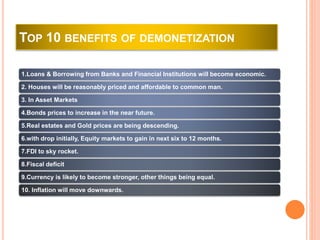

This document discusses India's demonetization that occurred in 2016 when the government withdrew the Rs 500 and Rs 1000 currency notes from circulation. It provides background on what demonetization is and the history of it in India. The objectives of the 2016 demonetization are described as targeting black money, corruption, terrorism financing. The impacts of demonetization on various sectors of the economy are discussed such as agriculture, banking, real estate, tourism, education, and healthcare. Challenges of the demonetization process and its effects in rural areas are also summarized.