Jpm top country and sector ideas 121015

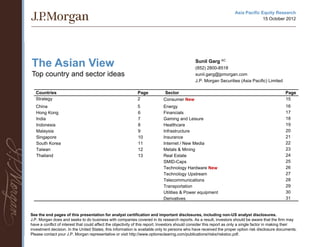

- 1. Asia Pacific Equity Research 15 October 2012 The Asian View Sunil Garg AC (852) 2800-8518 Top country and sector ideas sunil.garg@jpmorgan.com J.P. Morgan Securities (Asia Pacific) Limited Countries Page Sector Page Strategy 2 Consumer New 15 China 5 Energy 16 Hong Kong 6 Financials 17 India 7 Gaming and Leisure 18 Indonesia 8 Healthcare 19 Malaysia 9 Infrastructure 20 Singapore 10 Insurance 21 South Korea 11 Internet / New Media 22 Taiwan 12 Metals & Mining 23 Thailand 13 Real Estate 24 SMID-Caps 25 Technology Hardware New 26 Technology Upstream 27 Telecommunications 28 Transportation 29 Utilities & Power equipment 30 Derivatives 31 See the end pages of this presentation for analyst certification and important disclosures, including non-US analyst disclosures. J.P. Morgan does and seeks to do business with companies covered in its research reports. As a result, investors should be aware that the firm may have a conflict of interest that could affect the objectivity of this report. Investors should consider this report as only a single factor in making their investment decision. In the United States, this information is available only to persons who have received the proper option risk disclosure documents. 1 Please contact your J.P. Morgan representative or visit http://www.optionsclearing.com/publications/risks/riskstoc.pdf.

- 2. Adrian MowatAC (852) 2800-8599 adrian.mowat@jpmorgan.com J.P. Morgan Securities (Asia Pacific) Limited Emerging markets and AP equity strategy Key Messages Investment themes/issues 2013 is a continuation of 2012 macro trends Focus on earnings revisions…micro not macro Slow DM growth EM Nifty Fifty: (JPGIENIF Index) Lower profits in China lead to lower capex and cost reduction to rebuild margin = lower GDP China’s three inflection points Demographics Investors reluctantly buy equities 2008/9 stimulus QE3: interest rates low until 2015 Deflating housing bubble ECB and Fed actions reduce tail risks OW Tech…an unusual seasonal lift Do not extrapolate previous QEs Money chases momentum Margin expansion – falling PPI – Credit and equities not commodities Strong demand for EM fixed income – DM equities plus EM growth Knee-jerk reaction: Rotation into underperformers OW India and Turkey Country recommendations Risks to our view + volatility Overweight: China: Large stimulus Mexico, India, Turkey, Thailand and Philippines QE: Leading to higher commodity and energy prices Technology, consumer discretionary Underweight: Drivers of volatility China, Brazil, (Australia) Euro fiscal crisis Materials US fiscal cliff China data 2

- 3. Heat-maps: Key sectors in country recommendations OW: India, Turkey, Mexico, Thailand and Philippines UW: China, Brazil, (Australia) Emerging Markets Equity Strategy Heat Map Mexico tel. Mexico China Others China Brazil Financials Thailand Taiwan IT Brazil Energy Others Energy China Brazil Materials Brazil CS Brazil Others Mexico CS Telecom China CS Twn. Financials SA Telecom Indonesia China Fin. ex China CD Twn. Mater. Korea SA SA CD Twn. Others Chile banks China Ind. Materials Financials Russia Philippines Korea China Mater. India Energy SA Others Energy Financials Korea IT SA Materials India China Banks India Others Malaysia Financials Korea Turkey Fin. Russia Korea CD Korea Others CE3 India IT Industrials Turk. Others Others Source: J.P. Morgan Strategy. Note: Red Indicates UW, green OW and white Neutral. Smaller markets with weights < 0.5% of MSCI EM are not included. Area of the sector indicates weight in MSCI EM. Overweight Underweight Asia Pacific ex-Japan Equity Strategy Heat Map Korea Others HK Indust. Australia CS Korea IT HK CD HK Malaysia Aus. Indus Korea CD Korea HK Utilities Financials Australia Financials Australia Financials Taiwan Taiwan IT Energy Korea Korea Financials India Materials Industrials Taiwan India Others Financials Indonesia Australia China mat. China CS Materials India Energy Others China CD China Indus. Taiw. Others India IT China Banks China Singapore Thailand China Fin. China Sing. Others Australia Materials Energy China Others Financials Ex banks Telecom Sing. Indus Philippines Source: J.P. Morgan Strategy, MSCI, Datastream. Note: Red Indicates UW, green OW and white Neutral. Area of the sector indicates weight in MSCI APxJ. 3

- 4. 4 Countries

- 5. Sunil GargAC (852) 2800-8518 sunil.garg@jpmorgan.com China J.P. Morgan Securities (Asia Pacific) Limited Valuation comps for our highest-conviction recommendations Mkt cap Rating Price PT P/E (x) P/BV (x) ROE (%) DY (%) Company BB CMP (US$MM) target End date FY12E FY13E FY12E FY13E FY12E FY13E FY12E FY13E Top Picks 21Vianet Group Inc. VNET US 12 409 OW 16.3 31-Dec-13 142.8 88.1 8.5 7.9 5.6 9.3 0.0 0.0 Baidu.com BIDU US 111 30,182 OW 200 31-Dec-13 24.0 17.8 9.4 6.0 48.6 41.3 0.0 0.0 Beijing Capital International Airport 694 HK 5.26 1,275 OW 8.3 31-Dec-12 13.3 10.8 1.2 1.1 9.3 10.5 1.1 1.4 Beijing Enterprises 392 HK 49.1 7,205 OW 60 30-Jun-13 18.3 13.7 1.2 1.1 6.6 8.2 1.6 2.2 China Shenhua Energy - H 1088 HK 31.3 13,722 OW 35 30-Jun-13 11.2 10.3 2.0 1.8 19.0 18.3 3.4 3.7 China Shipping Container Lines 2866 HK 1.81 876 OW 2.85 31-Dec-13 -68.3 24.0 0.7 0.7 -1.0 2.7 0.0 0.0 China State Construction 3311 HK 8.92 4,473 OW 13 31-Dec-13 15.2 11.0 3.1 2.6 21.5 26.1 1.9 2.7 China ZhengTong Auto 1728 HK 4.85 1,382 OW 5.5 30-Jun-13 13.4 10.5 1.2 1.1 9.8 11.1 1.0 Country Garden 2007 HK 2.95 6,937 OW 3.55 30-Jun-13 7.5 6.6 1.2 1.0 17.4 16.7 5.2 5.9 Galaxy 27 HK 25 13,520 OW 31 31-Dec-12 14.8 12.7 4.9 3.6 39.9 32.8 0.0 0.0 Golden Eagle Retail 3308 HK 16.2 4,034 OW 19.5 30-Jun-13 20.7 18.2 4.9 4.4 25.4 25.4 2.4 2.7 ICBC - H 1398 HK 4.96 55,531 OW 5.8 31-Dec-12 6.3 6.4 1.3 1.1 21.3 18.3 5.1 5.0 Lenovo 992 HK 6.16 8,170 OW 8.1 31-Mar-13 17.0 13.9 3.1 3.5 22.1 25.8 2.3 3.1 Ping An Insurance Group - H 2318 HK 61 24,627 OW 65 31-Dec-12 15.9 13.1 2.6 2.2 17.5 18.2 0.9 1.0 Sinopec Corp - H 386 HK 7.82 16,927 OW 9 31-Dec-12 7.6 6.9 1.0 0.9 14.6 14.4 3.1 3.4 The United Laboratories 3933 HK 4.05 850 OW 4.5 31-Dec-12 21.3 12.0 1.2 1.2 5.6 9.9 1.7 3.2 Stocks to Avoid Anta Sports Products Ltd. 2020 HK 6.78 2,180 UW 3.6 30-Jun-13 9.5 14.2 2.0 1.9 21.9 13.9 6.5 4.3 Aluminum Corporation of China - H 2600 HK 3.34 1,699 UW 2.7 30-Jun-13 -7.4 139.1 0.8 0.8 -9.3 0.6 0.0 0.0 China Merchants Holdings Int'l 144 HK 23.6 7,579 UW 20 31-Dec-12 13.2 12.7 1.3 1.2 9.9 9.9 3.3 3.4 Glorious Property 845 HK 1.14 1,146 UW 1 31-Dec-12 5.2 5.3 0.4 0.4 8.0 7.4 0.0 0.0 New China Life Insurance Company Ltd - A 601336 CH 23 7,591 UW 25 31-Dec-12 23.4 15.3 2.1 1.8 9.3 12.7 1.8 0.7 PetroChina 857 HK 10.4 28,251 UW 8.75 31-Dec-12 10.2 9.9 1.4 1.3 14.6 13.9 4.4 4.6 Source: J.P. Morgan estimates, Bloomberg. Pricing date is 12 October 2012. 5

- 6. Adrian MowatAC (852) 2800-8599 Adrian.mowat@jpmorgan.com Hong Kong J.P. Morgan Securities (Asia Pacific) Limited Overall market view: We stay cautious and expect a Hong Kong – Hang Seng Index12M-fwd P/E range-bound market in 2H12. Outlook for the economy x remains poor, with 2012 GDP growth forecast low at 30 Current=9.2x 1.9% by JPMe. We think inflation is likely to fall further 25 on the back of the lower import prices and slower pace +2 std dev of Rmb appreciation. Market is de-rating on poor 20 fundamentals, trading at 12m P/E of 9.2x. +1 std dev 15 long term avg=13.5x Sector calls: Focus on residential among properties, as we think current prices have factored in potential 10 downside. We maintain our positions in casinos -1 std dev although we expect near-term pressure. Prefer 5 85 86 87 88 89 90 91 92 93 94 95 96 97 98 99 00 01 02 03 04 05 06 07 08 09 10 11 12 Insurance over Banks; UW on utilities. Source: Bloomberg, J.P. Morgan. Drivers/catalysts/events: 1) China policy easing on soft economic data, 2) declining inflation rate, 3) Stock views Recovery of property transactions, slower land sales, diminishing policy risk and record low mortgage rates P/E (x) BB Code Rating Price PT FY12E FY13E are positive for the property sector, 4) expect new Top Picks launch (Cotai Central II) in Macau in 3Q12. AIA 1299 HK OW 29.25 31 19.2 15.5 Key issues / risks: 1) Global economic uncertainty, BOCHK 2388 HK OW 24.1 27 12.6 12.9 2) trade sector supply and demand can incrementally Cheung Kong 1 HK OW 113.2 120 11.6 11.5 swing both ways, 3) central office demand is under Galaxy 27 HK OW 25 31 14.8 12.7 pressure as financial companies are downsizing and Lifestyle 1212 HK OW 17.02 19 15.3 14.2 relocating. Pacific Basin Shipping 2343 HK OW 3.88 4.5 -4.4 30.5 Power Assets 6 HK OW 66.55 70 14.2 13.7 View relative to region: Underweight. Source: Bloomberg, J.P. Morgan estimates. Note: Share prices and valuations are as of October 12, 2012. 6

- 7. Bharat IyerAC (91-22) 6157-3600 bharat.x.iyer@jpmorgan.com J.P. Morgan India Private Limited India At a 12-13x one-year forward P/E, Indian equities are MSCI India – 12 M forward P/E trend trading at the lower end of the last decade’s trading range. But the economy’s potential growth rate has deteriorated markedly over the past two years. In the absence of structural reforms to address growth constraints, markets could remain cheap. Over the interim, investors may have to contend with market returns in line with earnings growth (estimated at about 10-12% over FY12-14E). Political window of opportunity to address policy concerns over the next two quarters. Source: MSCI, Bloomberg, IBES Portfolio Stance Top Picks and Avoids Overweight private sector banks on expected policy stimuli. P/E (x) Underweight consumption as rural growth momentum BB Code Rating Price PT FY12E FY13E moderates. Top Picks Stock-specific approach for global sectors, given the ICICI Bank ICICIBC IN OW 1044.75 1025 19.3 15.6 uncertain environment. TATA Consultancy Services TCS IN N 1298.45 1400 23.9 18.4 Key risks IDFC IDFC IN OW 151.05 150 14.6 13.0 A sustained rise in global crude oil prices Power Grid Corporation of India PWGR IN OW 119.95 120 18.4 15.3 Policy environment remains directionless ITC ITC IN OW 283.5 260 33.9 29.1 Avoids We have an overweight rating on India in an Asia and Jubilant Foodworks Ltd JUBI IN UW 1364.8 995 82.3 56.6 Emerging Markets context. Adani Power ADANI IN UW 50.45 31 -291.3 -4086.5 Bank of India BOI IN UW 301.95 250 6.5 6.9 Source: Bloomberg, J.P. Morgan estimates, prices as of October 12, 2012. 7

- 8. Aditya Srinath, CFAAC (62-21) 5291-8573 aditya.s.srinath@jpmorgan.com PT J.P. Morgan Securities Indonesia Indonesia MSCI Indonesia: 12M Forward P/E Abs & and Rel to MSCI APxJ J.P. Morgan weighting: Neutral – Relative to MSCI EM/APxJ Indonesia has reversed early year underperformance of Asia ex-Japan & EM Rotation to the fore until clarity on earnings emerges Investment positives Valuation pressures being deflated Oil declining – inflation risks contained Domestic growth to be relatively resilient Source: MSCI, Bloomberg, Investment negatives Policy hazards Key stocks P/E (x) The rupiah BB Code Rating Price PT FY12E FY13E Risks to demand from commodity prices Top Picks Bank Rakyat Indonesia BBRI IJ OW 7500 8200 10.8 8.6 Sector weightings: Banks OW, Industrials OW, Materials Indocement INTP IJ OW 21000 23000 17.8 15.3 OW, Consumer Staples N & Utilities OW, Consumer Disc. Perusahaan Gas Negara PGAS IJ OW 4375 4100 15.3 14.1 UW, Energy UW, Telcos N Avoids United Tractors UNTR IJ UW 19900 18000 12.9 11.6 Off Index OW –Property (SMRA) Indika Energy INDY IJ N 1550 2000 0.0 0.0 Reinstated BBRI as top pick along with INTP, PGAS Source: Bloomberg, J.P. Morgan estimates, prices as of 12 October 2012. Avoids: UNTR, INDY 8

- 9. Hoy Kit MakAC (60-3) 2270-4728 hoykit.mak@jpmorgan.com Malaysia JPMorgan Securities (Malaysia) Sdn. Bhd. (18146-X) Malaysia’s defensiveness stands out amidst KLCI performance during 12th GE (2008) global uncertainties. Combination of large 1550 domestic funds presence and resilient economy/earnings drove MSCI Malaysia 1450 -4% valuations to a 29% premium to APxJ (historical average of 13%). 1350 -5% -9% -5% Key market driver/risk is the upcoming general 1250 elections, not due until Apr 2013. Sept/Oct are 1150 probable/final windows to hold elections. Pullback (close to 10%) highly likely regardless, when 1050 parliament is dissolved, as per 2008 outcome. We Jan-08 Feb-08 Mar-08 Apr-08 May-08 are uncomfortable with the market’s 2012 P/E of Source: CEIC. Bloomberg. 16.5x, against a historical average of 15x, suggesting event risk is not priced in. Stock views: Key top picks and avoids Tactical pre-elections call: We recommend that P/E (x) investors stick with apolitical stocks with earnings BB Code Rating Price PT FY12E FY13E growth prospects - AirAsia, Axiata, Sime Darby, OW Dialog, and KPJ Healthcare. AirAsia AIRA MK OW 3.05 4 5.5 14.1 Post elections drivers: 1) Political stability = Sime Darby SIME MK OW 9.72 11.3 13.9 13.0 policy continuity (ETP gaining traction). 2) Strong Dialog DLG MK OW 2.39 2.8 31.5 28.0 KPJ Healthcare KPJ MK OW 6.13 6.6 23.6 19.2 domestic-driven demand (on robust fixed capital Axiata AXIATA MK OW 6.47 5.6 17.3 15.4 formation) offsetting external demand drag. 3) Avoids Improving earnings momentum. 4) Consensus Hong Leong HLBK MK UW 13.92 11.5 13.9 14.9 UW with EM funds 2.5% weight vs. neutral weight British American Tobacco ROTH MK UW 61.04 50.2 21.6 20.8 of 3.7%; locals all cashed up. Rising free float IOI Corporation IOI MK UW 5.03 4.6 18.1 16.7 positive. Source: Bloomberg, J.P. Morgan estimates. Note: Share prices and valuations are as of 12 October 2012. Key risks: 1) BN loses even a simple majority. 2) Sharper-than-expected external sector slowdown. 9

- 10. James R. Sullivan, CFAAC (65) 6882-2374 james.r.sullivan@jpmorgan.com Singapore J.P. Morgan Securities Singapore Private Limited Summary of market correlations across sectors Market to head lower? Singapore macro actuals have 1.00 begun to miss estimates for the first time since Summer 2011 (GDP, IP recently; Retail sales have been missing for 0.90 Difficult period for Fundamental stock picking, some time). 2) More importantly, the trend of actuals is now stock specifics countered by high cross sector correlations - all trade as one 0.80 below the trend of revisions, i.e., additional negative revisions are likely. Per the chart on the right below, the 0.70 market has now traded higher despite this revision risk. 3) Singapore market earnings revisions turned negative in mid- 0.60 August. 4) Technicals have now turned cautious, versus 0.50 Positive period for fundamental stock picking their very bullish stance previously. Mitigating Factors: 1) EASI has moved into positive 0.40 territory, the median 6 -month return for the Singapore 0.30 market post a move into positive territory is 10%. 2) Singapore inflation moderating (although this could actually 0.20 strengthen the slowdown argument). 3) Great stock-picking Feb-11 May-11 Aug-11 Nov-11 Feb-12 May-12 Aug-12 environment, as cross-sector correlations are extremely low. Source: J.P. Morgan estimates, Bloomberg Stock picks: Own outward-looking Singapore (NOL, SIA, KEP), avoid anything inward-looking save inflating assets Stock views (CAPL). P/E (x) Market (blue) rising while likely revisions (red) falling BB Code Rating Price PT CY12E CY13E (sustainable)? Top Picks 12 1800 Neptune Orient Lines NOL SP OW 1.1 1.35 467.5 18.5 10 8 1700 Singapore Airlines SIA SP OW 10.47 13 26.9 18.3 6 4 1600 Keppel Corporation KEP SP OW 11.21 13.3 11.3 13.2 2 ? 1500 CapitaLand CAPL SP OW 3.16 3.4 13.5 11.7 0 ‐2 1400 Avoids ‐4 China Minzhong Food Limited MINZ SP UW 0.835 0.7 3.5 3.4 ‐6 1300 Source: Bloomberg, J.P. Morgan estimates. Note: Share prices and valuations are as of October 12, 2012. IP Actual trend ‐ Forecast Trend MXSG Source: J.P. Morgan estimates, Bloomberg. 10

- 11. Scott YH SeoAC (82-2) 758 5759 scott.seo@jpmorgan.com South Korea J.P. Morgan Securities (Far East) Ltd, Seoul Branch Overall market view – Entering 2Q12 earnings Korea – MSCI Korea 12M-fwd P/BV x season, we recommend that investors focus 2.0 more on the companies’ LT fundamentals 1.8 instead of short-term earnings volatility. Given 1.6 undemanding market valuations (i.e., below -1 1.4 STD of the historical average P/BV and P/E), we 1.2 1.0 expect to see a ST rebound when the macro 0.8 environment turns favorable (i.e., QE 3, China 0.6 government’s economic boosting measures). Jan-05 Oct-05 Jul-06 Apr-07 Jan-08 Oct-08 Jul-09 Apr-10 Jan-11 Oct-11 Jul-1 MSCI KOREA - 12MTH FWD P/BPS Average +1 stdev -1 stdev Sector calls – In a recovery phase, we expect Source: Datastream. IT and autos to continue to outperform the Korea – Top picks/avoids market. Moving toward 2H12, we expect easing P/E (x) P/B (x) regulatory pressure and probable boosting BB Code Rating Price PT FY12E FY12E measures for domestic consumption to be a Top picks catalyst for domestics. Doosan Heavy Industries 034020 KS OW 54100 71000 11.01 0.93 Kia Motors 000270 KS OW 68200 100000 6.04 1.55 Potential drivers/catalysts/events: 1) Mando 060980 KS OW 148500 220000 10.27 1.64 headline inflation managed within the BoK’s inflation target (3±1%), 2) more stable KRW Lotte Shopping 023530 KS OW 340000 388000 10.28 0.56 Orion movement (KRW to be less volatile than during 001800 KS OW 1018000 1020000 34.39 5.16 Samsung Electronics GFC, in our view), 3) easing regulatory 005930 KS OW 1296000 1800000 9.64 1.82 Samsung Life Insurance pressure, and 4) gradual recovery in residential 032830 KS OW 94900 140000 18.06 0.98 property market. Shinhan Financial Group 055550 KS OW 37250 50000 6.77 0.81 Stocks to avoid Key issues / risks: Korea market is particularly Honam Petrochem 011170 KS UW 240500 180000 0.01 1.45 vulnerable to macro volatilities due to its highly S-Oil 010950 KS UW 99600 70000 11.11 1.94 cyclical/export-focused industry structure. For domestics, regulatory direction ahead of the Source: Bloomberg, J.P. Morgan estimates. Note: Share prices and valuations are as of October 12, 2012. presidential election (Dec-12) should be a key concern. 11

- 12. Nick LaiAC (886-2) 2725-9864 nick.yc.lai@jpmorgan.com Taiwan J.P. Morgan Securities (Taiwan) Limited Sector calls 2012 YTD relative share price performance by sector Overweight: Tech (we prefer foundry, backend, NB ODM and avoid DRAM and display). 30% 20% Underweight: Consumer/discretionary, and Materials 10% (we are selective on SMCap stocks). 0% Neutral: Telco, Financials (we prefer banks over -10% brokers and insurance). -20% -30% Market view Transportation Elec. Distribution Plastic&Chemical Elec&Machinery Computer Chemical Components Info service Glass&Porcelain Communication Construction Biotech Textiles Machinery Cement Elec. Appliances Depart. Electronics Food Steel Auto Semicon Other elect. Financials Tourism Energy Rubber Plastic Opto elec. Others Paper J.P. Morgan is neutral on Taiwan in its regional portfolio; we foresee the market trading sideways or being range-bound at~7,000-7,600 in 2H12. Macro developments will be key to sentiment and Source: Bloomberg, *Performance is based on the closing price on 25th June 2012 performance, especially in tech . Top Five Large-Cap Picks BB Code Rating Price Mkt Cap P/E (x) P/BV (x) ROE (%) DY (%) (US$ MM) FY12E FY13E FY12E FY13E FY12E FY13E FY12E TSMC 2330 TT OW 86.3 76,380 14.2 13.0 3.1 2.8 23.3 22.6 3.5 ASE 2311 TT OW 21.95 5,691 11.0 8.4 1.3 1.2 12.4 14.9 3.0 Quanta Computer 2382 TT OW 69.3 9,101 9.8 8.0 2.0 1.8 21.7 23.6 6.2 Far EasTone Telecom 4904 TT OW 74.2 8,257 21.2 17.3 3.2 3.2 15.5 18.6 5.2 Chinatrust 2891 TT OW 16.8 7,124 10.8 10.2 1.2 1.2 11.4 11.7 3.8 Source: Bloomberg, J.P. Morgan estimates. Note: Share prices and valuations are as of October 12, 2012. 12

- 13. Sriyan PieterszAC (662) 684 2670 Thailand sriyan.pietersz@jpmorgan.com JPMorgan Securities (Thailand) Limited Thailand 12M fwd P/E x Current 12-month forward P/E (SET Index) = 11.8x We believe Thai equities will provide another half year of 20 outperformance, given their ability to orient toward both domestic 18 +2 stdev = 16.3x 16 themes and global growth re-acceleration. +1 stdev = 13.6x 14 12 Key drivers: (+) domestic growth outlook, (+) positive earnings 10 Average = 10.8x revisions on Financials, (-) external growth/risk aversion, (+) 8 -1 stdev = 8.1x accommodative policy, (+) sustained investment cycle; (-) politics 6 -2 stdev = 5.4x 4 and policy risk factors. 02 03 04 05 06 07 08 09 10 11 12 Source: J.P. Morgan estimates and calculations. Potential catalysts: monthly bank loan growth data, 2H12 earnings upgrades, political developments, global growth data. JPMQ Global Revisions Landscape As At 21-Aug-2012 Valuations are back at 10-year average P/E. Region Net Revs FY2 Net Revs FY1 EMOM 3MTHFY1 EMOM 3MTHFY2 MSCI All World -21% -14% -3% -3% Key issues/risks: 1) significant acceleration in inflation; 2) political ASIAPAC Ex JP -28% -26% -4% -4% risk; 3) cash calls. ASIAPAC -29% -27% -4% -3% China -47% -47% -4% -5% Sector weightings: We are overweight on Banks and Property, Hong Kong -26% 9% -2% -3% Korea -31% -42% -6% -3% neutral on Materials (Petrochemicals), and underweight on Malaysia -6% -5% -1% 0% Telecoms, Consumer and Energy. Singapore -20% -8% 2% -2% Taiw an -45% -44% -8% -7% Top picks are KBANK, SCB, SCC, LH, IVL, and BTS. Indonesia 5% -2% -2% -2% Philipines 33% 19% 0% 0% Thailand -18% -22% -3% -3% Source: J.P. Morgan Mkt P/E (x) P/B (x) Yield (%) Stock picks BB Code Rating Price PT Cap (US$MM) FY12E FY13E FY12E FY13E FY12E FY13E Top picks Kasikornbank KBANK TB OW 180 220 14,028 12.4 10.7 2.4 2.0 2.0 2.2 Siam Commercial Bank SCB TB OW 168.5 200 18,620 13.5 11.4 2.6 2.2 2.5 2.9 Siam Cement SCC TB OW 357 400 13,945 16.3 14.7 2.8 2.5 3.1 3.4 Land & Houses LH TB OW 8.6 9 2,820 17.2 17.4 2.9 2.8 5.0 4.9 Indorama Ventures IVL TB OW 27.5 41 4,329 11.8 7.4 1.8 1.5 2.5 4.1 BTS Group Holdings BTS TB OW 5.75 7.6 1,865 26.5 39.6 1.5 1.3 5.2 1.9 Tisco Financial Group TISCO TB N 45.5 49 1,078 8.8 7.9 1.8 1.6 4.9 5.5 Stocks to avoids Thai Oil TOP TB UW 64.25 53 4,286 13.8 14.0 1.6 1.5 5.2 5.3 Big C Supercenter BIGC TB UW 192.5 190 5,193 25.4 21.2 4.9 4.2 1.2 1.4 Source: Bloomberg, J.P. Morgan estimates, prices as of 12 October 2012. 13

- 14. 14 Sectors

- 15. Ebru Sener KurumluAC (852) 2800-8521 ebru.sener@jpmorgan.com J.P. Morgan Securities (Asia Pacific) Limited Consumer 2013 outlook. We are of the view that a Comparison of Chinese sportswear retailers' and other retailers' SSSG significant recovery in discretionary sales in 20.0% 18.0% 2013 is unlikely, so get ready to embrace longer- 16.0% 14.0% term single-digit or low-double digit SSSG in the 12.0% 10.6% space. 10.0% 10.0% 8.0% 0.0% 6.0% 4.8% Recent update: Retailers indicate a lackluster 4.0% 7.8% 7.8% 5.5% 3Q so far, and we believe 3Q SSSG is likely to 2.0% 3.8% 0.0% come in slightly below 2Q’s. We rebase our 2009 2010 2011 1H12 2013 estimates and cut our 2013 earnings Volume Pricing estimates for retailers by 5% on average. Source: J.P. Morgan estimates, Company data. Includes data from Parkson, Golden Eagle, Belle, Trinity, Daphne, and Ports Design. Top Picks: We remain positive on select Stock views retailers from a long-term perspective but do not P/E (x) expect an immediate re-rating catalyst to arrive BB Code Rating Price PT FY12E FY13E in 2012 in the form of a strong SSSG pick-up. OW Golden Eagle 3308 HK OW 16.18 19.5 20.7 18.2 Among retailers, Golden Eagle and Trinity are Trinity 891 HK OW 5.19 6.5 16.6 14.6 our top picks, but with a longer-term focus as 2H Chow Tai Fook 1929 HK OW 9.89 12 15.6 14.0 China Foods 506 HK OW 8.34 9.2 23.6 19.0 is likely to be lackluster. We also like CTF, Sa Sa China Mengniu 2319 HK OW 22.55 28 20.0 16.0 and Giordano. Among staples we have OW on UW Hengan 1044 HK UW 73.8 61 25.3 21.1 China Foods and Mengniu on the back of China Yurun 1068 HK UW 5.74 4.6 20.7 8.7 product mix upgrades. Tsingtao – A 600600 CH UW 33.12 26 24.1 20.7 Tsingtao Brewery - H 168 HK UW 44.55 32 26.3 22.7 Parkson 3368 HK UW 6.85 5.6 14.6 13.4 Anta 2020 HK UW 6.78 3.6 9.5 14.2 Li Ning 2331 HK UW 4.83 3.3 -71.5 16.7 Xtep 1368 HK UW 3.19 2.2 6.4 9.5 Source: Company data, J.P. Morgan estimates. Prices are as of October 12, 2012 15

- 16. Brynjar Eirik Bustnes, CFAAC (852) 2800-8578 Energy brynjar.e.bustnes@jpmorgan.com J.P. Morgan Securities (Asia Pacific) Limited We believe risk to demand is now greater than supply risk with EU/US economic issues to be resolved. Political risk to China, India, Japan, US and EU5 demand weakening (kBOPD) oil supply has subsided with the “worst” case now in the market. Resolution in Libya brought on light crude, pushing down oil prices and refining margins. Iran is the main wild card, threatening supply cuts or suffering EU sanctions. We believe lost crude from Syria, Yemen and Sudan is also priced in, partially offset by US liquids. Supplies from Saudi remain high, making up for less Iranian crude. Iraqi production is also increasing, along with North Y/Y change Sea. Angola should ramp up with Canadian oil sands and GRM strong last year on Libya/Japan EQ shale oil in the US at least adding to mid US supplies. 90% 10 Overall demand growth in Asia is trending down, with OECD 88% 8 in general not growing al all. China doesn’t need diesel 86% 6 imports (power trouble not happening) and coming out of 84% 4 maintenance and adding new capacity (1.0 mn BOPD in 82% 2 2012 along with India) should add more products in the 80% 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 E 2012 E 2013 E regional export market. Utilization GRM (US$/bbl - RHS) Based on the above, we see flat to weaker oil prices and weaker refining margins in 2012. Petrochemicals has been Source: J.P. Morgan estimates, Bloomberg, PAJ badly hit by Chinese tightening and is unlikely to rebound Stock views until 1H2013 at the earliest . P/E (x) BB Code Rating Price PT FY11A FY12E We think Sinopec offers the best value. China BlueChem is OW also not overpriced, in our view, while small-cap MIE offers PTT Public Company PTT TB OW 315 430 8.5 9.0 good value along with Inpex – but are asset plays. We think Inpex Corporation 1605 JT OW 466500 750000 10.5 10.6 SK Inno is the cheapest refiner in the region, but diesel Sinopec Corp - H 386 HK OW 7.82 9 7.6 7.6 spread reversal could be a negative for SKI as well. China Oilfield Services Limited 2883 HK OW 14.28 13 13.0 11.0 We see downside to CNOOC along with PetroChina due to UW deteriorating fundamentals and valuations. We think S-Oil in PetroChina 857 HK UW 10.38 8.75 11.7 10.2 Korea still prices in high expectations in both refining and Reliance Industries Ltd RIL IN UW 818.9 675 12.7 13.6 PX., while we think RIL has virtually no growth and trades at CNOOC 883 HK UW 15.88 13 8.2 9.5 a high valuation, and we see SK Innovation as fairly priced S-Oil Corp 010950 KS UW 99600 70000 9.6 11.1 at the high end and more defensive in a falling-margin Source: J.P. Morgan estimates, Bloomberg; Table priced as of October 12, 2012 environment. 16

- 17. Josh KlaczekAC (852) 2800-8534 josh.klaczek@jpmorgan.com Financials J.P. Morgan Securities (Asia Pacific) Limited In 1Q, we saw loan growth begin to decelerate Loan/Deposit Ratios: Large Increase Since 2008, Still Well <100% across the region, with weaker credit growth a 20 19 particular focus in China. For now, falling interbank rates & relatively conservative 15 14 leverage gives us a more constructive view on 9 Chg since 2008 (%) 10 6 asset quality – increasingly in China as well 4 5 3 2 2 0 -26 Key country calls : OW on Philippines & 0 -16 -19 Thailand, turning positive on China banks; UW -5 on Indonesia, Australia. Watch USD funding stress in ASEAN on external issues. -10 TH HK SG PH ID CH MY IN TW AU US KR Mar-12 95 68 88 65 82 68 77 73 84 128 81 102 Reasons to be constructive: 1) inflation Source: BIS falling, policymakers have more “bullets” than the West, 2) LDRs have risen but interbank Stock views markets show no signs of panic/stress, 3) P/E (x) valuations are now 7-9x P/E across the region BB Code Rating Price PT FY12E FY13E Key risks: Higher provisions are the most Top Picks important risk to the region, although we think Metropolitan Bank MBT PM OW 90.85 100 13.2 10.9 more immediate downgrades are likely to result China Minsheng Banking - H 1988 HK N 6.65 7.25 5.1 5.5 from NIM compression as policy-makers ease HSBC Holdings plc 5 HK OW 74.2 83 11.7 9.9 liquidity & credit demand begins to wane. Avoids Sinopac Financial Holdings 2890 TT N 11.6 10 12.3 12.3 With credit quality being a continued focus, our TMB Bank Public Company Limited TMB TB UW 1.79 1.3 13.3 15.9 portfolio remains anchored in positions in higher- Bank Central Asia (BCA) BBCA IJ UW 8150 7000 18.3 14.9 quality & defensive franchises – such as ICBC, Source: Bloomberg, J.P. Morgan estimates. BOCHK, HSBC, HDFCB, SCB – as well as a mix Note: Share prices and valuations are as of October 12, 2012. of “growth” stories like Minsheng & Yes Bank. 17

- 18. Kenneth Fong , CFAAC (852) 2800-8597 kenneth.kc.fong@jpmorgan.com Gaming and Leisure J.P. Morgan Securities (Asia Pacific) Limited Macau names rolling forward EBITDA multiple Key theme: The sector may see some near-term pressure on the back of a tougher comparison ahead EV/EBITDA (x) 16 (especially in July and August) and elevated analyst 15 expectations (Street’s revenue growth expectation for 14 2012 is 20-25% vs. actual delivered 26% ytd). We 13 12 advise investors to lock in some profit now as we see 11 opportunities for investors to gradually accumulate 10 9 over the next few months. We expect the sector to re- 8 rate again in late 3Q, when a gradually improving 7 Mar-10 May-10 Mar-11 May-11 Mar-12 May-12 Jan-10 Jul-10 Sep-10 Nov-10 Jan-11 Jul-11 Sep-11 Nov-11 Jan-12 China economy stimulates VIP headline revenue growth again and Sands Cotai Central phase II opens. 1-yr Rolling forward EBITDA mutiple Mean Key driver: We expect gaming revenue to grow 24% Source: J.P. Morgan. Bloomberg consensus estimates in 2012 and 18% in 2013. Stock views Key risk: Slower-than-expected China economic P/E (x) growth as Macau is a leveraged China internal BB Code Rating Price PT FY12E FY13E consumption play. OW Galaxy Entertainment Group 27 HK OW 25 31 14.8 12.7 Stock picks: In the short term, we like SJM for its MGM China Holdings Ltd 2282 HK OW 13.4 18.0 10.2 10.5 defensiveness, in the medium term we like Galaxy for Sands China Ltd 1928 HK OW 27.65 30 25.3 15.2 earnings upgrades, and Sands China for its longer- SJM Holdings Limited 880 HK OW 16.5 21 12.9 10.9 term mass market story. Wynn Macau Ltd 1128 HK OW 20.2 25.8 15.5 13.4 Neutral Melco International Development 200 HK N 6.75 8.9 11.6 11.3 Source: Bloomberg, J.P. Morgan estimates. Priced as at 12 October 2012. 18

- 19. Sean WuAC (852) 2800-8538 sean.wu@jpmorgan.com Healthcare J.P. Morgan Securities (Asia Pacific) Limited Key investment points: Low spending as a part of GDP means considerable room for The worst is likely over for the drug sector growth Pricing pressure rising for medical - Expected healthcare spending as % of GDP to go up to 10% by 2020E consumable but should be manageable Fundamentals of the healthcare industry stay 1,900.0 Healthcare Spending % of GDP Y/Y Growth 1,980.0 35% strong - remain positive in the longer term 1,700.0 1,611.9 30% 1,500.0 1,453.5 25% Key drivers: 1) new healthcare reform 1,300.0 1,157.4 20% 12th initiatives, 2) five-year plan fostering 1,100.0 866.0 984.3 15% 900.0 industry consolidation, and 3) potential 700.0 658.4 759.0 10% 579.0 corrections to Anhui EDL tendering 500.0 367.9 404.8 458.7 502.6 5% 319.7 300.0 0% 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 Key issues / risks: 1) Further price cuts, 2) Source: China Statistics Bureau. Adoption of DRG reimbursement, and 3) channel markup rule change OW on The United Laboratoeis – a high-beta play with commodity prices recovering. Stock views P/E (x) OW on Sino Biopharm– the best and most BB Code Rating Price PT FY12E FY13E OW balanced product portfolio and pipeline, in Sino Biopharmaceutical 1177 HK OW 2.91 3.6 19.5 16.5 our view The United Laboratories 3933 HK OW 4.05 4.5 21.3 12.0 UW UW on China Shineway: 1) strong exposure China Shineway 2877 HK UW 10.9 12 10.1 9.2 to EDL; 2) adverse effects of TCM injections Source: J.P. Morgan estimates. Prices are as of 12 October 2012 19

- 20. Karen Li, CFAAC (852) 2800-8589 Infrastructure karen.yy.li@jpmorgan.com J.P. Morgan Securities (Asia Pacific) Limited Investment thesis: Key issues / risks: Infra capex: Key beneficiaries of increasing govn't For infra operators in China, the key challenge is on the capex in China may be in two sectors: transport margin front as cost inflation continues despite softening infra and social housing. We expect rail capex to top-line volume growth (if any) and inability of tariff recover from end-2Q’12, to benefit names adjustments. including CRG, CRCC, CCCC, CSR, CSC, HOLI, For E&C sector in Asia region, the key concern is IJM, WIKA. whether inflation would return to haunt, resulting in Machinery: Though valuation seems cheap, we sooner-than-expected ending of current stimulus remain concerned about cash flow and receivable measures of policy easing. collection; hence Neutral on Zoomlion, Lonking and Sany Heavy. Key calls: Port operators have rebounded substantially P/E Next Yr YTD. We like HPH Trust for yield and Adani Company Name BB Code Rating Price PT FY2012E FY2013E EPS Y/Y Ports for growth. Hutchinson Port Trust HPHT SP OW 0.79 1 25.3 21.0 7.1 Tollroads, we believe, are defensive plays with CMHI 144 HK UW 23.6 20 13.2 12.7 -21.1 solid cash generation, healthy balance sheet and CCCC 1800 HK OW 6.71 11 6.5 6.0 5.6 decent yield. Operators are likely to benefit from CRCC 1186 HK OW 7.49 8.5 8.6 7.3 11.4 lifting of policy overhang at end-May as the sector CRG 390 HK OW 3.68 4.1 8.8 7.9 8.0 clean-up work comes to an end. Most Chinese CSR Corp Ltd. 1766 HK OW 5.66 9.3 13.2 10.2 7.5 names are good yield plays, in our view. Hollysys Automation HOLI US OW 10.331 13 10.1 9.2 35.8 Airports: Beijing Capital Airport's growth Zhejiang Expressway 576 HK OW 5.54 7.1 11.4 12.3 -4.9 potential has been long overlooked while concerns Beijing Capital Int'l Airport 694 HK OW 5.26 8.3 13.3 10.8 25.1 may be overblown on the construction of the 2nd WCT WCT MK OW 2.72 3.1 12.0 10.3 12.7 airport in Beijing. We also believe MAHB looks IJM Corporation IJM MK OW 5.06 5.8 16.6 13.9 19.0 interesting as KLIA II will be operational in Wijaya Karya WIKA IJ N 1330 1290 19.1 14.1 21.9 2012/2013. Samsung Engineering 028050 KS OW 170000 260000 10.8 9.9 22.9 Stock picks in China: BCIA, CSR, CCCC, CRG, GS E&C 006360 KS N 70000 80000 10.0 9.5 -15.7 CRCC Hollysys, Hutch Ports, Zhejiang Exy, and Adani Ports ADSEZ IN OW 125.4 160 24.0 17.7 13.9 selected machinery names. Outside China, our top Source: Bloomberg, J.P. Morgan estimates. picks in the region include: IJM, Wijaya Karya, Note: Share prices and valuations are as of October 12, 2012. Adani Ports, Samsung E&C and GS E&C. 20