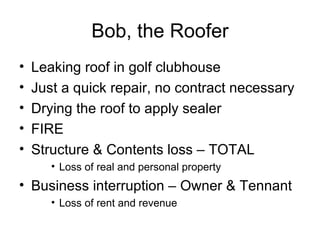

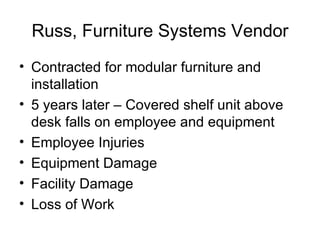

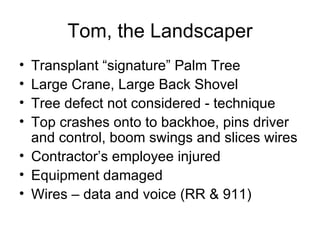

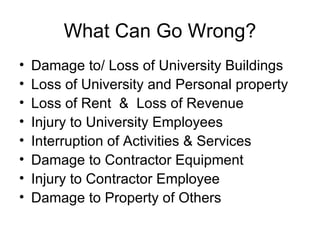

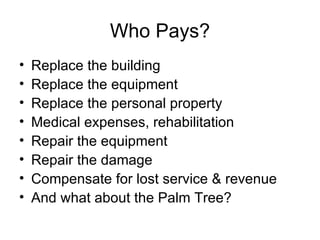

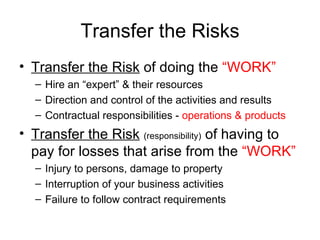

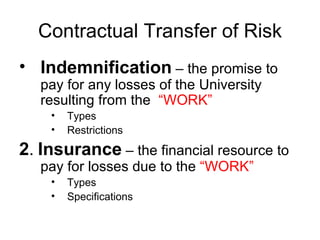

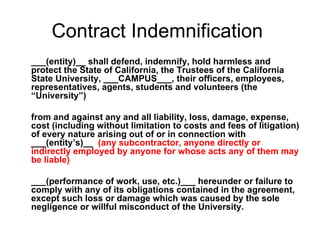

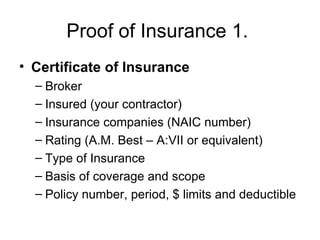

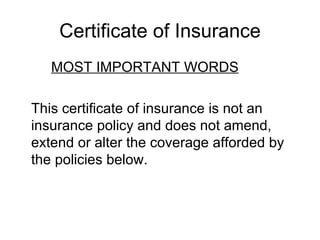

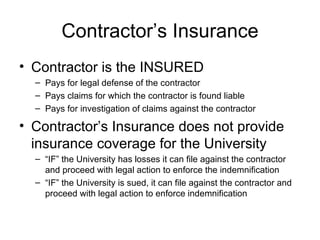

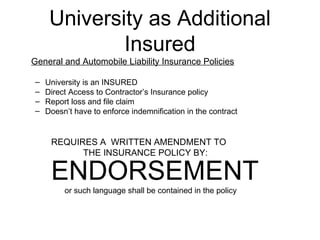

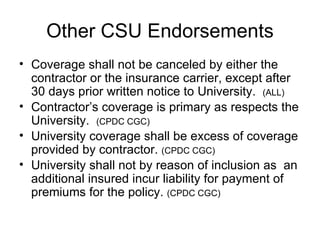

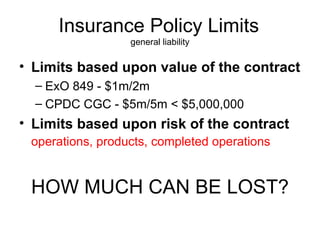

This document summarizes insurance requirements for contractors working with California Polytechnic State University. It outlines the need to transfer risk from the university to contractors through insurance and indemnification in contracts. Basic insurance types like general liability, auto liability, and workers' compensation are required, along with proof of insurance through certificates of insurance naming the university as an additional insured. Specialized policies and endorsements may also be needed depending on the type of work. The document provides examples of insurance issues that can arise and tips for managing risk through contractual agreements and verification of appropriate coverage.

![SPECIFICATIONS for INSURANCE Funding contractual indemnification Limitations Description of Losses: Arising out of the “WORK” [Operations, Products and Completed Operations] Arising out of the ownership and use of vehicles Arising out of employment of workers Arising out of damage to property Arising out of professional services Proof of Insurance - Documentation](https://image.slidesharecdn.com/contractinsurancerequirements-1230280792462389-1/85/Contract-Insurance-Requirements-20-320.jpg)

![Joseph C. Risser Chartered Property Casualty Underwriter (CPCU) Associate of Risk Management – Public Entities (ARM-P) Director, Risk Management, California Polytechnic State University, San Luis Obispo Executive Committee, Board of Directors, California State University Risk Management Authority (CSURMA) [email_address] 805-756-6755 office 805-756-1602 fax](https://image.slidesharecdn.com/contractinsurancerequirements-1230280792462389-1/85/Contract-Insurance-Requirements-40-320.jpg)