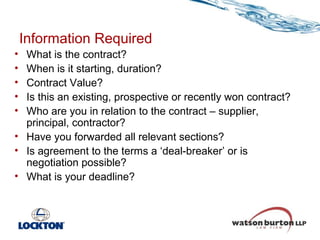

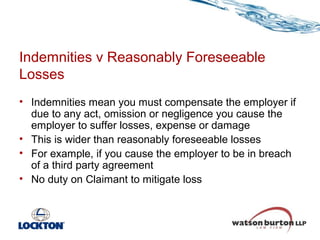

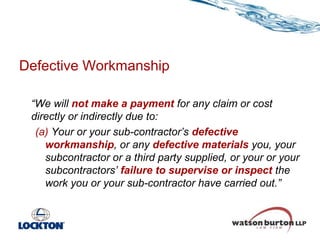

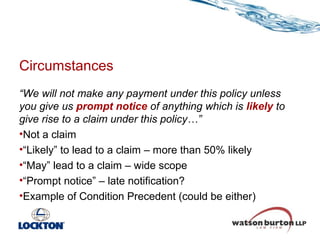

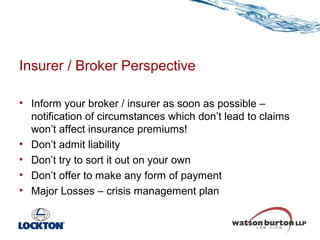

This document summarizes a presentation given by representatives from Lockton Companies LLP and Watson Burton LLP on commercial disputes and insurance coverage. The presentation covered getting contract terms right, understanding key policy components like claims reporting, and tips for businesses like involving brokers early and reading policies carefully. It provided perspectives from brokers, lawyers, and insurers on issues like fitness for purpose obligations, indemnities, limits of liability, and best practices for buying insurance.