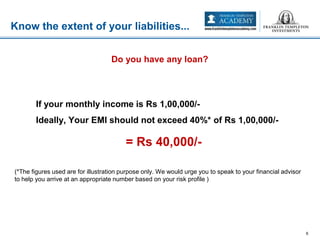

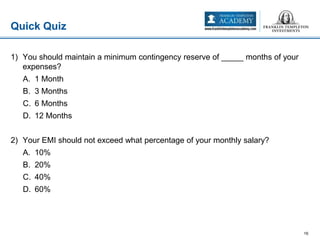

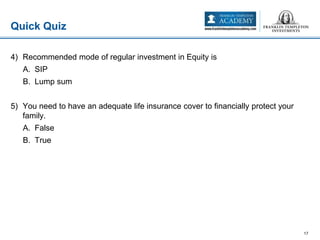

The document provides tips for maintaining good financial health by being aware of cash flows, ensuring finances are improving over time, building a contingency fund, managing debt levels, diversifying investments appropriately based on age and risk tolerance, investing regularly through SIP, monitoring investments, and having adequate insurance. Key recommendations include knowing expenses and avoiding unnecessary spending, maintaining a contingency fund of 6-12 months of expenses, keeping EMIs below 40% of monthly income, diversifying investments, and regularly reviewing finances and investments.