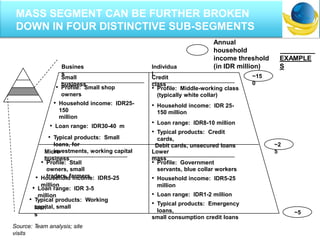

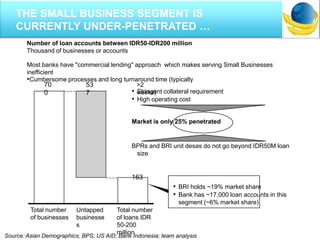

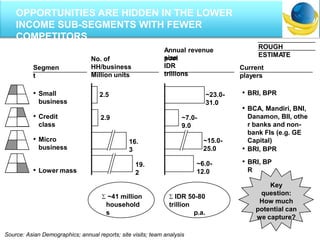

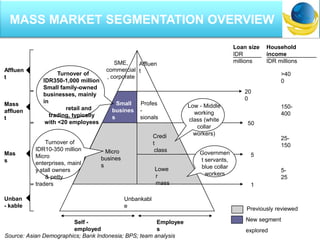

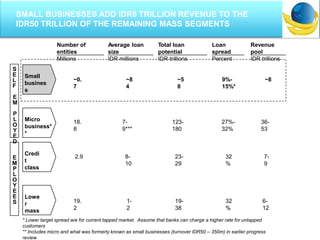

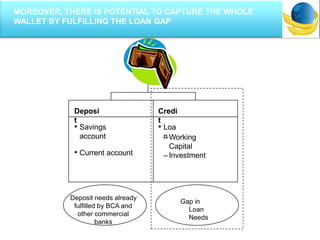

- The Small Business loan segment in Indonesia, defined as loans between Rp50-200 million, represents a significant opportunity for banks to double their market capitalization.

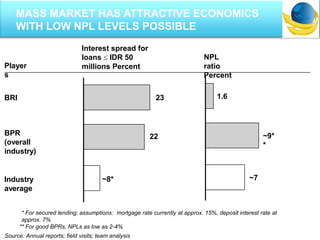

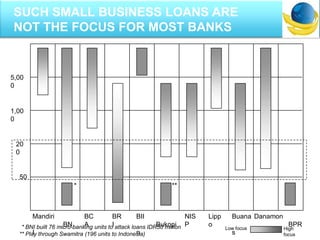

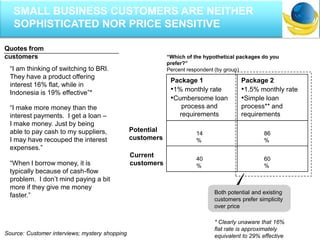

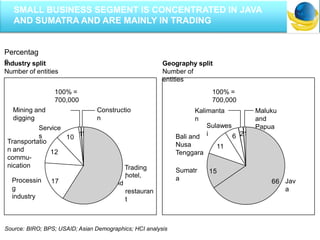

- The segment is currently underpenetrated, with only 25% of potential customers currently being served. Customers in this segment are also not very price sensitive.

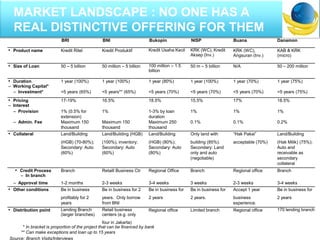

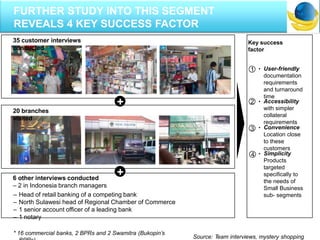

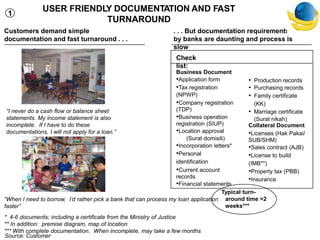

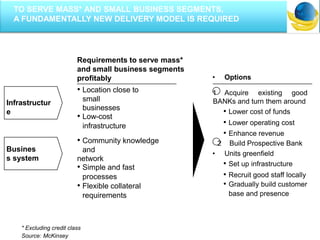

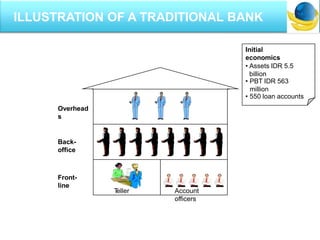

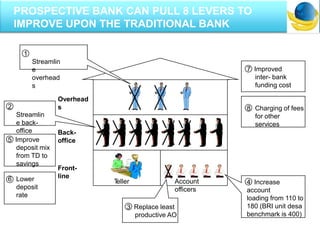

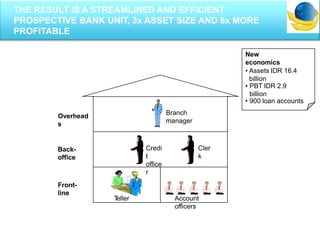

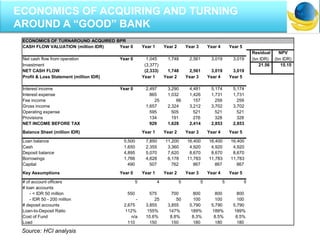

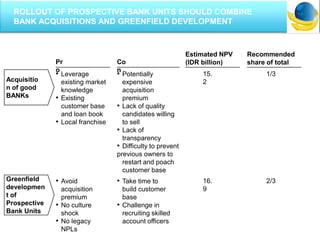

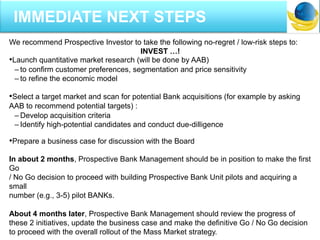

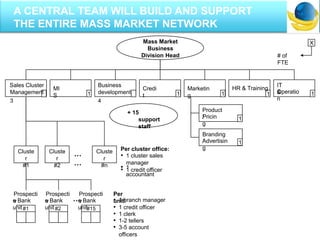

- To capture this opportunity, banks need to develop a new delivery model combining acquisition of existing banks and building new "Units" to specifically target Small Businesses and their simple needs around accessibility, convenience, and simplicity.

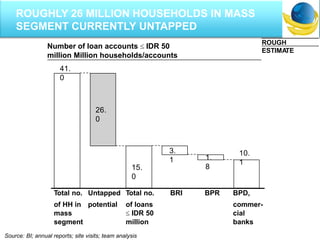

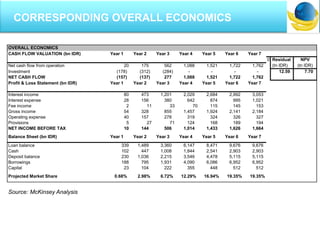

- Developing 600 new Units could allow one bank to gain 20% market share in the Mass Market, representing around Rp10 trillion in assets. The potential profit