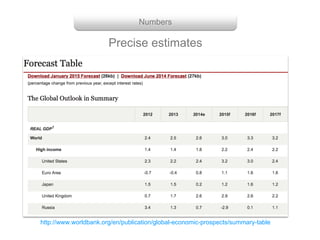

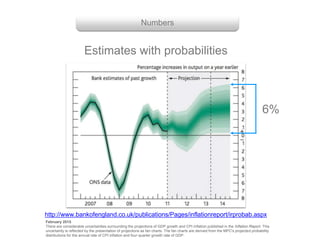

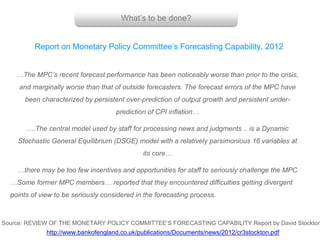

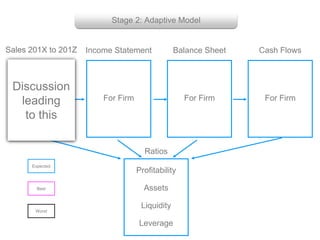

This document discusses different approaches to forecasting, including numbers, descriptive scenarios, and adaptive models. Numbers-based forecasting using precise estimates and models is described as dreadful due to its poor track record. Descriptive scenario-based forecasting involves qualitative discussions without figures to explore what could happen. Adaptive models combine descriptive scenarios with quantitative models to generate expected, best, and worst case projections along with risk commentary. The document advocates starting with descriptive scenarios to incorporate diverse perspectives before developing any models or projections.