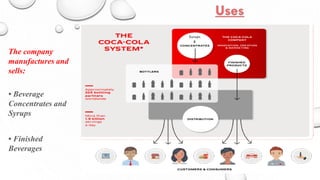

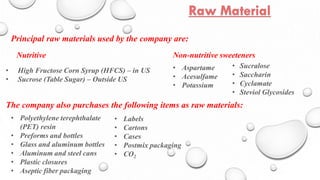

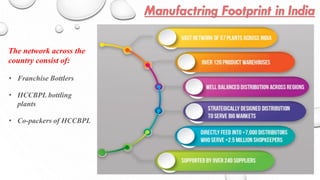

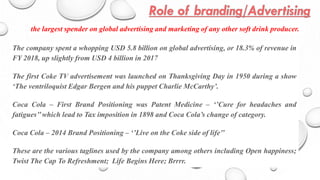

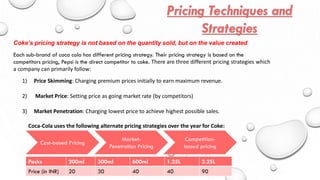

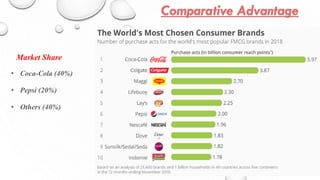

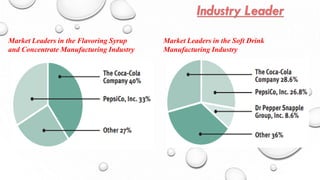

Coca-Cola is the world's largest beverage company founded in 1886 offering over 500 brands in over 200 countries. It owns top brands like Coca-Cola, Diet Coke, and Fanta and operates through four geographic segments. The company manufactures concentrates, syrups and finished beverages using raw materials like PET resin, sweeteners, and flavors. It has around 62,000 employees and spent $5.8 billion on advertising in 2018 maintaining its brand differentiation. The non-alcoholic beverage market is growing at 5.8% annually with Coca-Cola and Pepsi having the largest market shares.