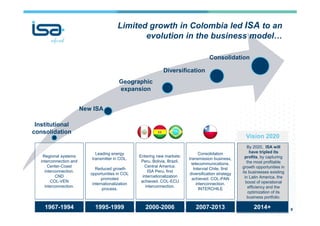

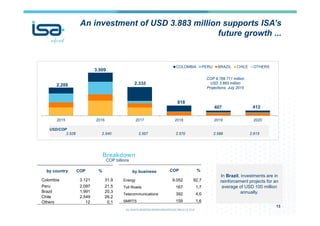

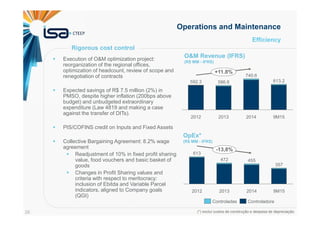

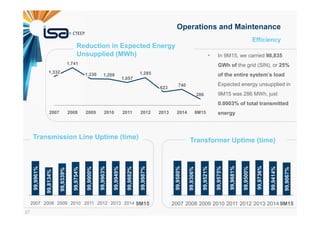

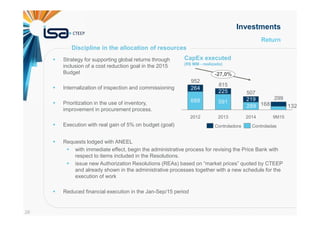

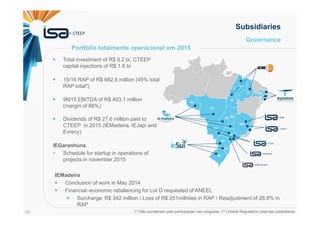

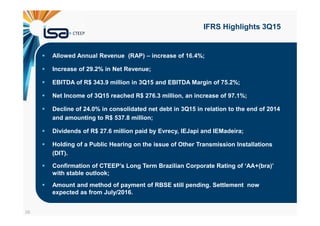

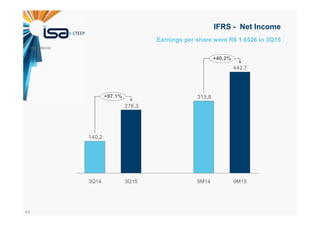

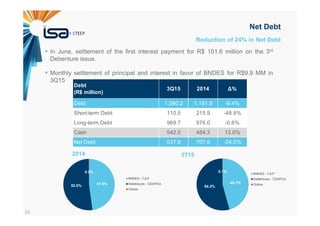

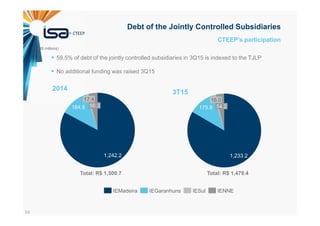

This document provides an overview and financial results of ISA and its subsidiary CTEEP. ISA is a multinational company operating in 8 Latin American countries with businesses in electric energy transmission, toll roads, telecommunications and more. CTEEP is ISA's main subsidiary in Brazil, operating transmission lines across 16 states. The document discusses CTEEP's history, investments, efficiency initiatives, financial results, and subsidiaries. It also provides an overview of ISA's strategy to triple profits by 2020 through growth opportunities, efficiency, and portfolio optimization across Latin America.