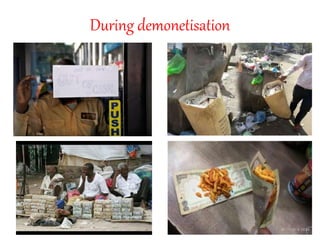

Demonetization is the act of stripping a currency unit of its status as legal tender. In India, the government demonetized Rs. 500 and Rs. 1000 notes on November 8th in an effort to curb black money, fake currency, terrorist funding, and move toward a cashless economy. While there were short term costs like bank lines and economic slowdown, demonetization is expected to increase transparency, tax collection, digitization of the economy, and decrease corruption in the long run. The move constituted over 85% of the total currency in circulation being wiped out overnight.