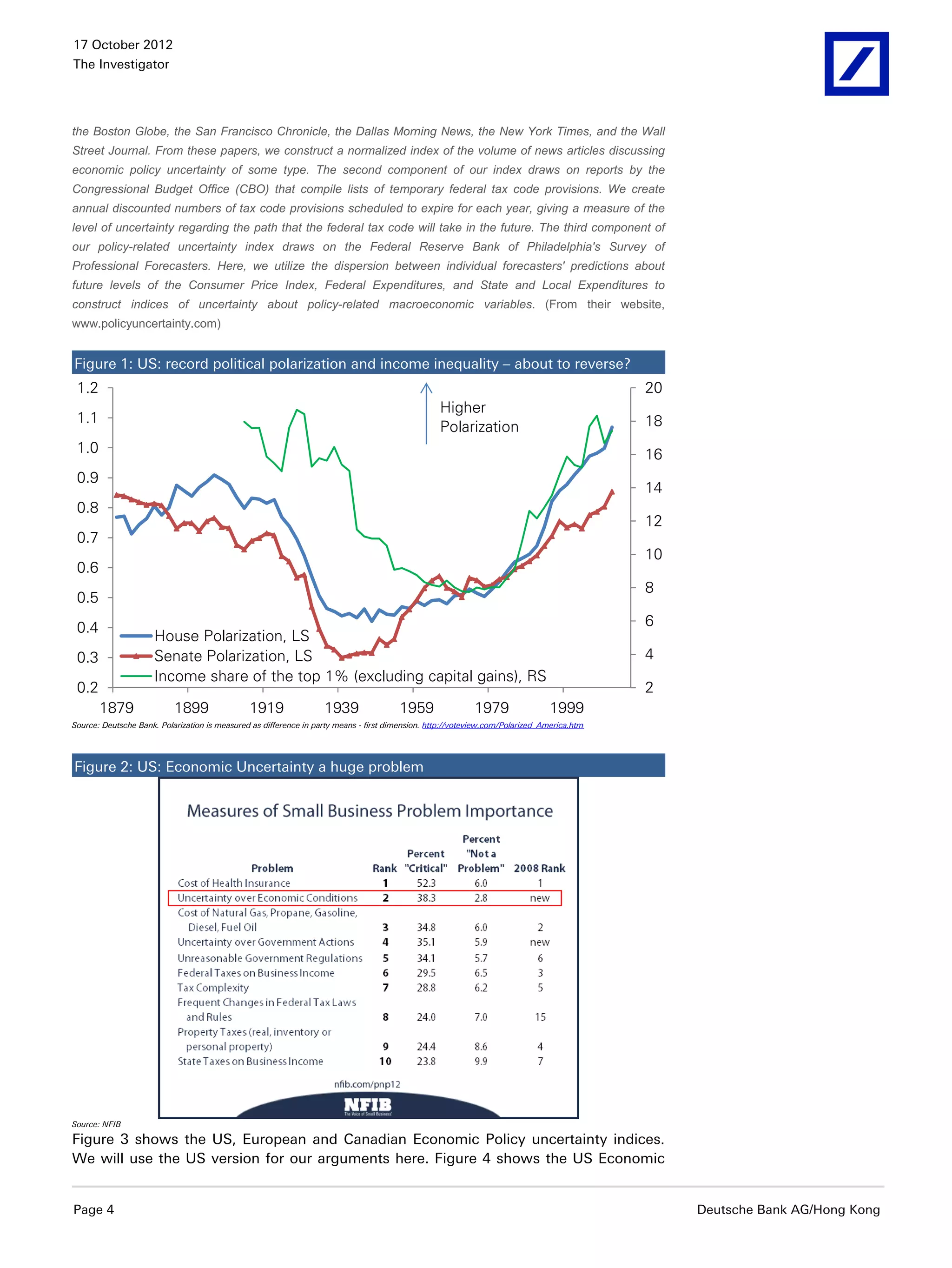

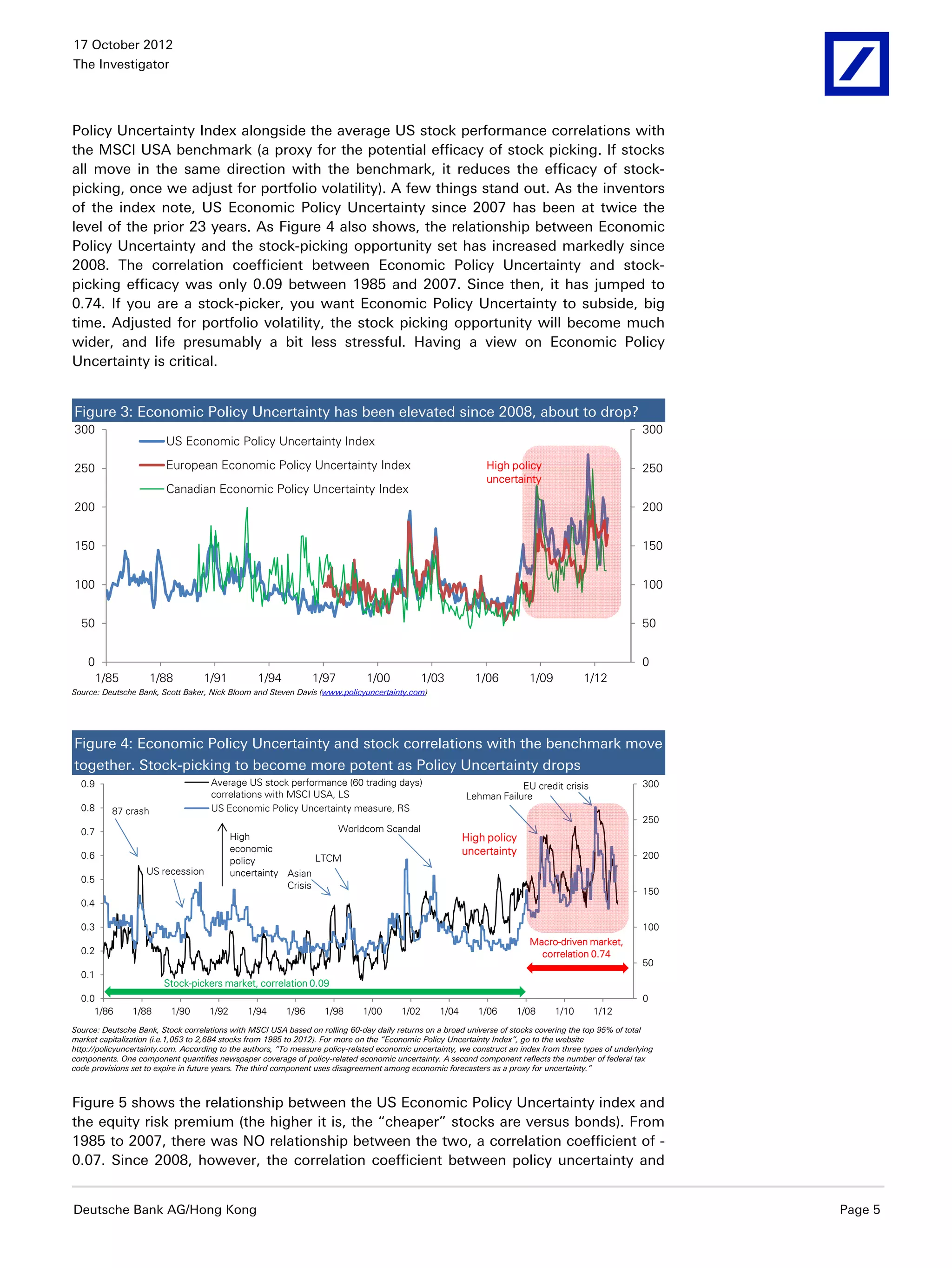

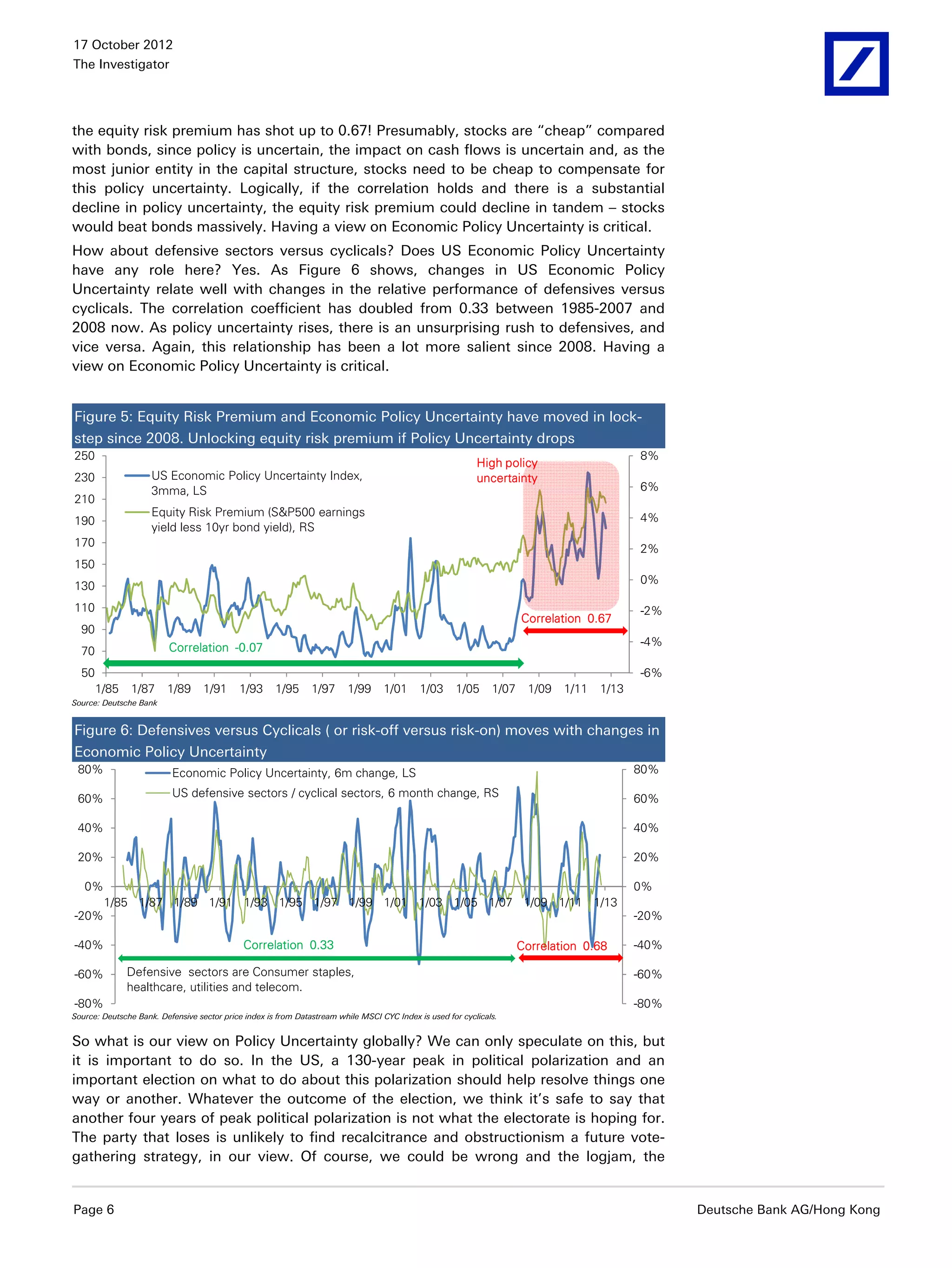

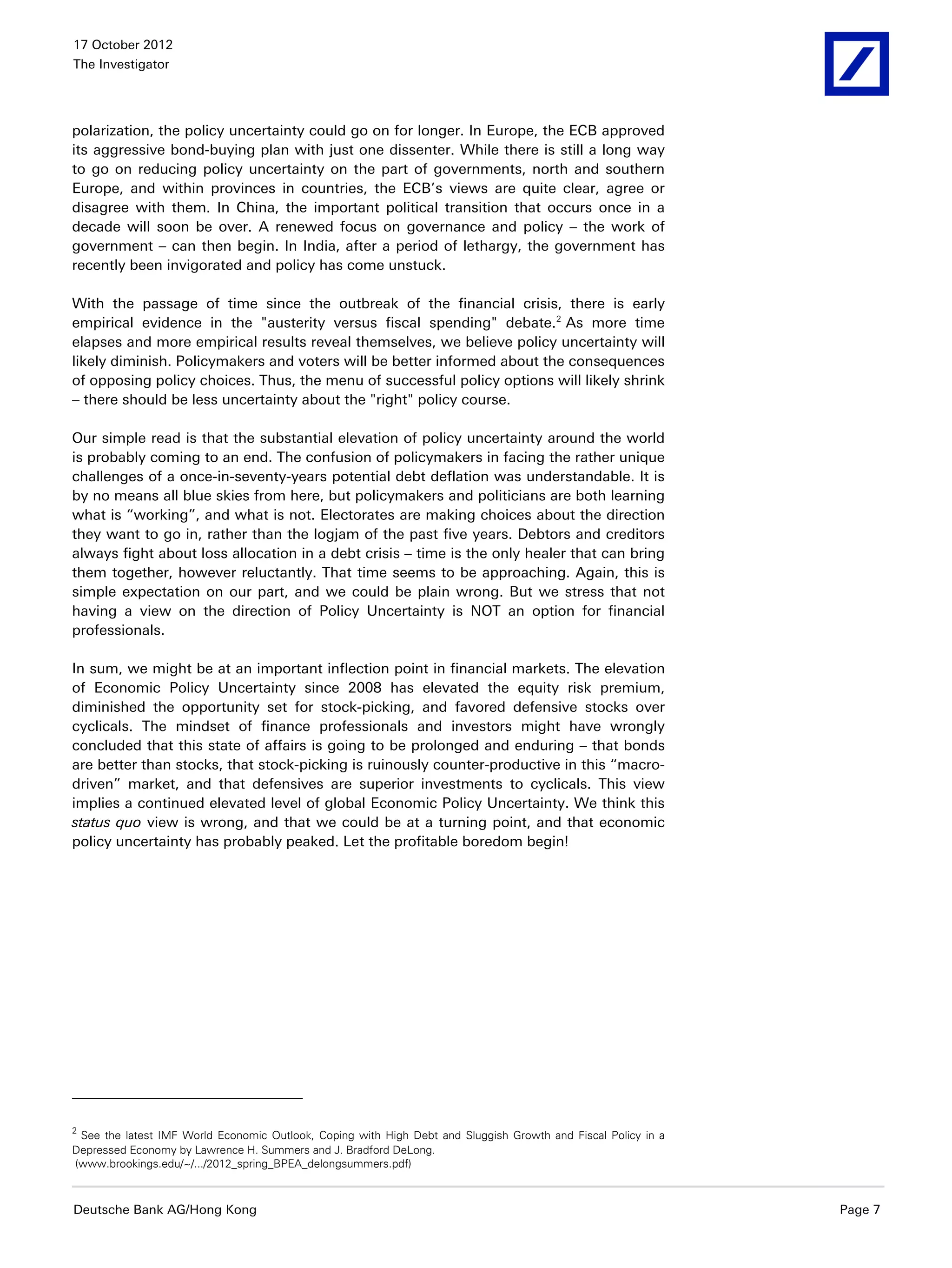

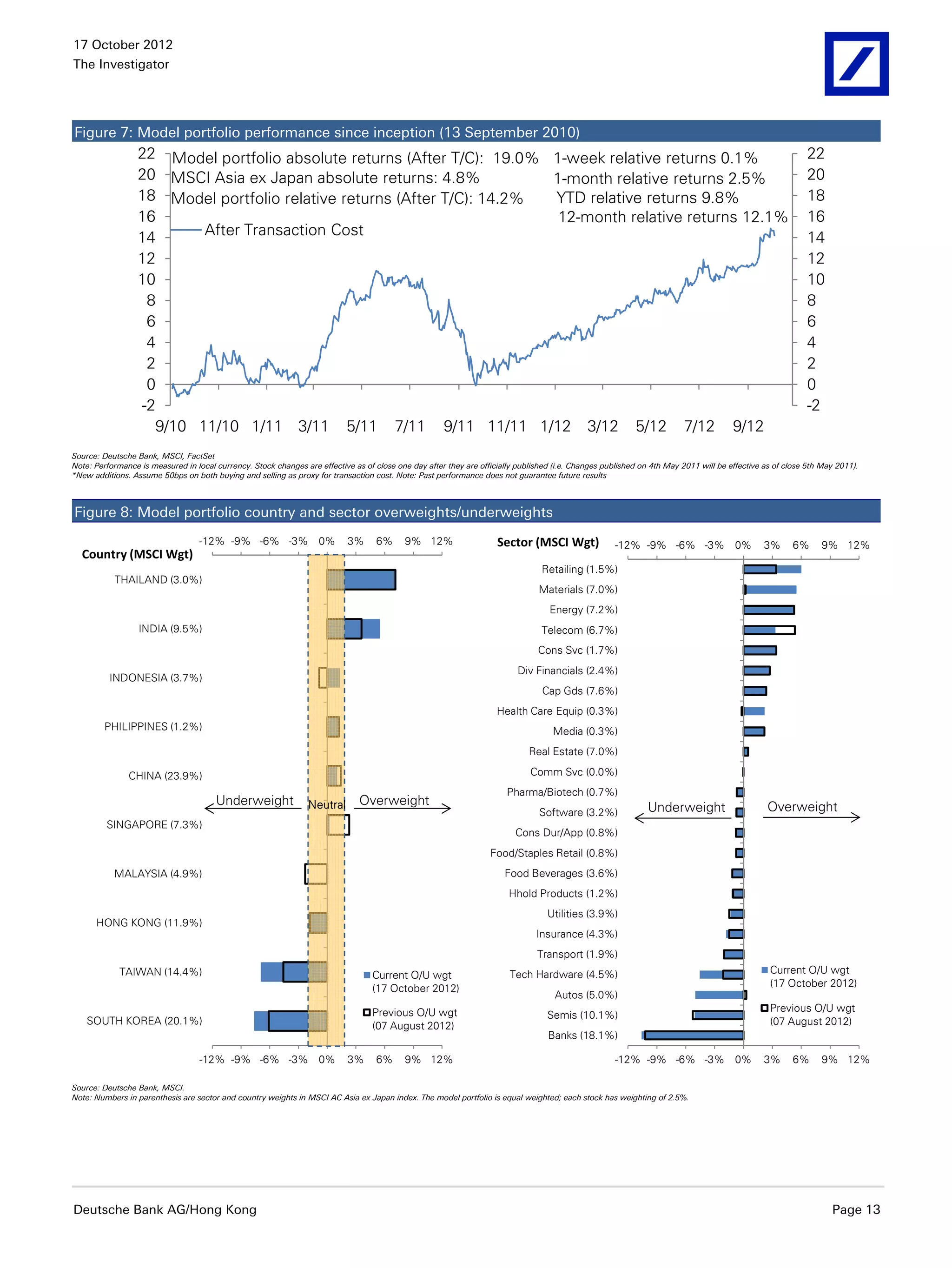

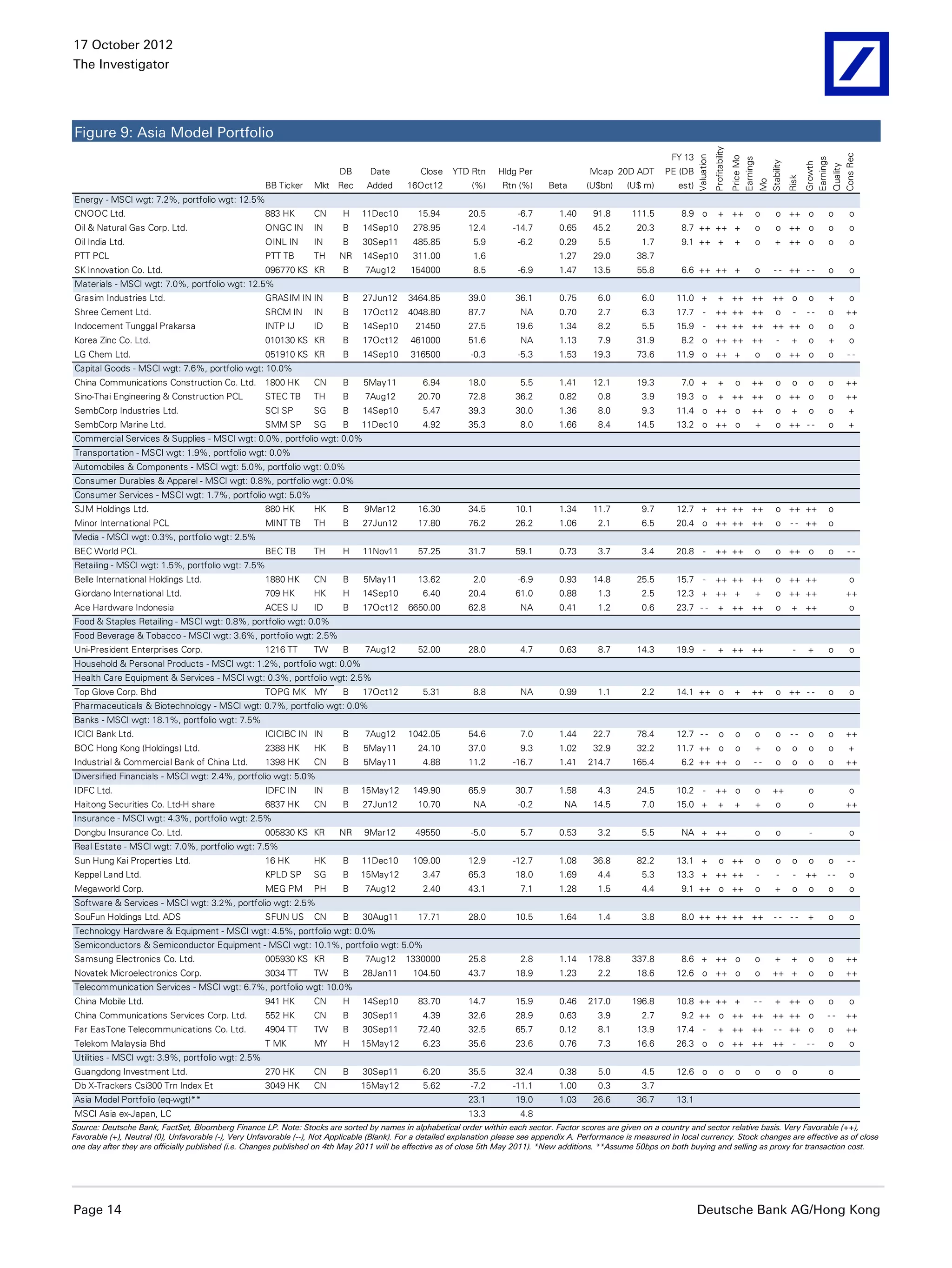

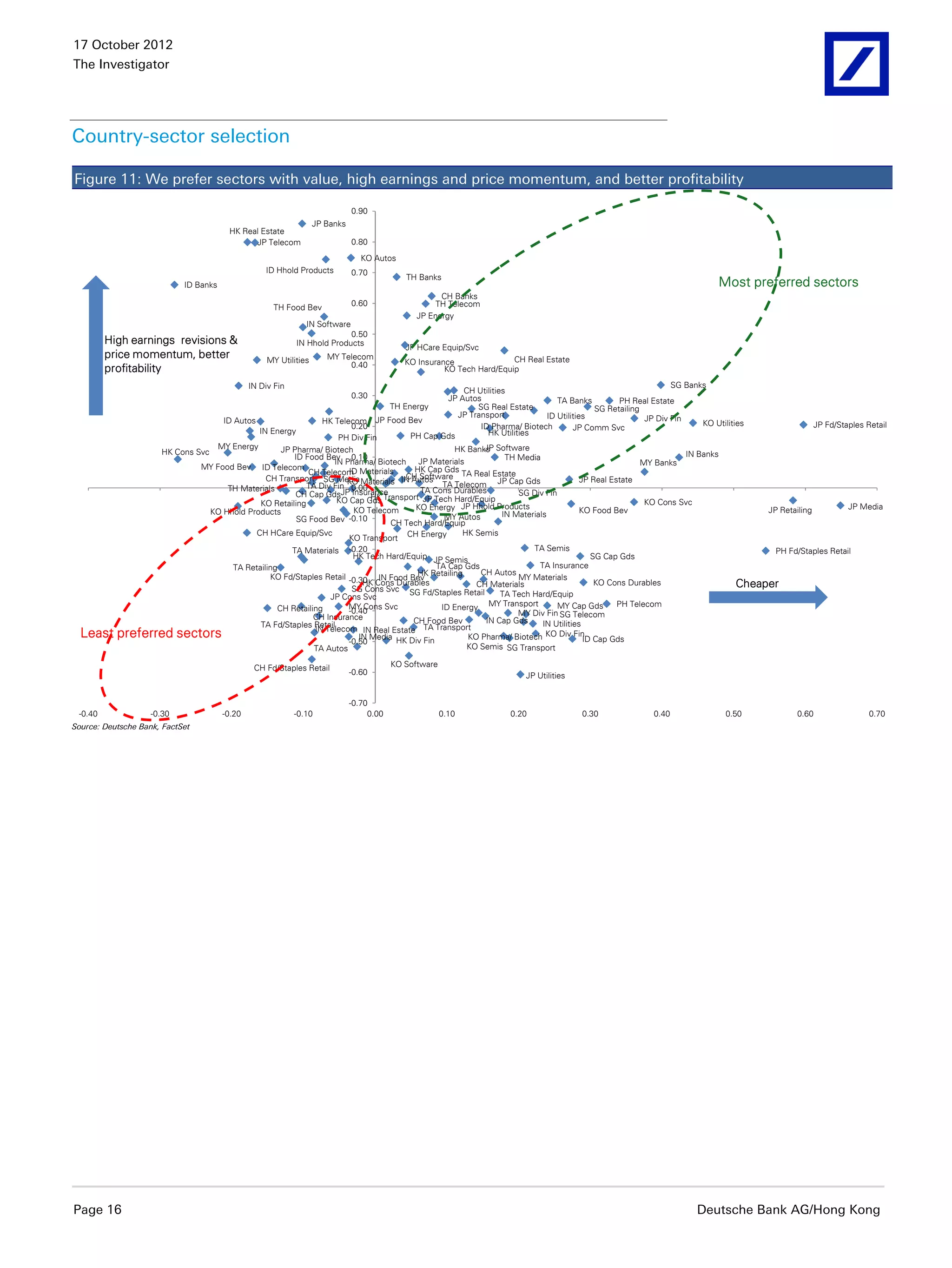

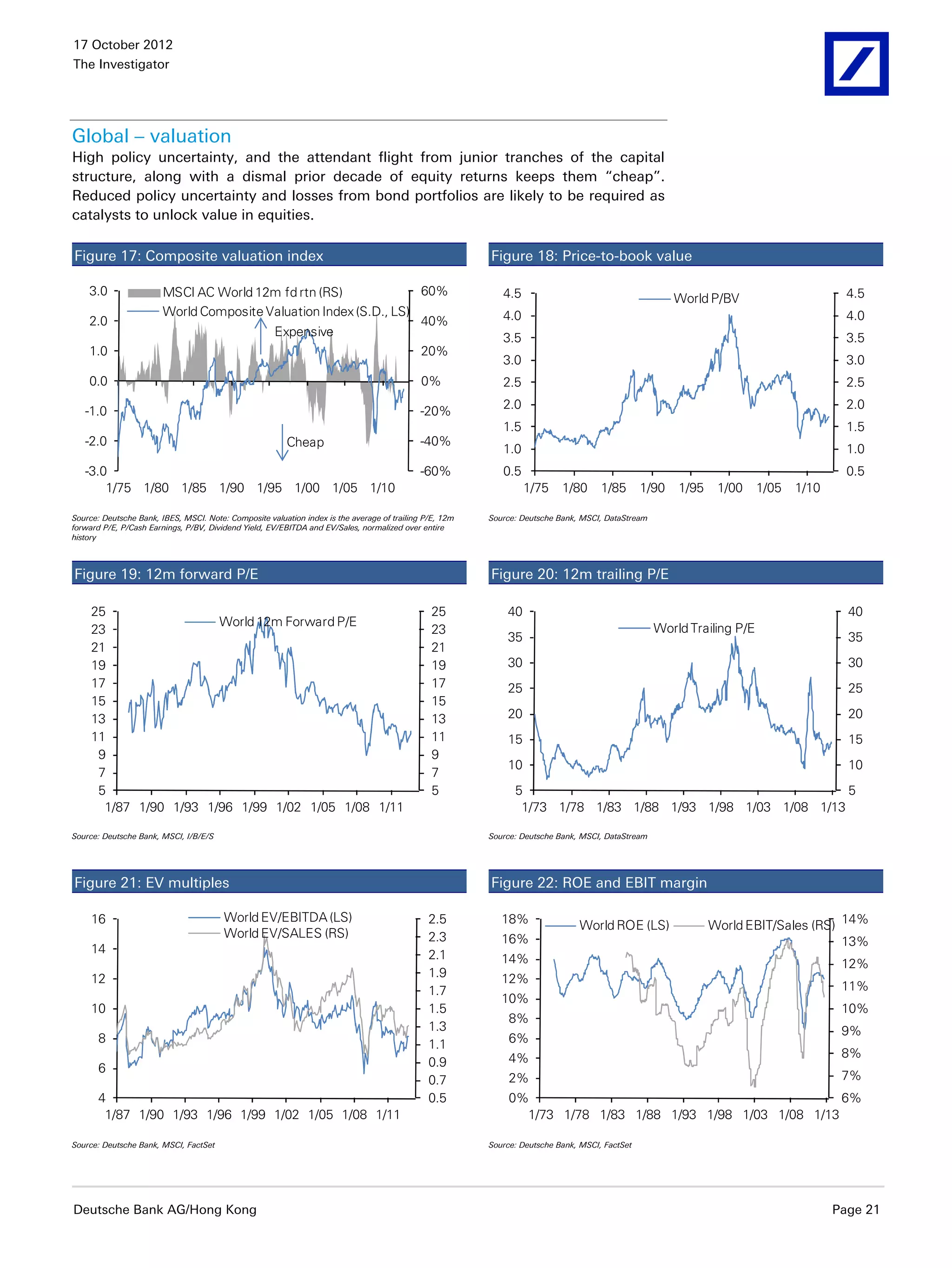

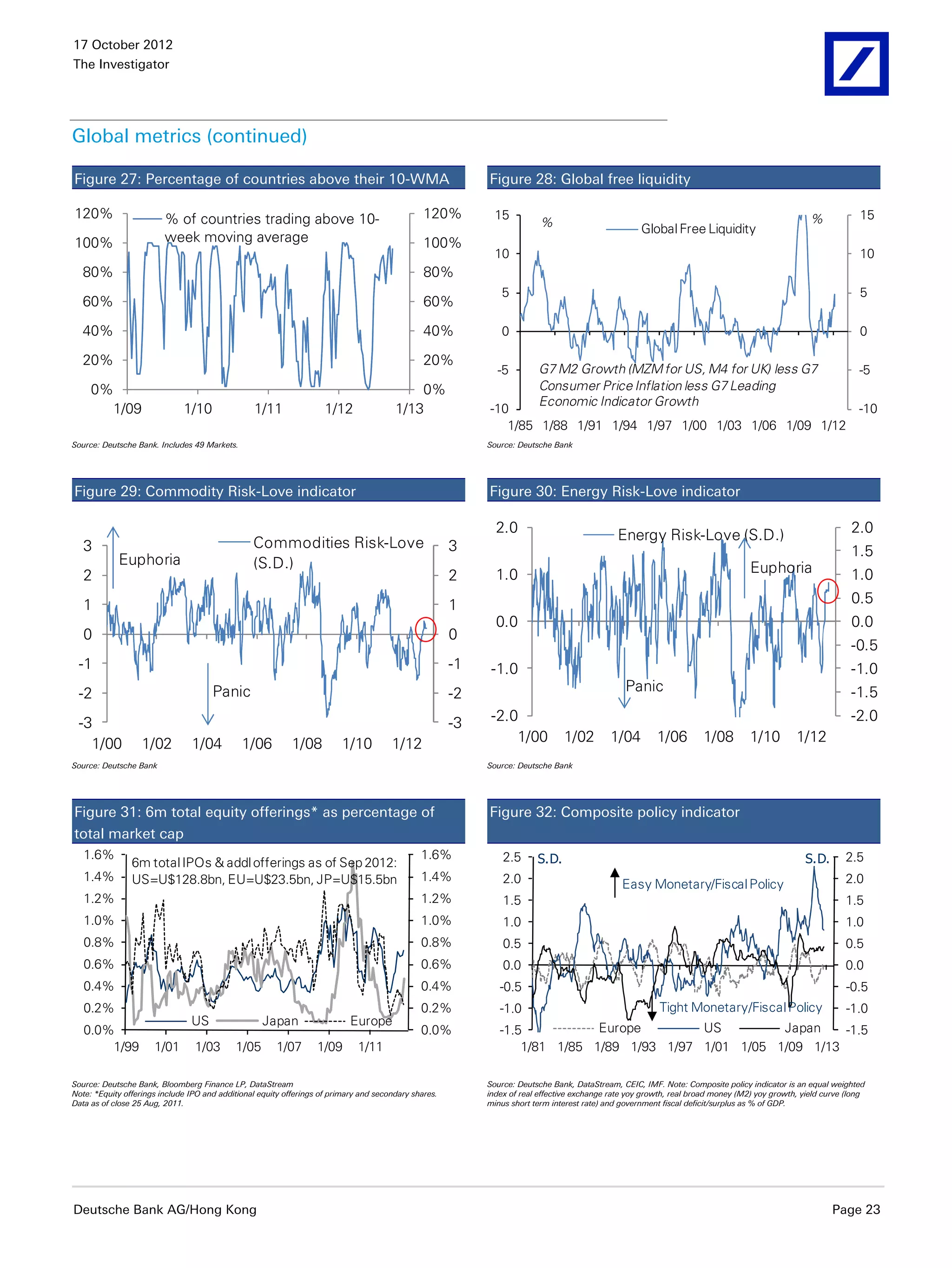

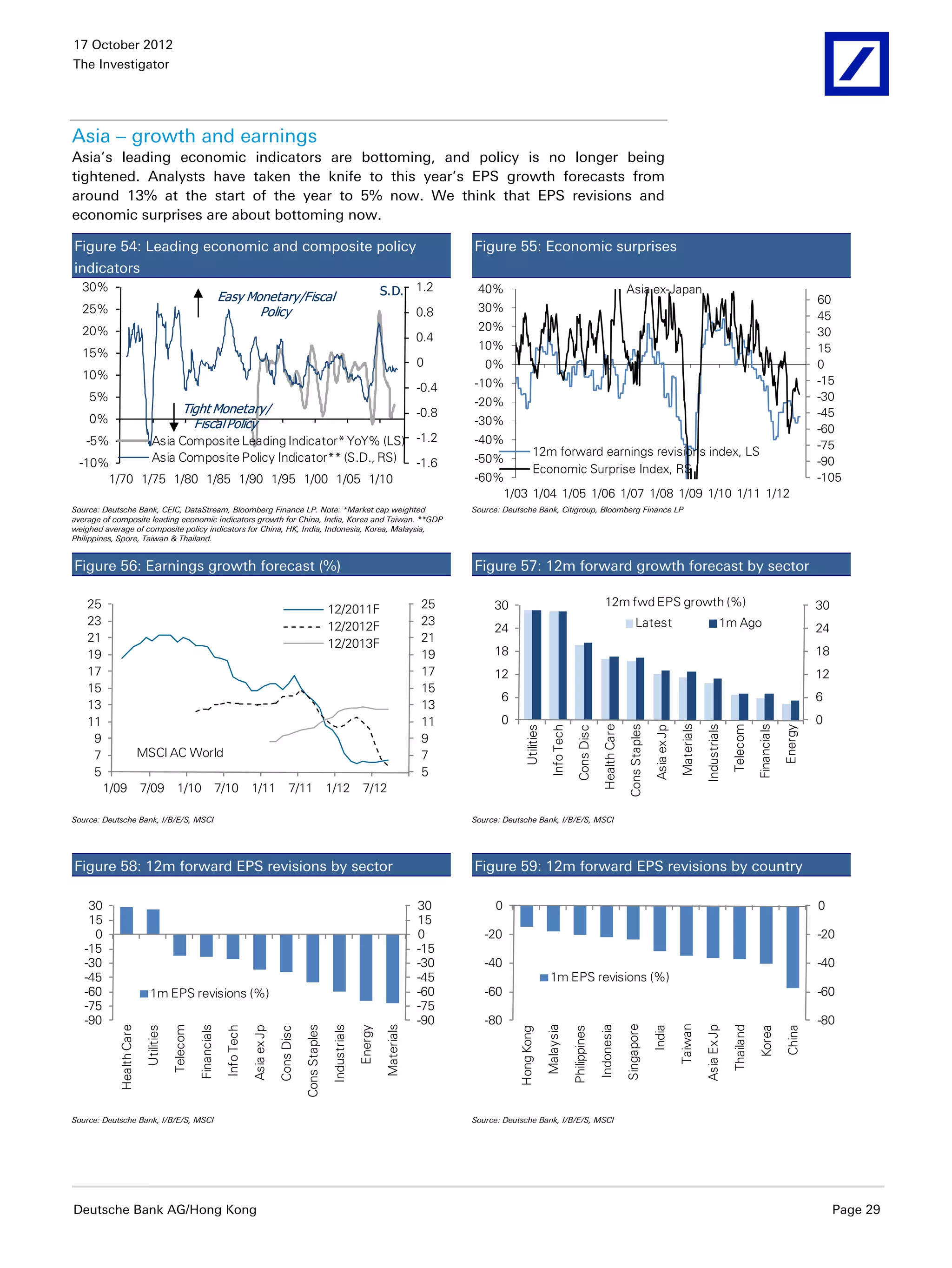

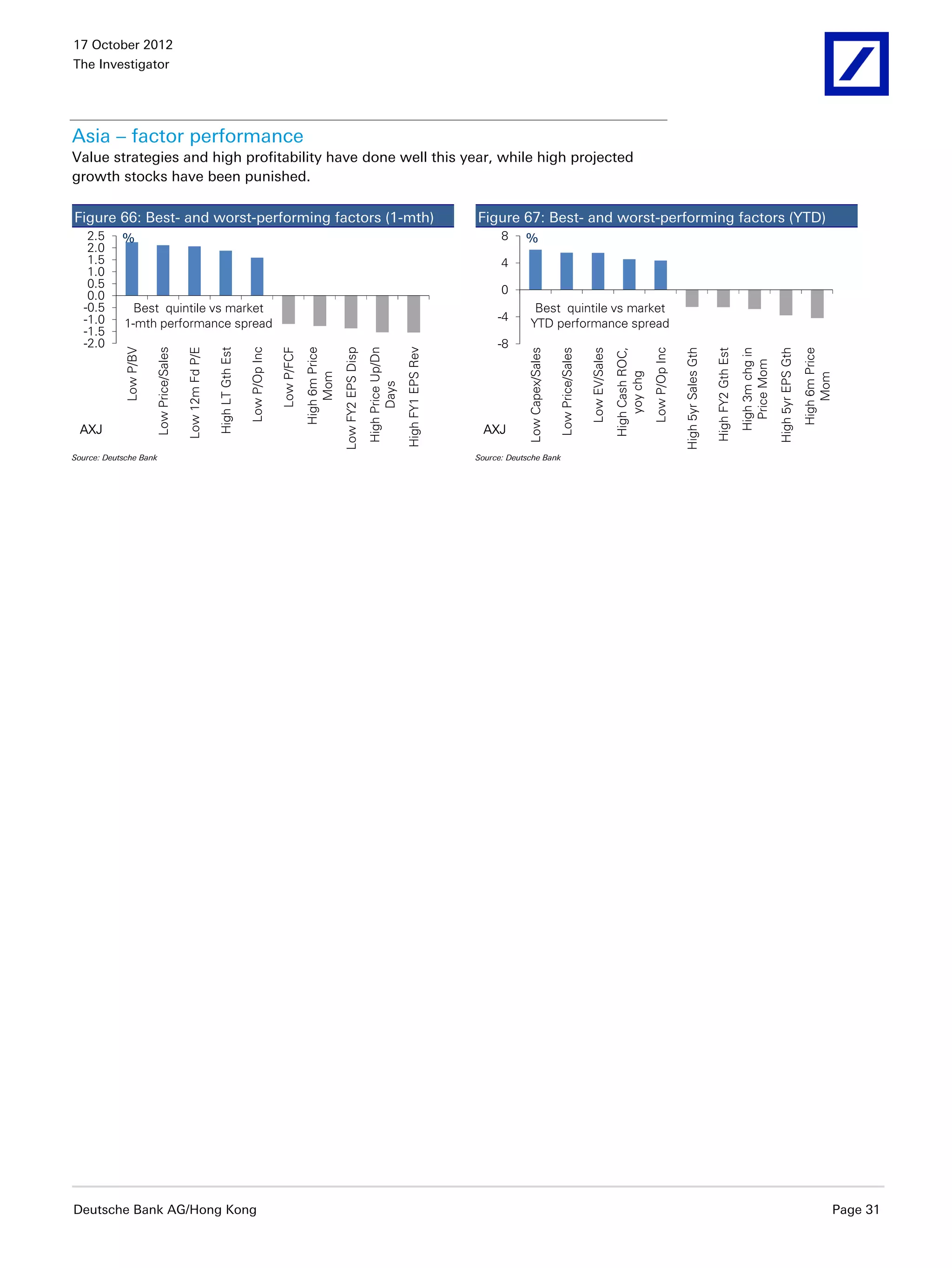

This document discusses how elevated economic policy uncertainty since 2008 has increased equity risk premiums, diminished opportunities for stock picking, and favored defensive stocks over cyclical stocks. The author argues that economic policy uncertainty is highly correlated with these market factors and is the main driver of financial markets currently. However, the author believes economic policy uncertainty may have peaked globally and is poised to decline, which would have positive implications for equities, risk assets, and stock picking opportunities. If policy uncertainty declines, it could lower equity risk premiums and widen the stock picking opportunity set by making individual stocks' performances less correlated with the overall market.