This document contains data on industrial investment in Indonesia from 2010-2015. It includes information on:

1. Palm oil plantation investments from both foreign and domestic sources, which have grown at average annual rates of 140% and 15% respectively. Domestic investment in the palm oil industry grew by an average of 145% annually.

2. The government is establishing eight special economic zones for palm oil processing to sustain investment growth.

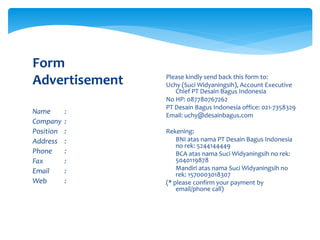

3. The data contains 12 pages and is useful for investors, financial institutions, researchers, and regulators to understand trends in Indonesia's industrial sector.