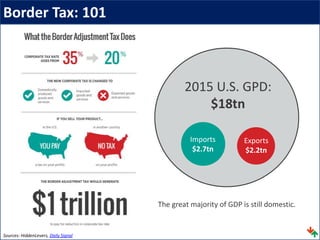

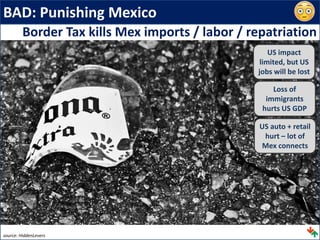

This document discusses trends toward de-globalization, including proposed US policies around border taxes. It outlines scenarios where a border tax plan works well and exporters benefit, punishing Mexico with modest US impact, or an ugly trade war hurting US GDP. Key takeaways are that exporters may win under border taxes while importers lose, and the big risk is a trade war, as protectionist US policies could hand global leadership to China.