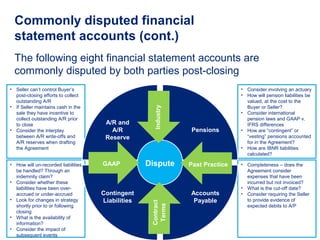

This document discusses common areas of financial statement disputes that arise during post-closing negotiations following a merger or acquisition. It identifies eight financial statement accounts - cash, revenue recognition, inventory, accounts receivable/accounts receivable reserves, pensions, contingent liabilities, accounts payable, and industry/GAAP past practices - that are frequently disputed. For each account, it provides examples of issues that cause disagreement between the buyer and seller such as how in-transit cash is defined, how revenue cut-off dates are set, and whether reserves have been over or under accrued. The document advises addressing these potential dispute areas carefully in the purchase agreement.