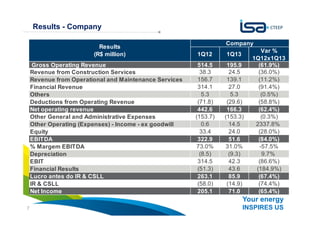

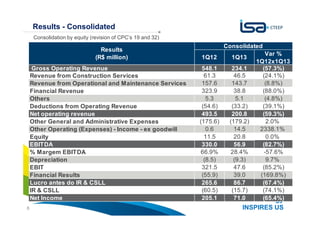

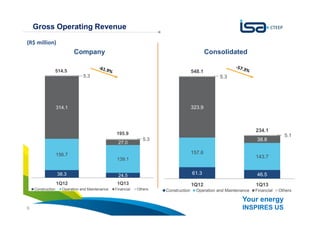

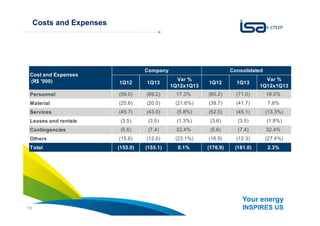

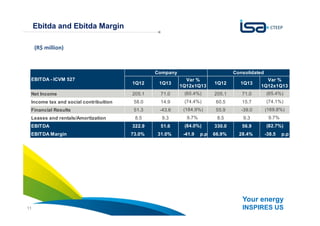

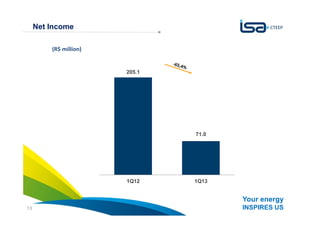

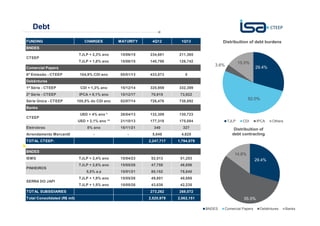

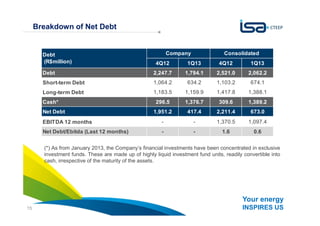

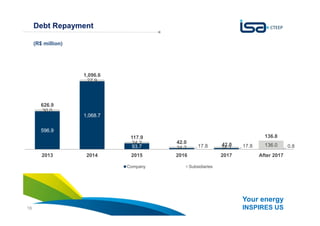

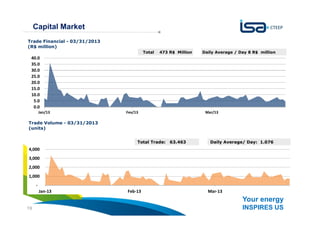

The document provides an overview of CTEEP's 1Q13 results. It summarizes that CTEEP's gross operating revenue declined 61.9% year-over-year to R$195.9 million in 1Q13. EBITDA fell 84.0% to R$51.6 million, with margins decreasing from 73.0% to 31.0%. Net income declined 65.4% to R$71.0 million. CTEEP's stock prices on the Brazilian stock exchange fell in 1Q13, with TRPL3 shares down 3.62% and TRPL4 shares down 7.55%. The document also reviews CTEEP's debt levels, capital expenditures, and operating metrics