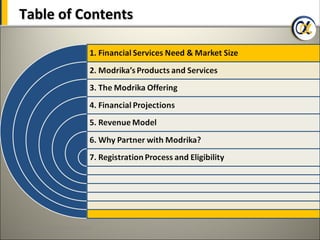

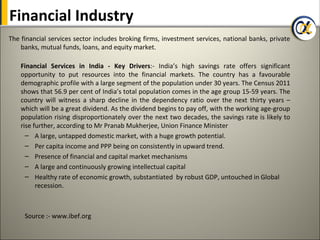

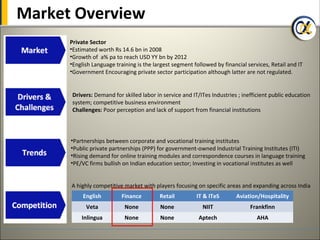

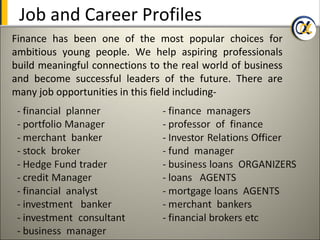

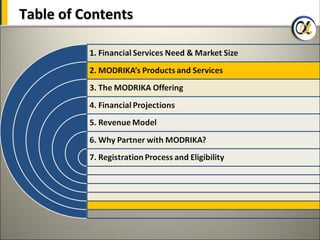

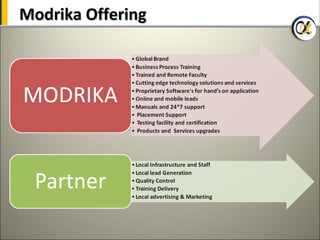

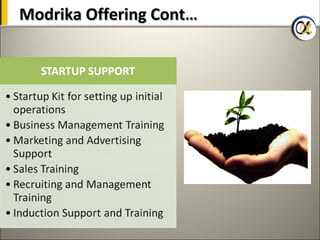

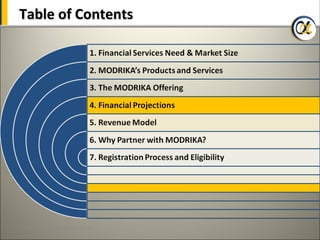

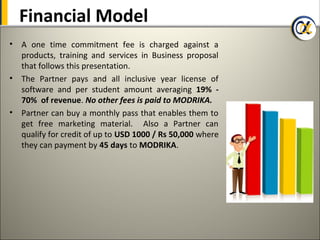

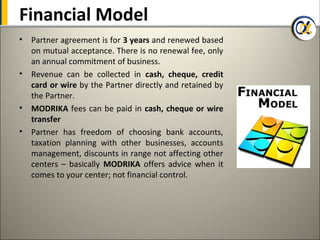

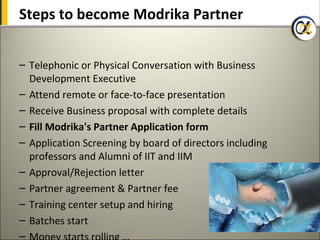

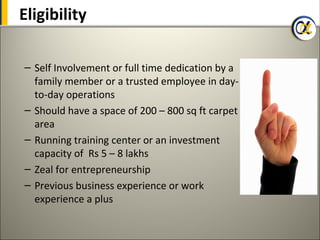

The document outlines the potential for growth in the Indian financial services sector, driven by a favorable demographic profile and high savings rates. It highlights the evolving landscape of finance as a global career opportunity, enriched by technology and diverse job possibilities. Additionally, the paper describes Modrika as a leading global financial services firm, emphasizing its partnerships and revenue models for aspiring financial educators.