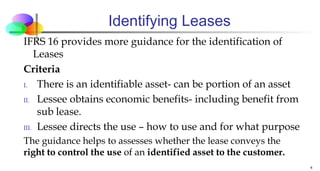

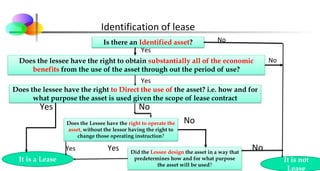

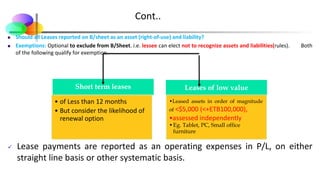

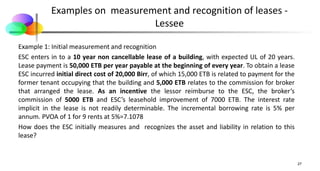

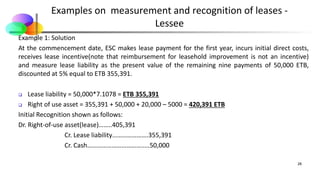

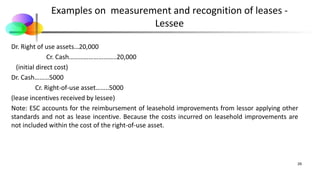

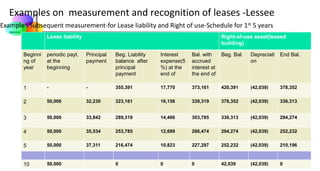

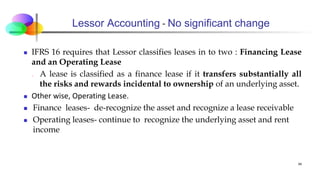

The document discusses the identification and accounting of leases according to IFRS 16. It defines a lease as a contract that conveys the right to control the use of an identified asset for a period of time in exchange for consideration. A lease is identified when there is an asset, the lessee obtains economic benefits from the asset, and directs how the asset is used. The document provides examples and analysis to demonstrate how lease identification criteria are applied in shipping contracts.