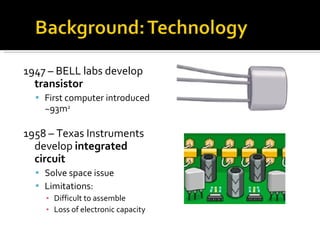

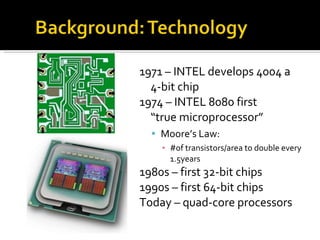

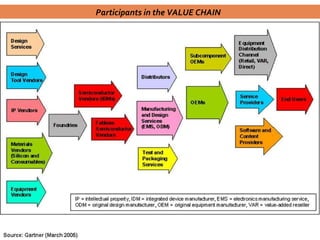

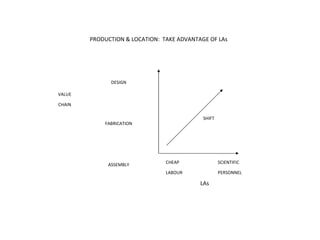

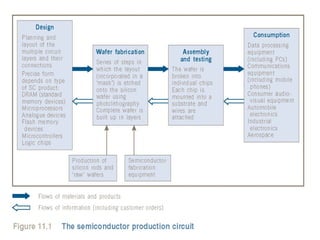

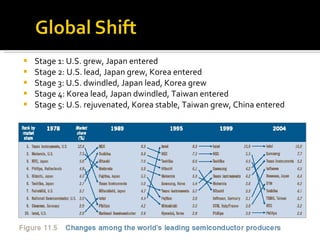

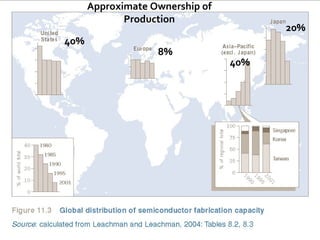

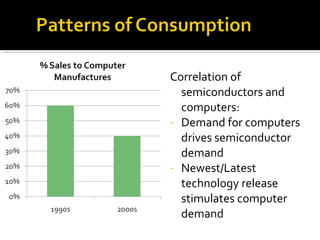

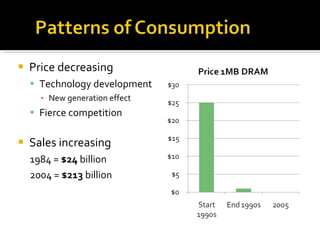

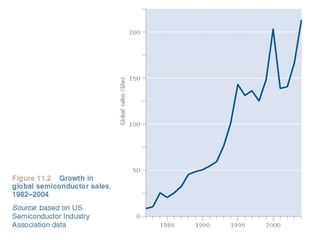

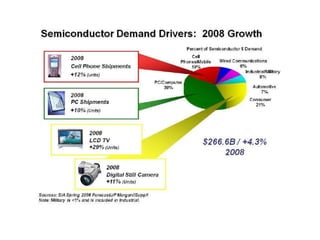

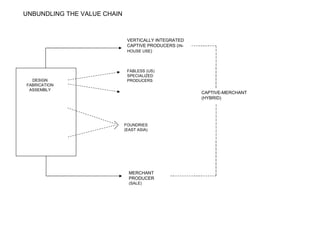

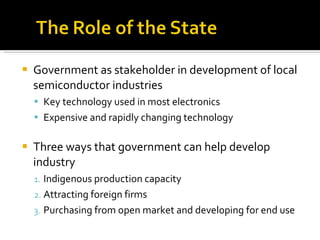

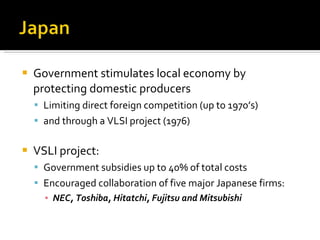

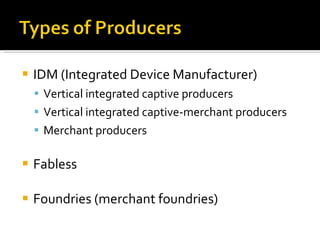

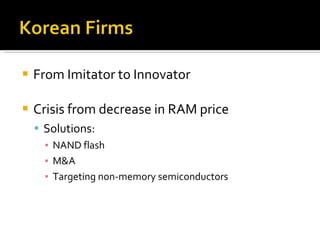

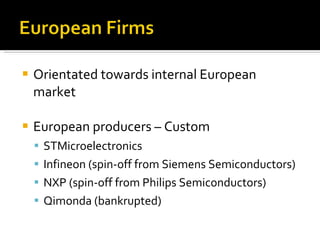

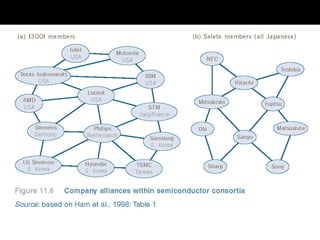

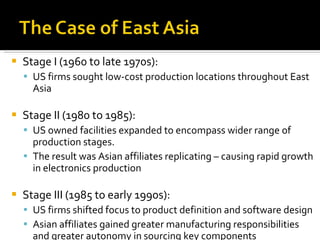

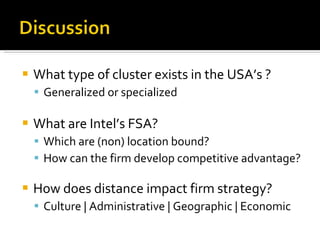

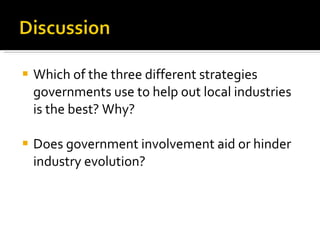

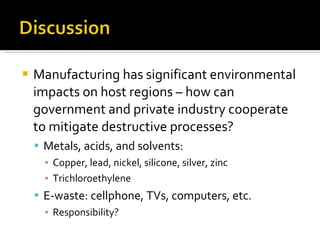

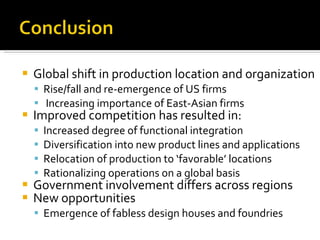

The document discusses the evolution of the semiconductor industry, highlighting pivotal advancements from the development of the transistor in 1947 to today's quad-core processors. It examines the global shifts in production from the USA to East Asia, addressing the role of government, corporate strategies, and market dynamics in shaping the landscape of semiconductor production. Additionally, it stresses the importance of strategic government involvement to foster local industries and innovation amid increasing international competition.