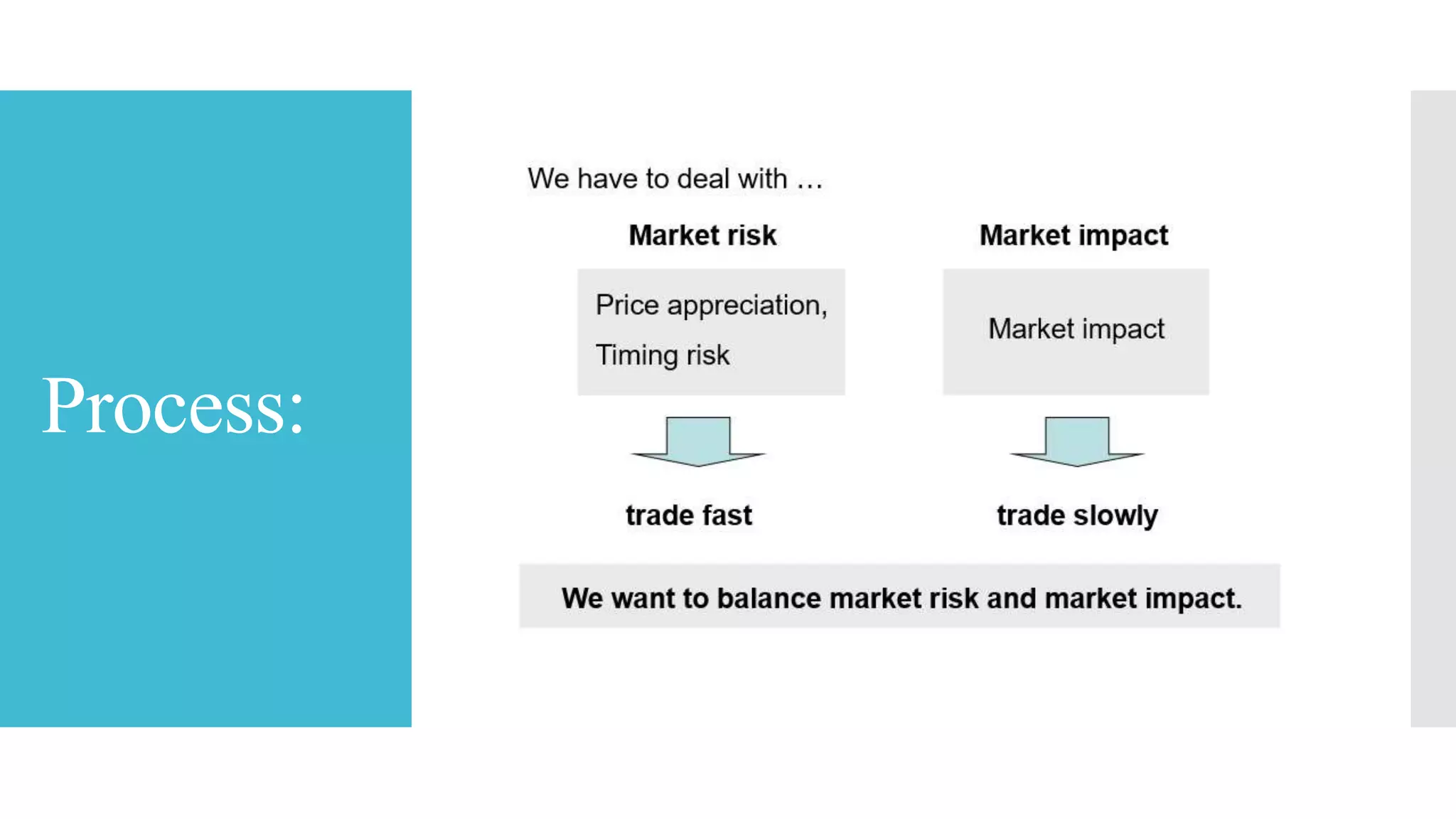

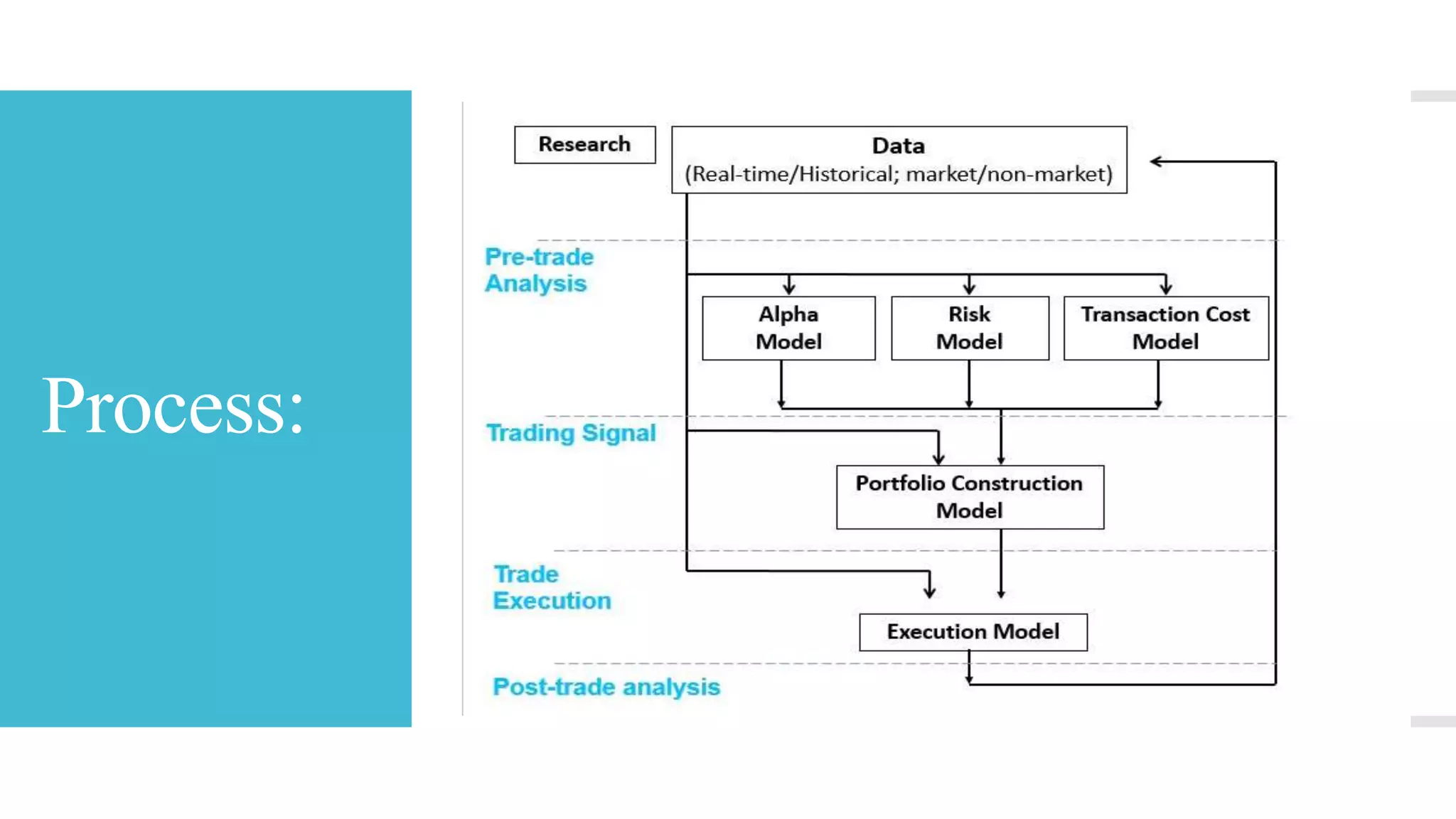

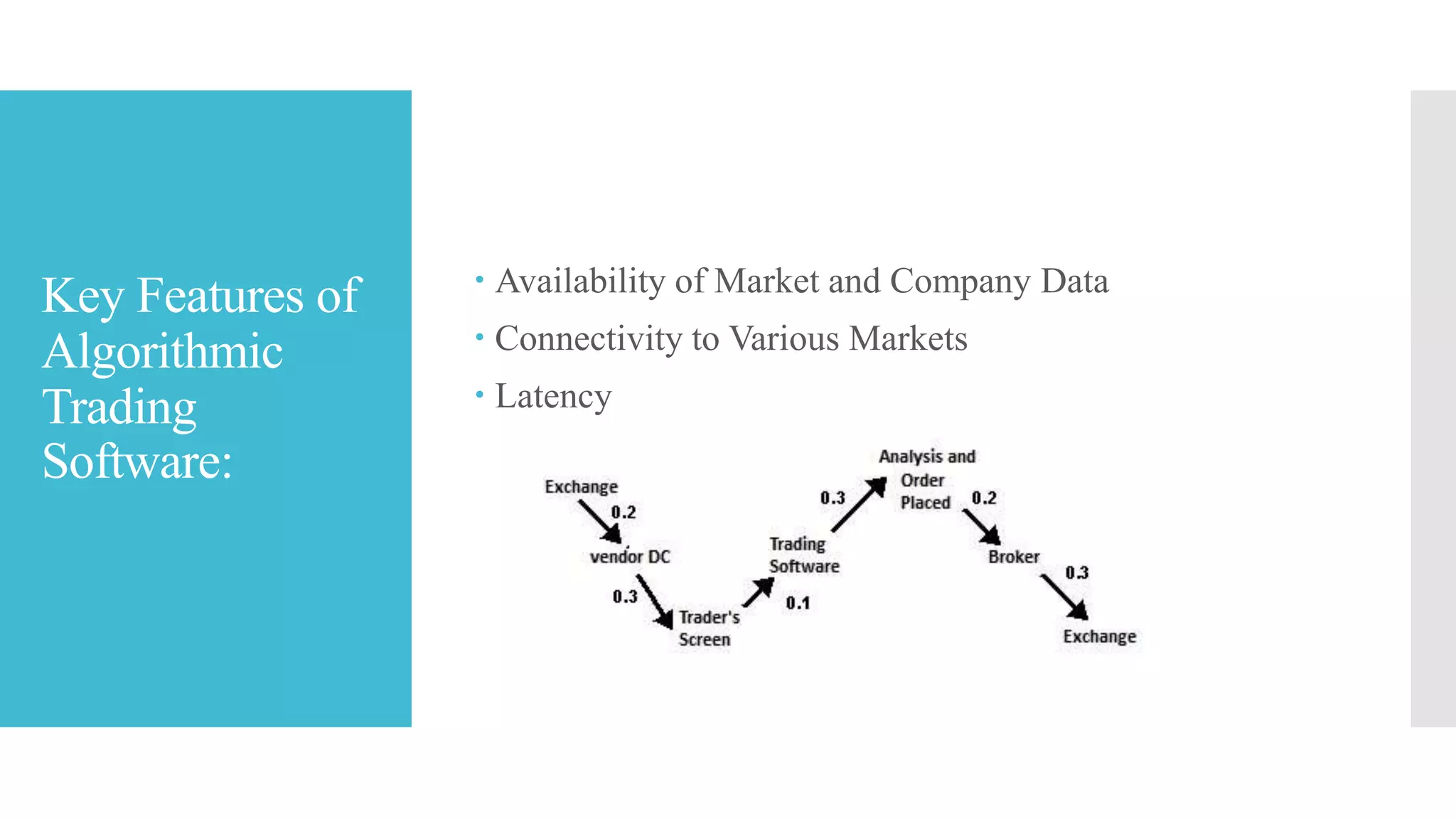

Algorithmic trading utilizes computer programs to automate trading processes, enhancing speed and accuracy beyond human capabilities. It involves a systematic approach for executing trades, aiming to minimize costs, reduce risks, and leverage complex prediction models. Key features of algorithmic trading software include market data access, configurability, and back testing capabilities, making it essential in a highly competitive trading environment.