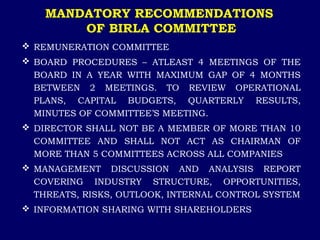

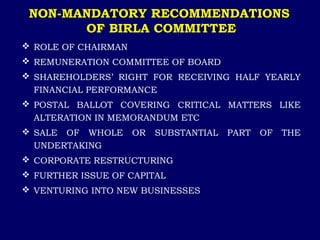

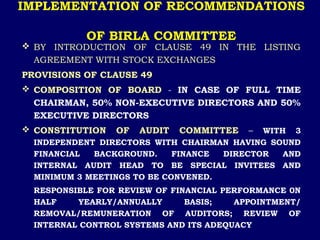

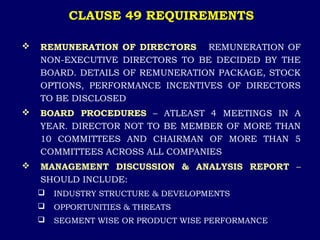

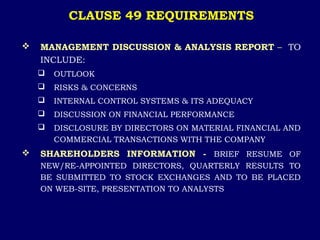

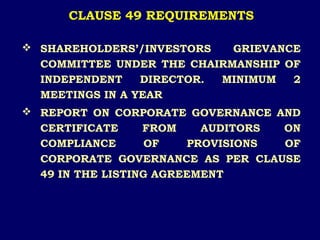

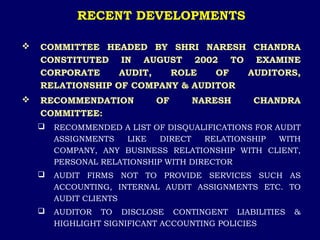

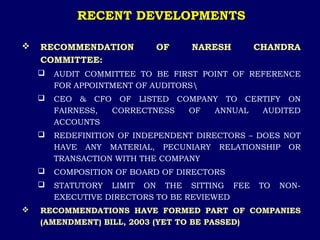

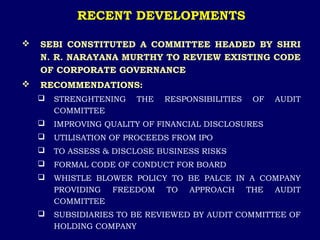

This document discusses corporate governance, including its objectives, global initiatives, and implementation in India. It outlines committees established to promote corporate governance in the UK, Singapore, US, and India. Key recommendations include establishing audit committees, defining roles of directors and boards, and increasing transparency through disclosure requirements. The goal of corporate governance is to direct companies in a transparent manner to maximize stakeholder value.