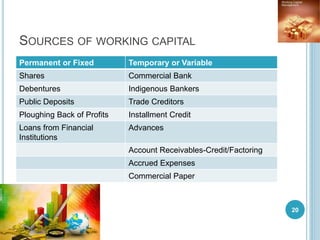

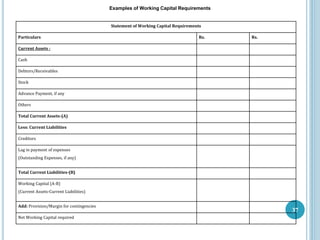

The document covers working capital management, explaining its concept, types, significance, and factors influencing working capital requirements, as well as sources of working capital from various financial institutions. It details aspects such as cash management and the importance of maintaining cash flow for operational stability. Additionally, it highlights the various techniques for managing cash and online payment systems that facilitate transactions.