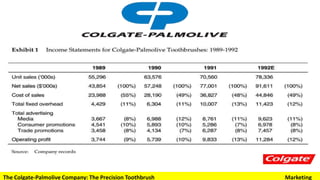

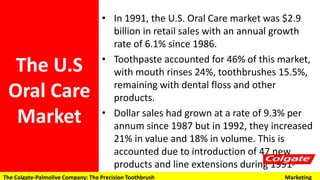

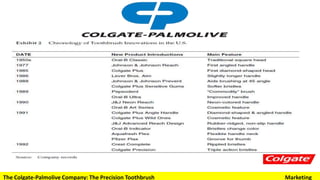

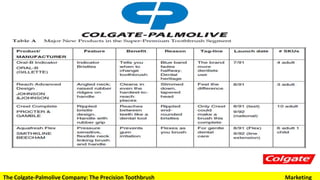

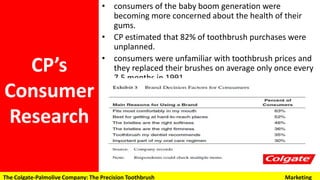

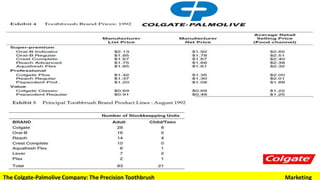

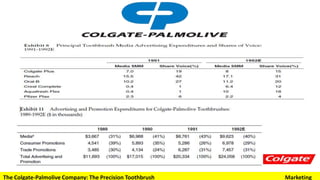

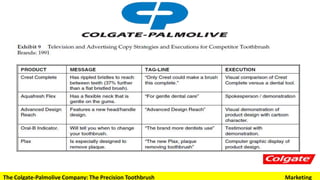

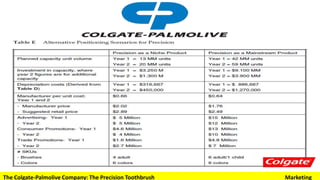

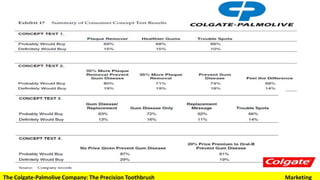

The document discusses Colgate-Palmolive's launch of a new toothbrush called Precision in the United States. It provides background on Colgate-Palmolive and analyzes the oral care market and consumer behavior. Research found the Precision toothbrush was more effective at plaque removal than competitors' brushes. The case examines different positioning and branding strategies for Precision and reviews test marketing and concept testing to refine the product and messaging.