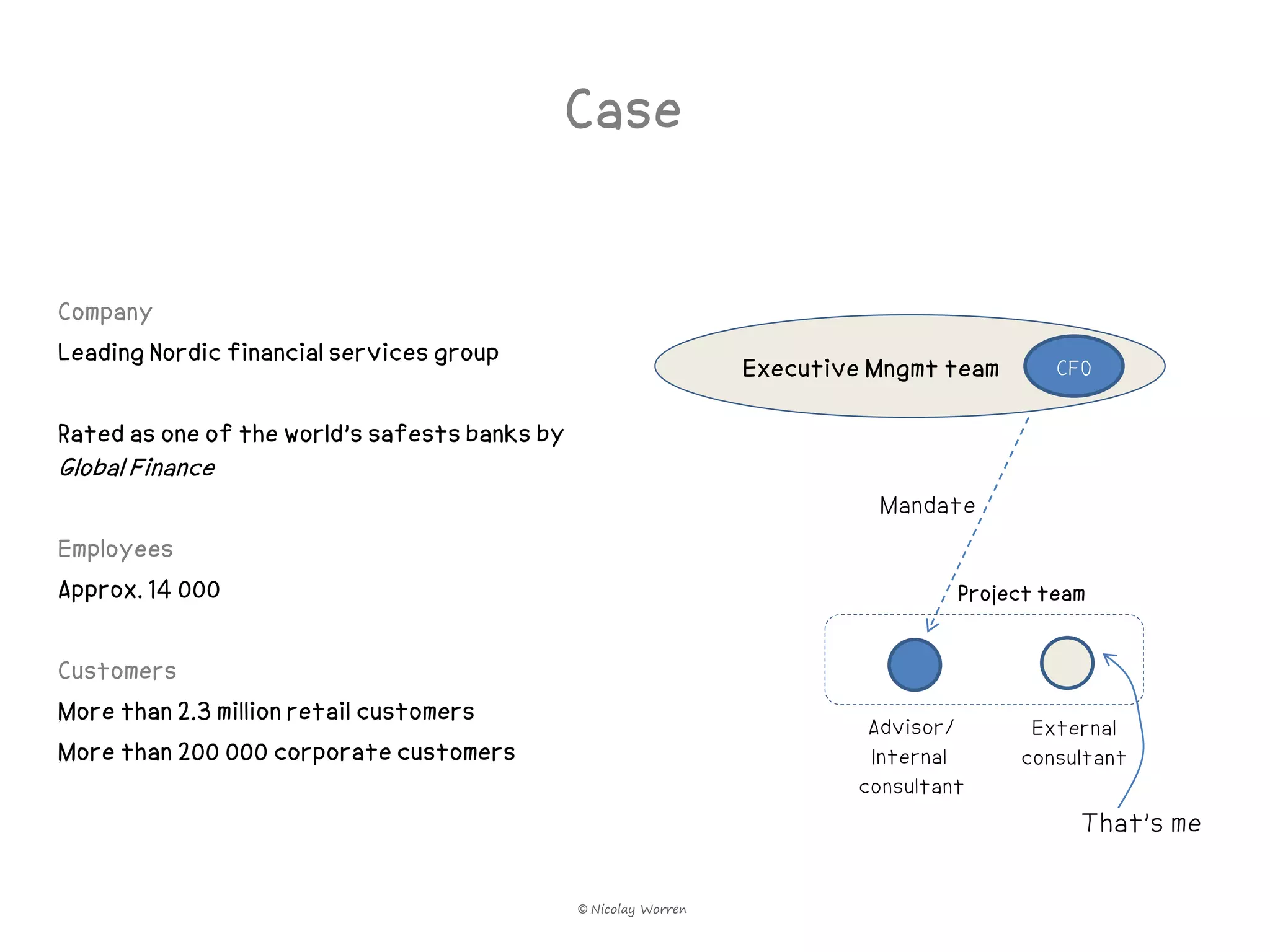

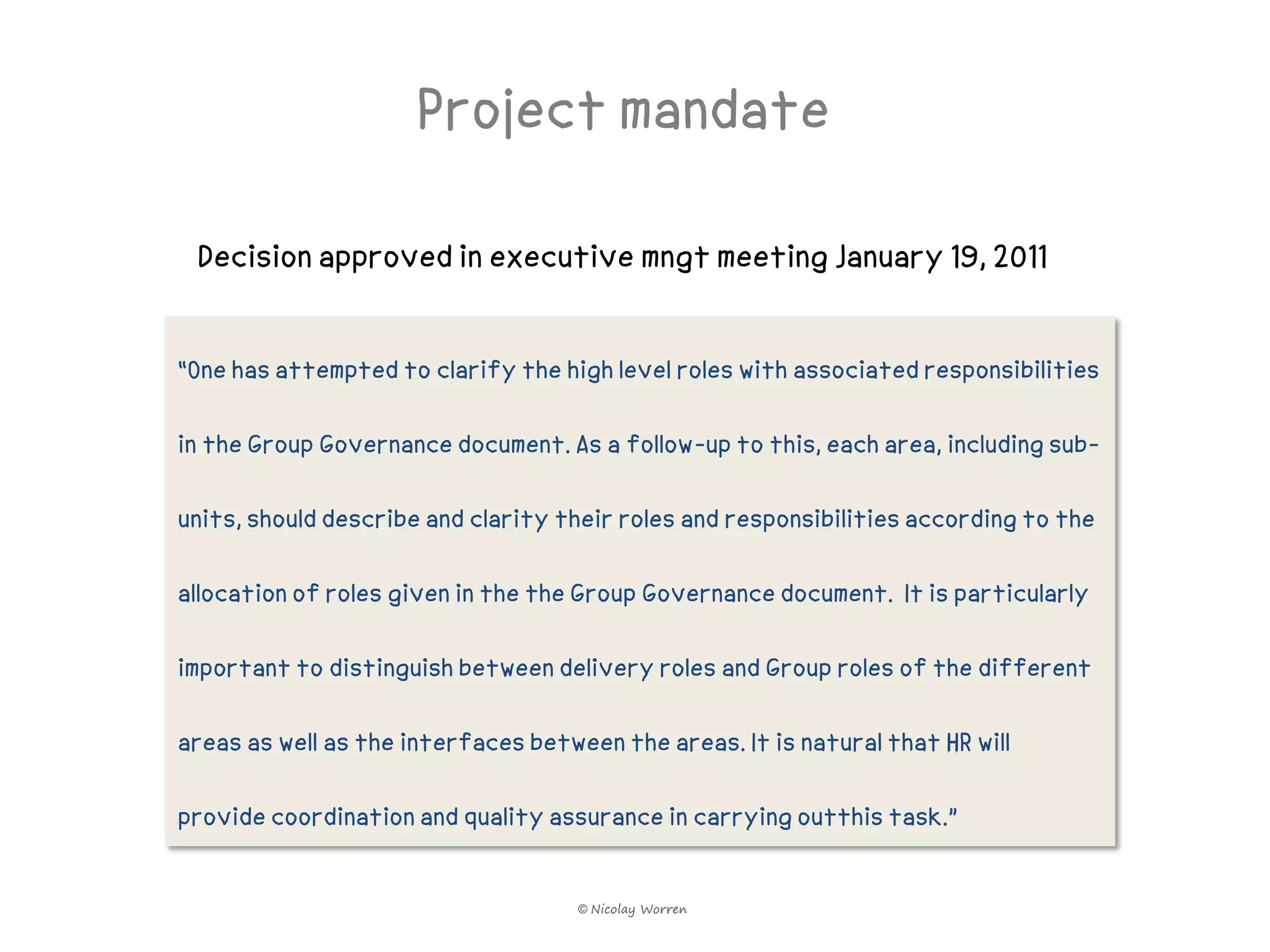

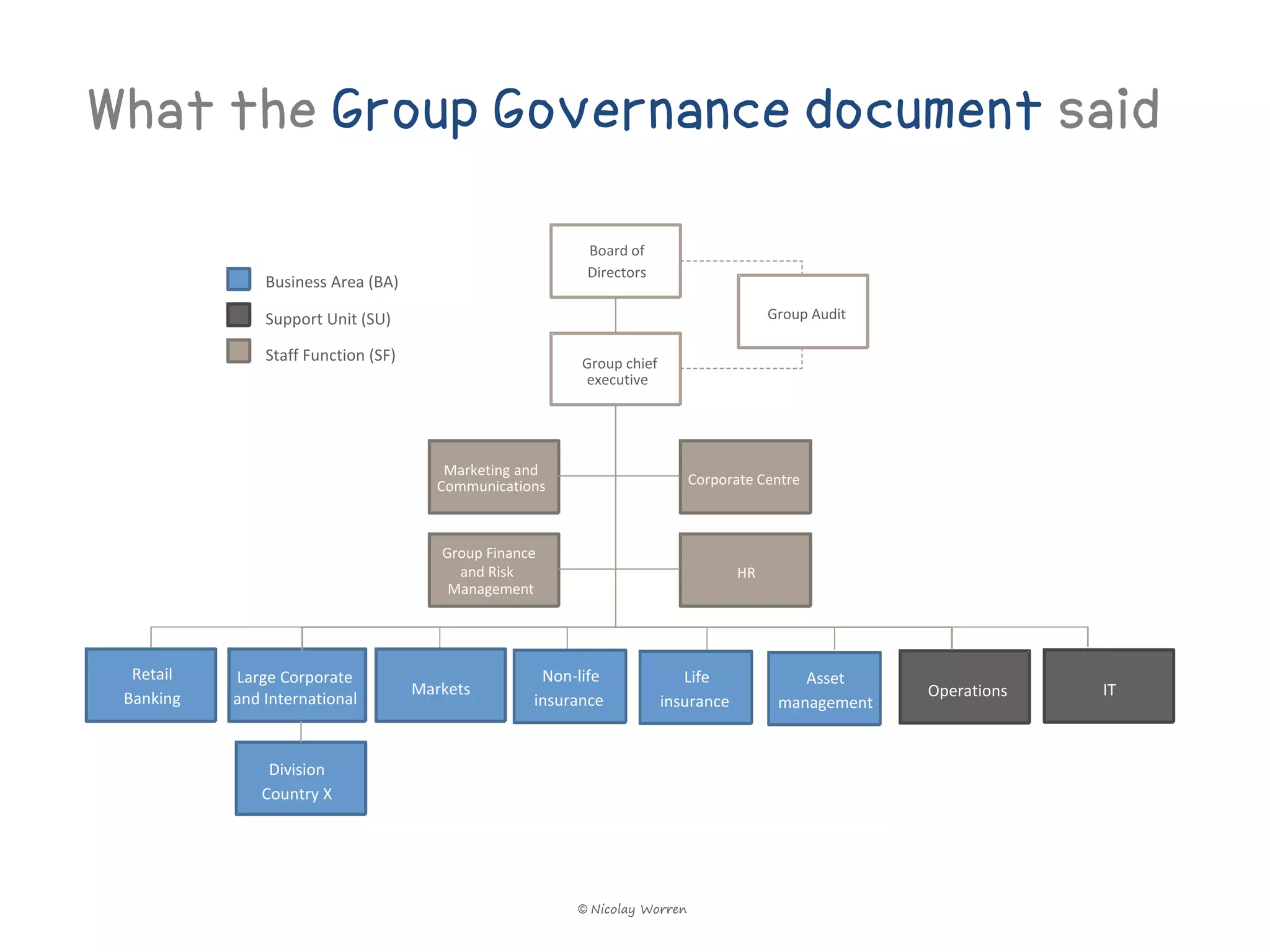

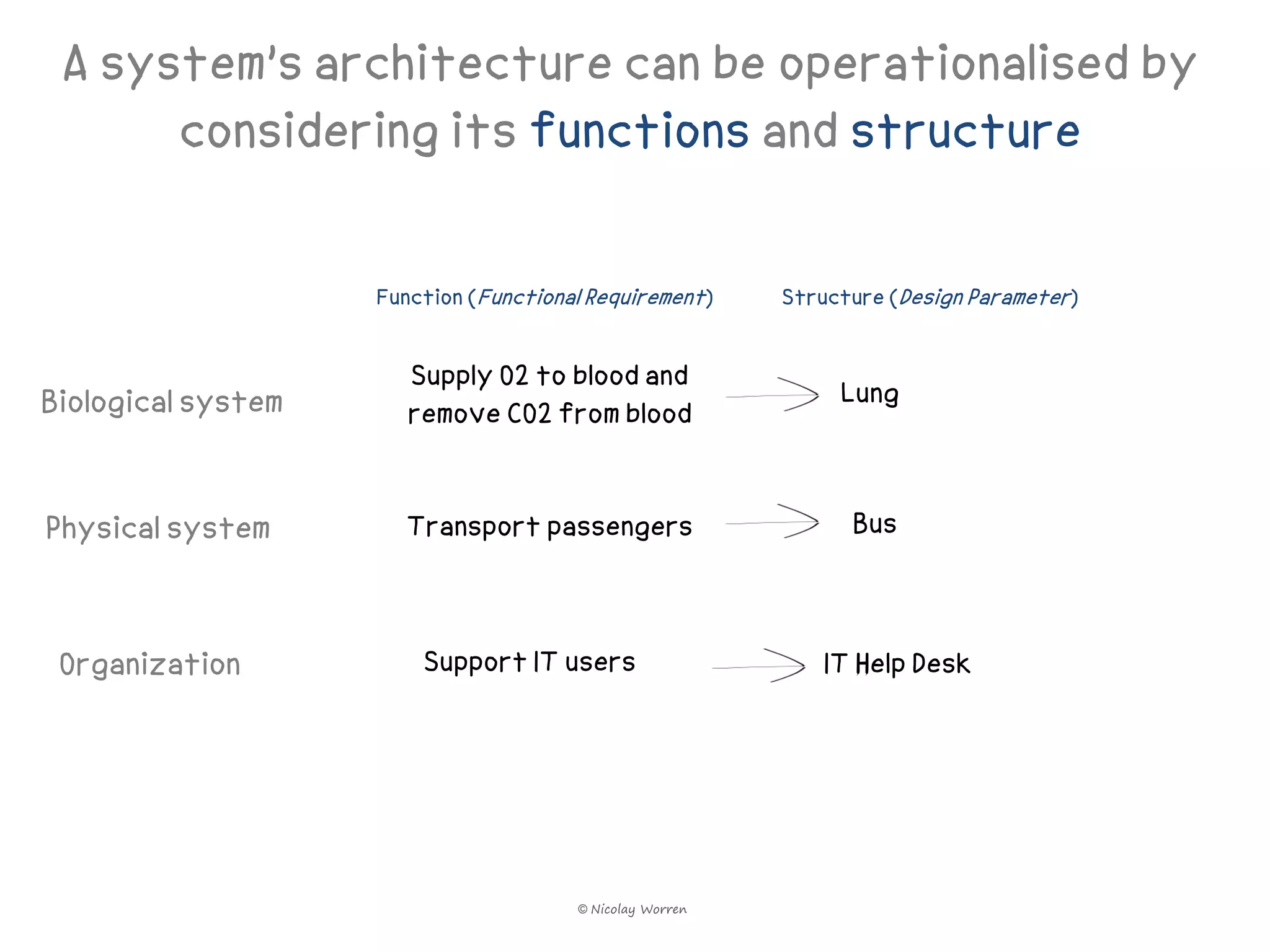

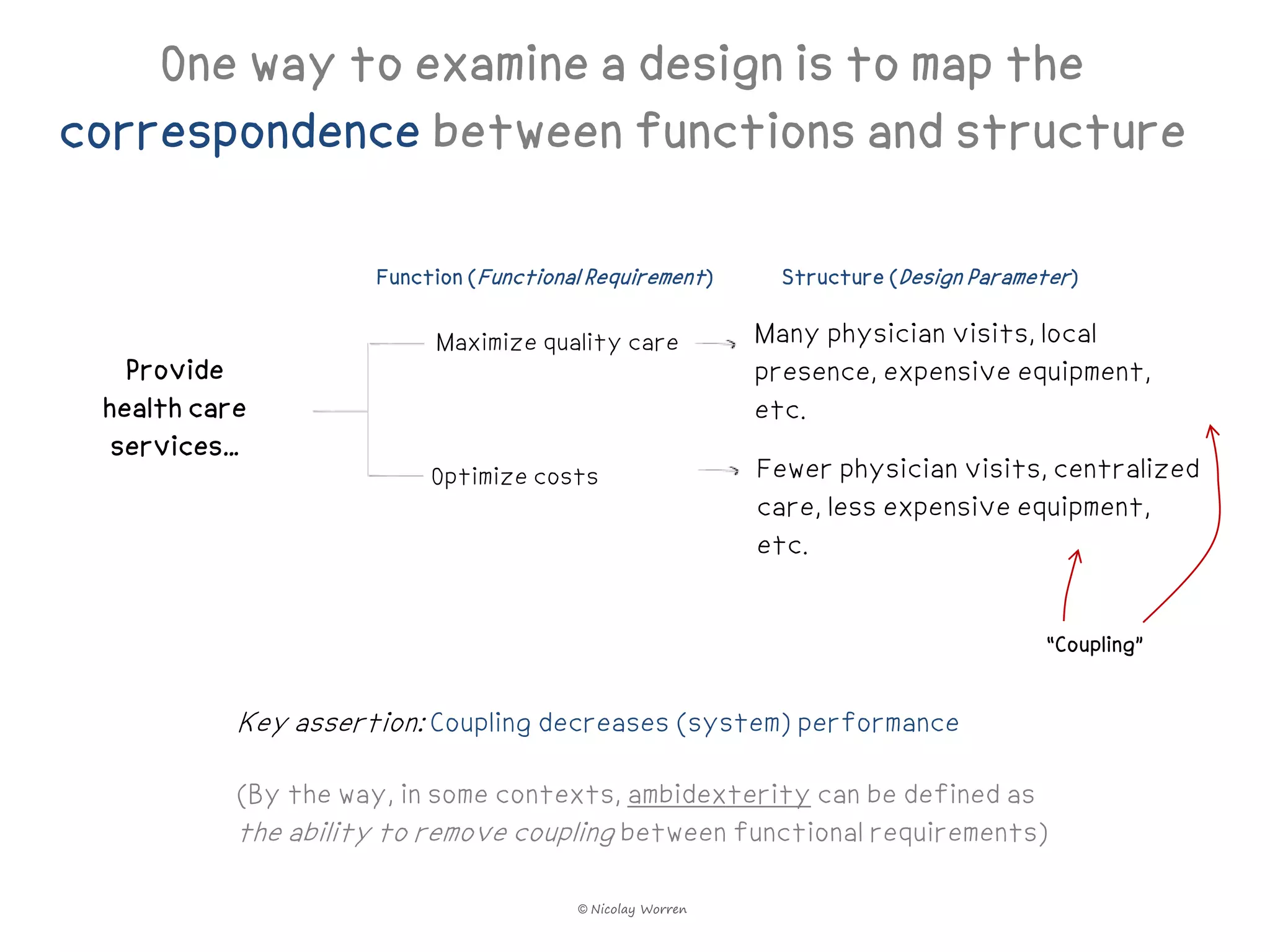

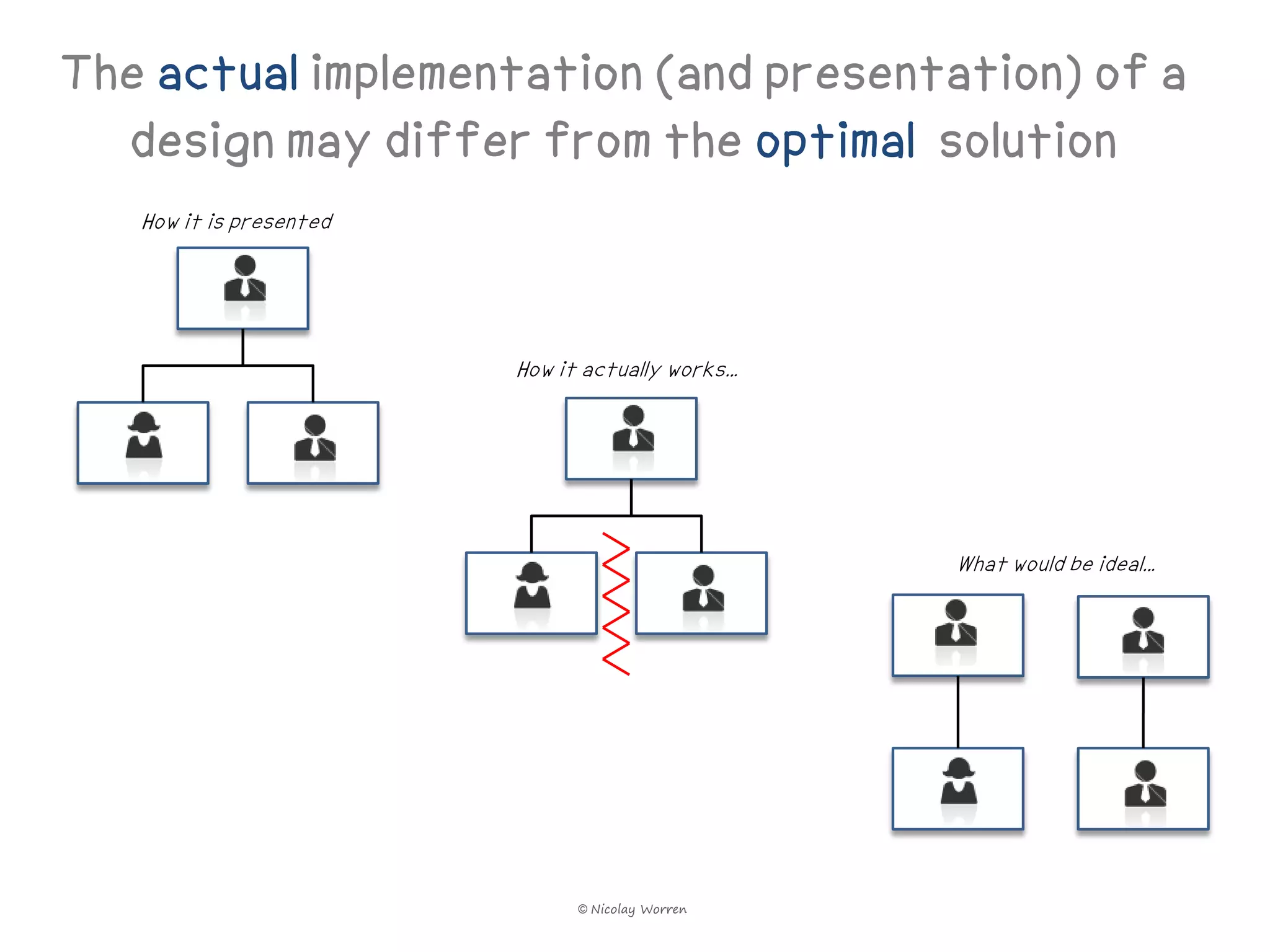

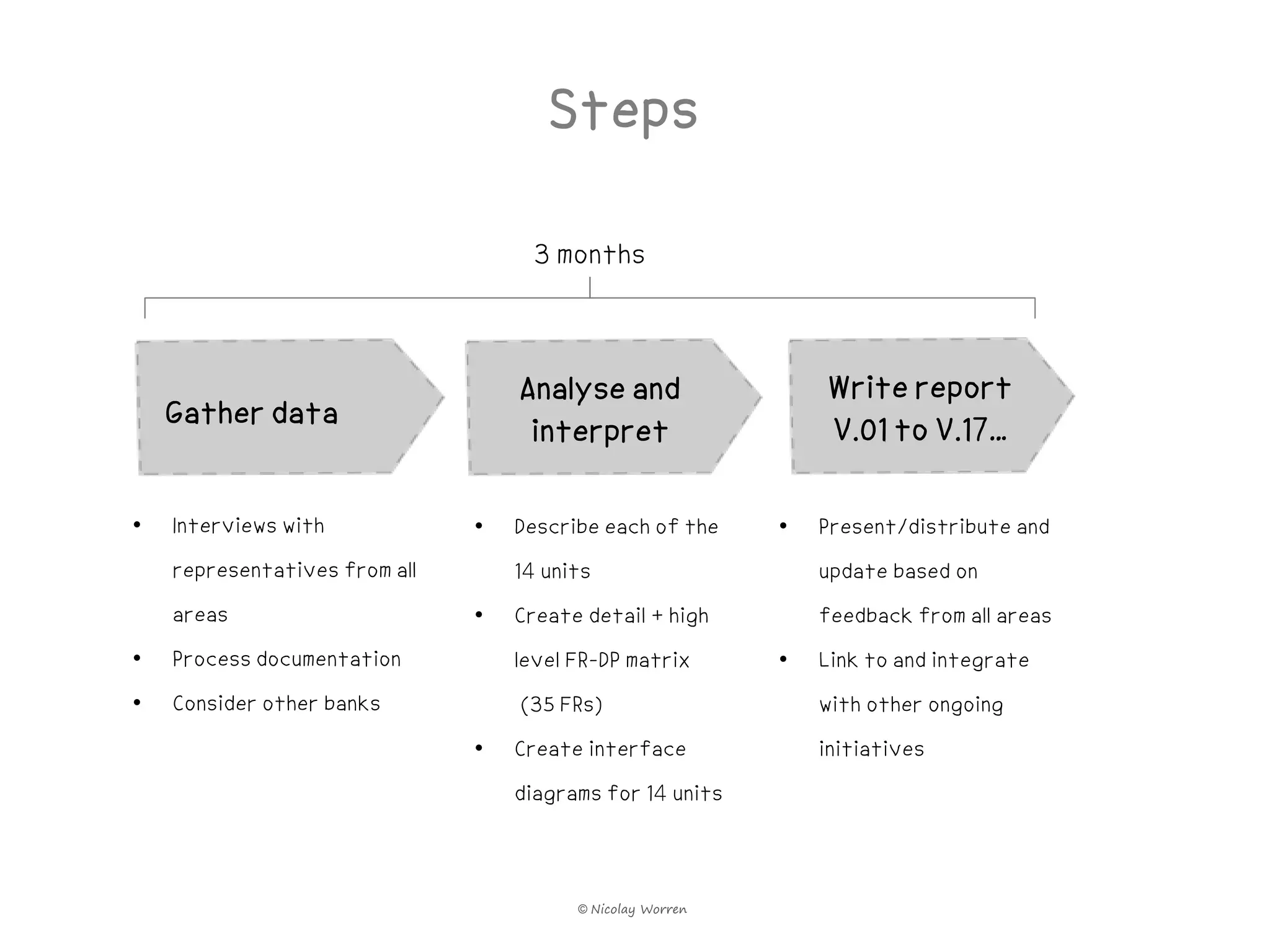

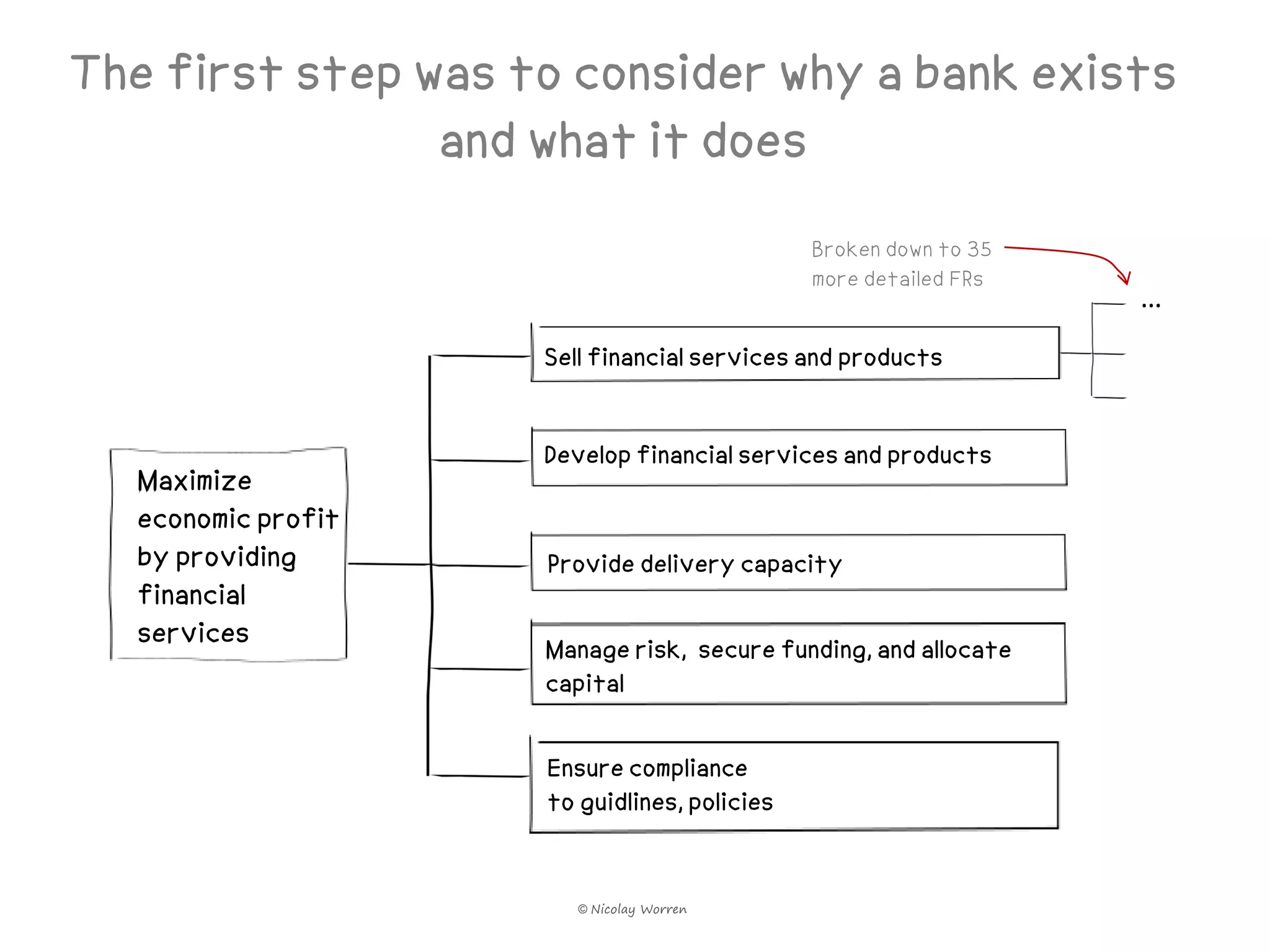

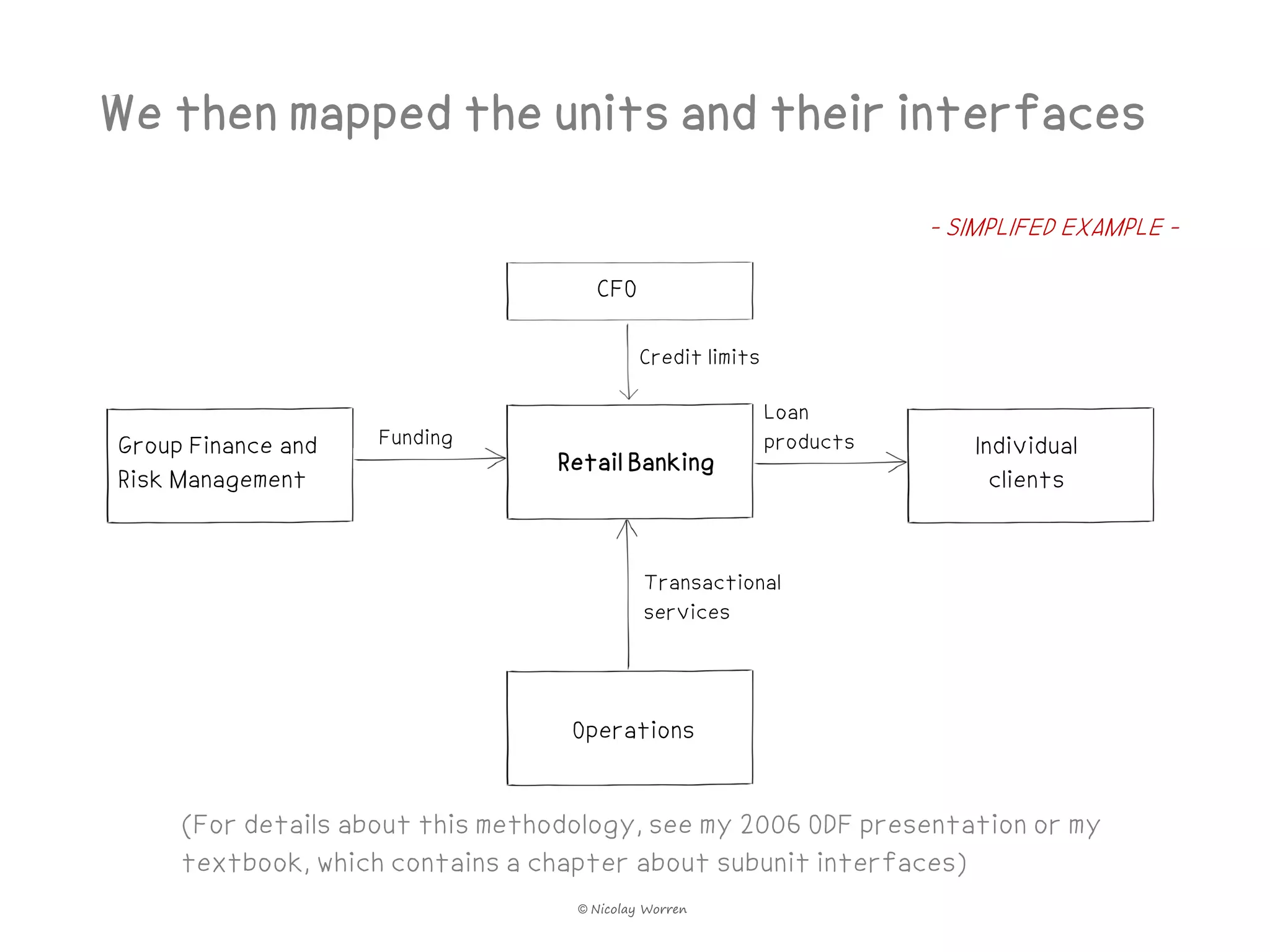

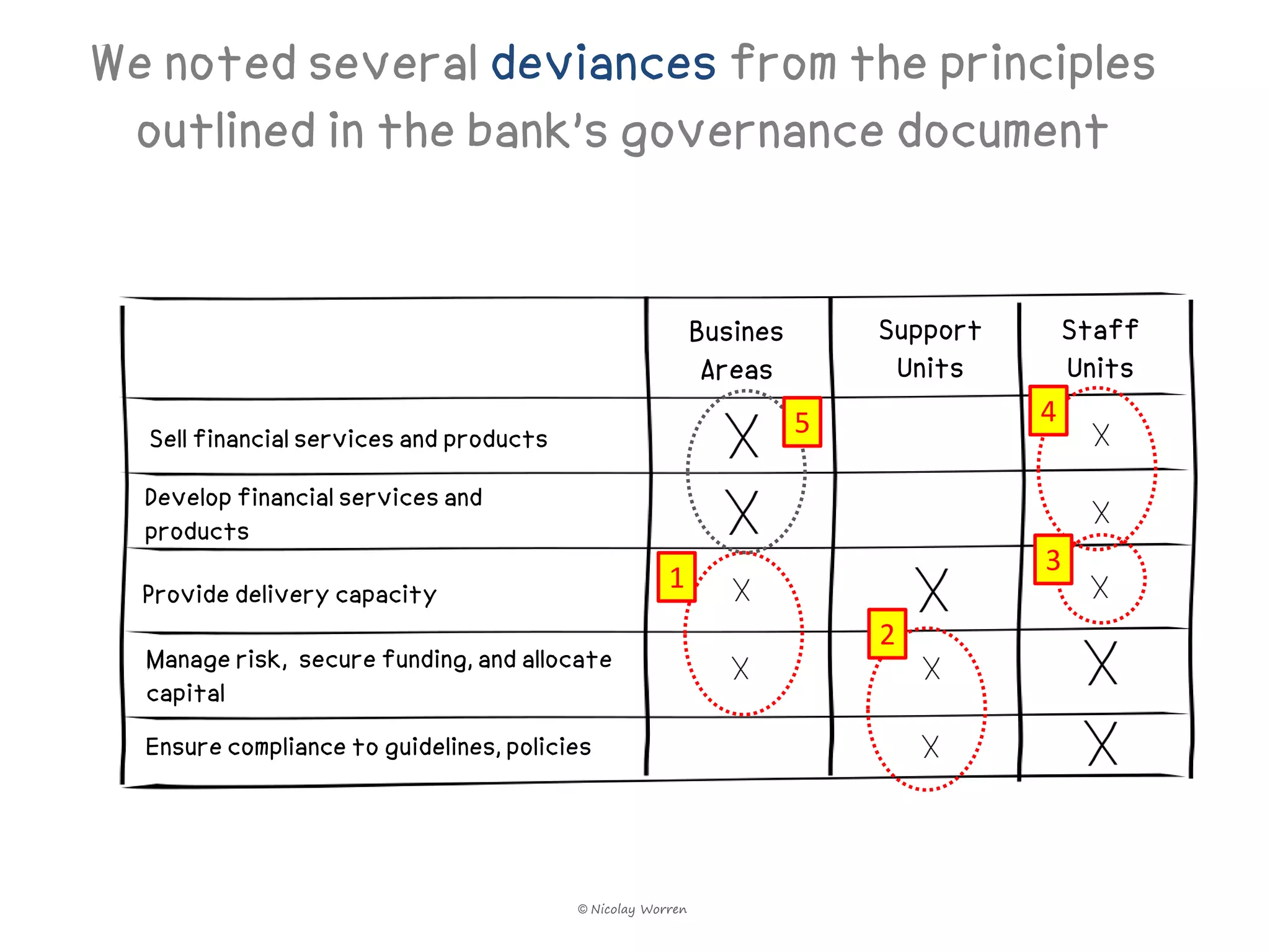

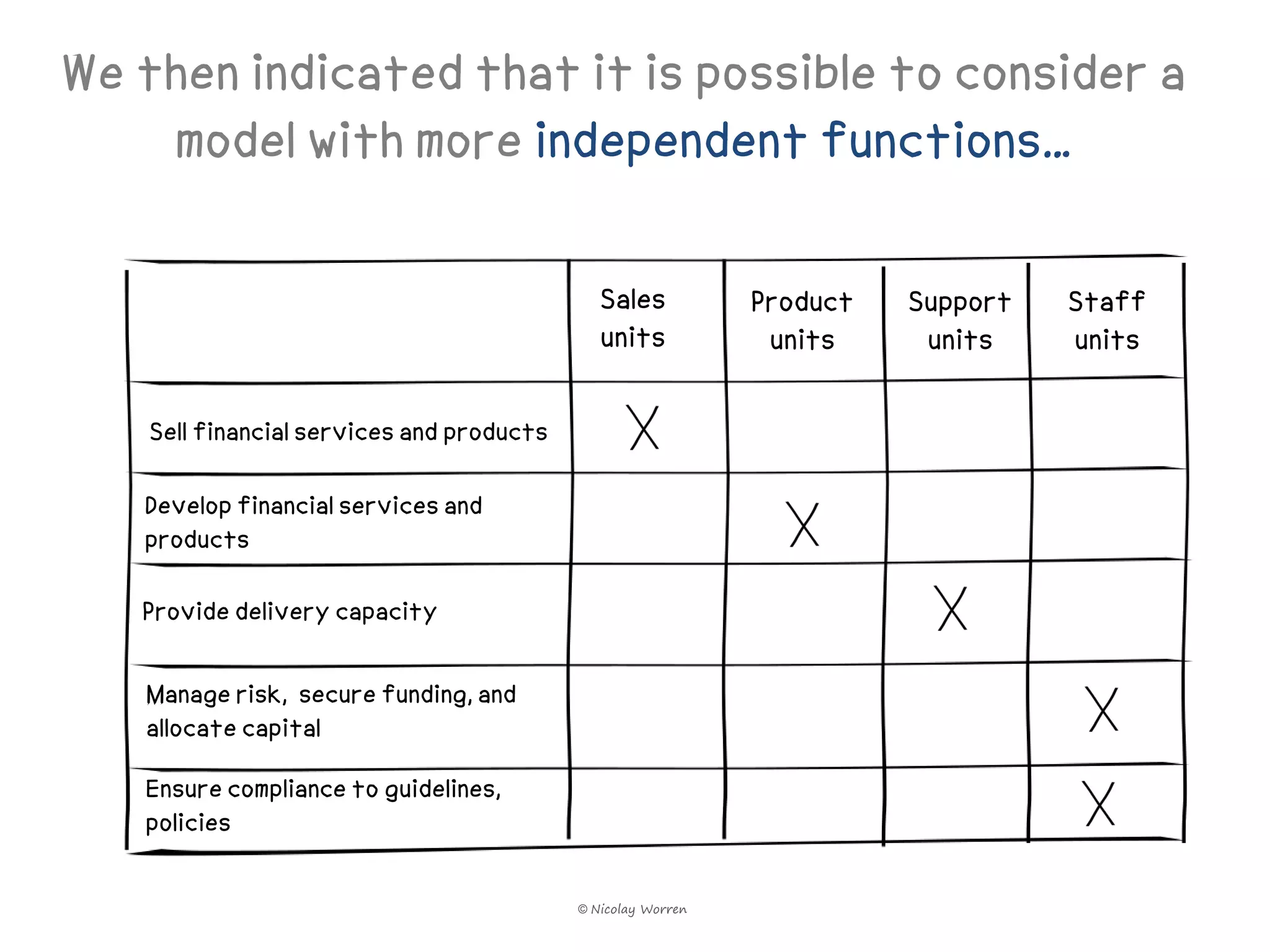

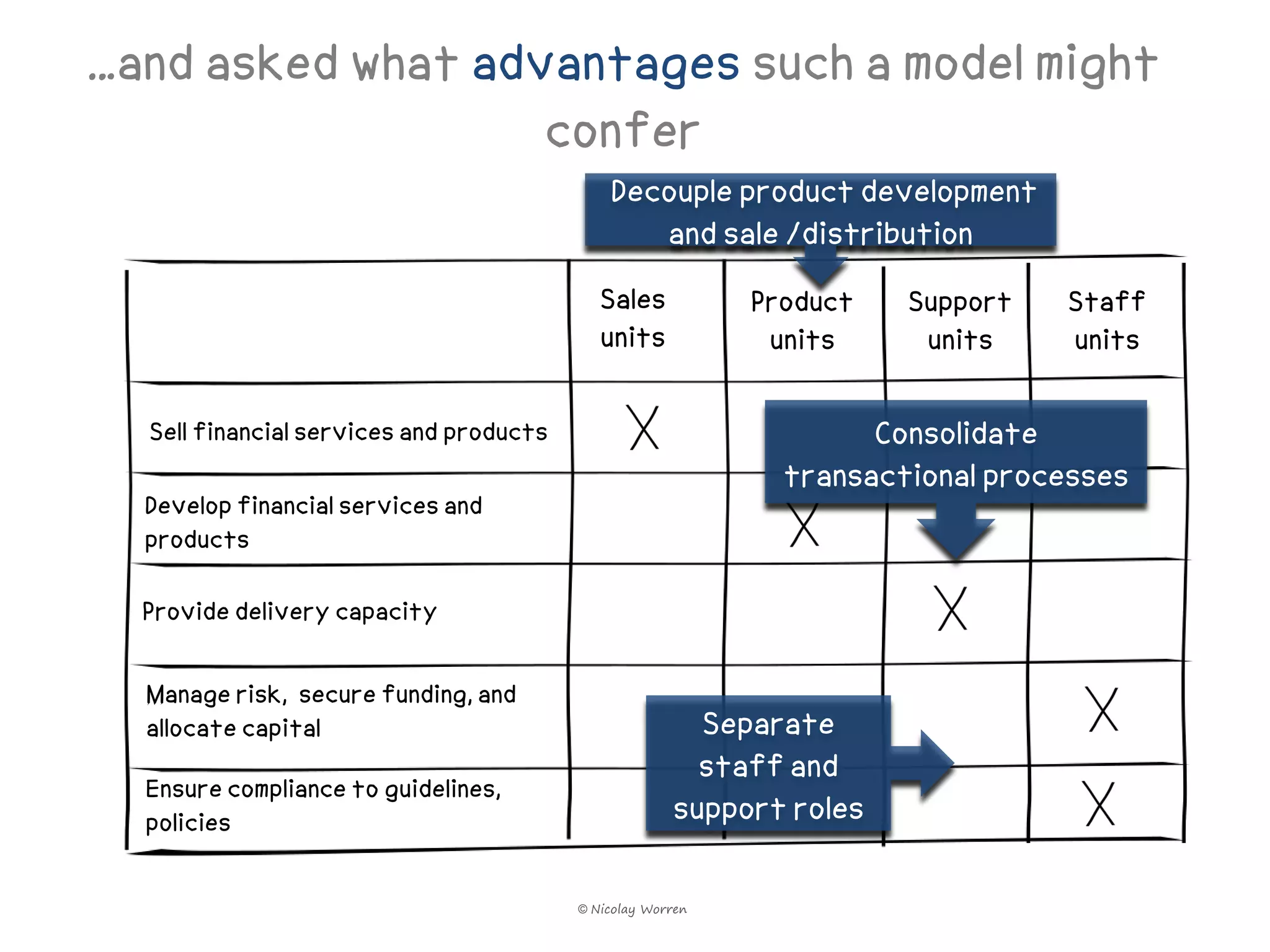

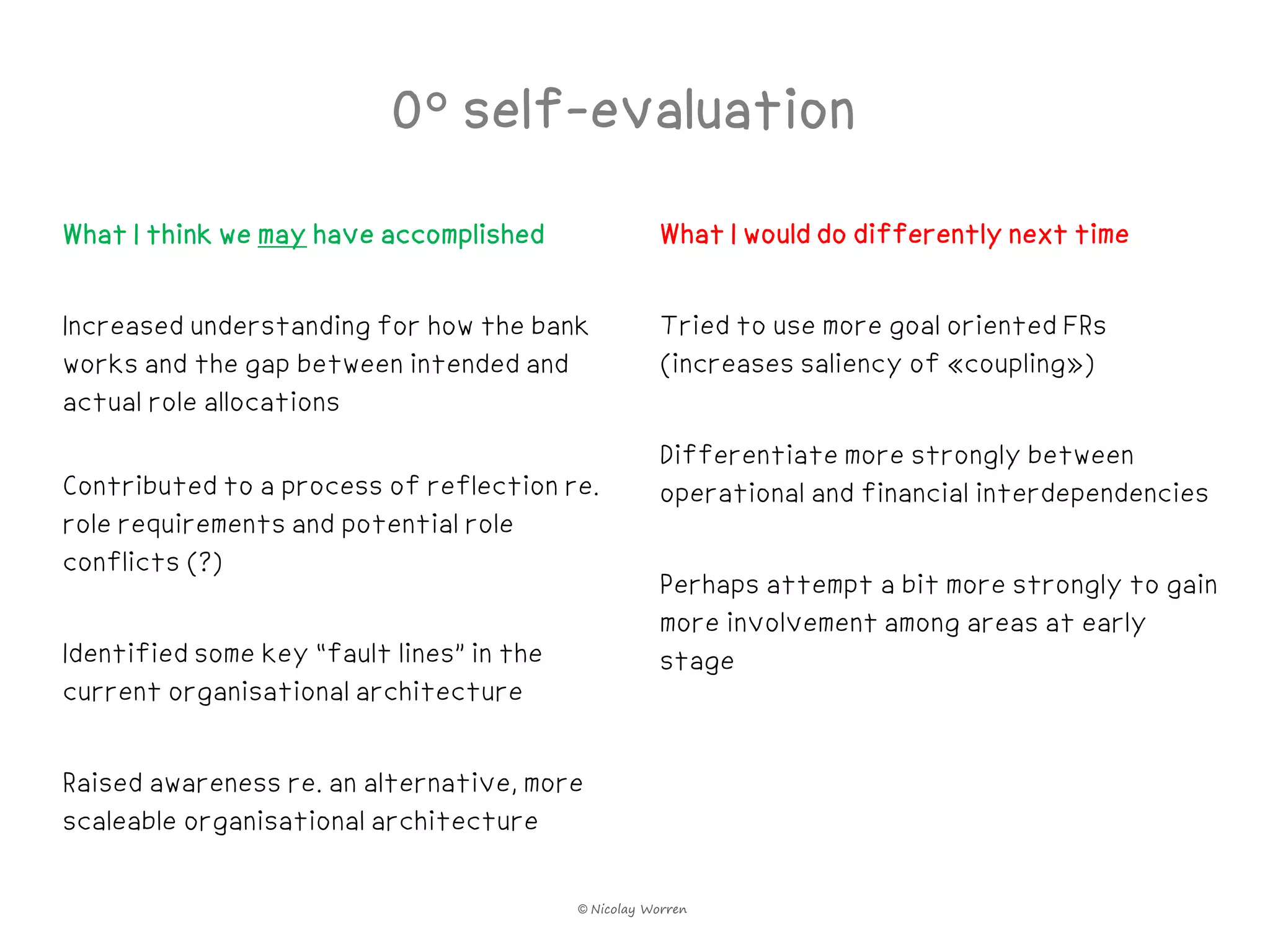

The consultant was hired to help clarify roles and responsibilities across a large Nordic bank's organizational units. They gathered data through interviews and documentation. They mapped the bank's high-level functions to its organizational structures, noting deviations from its governance principles. They also modeled alternative structures with more independent functions to potentially improve performance by reducing coupling between roles. The analysis aimed to increase understanding of current issues and raise awareness of design options.