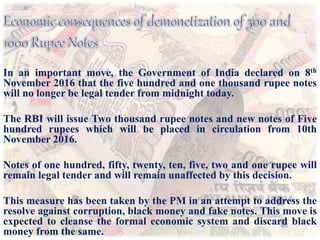

- Demonetization of Rs. 500 and Rs. 1000 currency notes has significantly impacted retailers in India. Small retailers relying on cash transactions have seen a major slump in sales, while organized retailers have faced a drop in store footfalls and sales.

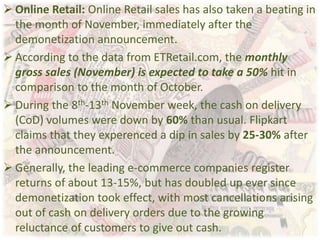

- Online retailers have also seen a dip in sales of around 50% due to a decrease in cash-on-delivery orders in the aftermath of demonetization.

- In the long run, as customers increasingly adopt digital payments, retailers expect sales and footfalls to return to normal levels. Demonetization is aimed at curbing black money, corruption, and use of illicit funds to sponsor terrorism.