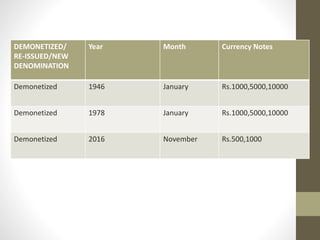

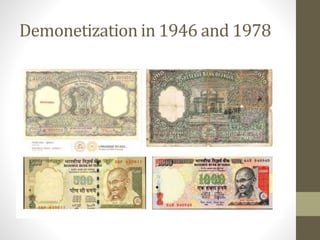

Demonetization in India involved the removal of Rs 500 and Rs 1000 banknotes as legal tender. On November 8, 2016 Prime Minister Modi announced that these notes would no longer be accepted, aiming to curb corruption, black money, and terrorist financing. Citizens were given time to deposit the old notes in banks. While the move aimed to promote digitization and a cashless economy, it also led to cash shortages and economic slowdown in the short-term as cash transactions reduced. The impact on corruption, black money, and GDP growth remains debated, with both benefits and costs associated with this large-scale demonetization initiative.