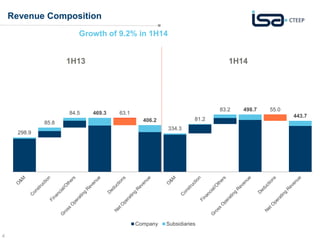

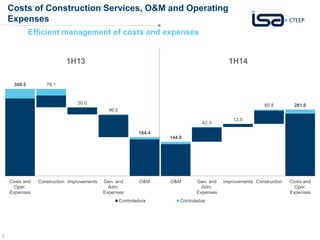

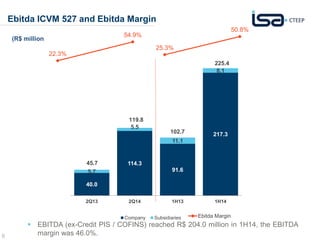

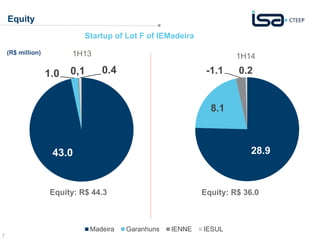

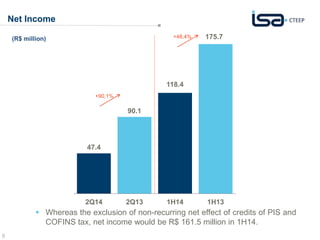

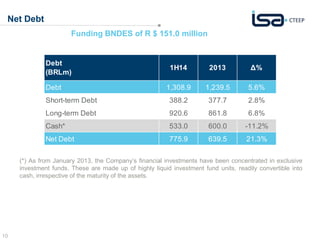

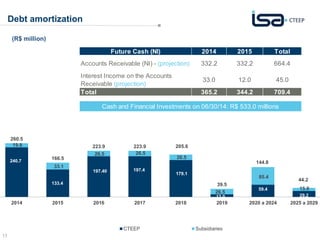

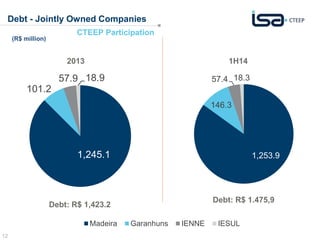

The document is a presentation of CTEEP's 2Q14 financial results. It highlights that CTEEP grew revenue 9.2% in 1H14 compared to the same period in 2013. EBITDA reached R$204 million in 1H14, with a margin of 46%. Net income increased 48.4% in 1H14 versus 1H13 to R$90.1 million. The presentation also reviews the company's debt position, capital market performance, and provides disclaimers about projections.