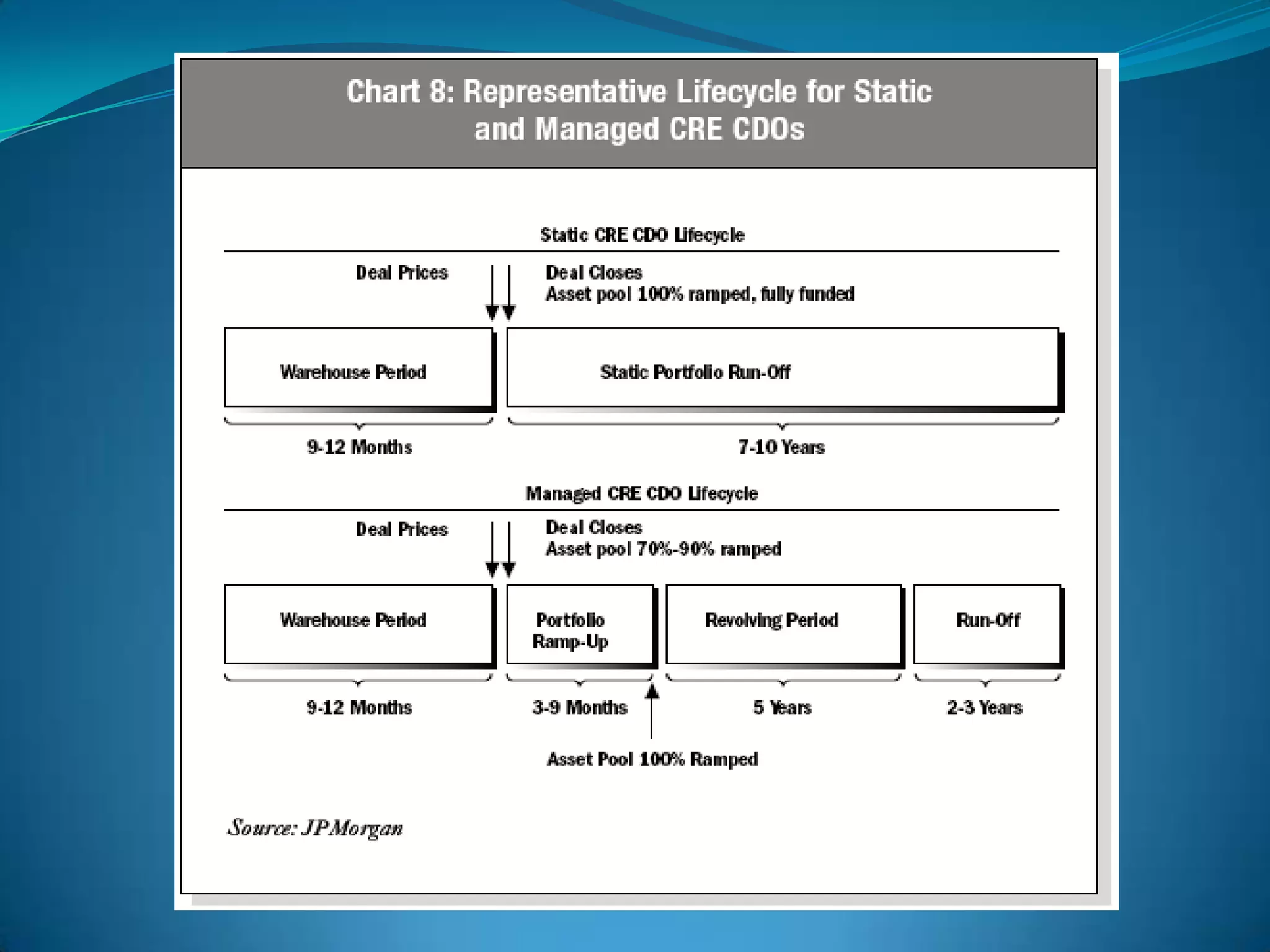

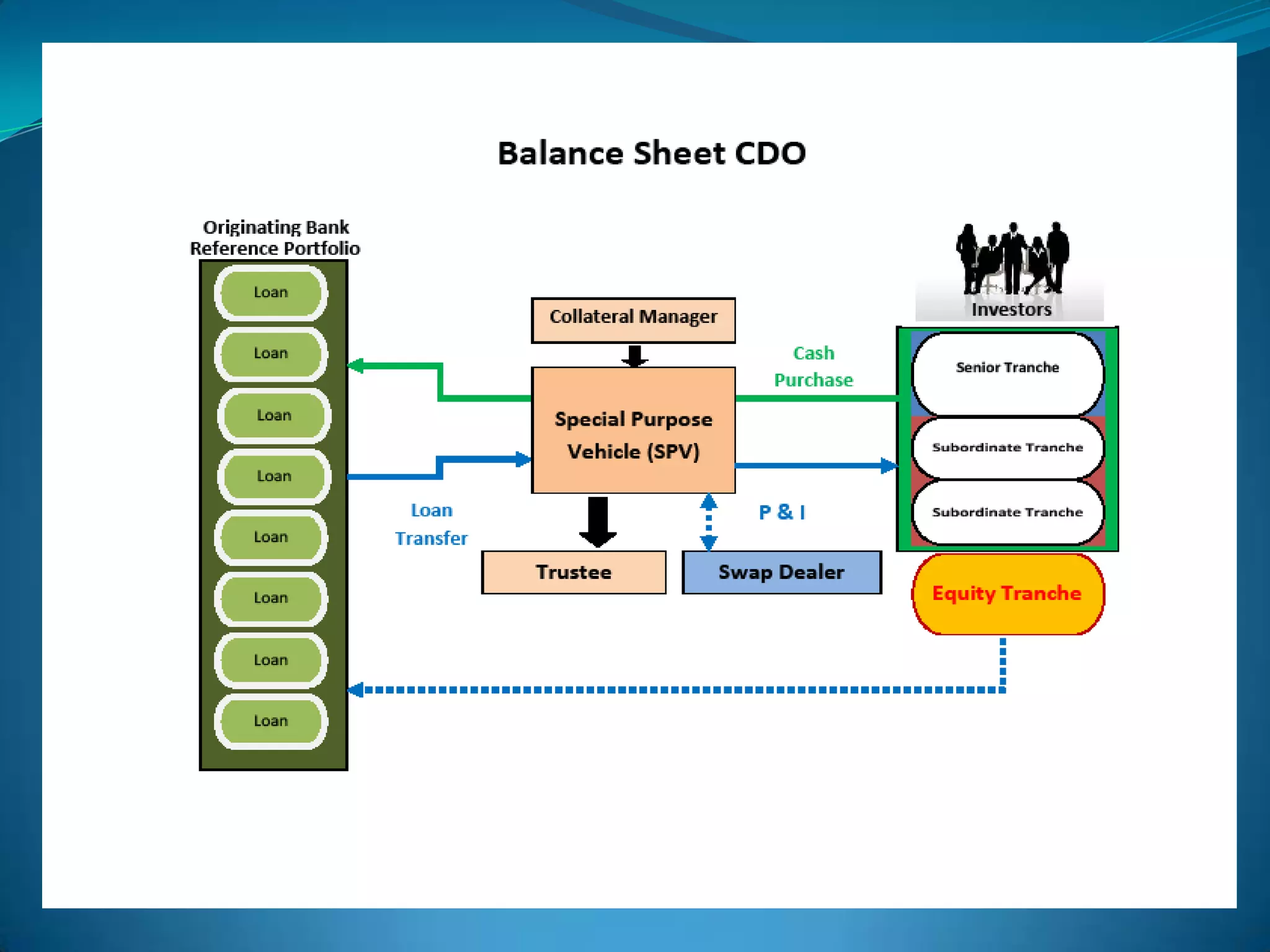

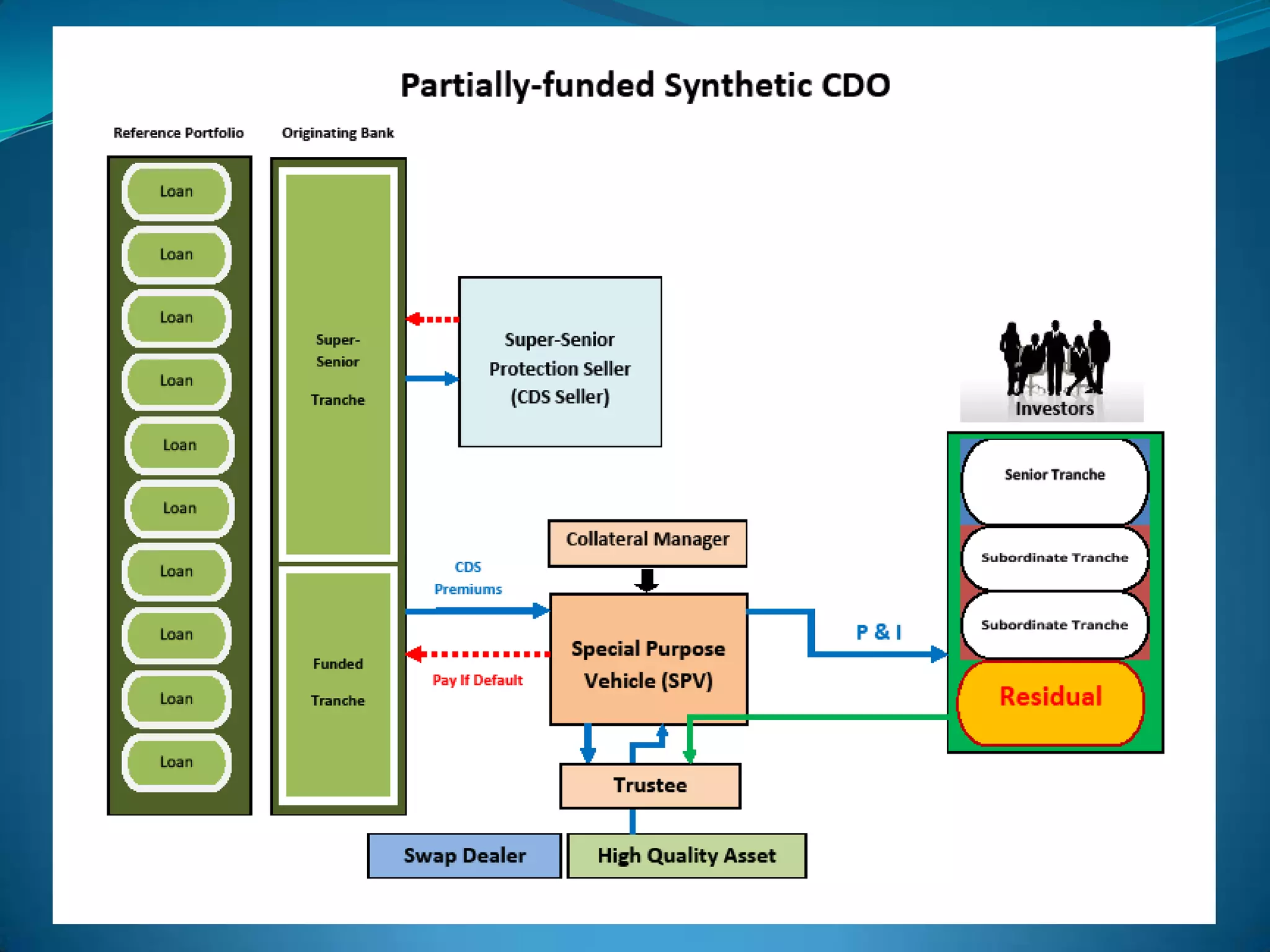

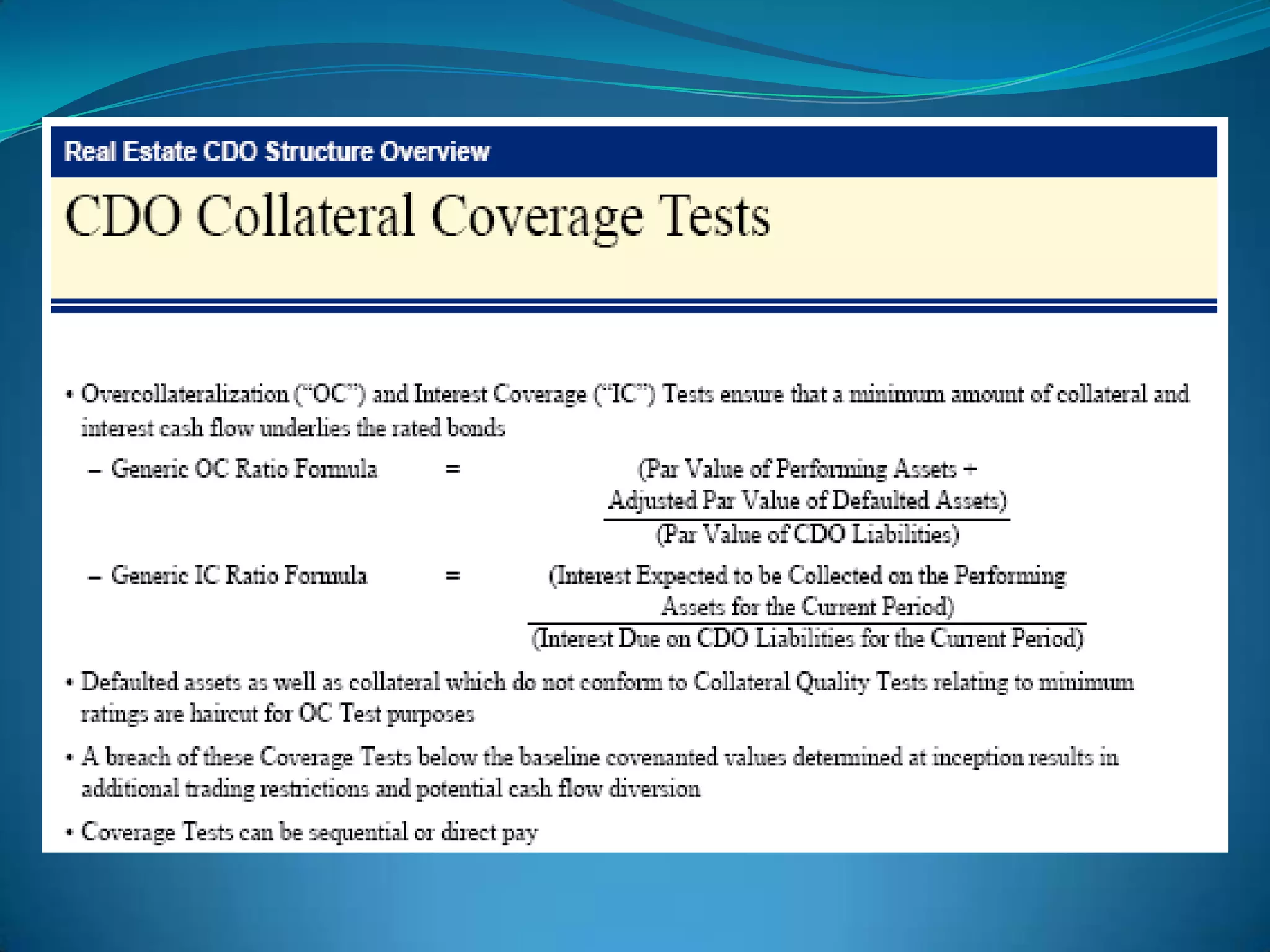

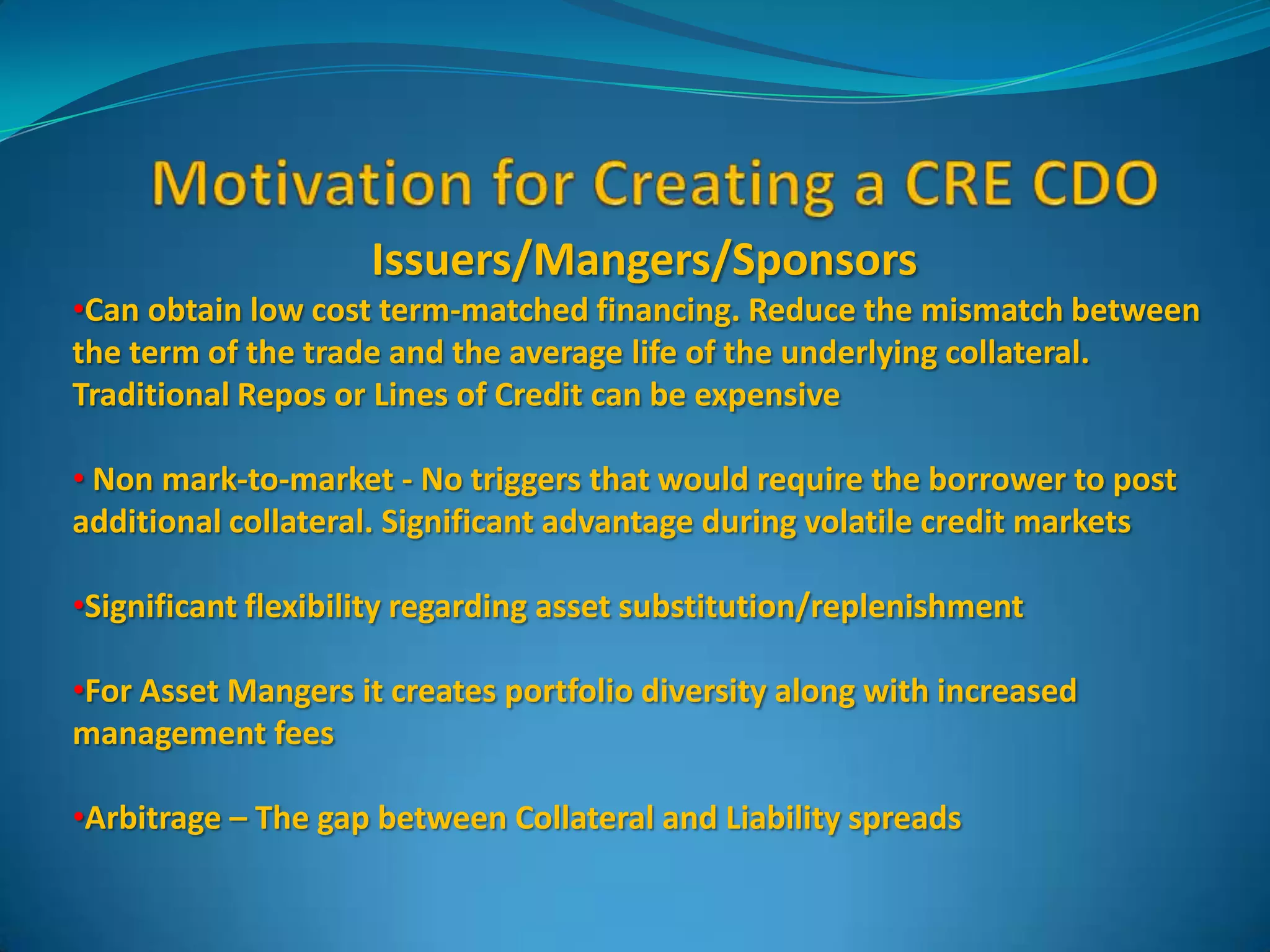

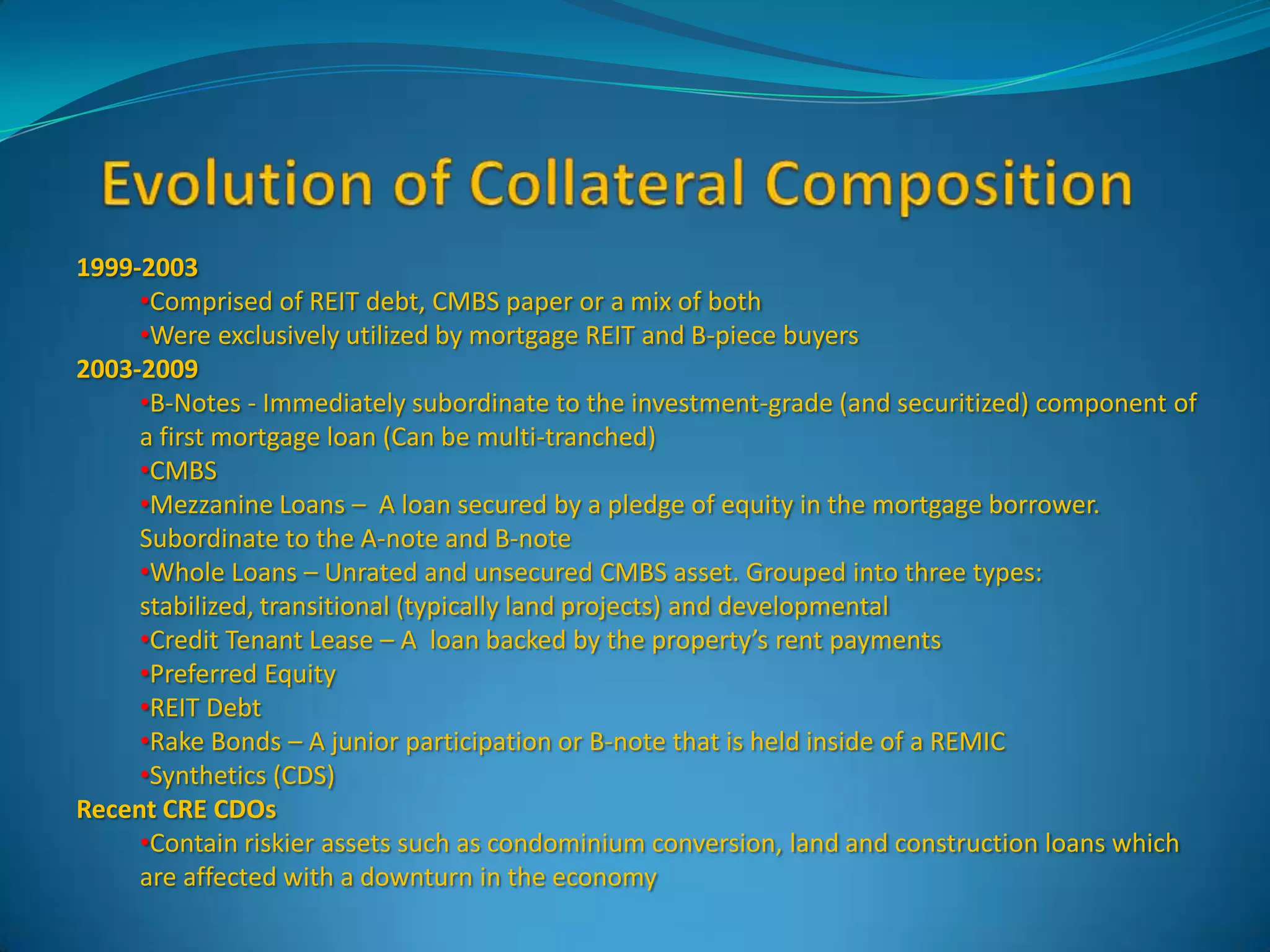

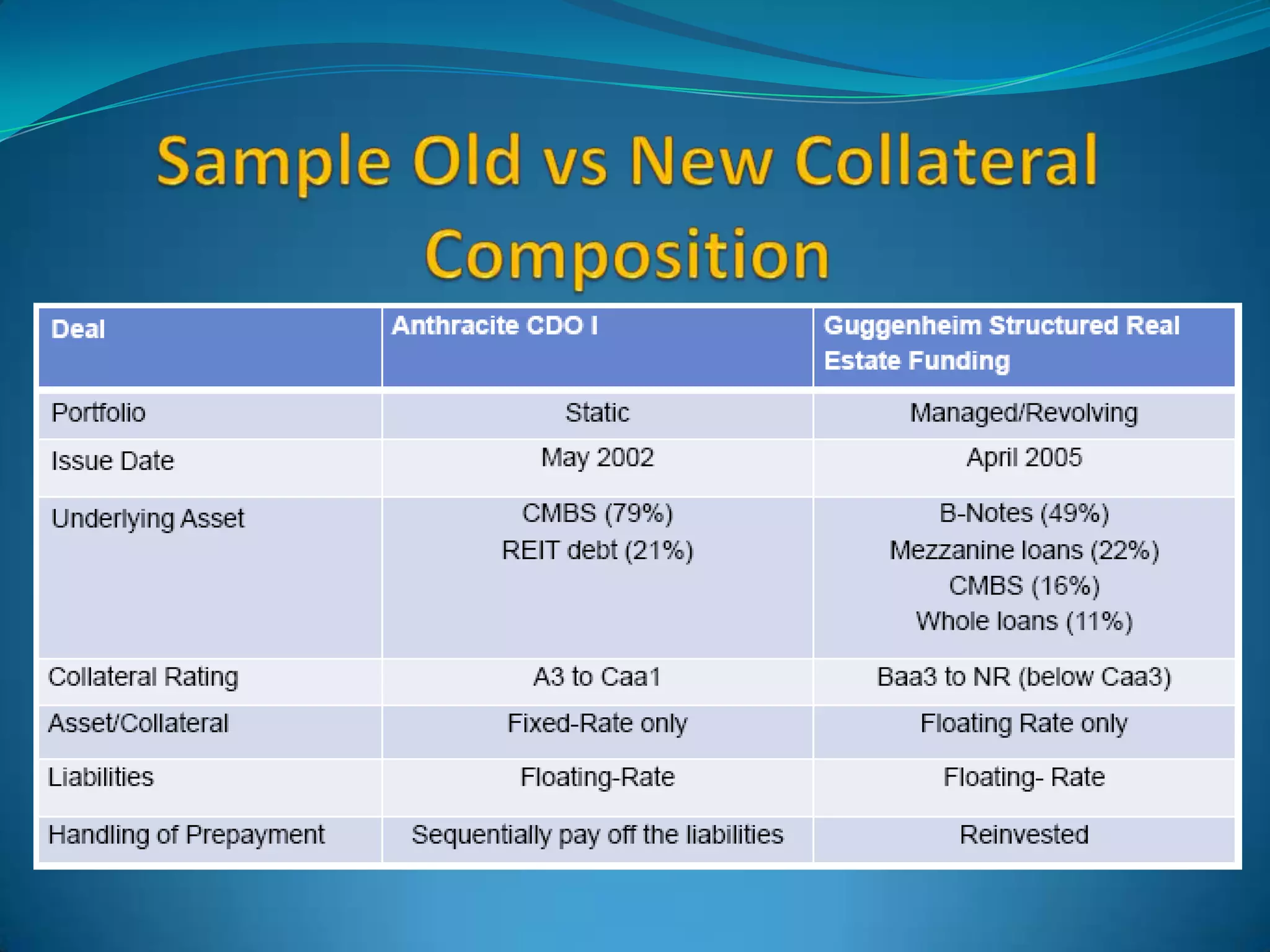

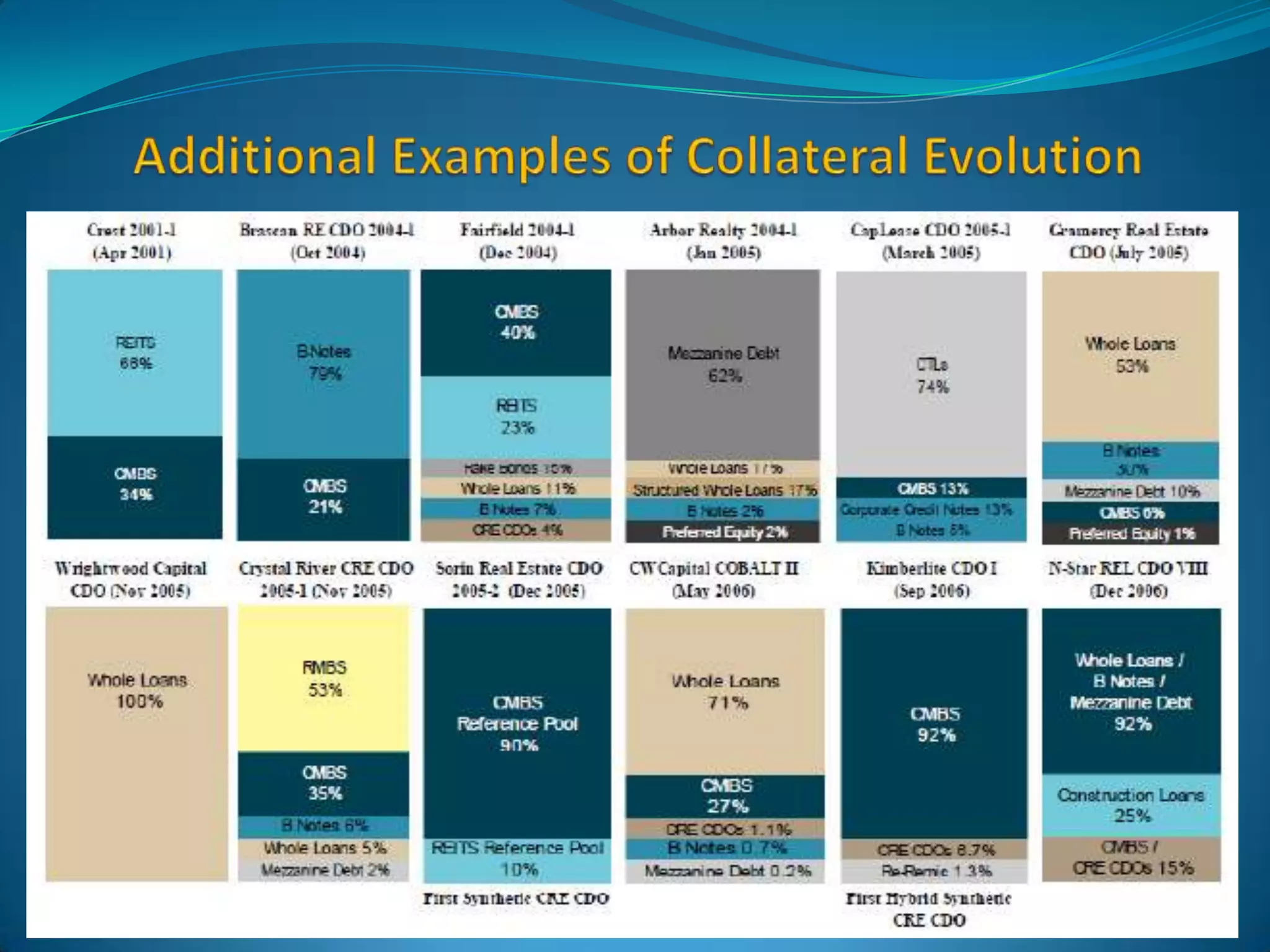

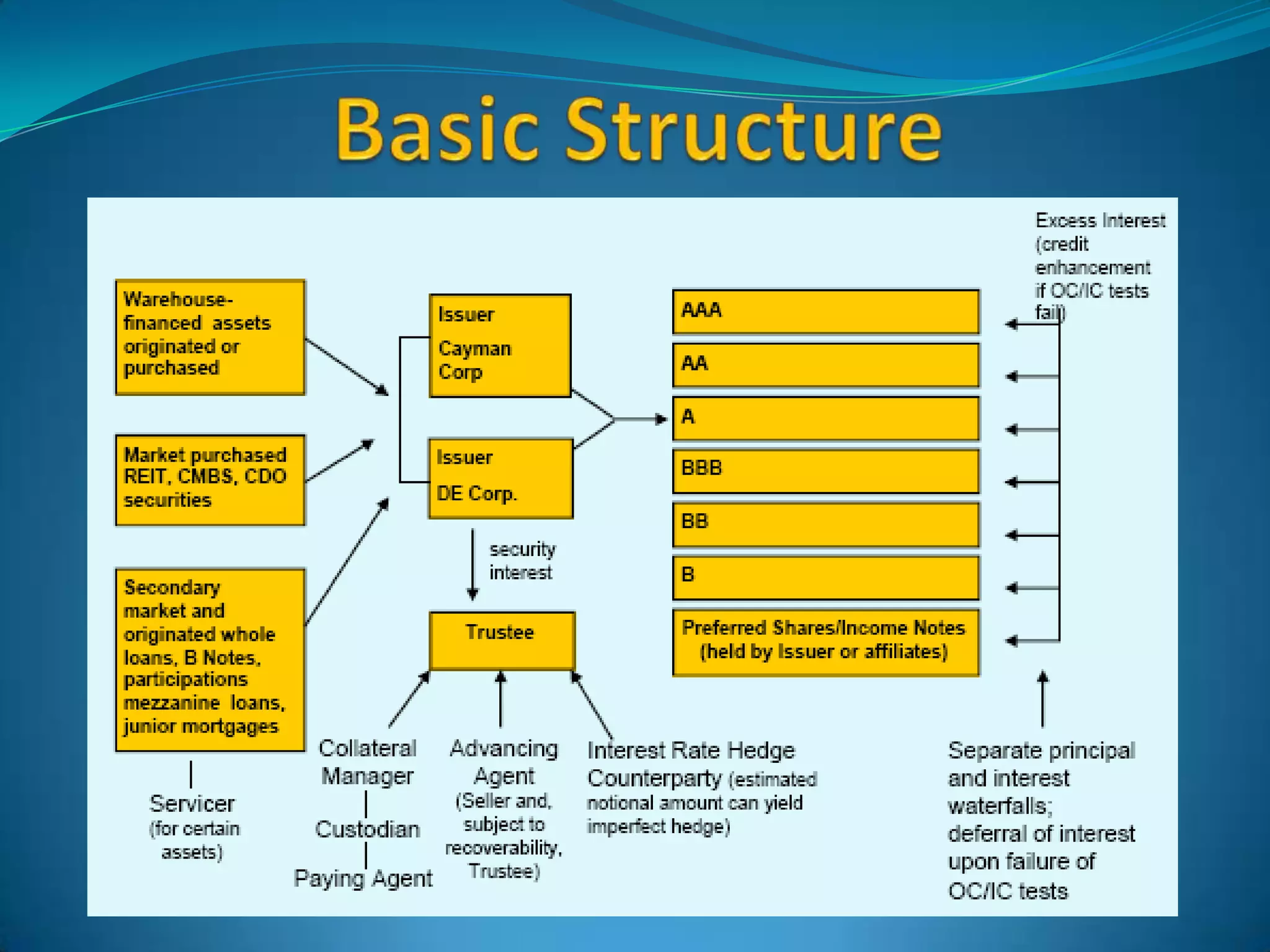

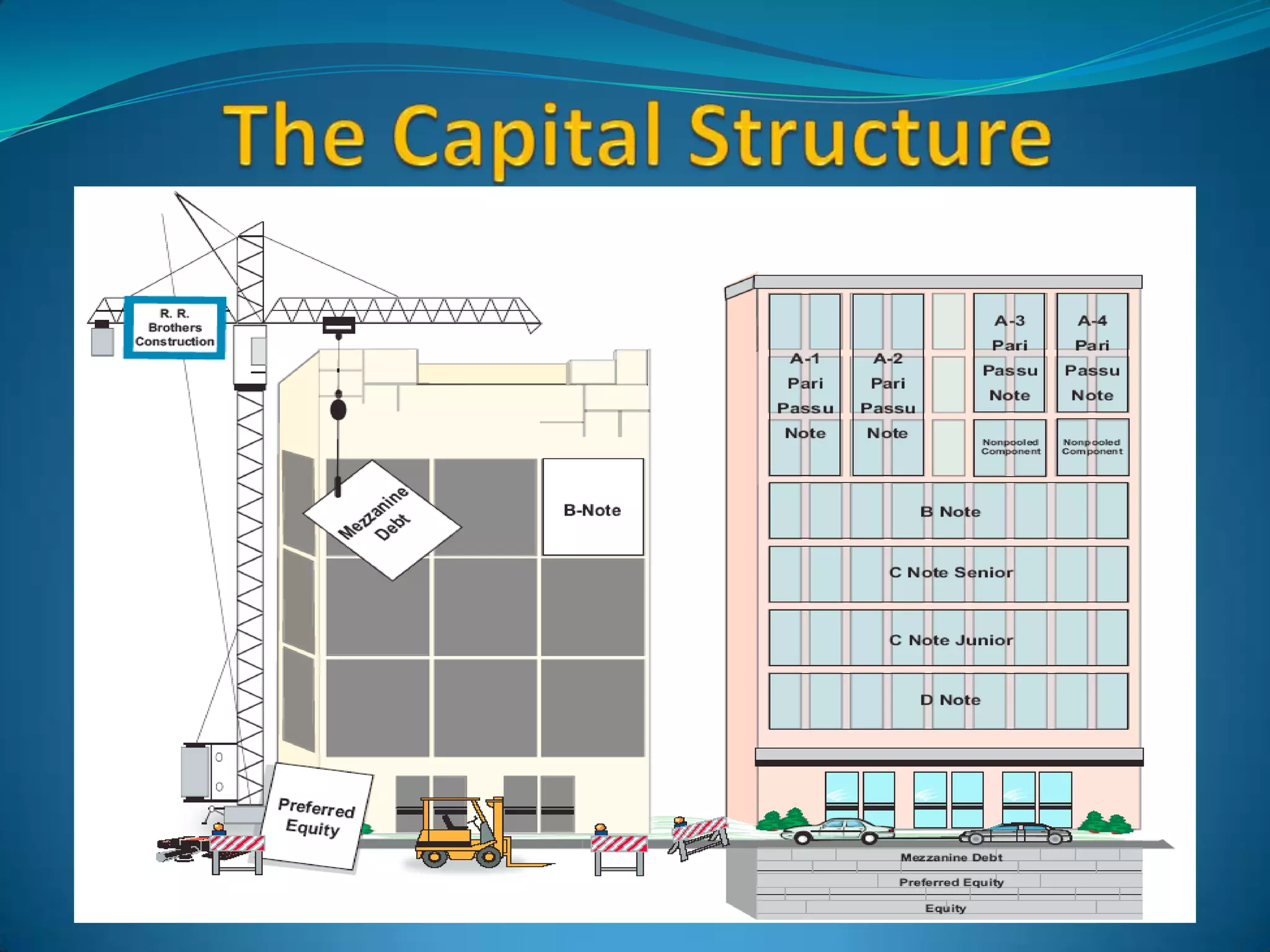

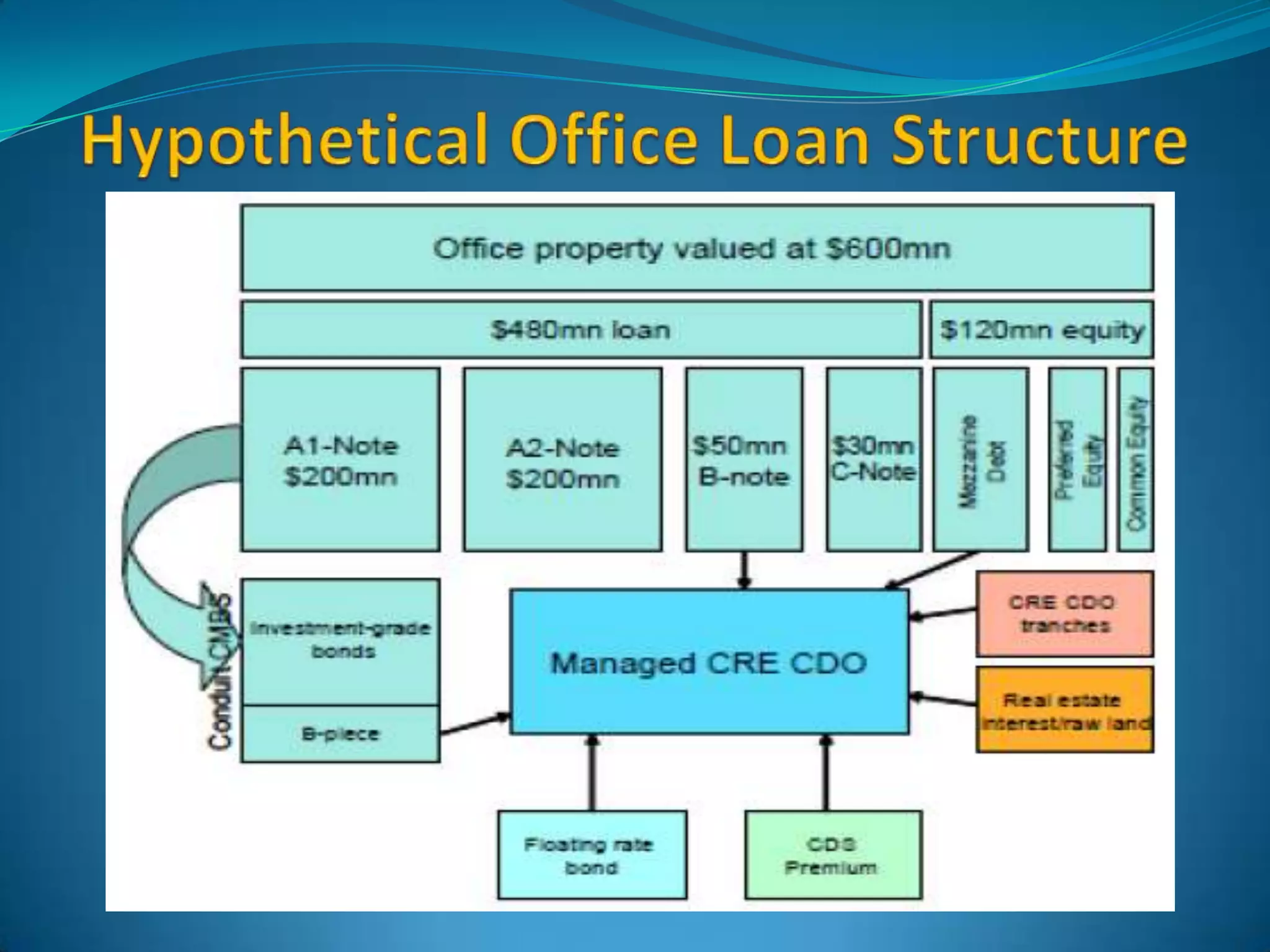

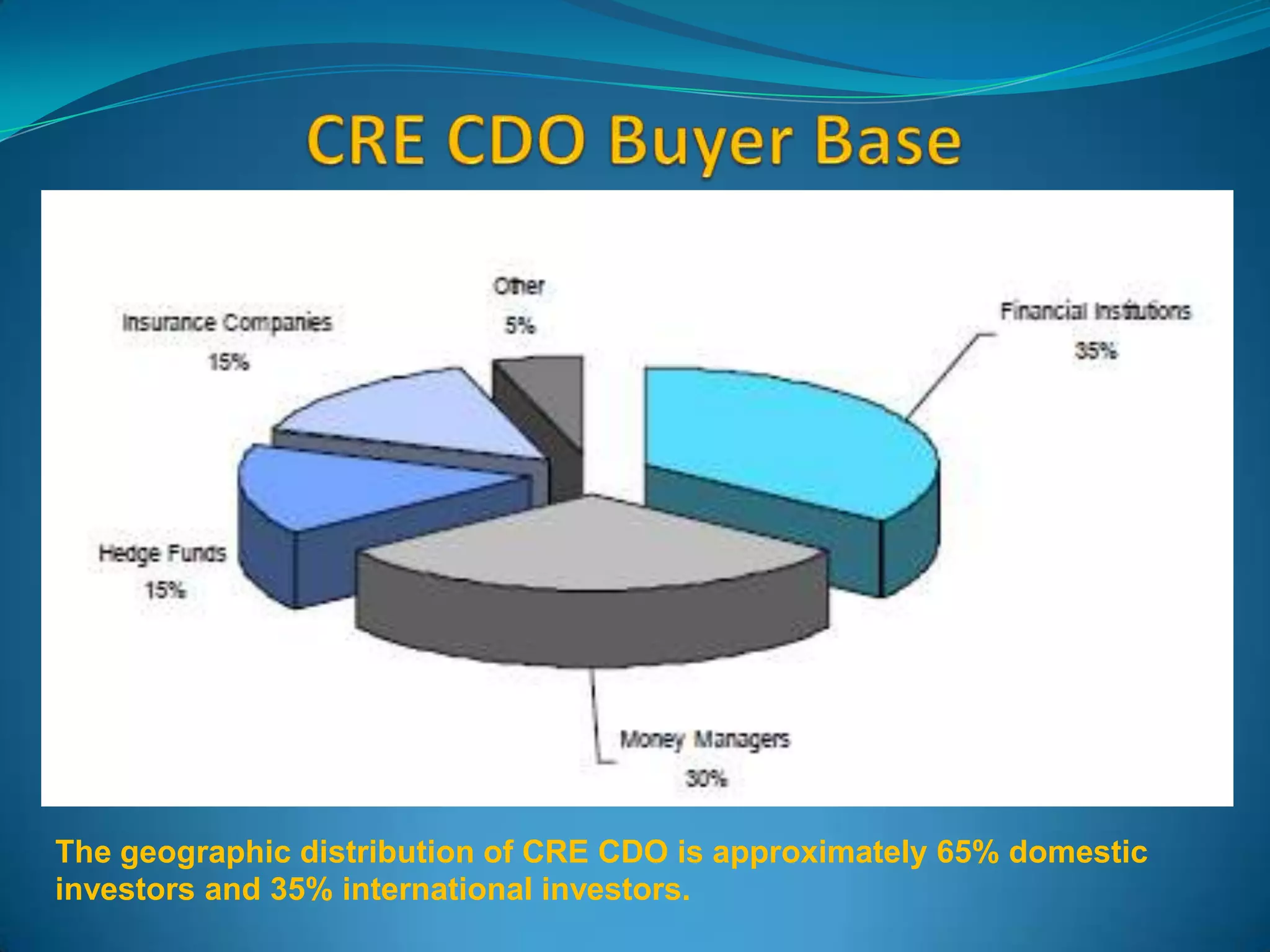

This document provides an overview of collateralized debt obligations (CDOs) focused on commercial real estate. It discusses the taxonomy and anatomy of CDOs, including the types of assets they contain, their capital structure, and the parties involved such as issuers, investors, and rating agencies. It also describes the evolution of CDO collateral over time from assets like REIT debt and CMBS to include riskier products like whole loans, B-notes, and mezzanine loans.