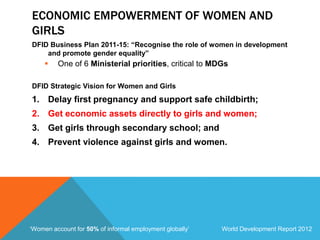

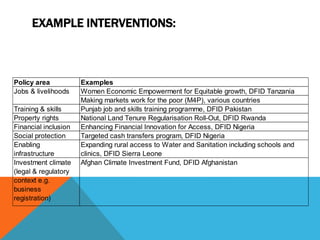

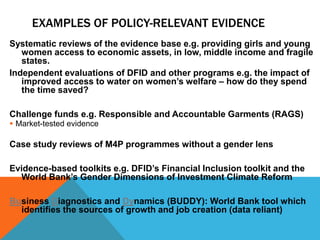

This document discusses economic empowerment, particularly for women and girls. It defines economic empowerment as increasing people's access to economic resources like jobs, financial services, and skills training. The first section explains why economic empowerment is important for individual welfare and economic growth. It then outlines barriers that prevent women from accessing these resources, like discriminatory norms. The rest of the document provides examples of interventions and policies to promote women's economic empowerment, such as improving access to finance, land, and education. It also discusses challenges in using evidence to inform policies that empower women economically in a sustainable way.