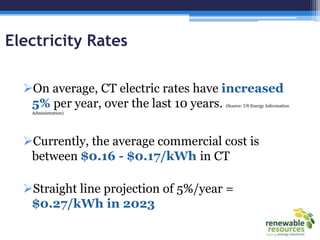

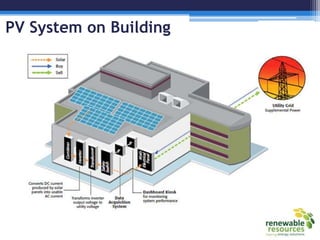

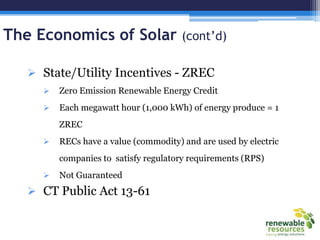

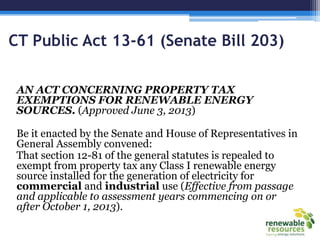

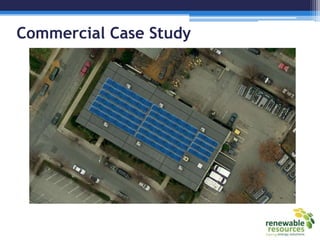

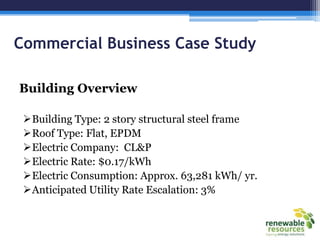

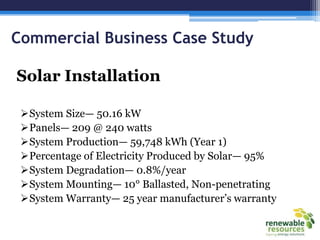

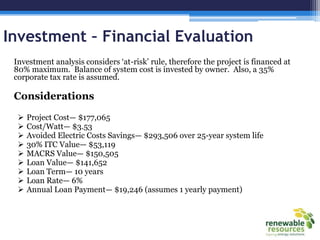

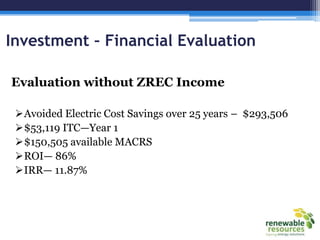

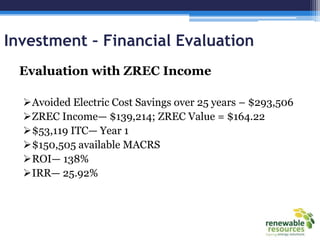

The document outlines the economic and corporate benefits of investing in solar energy, highlighting a case study of a commercial building's solar proposal. It covers renewable resources, financial evaluations, tax benefits, and the importance of sustainability in business practices. Additionally, it discusses various financing options and the impact of state incentives for solar energy projects.