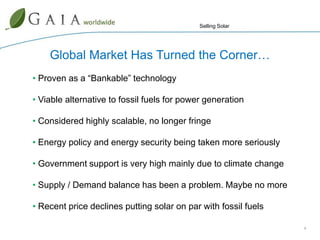

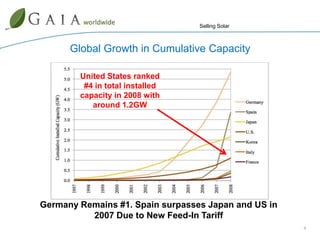

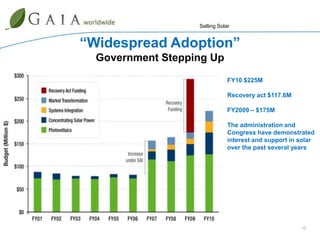

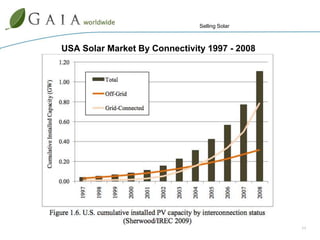

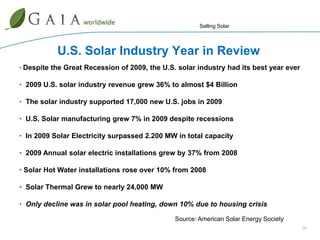

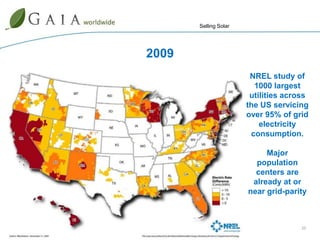

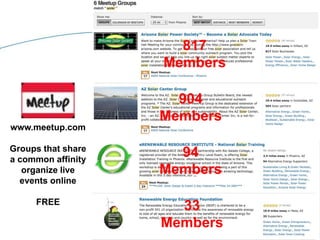

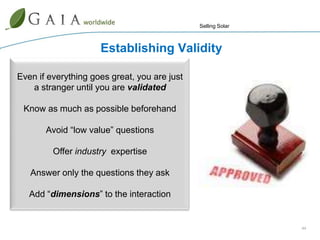

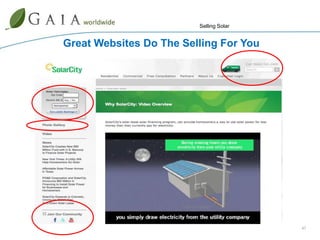

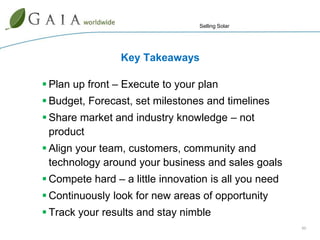

The document provides an overview of the solar industry and advice for entering the solar business. It summarizes that the global solar market has grown significantly in recent years. It then provides tips on establishing validity and thought leadership to build a brand in the solar industry locally. This includes sharing industry knowledge, partnering with local businesses, and keeping marketing messages clear and consistent.