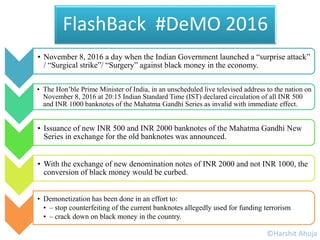

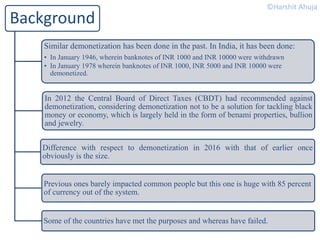

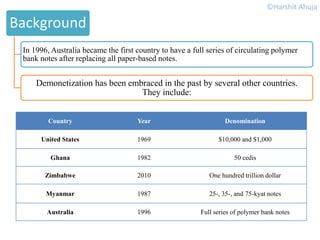

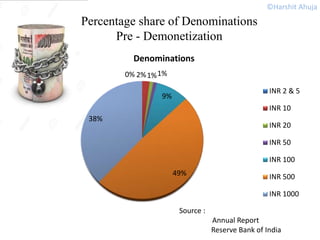

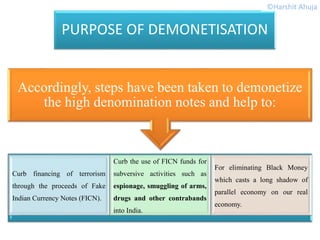

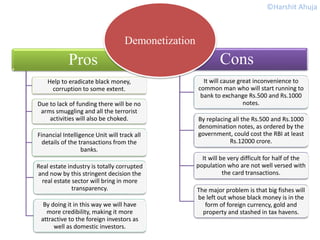

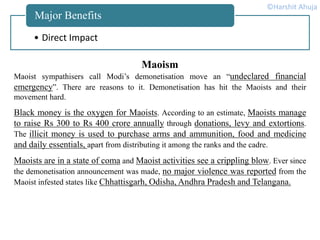

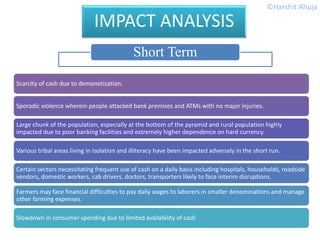

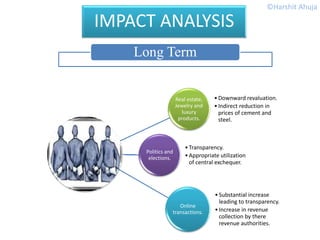

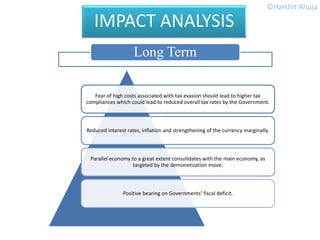

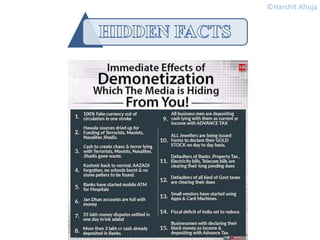

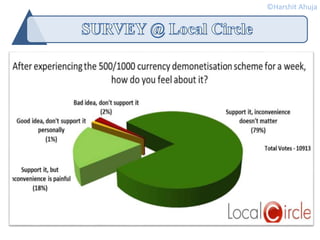

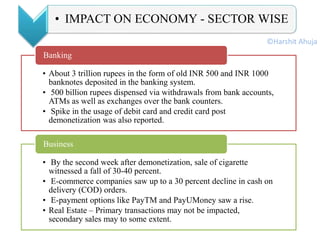

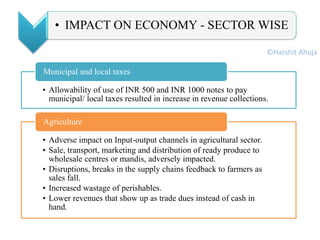

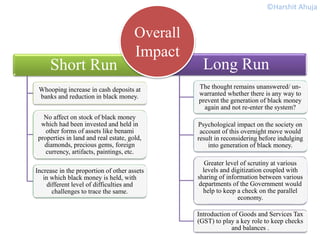

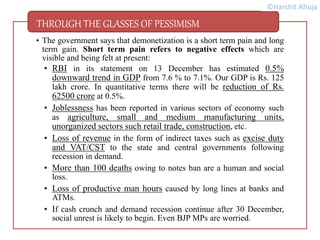

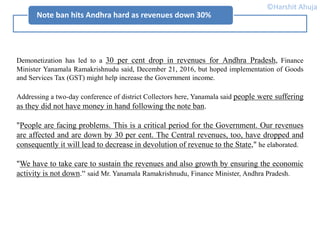

The document discusses the demonetization effort initiated by the Indian government on November 8, 2016, which invalidated INR 500 and INR 1000 banknotes to combat black money and counterfeit currency. It reviews the pros and cons of the move, outlining its potential long-term benefits such as increased economic transparency and a reduction in illegal financial activities, alongside short-term inconveniences and negative impacts on certain sectors of the economy. Furthermore, it highlights the historical context of demonetization in India and other countries, and emphasizes the expectation of a significant overhaul in the country's economic dynamics as a result.