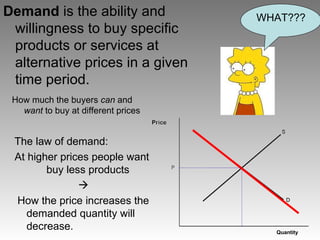

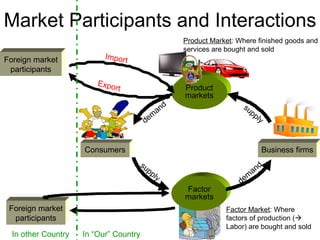

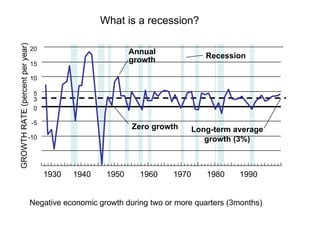

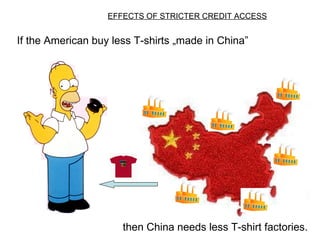

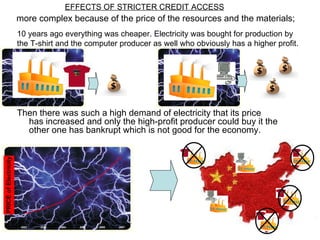

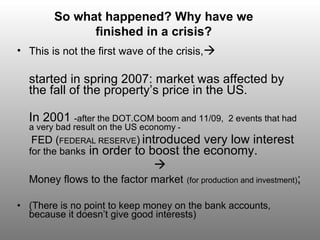

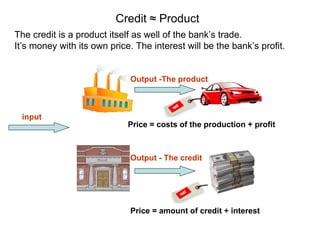

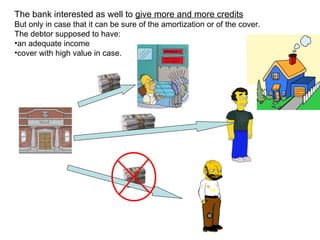

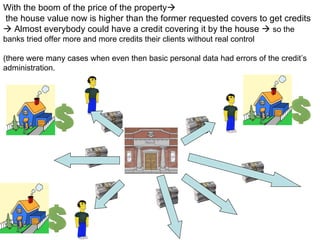

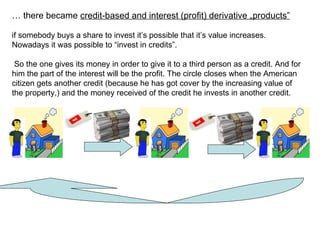

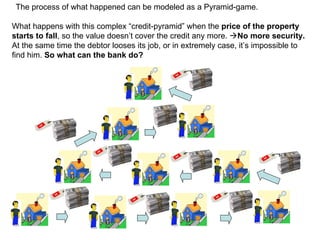

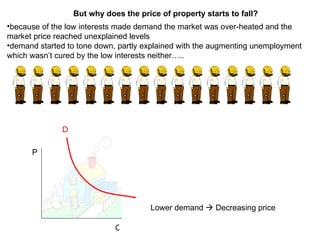

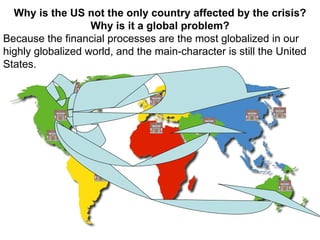

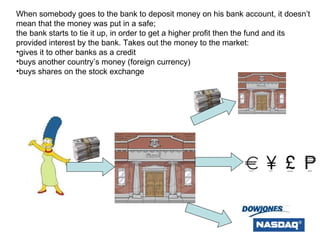

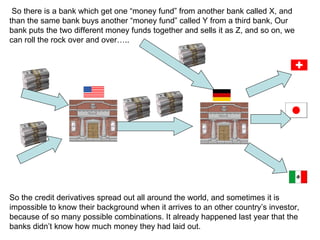

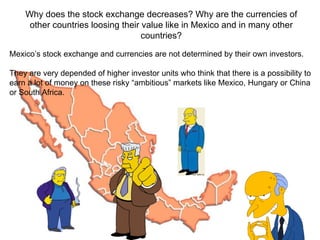

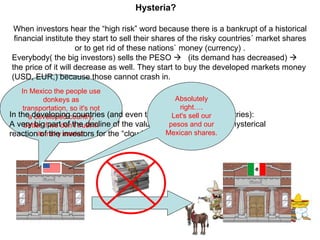

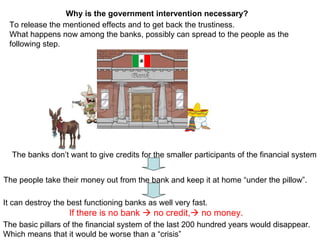

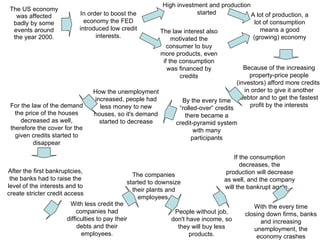

The document discusses the economic causes and effects of the 2008 global financial crisis. It explains that low interest rates in the US boosted consumption and an asset price bubble through easy credit availability. This led to over-leveraged households and financial institutions. When the housing market collapsed, the credit crunch caused a fall in consumption and widespread bankruptcies, spreading the crisis globally through interconnected financial markets. Government interventions were needed to prevent a complete meltdown of the global financial system. The crisis had a severe impact through falling trade, production and rising unemployment.