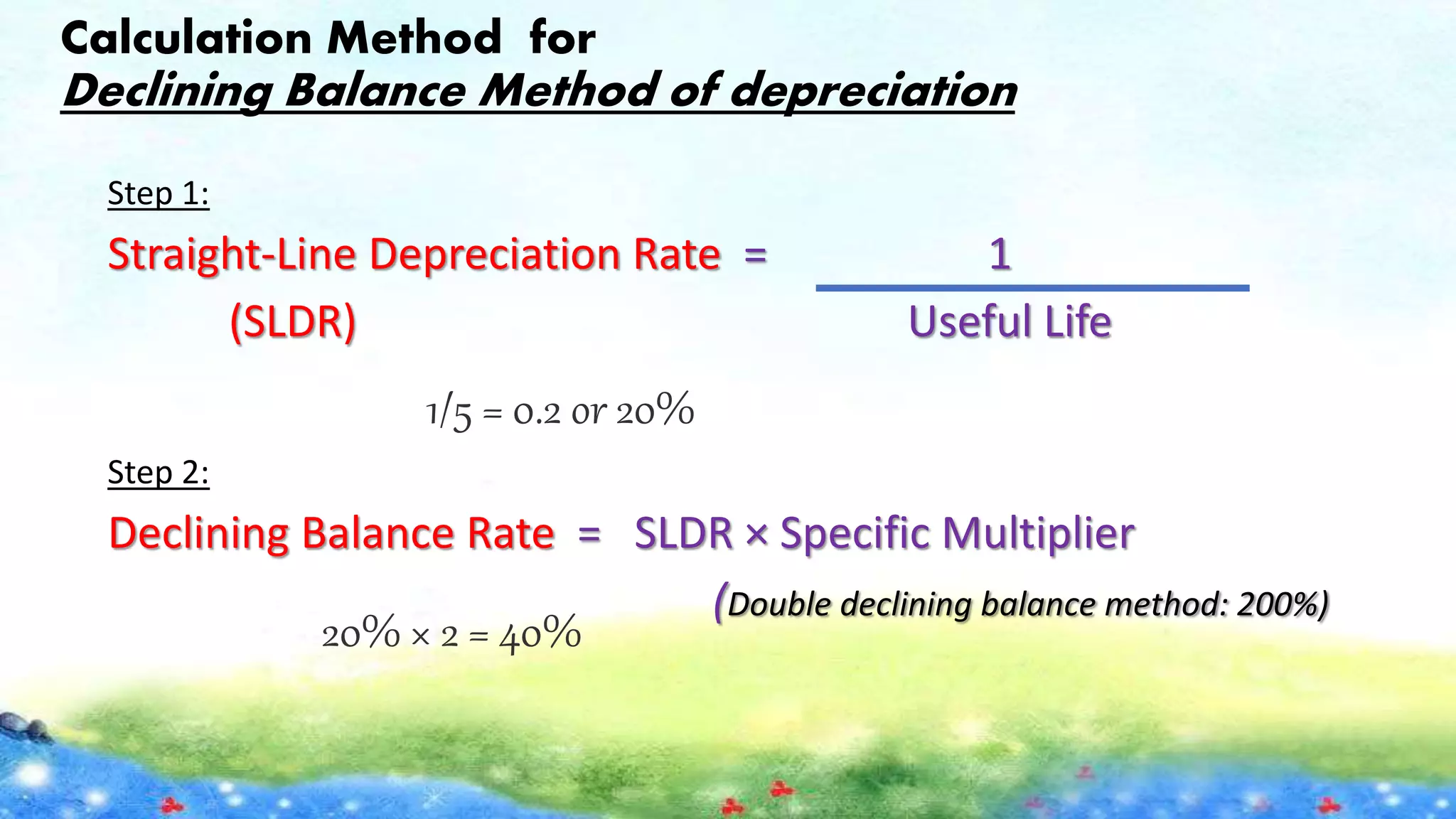

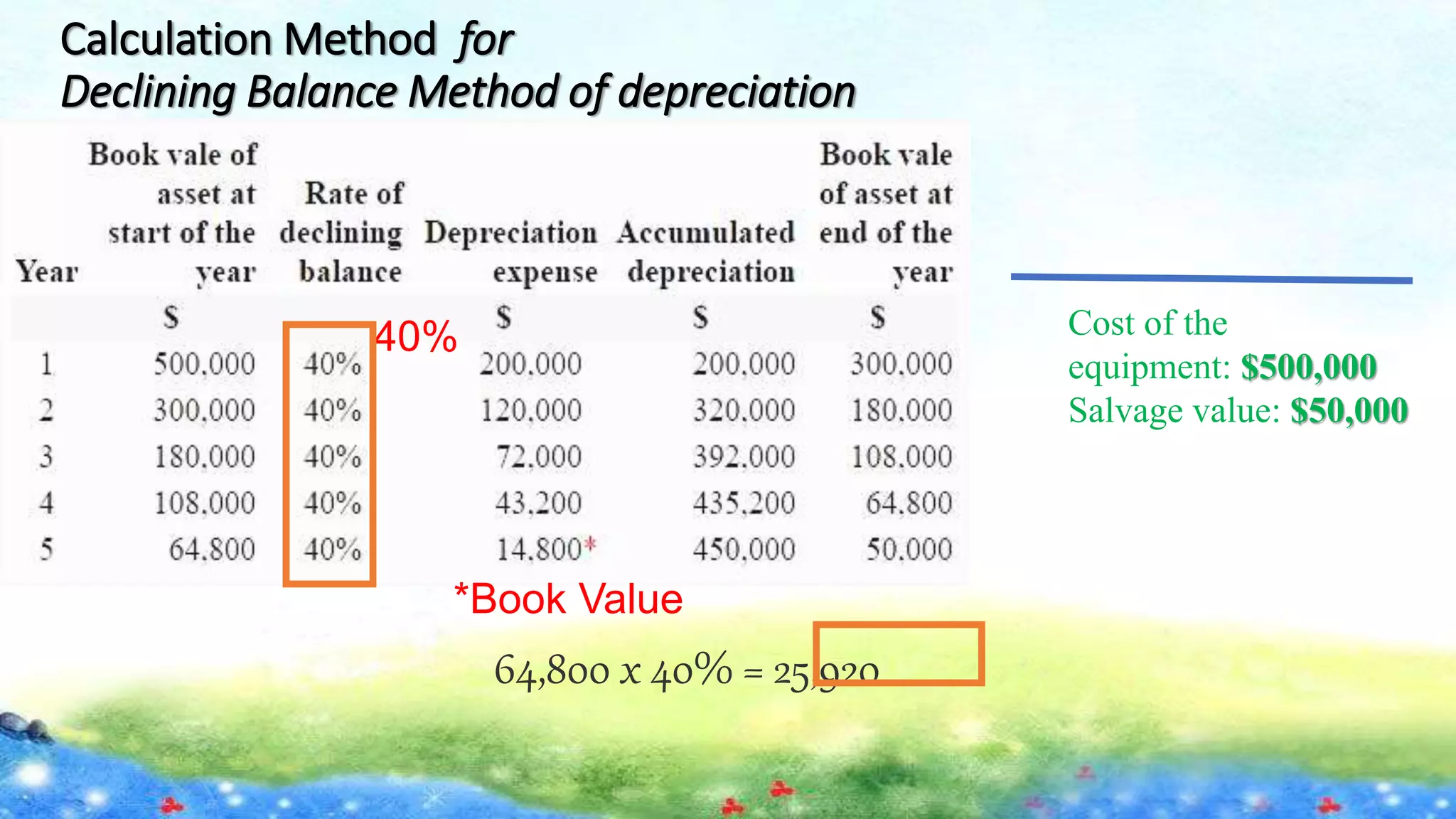

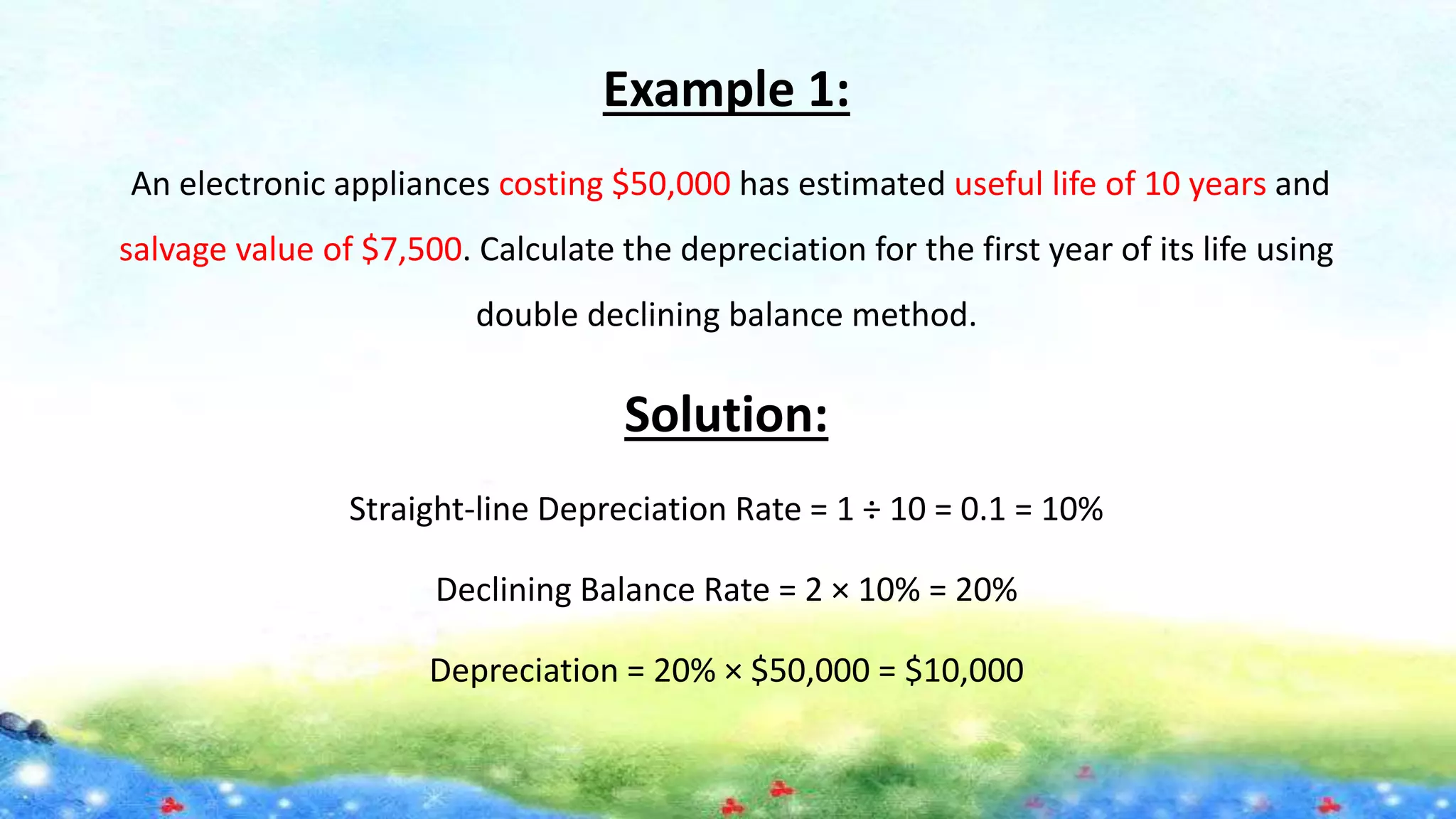

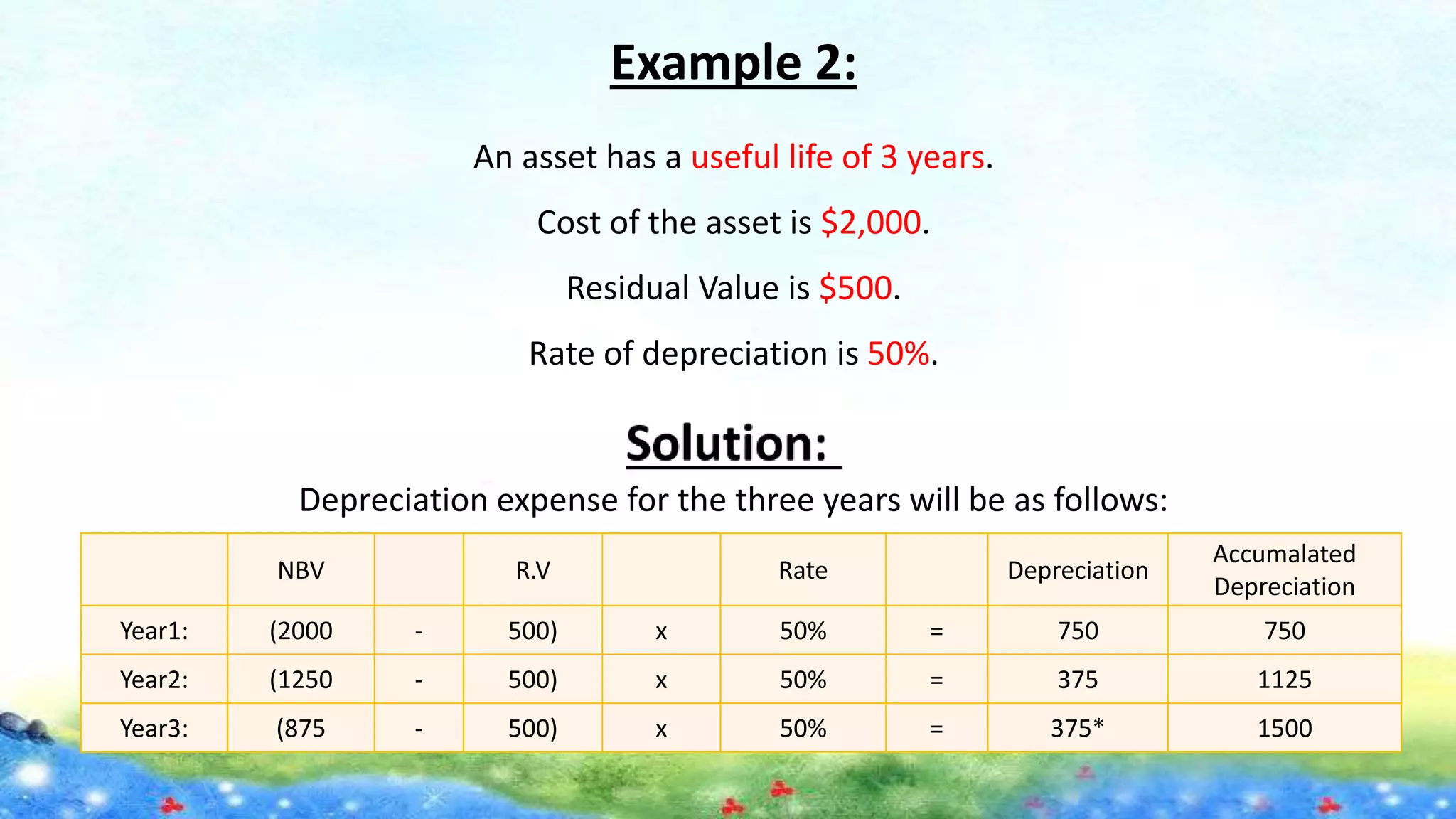

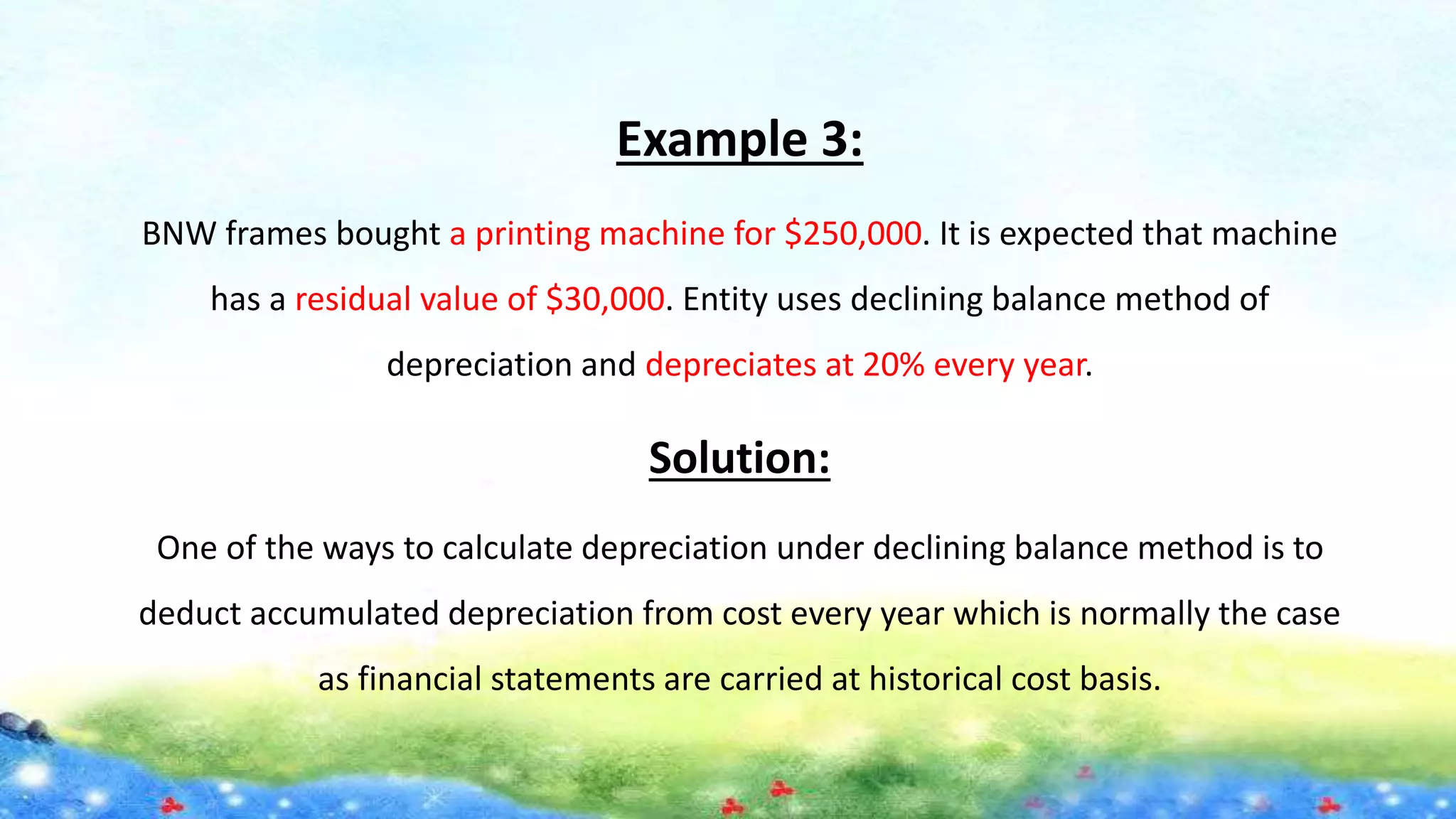

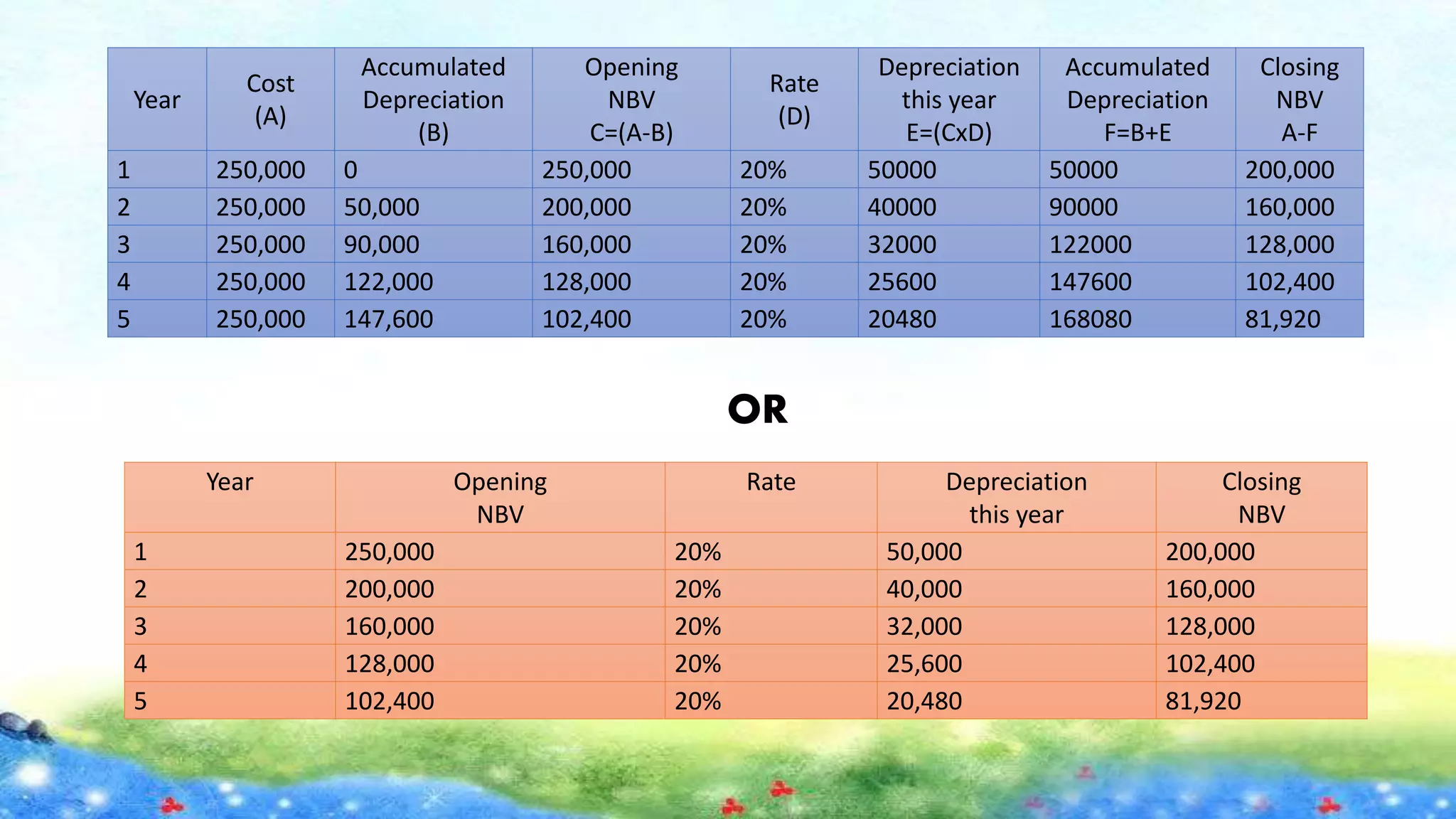

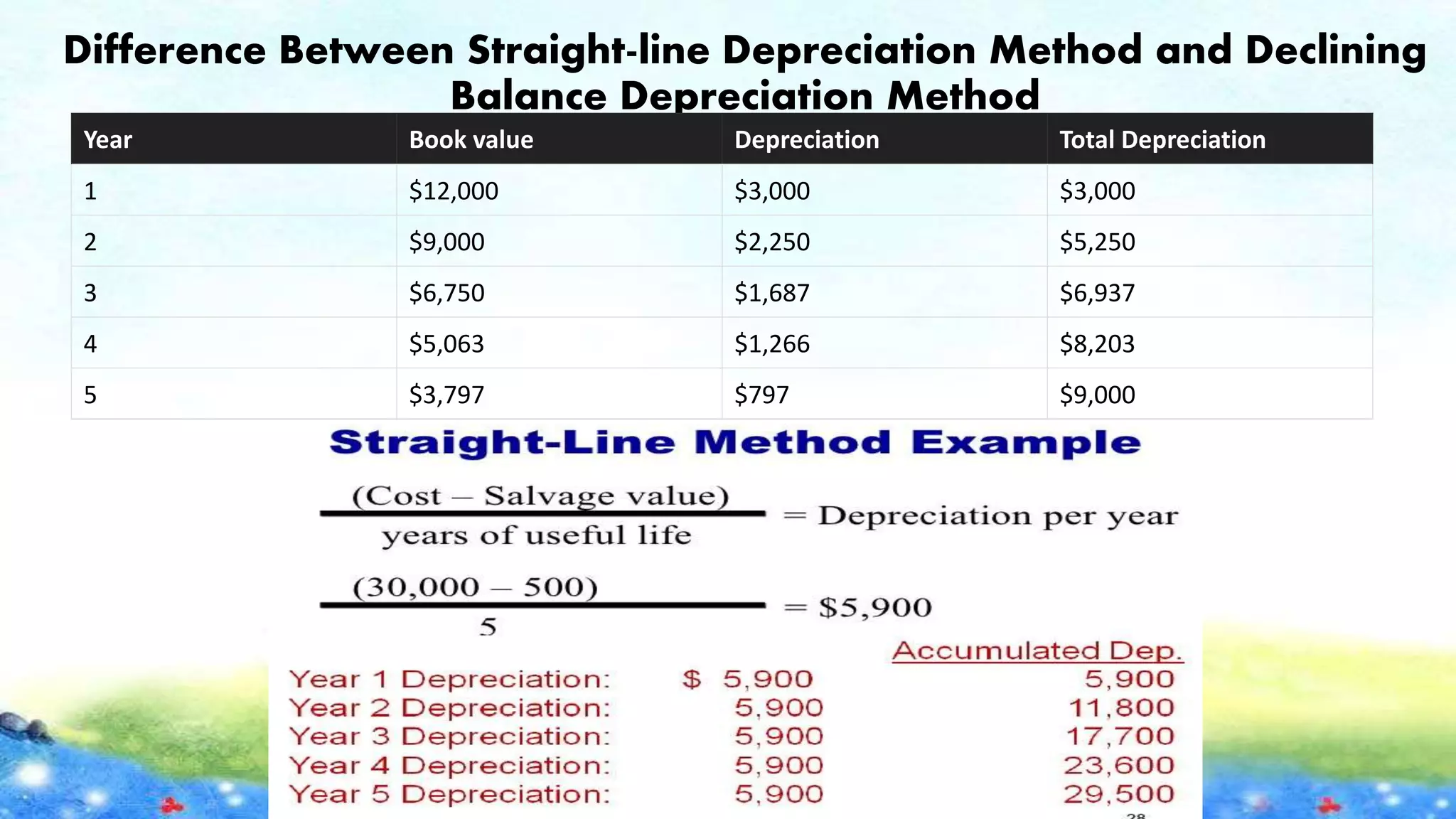

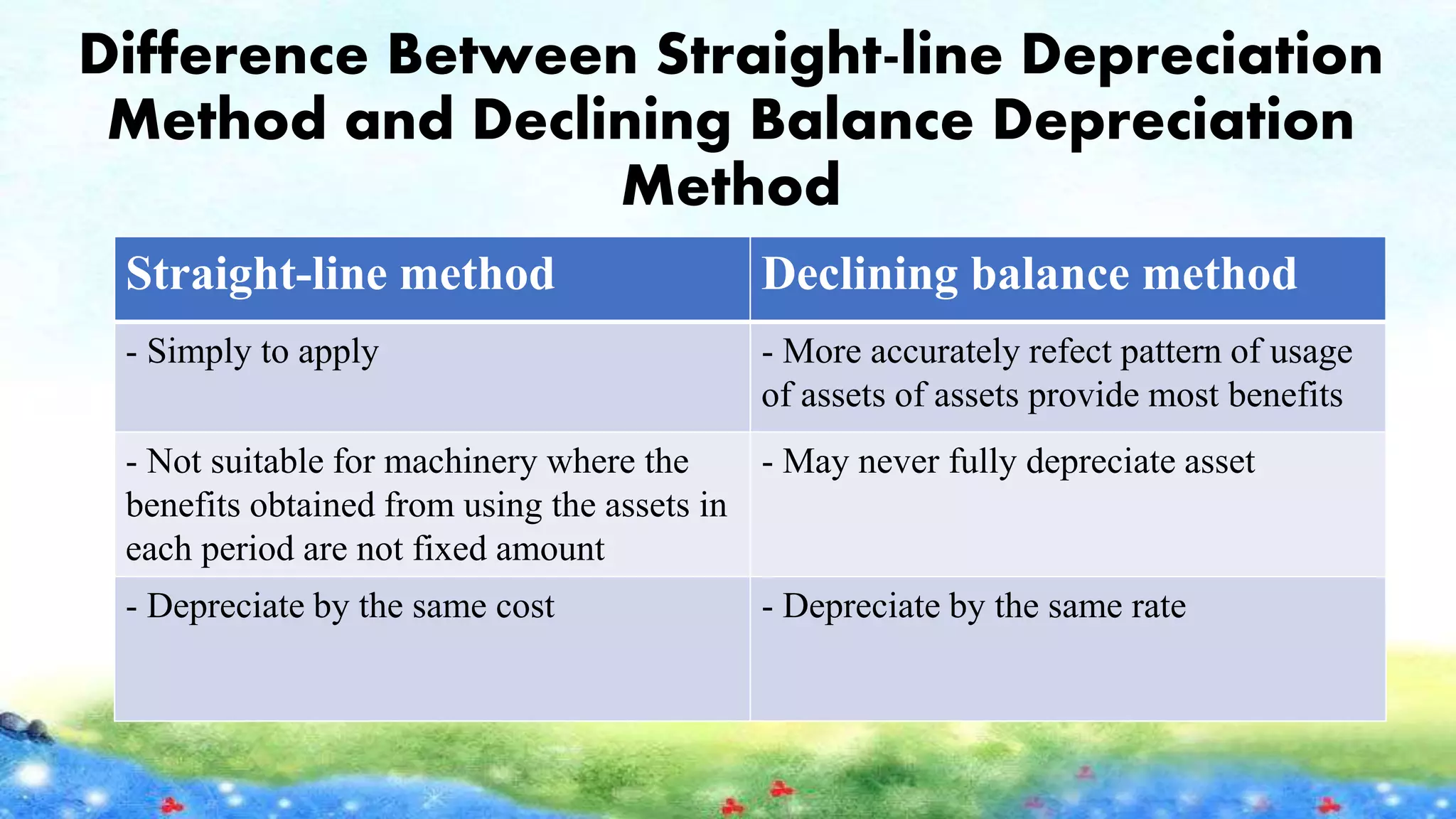

The document discusses the declining balance method of depreciation. It states that the declining balance method results in larger depreciation amounts in earlier years of an asset's life and lower amounts in later years. It provides the calculation method which involves applying a declining balance rate, usually double the straight-line depreciation rate, to the book value of the asset each year. Several examples are provided to illustrate the calculation and application of declining balance depreciation. The key difference between straight-line and declining balance methods is also summarized.