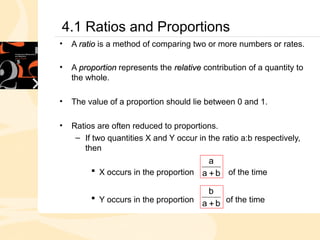

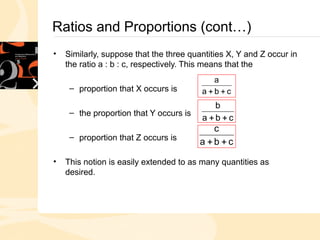

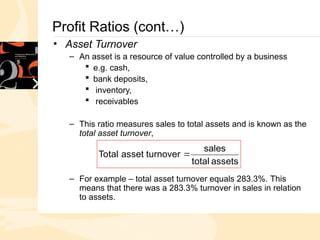

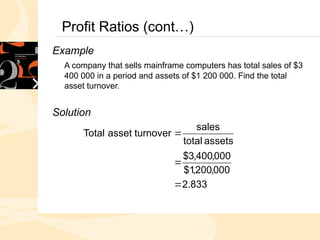

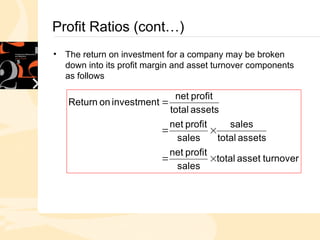

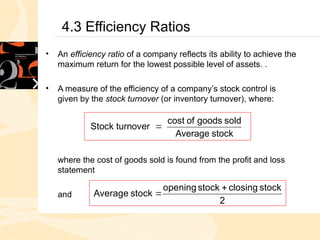

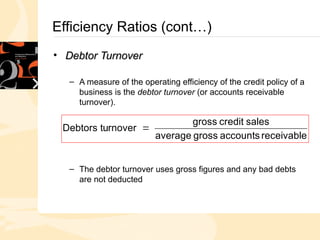

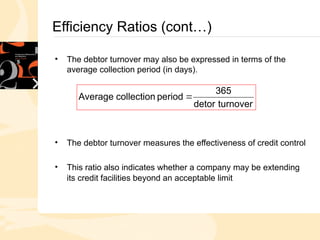

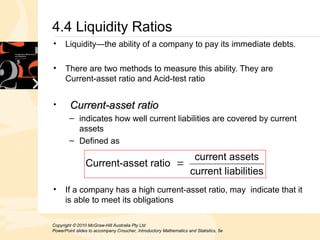

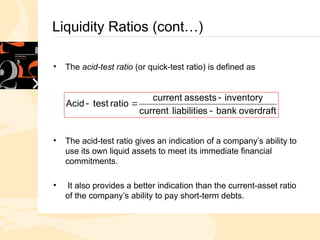

The document provides an overview of ratios and proportions in relation to business mathematics, including methods to calculate and apply profit, efficiency, and liquidity ratios. It explains the definitions and significance of ratios, proportions, and related financial metrics such as total asset turnover, stock turnover, and liquidity ratios like current-asset and acid-test ratios. Additionally, it emphasizes how these ratios help assess a company's financial position, operational efficiency, and ability to meet obligations.