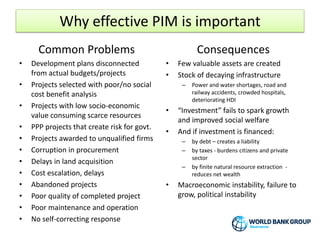

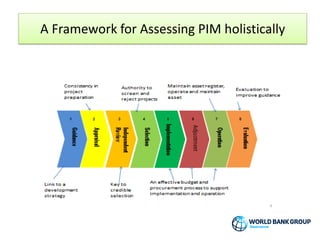

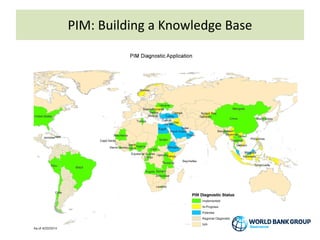

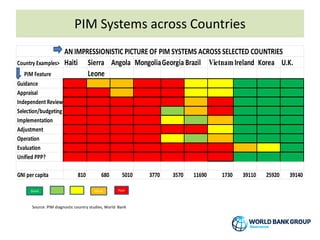

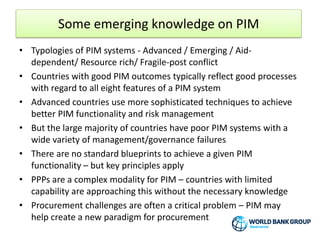

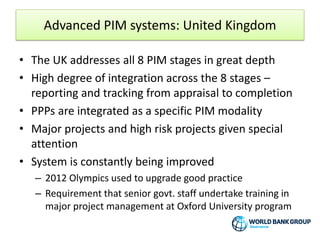

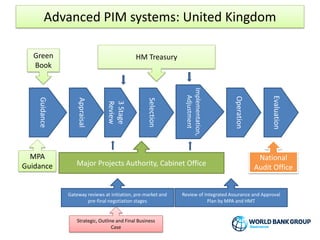

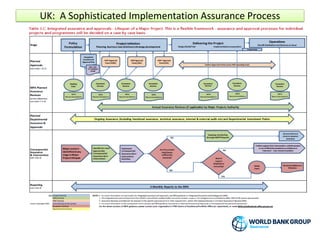

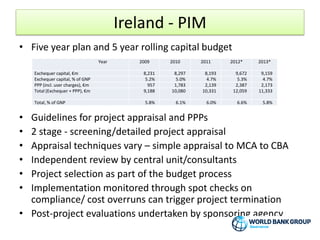

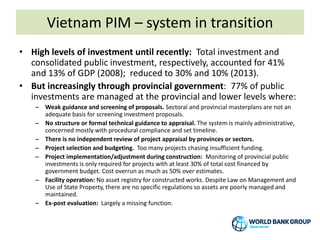

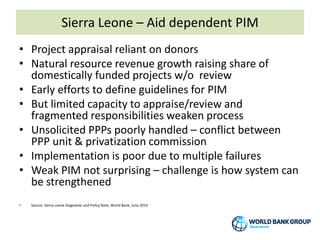

The document summarizes a presentation on public investment management (PIM) systems given by Anand Rajaram of the World Bank. It discusses key questions around public investment and introduces a framework for assessing PIM systems. Examples are provided of advanced PIM systems in countries like the UK and emerging systems in countries like Vietnam and Sierra Leone. The document concludes that while calls for more public investment are growing, attention must also be paid to strengthening PIM institutions to ensure funds are well spent.