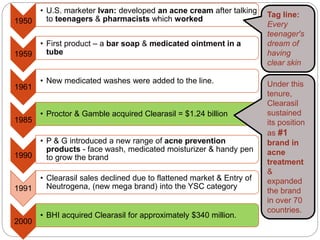

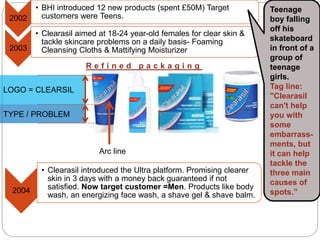

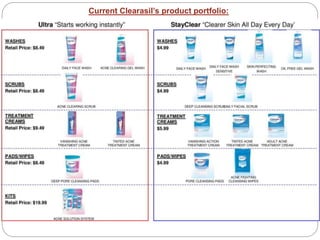

Clearasil is a skincare brand that was founded in the 1950s and has changed ownership several times. It is currently owned by Reckitt Benckiser and focuses on acne treatment products. Over the decades, Clearasil has expanded its product line and refined its packaging and branding to target both teenage and young adult consumers. It aims to become the number three skincare brand for young people in the United States by overtaking Clean & Clear in the next five years.