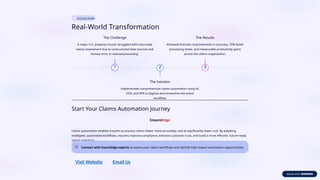

Claims automation enables insurers to process claims faster, more accurately, and at lower cost. By adopting intelligent, automated workflows, insurers can improve compliance, enhance #customer trust, and build a more efficient, future-ready claims operation.

Start Your Claims Automation Journey with InsureEdge.

Connect with experts to assess your claims workflows and identify high-impact automation opportunities using InsureEdge.

Explore More—https://www.damcogroup.com/blogs/revolutionizing-claims-processing-in-insurance-with-automation