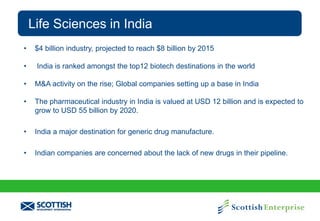

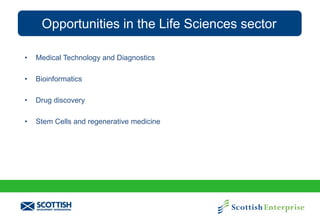

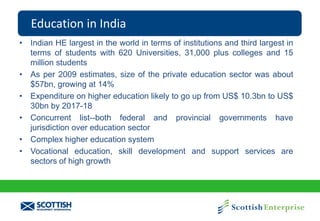

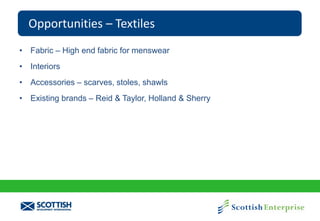

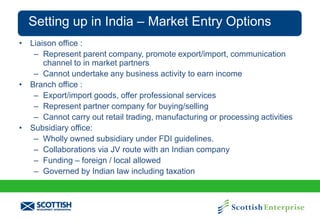

The document presents an overview of business opportunities and strategic insights for doing business in India, focusing on key sectors such as IT, life sciences, education, food and drink, and textiles. It outlines India's economic landscape, including growth forecasts, foreign investment opportunities, and the regulatory environment, emphasizing the importance of understanding local market dynamics and building business relationships. Additionally, it highlights the support available to Scottish companies through initiatives like the Smart Exporter program.

![India business presence - Overview of the forms

Foreign Company

Operates as a foreign

company

Liaison

Office [‘LO’]

Project

Office [‘PO’]

Establishes an

Indian company

Branch

Office [‘BO’]

Joint Ventures

Wholly Owned

Subsidiary [‘WOS’]

Limited Liability Partnership [concept recently introduced] is another option of establishing presence in

India.

Each of the options have their own commercial and tax advantages and disadvantages which would need

to be evaluated based on facts of the case.

For example if the Indian operation is to limited to preliminary functions of understanding the Indian markets

business , etc, the LO option could be considered. However, where the India expansion plans are

imminent, one would need to consider the BO or WOS option

One would need to determine a suitable form of business presence in India based on the nature of

operations in India and the proposed business expansion plans

Page 31](https://image.slidesharecdn.com/finalslides-doingbusinessindia31-131031082427-phpapp01/85/Final-slides-Doing-business-in-India-31-10-13-31-320.jpg)

![Basic tax provisions

Indian domestic tax laws

For the purposes of corporate income-tax, tax year runs from April 1 to March 31 of the following

year.

Taxable profit is computed in accordance with common business or accounting principles, subject

to specific limitations

Different tax rates for domestic and Indian companies. Also, one needs to consider Dividend

Distribution Tax (‘DDT’)

Provisions of domestic law or relevant tax treaty, whichever is more beneficial to the taxpayer,

apply

Deduction

is

allowed

only

for

business-related

while capital expenditure [other than those specified] are not deductible

revenue

expenses,

Robust ‘transfer pricing regulations’ governing cross-border transactions between related parties

Page 32](https://image.slidesharecdn.com/finalslides-doingbusinessindia31-131031082427-phpapp01/85/Final-slides-Doing-business-in-India-31-10-13-32-320.jpg)

![India business presence

Permanent Establishment (‘PE’) considerations

Fixed place PE

►

►

Created if Foreign Co has premises in India at its disposal from where it carry

on its operations

Service PE

PE exclusion available to preparatory/auxiliary activities

►

Constituted if Foreign

Co furnishes services,

through employees or

other personnel in India

[subject

to

time

threshold]

►

Some of India’s tax

treaties do not contain

this clause

Installation PE

►

►

Constituted if Foreign Co

assembles or installs

equipment in India or

undertakes

connected

supervisory activities in

India [subject to time

threshold]

If a PE is constituted for Foreign Co in India,

income attributable to the PE would be

taxable at 42.23% on net income basis

►

If the income constitutes Fees for Technical

Service / royalty and is not attributable to a

PE in India, India withholding tax on gross

basis applicable

Agency PE

►

Arises if Foreign Co has an agent in India who, inter alia, concludes contracts, secures orders or maintains

stock in India

►

Agent of independent status is excluded from the purview

The presence of a PE to be determined based on the relevant facts and tax treaty

Page 33](https://image.slidesharecdn.com/finalslides-doingbusinessindia31-131031082427-phpapp01/85/Final-slides-Doing-business-in-India-31-10-13-33-320.jpg)

![Regional Tax Incentives

India – investment/expenditure linked tax incentives

Agricultural Extension Project

► Weighted deduction of 150% of expenditure incurred would be available to any taxpayer who incurs any expenditure on Agricultural

Extension Project notified by the Board in accordance with the prescribed guidelines.

Skill Development Project

► Weighted deduction of 150% of expenditure incurred, other than expenditure on land and building, would be available to company which

incurs any expenditure (other than on land & building) on Skill Development Project notified by Board in accordance with prescribed

guidelines.

Employment of new workmen

► An Indian company engaged in the manufacture or production of article or thing is eligible for deduction, from gross total income, of 30%

of additional wages paid to new regular workmen employed in the previous. The deduction is available on satisfaction of the prescribed

conditions. Further, the deduction is available for 3 years, including the year in which employment is provided.

Developers of SEZ

► Eligibility – Taxpayer being a developer, derives income by an undertaking or enterprise from business of developing SEZ, notified on or

after 1 April 2005 under SEZ Act, 2005.

► Quantum of deduction – 100% of the profits derived from such business for 10 consecutive years, at the option of the taxpayer, out of 15

years beginning from the year in which SEZ is notified.

Business of processing of bio-degradable waste

► Eligibility - Taxpayer engaged in the business of collecting and processing or treating of bio-degradable waste for:

i] Generating Power or ii] Producing bio-fertilizers or bio-pesticides or other biological agents or iii] Producing bio-gas or iv] Making pellets

or briquettes for fuel or organic manure.

► Quantum of deduction – 100% of the profits derived from such business for 5 consecutive years beginning from the year in which such

business commences.

Page 38](https://image.slidesharecdn.com/finalslides-doingbusinessindia31-131031082427-phpapp01/85/Final-slides-Doing-business-in-India-31-10-13-38-320.jpg)

![Regional Tax Incentives

India – investment/expenditure linked tax incentives

Specified business

► Weighted deduction for expenditure incurred is available to all taxpayers who incur capital expenditure (other than on land or

goodwill or financial instrument) wholly and exclusively for the purposes of specified business carried on during the year in

which expenditure is incurred.

►

For the specified business of – i] Setting up & Operating a cold chain facility; ii] Setting up & operating a warehousing facility

for storage of agricultural produce; iii] Building & Operating a hospital anywhere in India with at least 100 beds; iv] Developing

& Building a housing project under a scheme for affordable housing framed by Government and notified by Board; and v]

Production of fertilizers in India, deduction is available up to 150% of the expenditure incurred.

►

The quantum of deduction would be 100% of the expenditure incurred for the following specified business: i] Laying and

Operating a cross country natural gas or crude or petroleum oil pipeline network for distribution; ii] Building and Operating

anywhere in India a hotel of two star or above category; iii] Developing & Building a housing project under a scheme for slum

redevelopment or rehabilitation framed by Government and notified by Board; iv] Setting up and operating an inland container

depot or a container freight station; v] Bee-keeping and production of honey and beeswax; vi] Setting up & Operating a

warehousing facility for storage of sugar.

►

Deduction is available subject to satisfaction of specified conditions.

Page 39](https://image.slidesharecdn.com/finalslides-doingbusinessindia31-131031082427-phpapp01/85/Final-slides-Doing-business-in-India-31-10-13-39-320.jpg)