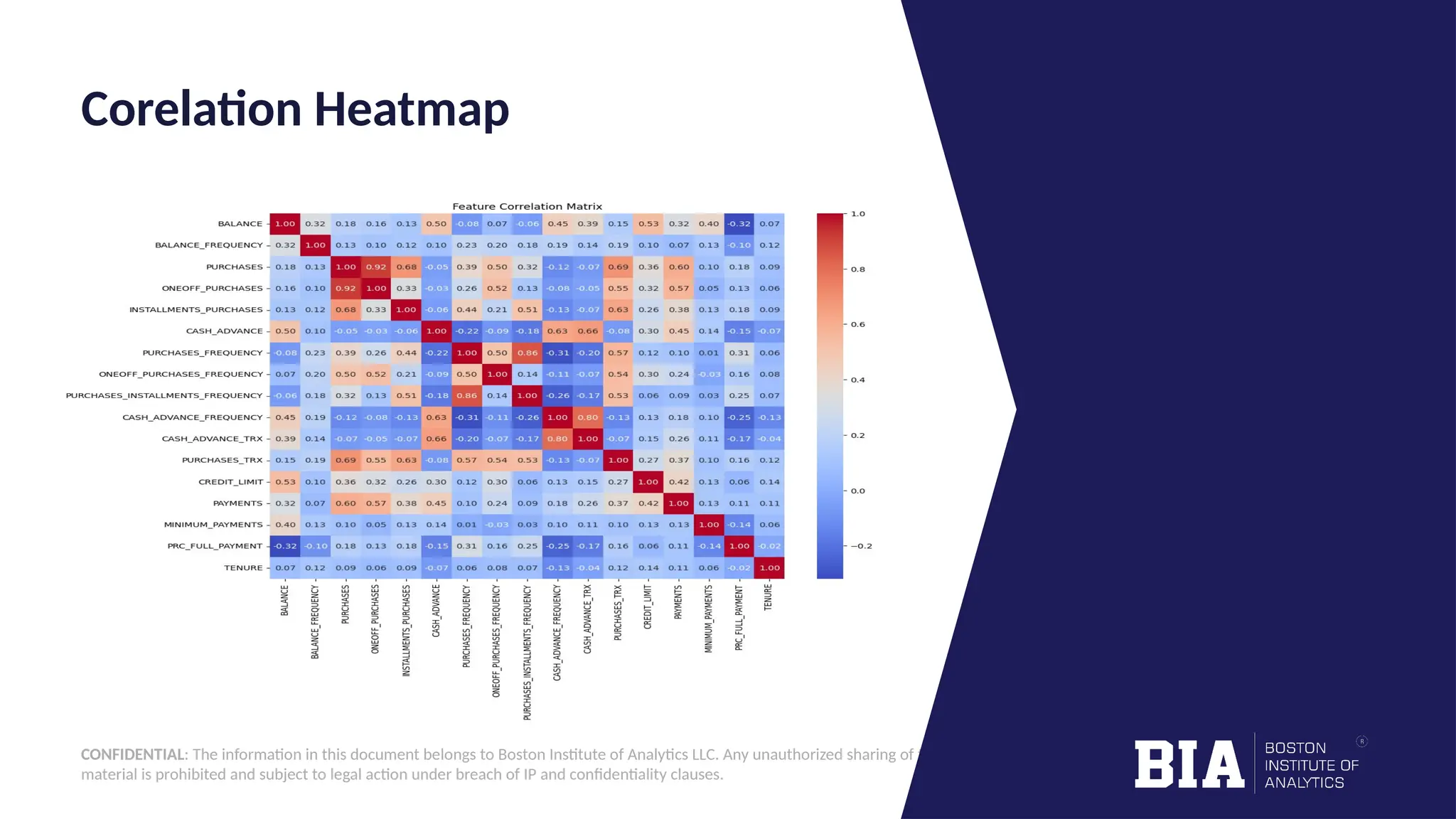

The document outlines a project by Boston Institute of Analytics focused on customer segmentation based on credit card usage data using unsupervised learning models. It details the steps involved in data preprocessing, exploratory data analysis, clustering techniques, and the applications and benefits of segmentation, such as targeted marketing and risk management. The project aims to enhance understanding of customer behaviors and improve strategies for engagement and retention.