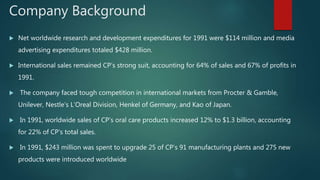

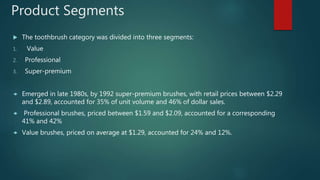

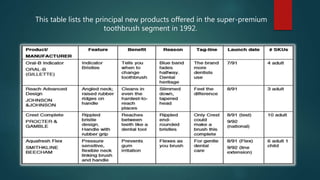

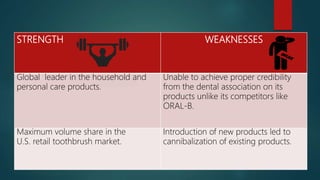

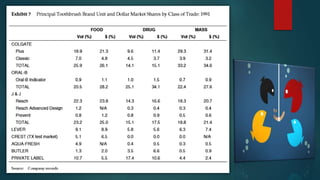

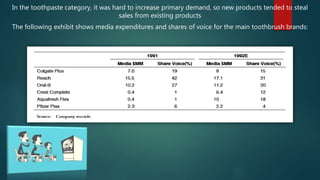

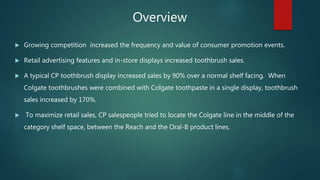

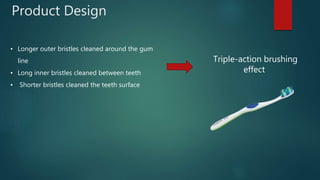

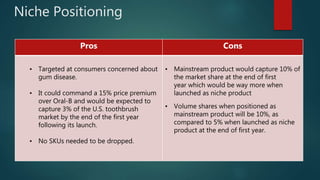

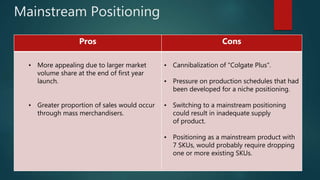

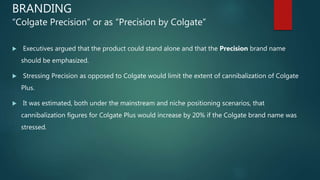

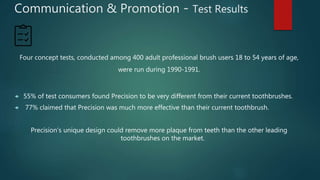

Colgate-Palmolive is launching a new technologically superior toothbrush called the Precision Toothbrush in a competitive market. It faces challenges in gaining credibility and preventing cannibalization of existing products. The document analyzes positioning the brush as a niche or mainstream product, branding, test results that found the brush more effective but unusual looking, and recommendations such as niche marketing initially, aggressive advertising of its benefits, and free dental checkups to promote the issue it addresses.