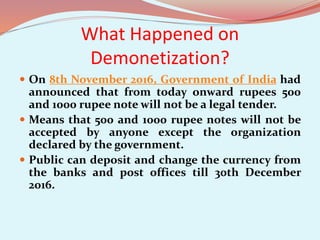

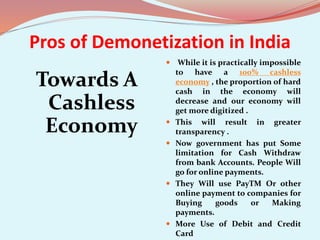

On November 8th, 2016 the Indian government announced that Rs. 500 and Rs. 1000 banknotes would no longer be legal tender. People could deposit or exchange the old currency at banks and post offices until December 30th. Demonetization involves removing a currency from circulation. It has happened twice before in India, in 1946 and 1978. The goal of the 2016 demonetization was to target black money, fake currency, terrorist funding, and move toward a cashless economy. It had short term costs like overcrowding at banks and rising prices, but long term benefits for transparency and the digital economy. Overall it was assessed as having more advantages than disadvantages for India.