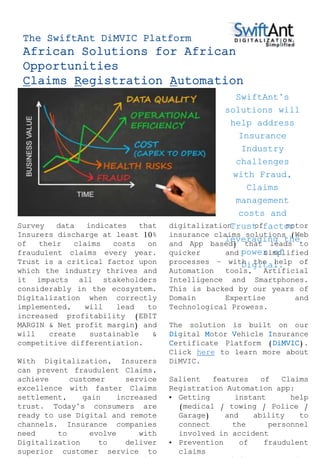

SwiftAnt's Claims Registration Automation solution leverages digital technology like artificial intelligence and smartphones to simplify the motor insurance claims process. This helps address industry challenges of fraud, high claims management costs, and low trust by providing tamper-proof visual evidence, contactless processing, and automated instant assistance. The solution is built on SwiftAnt's Digital Motor Vehicle Insurance Certificate Platform and follows their proprietary C-A-R-E framework to strategically create value and drive operational effectiveness through automation.