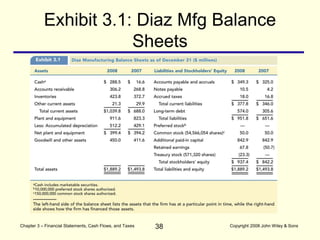

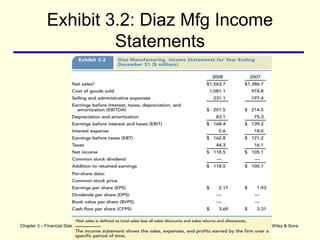

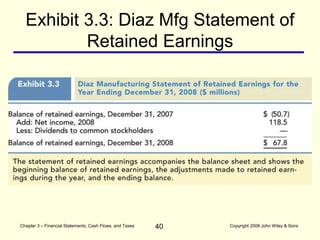

This chapter discusses key financial statements including the balance sheet, income statement, statement of retained earnings, and statement of cash flows. It also covers accounting principles such as GAAP, inventory valuation methods, depreciation, and amortization. Additionally, it describes the federal corporate income tax system and tax treatment of dividends versus interest payments. Financial statements are prepared according to GAAP and provide important information to managers and investors about a company's performance and financial position.